About 98% of Ukrainian citizens hospitalized with coronavirus disease COVID-19 are unvaccinated, Health Minister Viktor Liashko said.

“I have one clear answer: there is no need to wait for some region to enter the red level of epidemic danger. Today there is an opportunity to prevent it from getting there: you need to get off the couch, come to the vaccination center and get vaccinated. Why is this important? Because when transferring to the red level of epidemic danger, there are three criteria regarding hospitalization. The rate of hospitalization, the percentage of hospitalized, as well as the occupancy of beds with oxygen. What does statistics show today? That among hospitalized 95-98% are unvaccinated,” Liashko said in a comment to journalists on Thursday at the presentation of the book of MP Yulia Hrishyna “Knowledge that Changes the World.”

Therefore, according to the minister, today we can influence this situation as follows: “we get vaccinated – we prevent hospitalizations, we do not allow the red level of epidemic danger: schools, kindergartens, business, the economy are working, we are raising the level of the economy, we are investing in the health care system.”

Answering the question about the reasons for the low level of vaccination in the country, Liashko noted that in this case, attention should be paid to the dynamics of vaccination.

“Now we see an increase in the number of vaccinated. Three days in a row – a daily record, and yesterday a pleasant record: 251,000 vaccinations per day were made. We have reached the level that European countries reach in four to five months. If you look at when we got access to the vaccine, and this is July, then we have caught up with the same European rates. The main thing is that they do not slow down,” the minister said.

Experts of the European Business Association (EBA) insist on the obligatory revision of the draft law on the timber market taking into account the proposals of the business, in particular, it should provide for a cascade principle of the auction.

“In our opinion, priority access to the resource should be provided to companies that have production facilities and carry out wood processing in Ukraine,” the EBA said in a press release on Thursday.

In addition, according to the press release, it is necessary to significantly revise and simplify the rules of administration of transactions with wood products.

“According to business, they are not only excessive but also inappropriate given the specifics of the market. Businesses find it inexpedient to declare transactions related to wood products, instead of focusing on declaration of the procurement and sale [resale] of wood,” the association’s experts said.

The EBA also notes the need to revise the list of wood products requiring a certificate of origin and exclude from it products that are not of primary wood processing.

The press release notes that the consideration of this bill (No. 4197-d) in the Verkhovna Rada is scheduled for October 22.

“It is worth noting that the updated version of draft law No. 4197-d took into account certain important proposals from businesses. These are provisions that provide a mechanism for the sale of timber on the terms of the offer in parity with the auction and the restructuring of state forestry enterprises by separating the woodworking units of state forestries,” the press release states.

The association notes that it continues to develop proposals for the wording of the bill, which will be submitted additionally.

As reported, revised draft law No. 4197-d on the timber market envisages the abolition of the moratorium on export of unprocessed timber from Ukraine and the introduction of a transparent timber market.

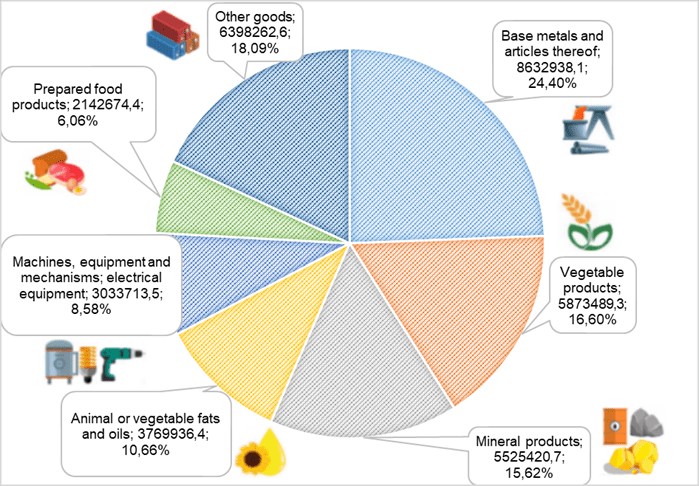

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS IN JAN-JULY 2021 (EXPORT)

Minister of Culture and Information Policy of Ukraine Oleksandr Tkachenko does not exclude that due to low rates of vaccination in Ukraine, European countries may limit entry for Ukrainian tourists as much as possible.

“Thousands, tens of thousands of disrupted trips, as countries are quickly changing the rules for entry. And there is logic in this. Their governments care about the safety of their citizens, maintain an appropriate level of vaccination. Yesterday I came across statistics of vaccinations in the world. European indicators are about 70%. In the UAE, practically the entire population is vaccinated – 98%. In Ukraine, this figure is 18%, which is very small,” he wrote on the Telegram channel on Thursday.

The minister lamented that the pace of vaccination in Ukraine may lead to the fact that citizens will not be able to actively travel abroad.

“Remember, in February 2020, our tourists were returning home from the Chinese Wuhan, already covered by the epidemic. They were taken for observation in Novi Sanzhary. Frightened people even threw stones at buses then … Of course, Europeans will not throw stones at Ukrainian tourists. Just do not exclude that with such a rate of vaccination, we may be restricted as much as possible from entering. And the restrictions will continue until we reach at least close to the European level of vaccination,” Tkachenko said.

In this regard, the minister once again urged everyone to be vaccinated.

The housing price index in Ukraine in July-September 2021 amounted to 115.8% compared to the same period in 2020, the State Statistics Service has reported.

According to its data, prices in the primary market rose by 14.3%. Most of all three-room apartments have risen in price – by 16.3%, the least – two-room apartments (by 13.4%).

According to the State Statistics Service, in the secondary market, housing has risen in price by 17% over the year. Three-room apartments added the least in price – 15.8%, two-room apartments added the most (18.4%).

Compared to the fourth quarter of 2020, housing prices grew by 13.8%, in the primary market by 12.5% and in the secondary market by 14.9%.