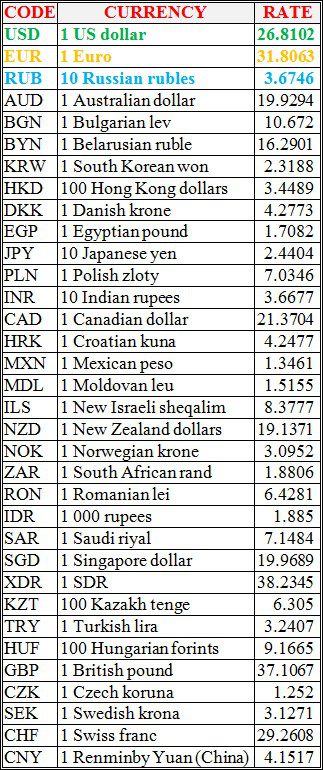

National bank of Ukraine’s official rates as of 07/09/21

Source: National Bank of Ukraine

Restoration of the Catholic Church of St. Nicholas in Kyiv after the fire will cost at least UAH 75 million, according to preliminary estimates, Minister of Culture and Information Policy of Ukraine Oleksandr Tkachenko said.

“According to preliminary estimates, the restoration will require UAH 75 million. The state will allocate the rest of the necessary funds to the amount raised by the business. That is, it is a unique case of public-private partnership,” Tkachenko wrote on his Telegram channel.

According to him, the funds transferred by business representatives will go to emergency work. They are expected to begin in mid-October.

As reported, on Friday evening, mayor of the Ukrainian capital Vitali Klitschko wrote in the Telegram channel that the church of St. Nicholas caught fire in the center of Kyiv. The fire broke out between the first and second floors and quickly spread to the roof of the building. Rescuers said that the area of the fire was 80 square meters, the fire damaged the body. According to the Ministry of Culture and Information Policy, the building was not badly damaged. Late in the evening the fire was extinguished, none of the people were injured. Later, the Minister of Culture and Information Policy of Ukraine Oleksandr Tkachenko said that the fire destroyed a unique organ, which was located in the building.

Some 29,048 flights were performed in the airspace of Ukraine in August 2021, which is 76% of the August volume of pre-crisis 2019 flights, the press service of the Ukrainian State Air Traffic Services Enterprise (UkSATSE) reported.

According to it, Ukrainian airlines performed 10,505 flights in August 2021 (10.2% less compared to August 2019), foreign airlines carried out 18,543 flights (30.1% less).

In total, over the past month, 3,516 domestic flights (17.7% more than in the corresponding period of 2019) and 14,595 international flights (12.3% less), as well as 10,937 transit flights (41.2% less) were operated.

“The dynamics of the number of flights in the airspace of Ukraine in 2021: July – 26,952 flights, June – 21,113 flights, May – 16,986 flights, April – 13,661 flights, March – 12,160 flights, February – 8,758 flights, January – 9,842 flights,” UkSATSE reports.

The department explained that the increase in the number of flights in the Ukrainian sky is associated, in particular, with the spread of vaccination in the country and the world, the opening of the borders of foreign countries, the restoration of the confidence of air passengers in travel and the traditional growth in demand for air travel during the tourist season.

“It is important to note the positive dynamics of the intensity of flights in the international airspace, which is under the responsibility of Ukraine, namely in the western part of the Simferopol flight information region, the so-called green zone. In August, 80% more flights were performed on these routes with special flight planning procedures compared to July of this year, and three times more than in June,” head of UkSATSE Andriy Yarmak said.

According to him, this is facilitated by the new air navigation rate for air navigation services, established by the Ministry of Infrastructure from June 1, 2021, as well as proactive work with domestic and international airlines.

On September 6, 2021, the Interfax-Ukraine press center hosted a presentation of the anthology of Ukrainian modern futurism “Zvyzdobolid”. The authors of the book and the founders of the reputation management agency “WikiBusiness” Bohdan Dubylovskyi and Roman Melnyk presented a reprinted book with the best of their own texts and the works of Ukrainian futurists of the XX-XXI centuries.

The moderator of the meeting was the winner of the show “Comic for a Million”, stand-up comedian and humorist Oleksandr Sas.

The participants of the press conference discussed the phenomenon of devaluation of the realities of the digitized world, the need for personal progress and stop of vulgar degradation, approaches to the organic education of the new generation and others.

The authors have announced the release of a new book and they don’t reject the possibility of publishing young futurists in the next collection. There are also plans to publish “Zvyzdobolid” in other languages, including Chinese and Japanese.

Criminal proceedings against fifth president of Ukraine Petro Poroshenko, which were initiated at the request of oligarch Igor Kolomoisky, were closed before the visit of incumbent head of the country Volodymyr Zelensky to the United States, Poroshenko’s attorneys said.

“Literally synchronized with the flight of President Zelensky to the United States, criminal proceedings were closed, which at one time was registered at the request of Kolomoisky,” attorney-at-law Ihor Holovan said according to the European Solidarity party’s website.