The Pivnichny (Northern) Economic Court of Appeals on February 2 rejected the complaint of Imperial Tobacco Ukraine and Imperial Tobacco Production Ukraine against the decision of the Antimonopoly Committee of Ukraine (AMCU) on a fine of UAH 460 million on suspicion of anti-competitive concerted actions of cigarette manufacturers and distributors.

“Imperial Tobacco Ukraine and Imperial Tobacco Production Ukraine will appeal the decision of the Court of Appeals in the Supreme Court. In addition, the companies are simultaneously preparing to transfer the case to the international investment arbitration, because it is becoming increasingly clear that in Ukraine foreign investors cannot count on a fair trial,” the group of companies said in a press release.

According to Imperial Tobacco, the decision of the court is the result of political pressure.

“Unfortunately, the appellate link of the judiciary has demonstrated the same bias and political bias as the court of first instance. This development of events gives another alarming signal to the community of foreign investors about the real state of legal proceedings in Ukraine,” the press service of the company said citing director general of Imperial Tobacco Rastislav Cernak.

The company clarified that the fine of UAH 460 million was paid in full the day after the loss in the court of first instance – July 21, 2020, in order to prevent the accrual of additional penalties and to avoid further pressure on the company’s operating activities from the AMCU.

Ukraine’s neighboring countries are in the “red” zone for the situation with coronavirus (COVID-19) disease, according to data on the Health Ministry’s website on Friday.

Among the closest neighbors of Ukraine, the “red” zone includes, in particular, Slovakia (468.4 cases of COVID-19 per 100,000 population), Belarus (222), Poland (196.1), Russia (189.8), Romania (173), Hungary (163.8), and Moldova (172.3).

The “red” zone includes countries with an incidence rate per 100,000 population over the past 14 days higher than in Ukraine (142.3). In total 80 countries.

Portugal, Israel, Spain, Montenegro, the Czech Republic, Slovenia, the United States, Great Britain, Latvia, Lithuania, Sweden, France, the Netherlands, Switzerland, Italy, Belgium, Georgia, Austria, Germany, and Canada are also among the countries of the “red” zone.

The list of countries of the “green” zone includes, in particular, Turkey, Bulgaria, Finland, Greece, Japan, India, and Egypt.

Mix Line LLC (Chornomorsk, Odesa region), which organizes cargo transportation, can buy shares of Odesa Airport Development LLC (Kyiv), which will provide the buyer with over 25% of the voting shares on the company’s board.

According to the Antimonopoly Committee of Ukraine (AMCU), it provided Mix Line LLC with the appropriate permissions on February 4.

The founder of Mix Line LLC is Liudmyla Shinkarenko. She is also the founder of Agro-Aldmish LLC and Phoenix Security Agency LLC.

As reported, in 2011, the disposal of municipal property of Odesa International Airport took place in favor of economic entities. The alienation took place as a result of the creation by Odesa City Council and Odesa Airport Development, the beneficial owners of which at that time were known local Odesa entrepreneurs Borys Kaufman and Oleksandr Hranovsky, of Odesa International Airport LLC, in whose charter capital the property of municipal enterprise Odesa International Airport was transferred. At the same time, the city’s share in the newly created company was only 25%.

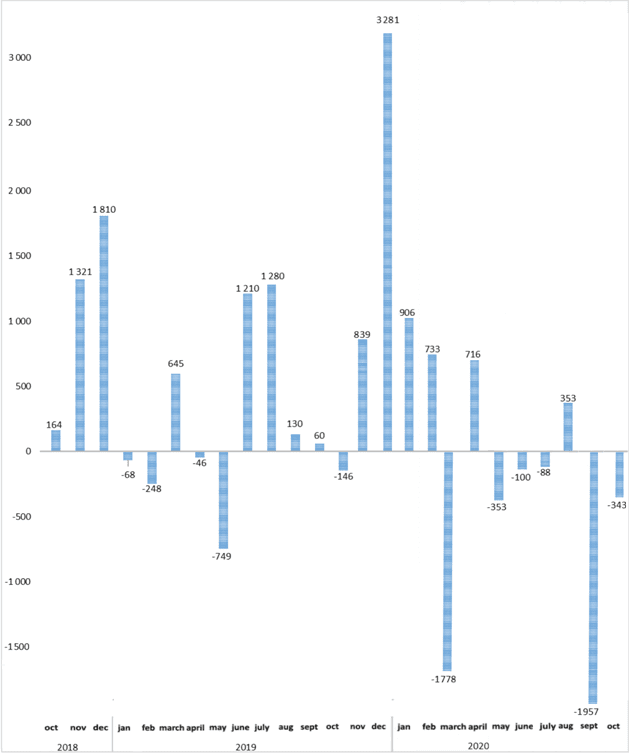

Dynamics of balance of payments of Ukraine (USD mln).

Two container trains from China passed the station Kyiv-Lisky in January 2021, another train is on the way, the press service of JSC Ukrzaliznytsia said on Wednesday.

According to the company, in January 2021, a total of 14 trains passed across Ukraine in the direction of China-EU countries (seven in the direction of Poland, six to Hungary, and one to Slovakia).

As reported, 22 container trains from China arrived in 2020. Over the past year, more than 425,000 containers in conventional units (TEU) were transported across the territory of Ukraine, which was 10.7% more than in 2019.

PJSC ArcelorMittal Kryvyi Rih (Dnipropetrovsk region) in 2020 reduced investments in labor protection by 24.4% compared to the previous year, to UAH 380.7 million from UAH 503.4 million.

According to a press release from the enterprise, the company continues to invest in improving working conditions, providing workers with special clothing and footwear, personal protective equipment, as well as implementing measures to reduce injuries and increase the level of industrial safety.

At the same time, it is specified that last year the company registered 34 lost time injuries among its own personnel and contractors. Of these – three fatal accidents (two with the plant employees and one with an employee of the contractor). The overall accident rate in the plant for 2020 (including subsidiaries in Ukraine) was 0.61. The injuries were predominantly associated with the falls of the victims. In the second place is the exposure of workers to high temperatures, as well as injuries as a result of the action of moving, flying and rotating parts, equipment parts and objects.

Most of the injuries occurred for organizational reasons – violation of labor and production discipline. Some 38% of injured workers are not new to production, their work experience in the profession is more than 10 years. The cause of injury is in performing habitual actions with reduced attention during work. Some 24% of injuries occur among young workers with up to 1 year of work experience in production.

From September 22 to September 25, 2020, TMS certification organization conducted an audit of the plant’s labor protection management system for compliance with the requirements of international standard ISO 45001: 018, as a result of which the company received a certificate of conformity.