OKKO Group Holding plans to start construction of a ski resort in 2021 on the territory of the Slavske amalgamated territorial community (Lviv region).

Taras Lozynsky, the deputy head of the department of tourism and resorts of the Lviv Regional Administration, told Interfax-Ukraine that the investment will amount to $500 million.

“This is a very long-term project that will last about four years. It will start in 2021. Now all issues with the land have been resolved, the next step is the development of the project, design estimates and the start of construction work,” he said.

According to Lozynsky, the resort will be built 15 km far from Slavske in the villages of Verkhnia Rozhanka and Volosianka.

“Austrian experts came to study the slopes, the height of the mountains, infrastructure and these settlements were included in the strategy,” he said.

“OKKO registered all its shares in Slavske and, accordingly, the tax paid by the company remains here in the community. These funds will be reinvested in the development of ski infrastructure, in the Slavske brand, in road repairs and community development,” Lozynsky added.

According to him, the resort will be eight or nine years ahead of Bukovel in technical development. The complex will include over 60 km of skiing pistes. The project will be implemented in three stages.

OKKO Group is an all-Ukrainian holding, the flagship of which is the network of OKKO filling stations (Concern Galnaftogaz). The OKKO Group includes more than 10 diversified businesses in the field of production, trade, construction, insurance, service and other services.

The holding also includes the Vash Dom housing construction company, which is engaged in the design, construction and implementation of housing projects.

The shareholders and institutional investors of the holding companies are the European Bank for Reconstruction and Development, GoldmanSachs, Horizon Capital, Renaissance Capital, Genesis AssetManagers, LLP, and others.

The international vertically integrated pipe and wheel company Interpipe concluded an agreement with JSB Ukrgasbank to sign a general loan agreement for the amount of EUR 37 million.

According to a company’s press release, the general agreement provides for a EUR 30 million amortized loan for five years and a revolving credit line for EUR 7 million for three years.

Interpipe Chief Financial Officer Denys Morozov said that Interpipe has raised its first loan after completing the debt restructuring in October 2019.

“It has been obtained as part of the implementation of the Company’s strategic goals and allows reducing the interest burden for the Company. We are especially pleased that the financing for the Ukrainian industrial company has been secured at the Ukrainian state bank Ukrgasbank that is known as Ecobank and has been financing a wide range of environmental and green projects. We intend expanding our cooperation with the bank in other areas as well,” Morozov said in a press release.

As reported, Interpipe announced the decision to carry out the next partial redemption (buyout) of eurobonds 2024, this time in the amount of $74.82 million. The redemption is scheduled to be carried out by December 29 this year.

The state-owned Oschadbank (Kyiv) on December 18 attracted UAH 8 billion at the tender of the National Bank of Ukraine (NBU) for 90-day refinancing at 6%, according to the NBU’s website on Monday.

According to the NBU, the regulator also satisfied the applications for refinancing the banks Sich (UAH 250 million), Avangard (UAH 50 million) and Concord (UAH 36.6 million).

According to statistics, in general, starting from April 30, 2020, the NBU held 31 auctions for 90-day refinancing for a total amount of about UAH 45.886 billion. The tenders scheduled for June 5, July 10 and September 11 did not take place due to a lack of bids.

In addition, starting from May 8, the National Bank held eight refinancing tenders for a period of one to five years for a total amount of about UAH 48.53 billion.

According to the schedule of tenders published on the NBU’s website, the next refinancing auction for a period of up to 90 days will take place on December 24, for a period of one to five years on January 15, 2021.

The transport companies of Ukraine (excluding the territory of the Autonomous Republic of Crimea and Sevastopol, as well as part of the JFO zone) in January-November 2020 reduced transportation of goods by 11.6% compared to the same period in 2019, to 546.6 million tonnes, the State Statistics Service has reported.

According to the report, the freight turnover of carriers for the specified period decreased by 15.1%, to 263.9 billion tonne-kilometers.

According to statistics, over the 11 months of this year, 278.8 million tonnes of goods were transported by rail in domestic traffic and for export, which is 3.2% less than in January-November 2019. Some 174.6 million tonnes (less by 21.6%) were transported by road, 5.2 million tonnes (8.4% less) by water, 87.9 million tonnes (13.5% less) by pipeline, and 100,000 tonnes (6.5% less) by air.

The European Bank for Reconstruction and Development (EBRD) is providing a loan of up to EUR 13.8 million in the form of two allocated tranches to PJSC Kokhavynska Paper Mill (Lviv region) to finance the construction of a new production and warehouse building.

According to a report on the EBRD website, the project involves the construction of a plant for the production of paper goods based on cellulose.

“The project assumes the construction of a facility for the production of pulp-based tissue products to meet growing demand for high quality tissue products. It will enable the company to enter the higher quality retail tissue segment, double its tissue production capacity and improve operating efficiency. The CAPEX for capacity expansion comprises tissue and converting machines, the construction of an industrial production and storage workshop,” the bank said on its website.

The total cost of the project is EUR28.5 million.

The shareholders of the plant approved raising a EBRD loan in the amount of up to EUR17 million to finance the construction of a new production facility at a meeting on November 10.

According to the decision, the property of the factory, the market value of which exceeds 50% of the value of the assets (according to the latest financial statements), will be pledged on the loan.

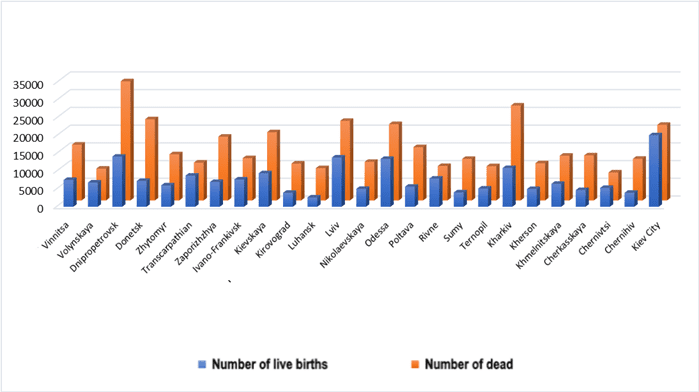

Ratio of fertility and mortality by region as of Jan-Sept, 2020.

SSC of Ukraine