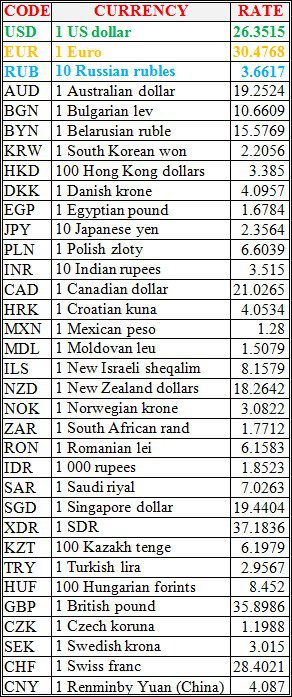

National bank of Ukraine’s official rates as of 11/10/21

Source: National Bank of Ukraine

Ferrexpo Plc (the U.K.), managing Poltava Mining and Yeristovo Mining in Ukraine, has started cooperation with specialists Ricardo Plc (the U.K.), as part of decarbonization plans by 2050. “The Group undertakes a commitment to achieve net zero carbon emissions from its operations by the year 2050,” the company said in a press release on Monday. In addition, the group undertakes an initial commitment to achieve a minimum of a 30% reduction in combined Scope 1 and 2 emissions by 2030.

According to the press release, Ricardo to also help enhance the group’s existing climate change scenario reporting and review the role of Ferrexpo’s iron ore pellets within the circular economy. Results of Ricardo’s analysis expected to enhance the group’s carbon reduction targets and to further develop climate change reporting in 2022.

Jim North, Interim Group Chief Executive Officer, said that whilst iron ore pellets offer our customers the opportunity to significantly reduce carbon emissions already, it is important to signal a clear intention to decarbonise our own operations.

“It is on this basis that we have adopted the targets announced today, to demonstrate both our focus on climate change and our understanding of the importance of decarbonisation,” North said.

He said that Ferrexpo jointly with Ricardo intends to be a workstream that develops science-based reduction targets and a timeline for the stages of decarbonisation in each aspect of the Ferrexpo business.

“In the 18 months to June 2021, the group has already recorded a carbon reduction in excess of 20%2, which is a demonstration of our commitment to the environment,” North said.

Tim Curtis, Energy & Environment Managing Director at Ricardo Plc, said that Ricardo’s experts have been helping organisations around the world to develop robust and science-based pathways to achieving net zero carbon emissions and they will support Ferrexpo with the development of its decarbonisation targets and providing objective expertise to help realise this ambition.

Ricardo Plc is a world-class environmental, engineering and strategic consulting company.

Ferrexpo is an iron ore company with assets in Ukraine.

The State Customs Service considers it necessary to revise the coefficients according to two criteria for enterprises-candidates for obtaining the status of an Authorized Economic Operator (AEO), Head of the State Customs Service of Ukraine Pavlo Riabikin has said.

“Today, from our experience, we see that there is a need to revise the coefficients for candidate enterprises in two positions – liquidity and solvency. They can be revised by a government decision without touching the legislation,” he said in an exclusive interview with Interfax-Ukraine.

The head of the State Customs Service added that this issue does not lie in the political plane.

“This is an objective necessity dictated by our financial and economic realities,” Riabikin said.

The AEO status provides the company with significant advantages and simplifications in its work. In particular, the implementation of customs formalities as a matter of priority (for example, an extraordinary registration of customs declarations), a simplified declaration procedure by the customs authority, the use of a specially defined traffic lane at a checkpoint, etc.

“So far, the AEO authorization has been granted to one enterprise [JTI Ukraine]. In total, five applications have been submitted, two applications are at the stage of preliminary consideration, two enterprises have been denied the assessment,” Riabikin said.

Kadorr Group (Odesa) intends to acquire a 100% stake in First Kyiv Machine-Building Plant JSC (formerly the Bilshovyk plant).

According to the company’s report in the information disclosure system of the National Securities and Stock Market Commission dated October 8, Kadorr Invest LLC intends to acquire 44.58 ordinary registered shares constituting 100% of the charter capital of the plant.

The company and its affiliates do not own the shares of the plant at the time of notification.

According to the Unified public Register of Legal Entities and sole proprietors, Adnan Kivan (50%) and Olha Pavlova (50%) are the founders and ultimate beneficiaries of Kadorr Invest LLC with a charter capital of UAH 1 million.

According to the data on the official website, the portfolio of Kadorr Group has more than 2 million square meters of residential real estate put into operation, including more than 50 residential complexes, 90 cottages. The assets of the group also include 7 business centers, 5 shopping malls and commercial space with a total value of more than $800 million. The owner of the group, Adnan Kivan, is in the top five rentiers of Ukraine with the highest income from real estate lease according to Forbes Ukraine with an indicator of $45 million at the end of 2020.

The downward trend in non-renewable energy sources is very strong and it will progress, but the demand for natural gas will remain or even grow in the next decade, Mikhail Fridman, founder of LetterOne, shareholder of Alfa Group Consortium, has said.

“Gas is likely to rise rather than fall in the next decade,” he said at the Kyiv International Economic Forum on Thursday.

Fridman added that the share of alternative energy will also grow, helped by government incentives and worsening conditions for carbon sources.

At the same time, according to his forecasts, despite the strong trend against non-renewable energy sources, the change in the structure of energy generation will not be very rapid.

“It is frivolous to say that everything will happen very quickly – it is irresponsible,” the businessman said.

In such an environment, Fridman believes, oil and gas companies will not be popular, but they will exist for a long time and actively invest in carbon neutrality.

“They will be arranged like a tobacco industry,” the shareholder of Alfa Group said.