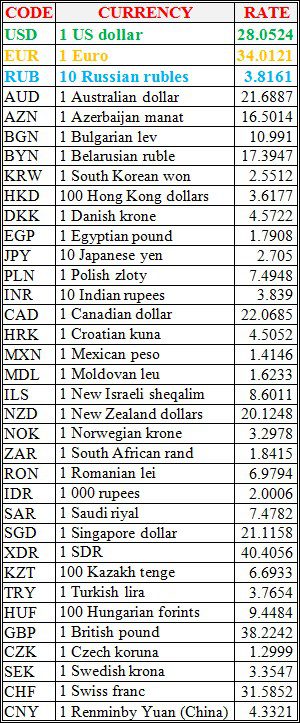

National bank of Ukraine’s official rates as of 18/01/21

Source: National Bank of Ukraine

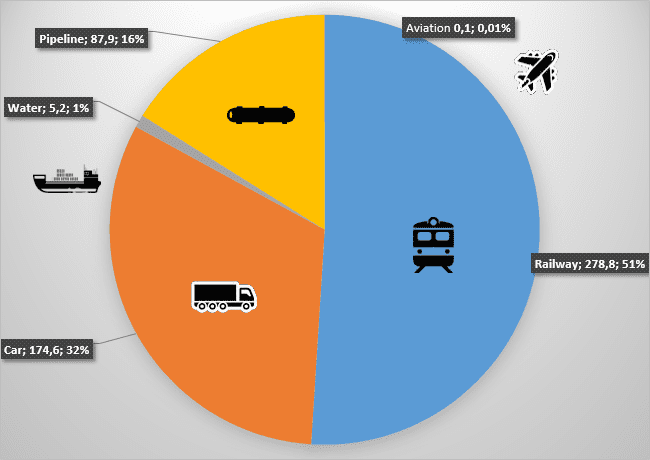

Volumes of cargo transportation IN Jan-Nov of 2020, MLN tons.

The share of vacant space in the office real estate market in Kyiv at the end of 2020 amounted to 12.5%, whereas in the previous year this figure was 9%, NAI Ukraine has reported.

“Despite the rather impressive new supply in 2020 – almost 80,000 square meters – and vacating of space due to the crisis, the office market withstood the blow due to deferred demand and preliminary lease agreements. The total market vacancy did not show significant growth – 12.5% at the end of the year compared to 9% at the end of 2019,” the company said in the report.

According to NAI, rental rates in the office market fell by an average of 20% at the end of 2020: to $20-30 per square meter in class A offices and to $12-23 per square meter in class B offices. In addition, discounts on rent of up to 50% set in a number of properties due to quarantine in the spring were mostly no longer in effect by autumn.

The lease of an office by Vodafone in the Sigma business center (7,500 square meters), by EvoPlay in the business center on. Leipzig Street (4,500 square meters), the moving of Frag Lab to the Veneciansky business center (3,600 square meters) were among the largest deals in 2020. According to preliminary data, the volume of gross absorption of offices in Kyiv last year amounted to about 85,000 square meters.

At the same time, the planned volume of new supply (about 370,000 square meters) and the growing popularity of flexible offices will continue to intensify competition in the market in 2021. Conventional offices may experience a lack of demand and, as a result, lower rental rates, NAI experts said.

“In 2021, the remote work is likely to continue to prevail: this is fully true for the first half of the year, and from the second half of the year there is a high probability of a gradual return to work in offices. This is a question of the speed and efficiency of vaccinations and quarantine measures. Nevertheless, experience of effective work online will bring changes to the organization of office spaces forever – various hybrid models (remote work of some employees, combining offline and online working days in weeks with hot desking, etc.) will most likely continue taking place after the stabilization of the situation with the pandemic,” the company said.

The National Bank of Ukraine (NBU) has lifted the ban on the conduct of transactions by individuals as the forward purchase or sale of foreign currency, the purchase or sale of foreign exchange and bank metals on margin trading and the settlements in foreign currency to buy government securities denominated in foreign currency, the press service of the central bank said on Saturday.

The changes were approved by NBU Board resolution No. 3 dated January 15 posted on the regulator’s website. The document came into force on January 17.

According to it, the NBU also lifted the prohibition for legal entities to carry out transactions for the forward sale of foreign currency and the prohibition on banks’ swaps with resident individuals, if the first part of such an operation involves the sale of foreign currency or bank metals to the client.

In addition, the National Bank allowed banks and non-bank financial institutions to buy foreign currency from the population for non-cash funds in hryvnia through self-service terminals and approved the rules of conducting relevant operations. In particular, after the sale of currency through payment devices, hryvnia funds will be credited to the personal current accounts of individuals.

In order to promote the use of digital analogs instead of paper documents, the National Bank clarified the requirements for the implementation of transfers of funds in foreign currency by individuals outside Ukraine and the receipt of such transfers from abroad.

In particular, the regulator added the ability for individuals to use digital passports in the Diia mobile application when carrying out these operations, where information is displayed in electronic form, which contains an ID card and a biometric passport of a citizen of Ukraine.

According to the estimates of the National Bank, the easing of these requirements will ensure the implementation of further steps on the path of currency liberalization, as well as contribute to the expansion of opportunities for businesses and individuals to hedge currency risks, further develop new services provided by authorized institutions in the field of currency exchange transactions and the use of digital documents in foreign exchange transactions.

Map of internet coverings of ukrainian basic mobile operators in Jan 2021