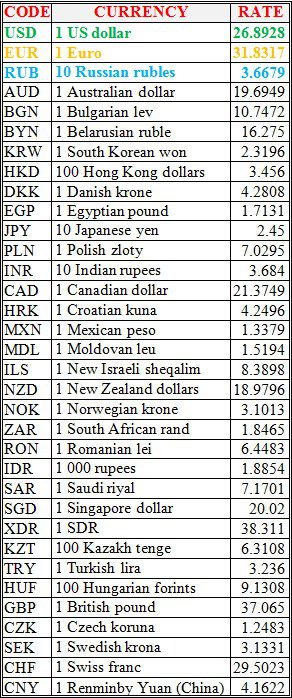

National bank of Ukraine’s official rates as of 01/09/21

Source: National Bank of Ukraine

Deputy Prime Minister, Minister of Digital Transformation of Ukraine Mykhailo Fedorov calls for the opening of separate representative offices of Google and YouTube in the country.

“The team of the Ministry of Digital Transformation is to meet with the Google team. We will talk about the company’s development plans in Ukraine. We really want to see separate representative offices of Google, YouTube in Ukraine,” Fedorov said on the air of the Ukraine 24 TV channel during his working visit to Washington (the United States).

According to him, during military aggression, it is necessary that the content is moderated in Ukraine, and not in Russian offices.

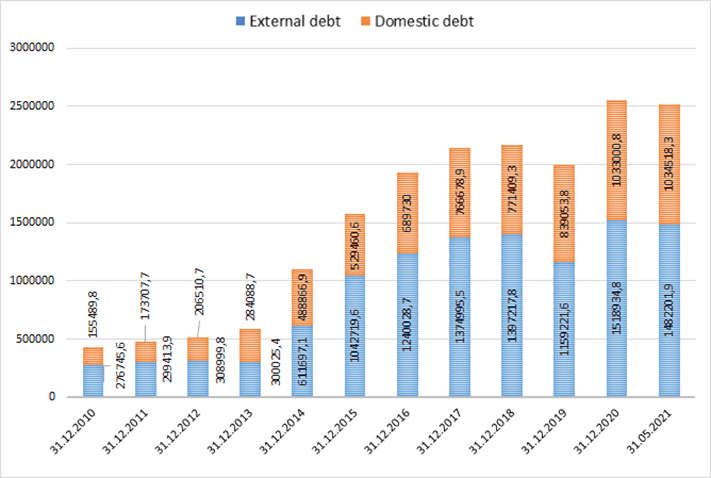

INTERNAL AND EXTERNAL DEBT OF UKRAINE IN 2009-2021

Polish PGNiG plans to invest $50 million in gas production in western Ukraine at the first stage as part of a partnership with the Energy Resources of Ukraine (ERU) group of companies, MP Andriy Gerus has said.

“At the first stage, it is planned to invest $50 million. And in the future, the volume of investments may reach up to $500 million,” he wrote on his Facebook page after attending the 24th Gazterm gas conference in Poland.

As reported, early December 2019, the Polish company PGNiG SA and the Ukrainian group of companies ERU signed an agreement on the exploration and production of natural gas in Lviv region. The agreement provides for the drilling of an exploration well up to 2,500 meters deep at the initial stage, and measures to design the location of other wells.

In May 2021, the Antimonopoly Committee of Ukraine (AMCU) allowed PGNiG SA to acquire over 50% in Karpatygazvydobuvannia LLC, which belongs to ERU.

Energy Resources of Ukraine (ERU) is a group of companies with foreign investments specializing in the implementation of projects in the Ukrainian energy sector. It is one of the largest private importers of natural gas and electricity to the country. ERU Group belongs to Yaroslav Mudry and Dale Perry.

PGNiG is the largest oil and gas company in Poland, engaged in the development of gas and oil fields, production, storage and transportation of energy resources, as well as construction and development of oil and gas transport networks, export and import of gas.

All basic services of Kyiv Sikorsky International Airport are to be transferred to an electronic format, Yevhen Belik, the director of the enterprise development, said in an exclusive interview with Interfax-Ukraine.

“Together with Director General Olha Tovkes, we are now looking towards digitalization, the development of marketplaces and an e-commerce module for the comfort of passengers and more efficient management of our revenues,” he said.

According to Belik, this can be not only priority registration, but also expedited formalities, payment for parking and even buying coffee in a cafe and perfumery in duty-free stores.

“The module is still under development, but we know for sure that it will be an application that every passenger can install and order any service for himself from anywhere in the world,” he said.

The airport development director noted that at the moment the distribution of total profits between the aviation and non-aviation sectors is 70% to 30%.

He also said that the approach to the formation of profitability has changed at the airport.

“If earlier we took into account the area of leased space, now we take into account another component – conversion from sq m. In other words, how efficiently the tenant works,” Belik said.

In particular, in order to provide a full and varied leisure while waiting for a flight, the concept of duty-free shops was changed, now they will offer a different assortment of different price categories.

“A specialized shop for optics and haberdashery is already operating. In the near future, a targeted children’s duty-free shop with a large assortment of toys and gadgets will be opened, and a children’s zone will be equipped nearby,” Belik said.

Four locations with a total area of 1,500 square meters is represented by the leading duty-free operator Heinemann. Another of the locations, about 100 sq m, will soon be considered as a potential choice for a new duty-free operator.