With the adoption at first reading a bill, the Verkhovna Rada set the minimum rental period for agricultural land under vineyards or for laying it at 25 years.

Bill No. 2064 on amending certain legislative acts of Ukraine concerning the promotion of viticulture in Ukraine was supported by 295 MPs.

In addition, the bill establishes the pre-emptive right to renegotiate the contract after the expiration of the previous period for a person who leases land for growing vineyards and who properly fulfills the terms of the contract.

It is envisaged that upon transfer of ownership with the early termination of the right to use the land plot under viticulture, the land user should be paid reimbursement of expenses incurred for laying and caring for perennial plantations, as well as for losses incurred. The amount of losses should be determined by an independent assessment.

According to an explanatory note to the document, in recent years 21,200 hectares of new plantings were grown on farms of all forms of ownership, and 34,100 hectares were uprooted.

The problems of the development of viticulture are also associated with the high capital intensity of creating a modern vineyard (investments per 1 ha are more than UAH 100,000) and the duration of its payback. The duration of the creation of a vineyard is four years or more. The period of intensive operation of an industrial vineyard is 20-25 years.

Ukraine’s Verkhovna Rada has adopted bill No. 2493on joint stock companies, which proposes to allow companies to choose a corporate governance model and, along with the current two-tier corporate governance system, introduces a single-level one.

An Interfax-Ukraine correspondent reported that the bill at first reading was supported by 270 MPs with the required 226 supportive votes.

“This law brings the legislation into line with the requirements of reality. The general meetings are being improved: it is envisaged that they can be held in electronic form. A corporate affairs adviser is being introduced to help shareholders. The legal status of the corporate secretary has been settled. Today he or she may be appointed by the supervisory board of the company, but his or her status is not regulated,” Head of the parliamentary committee on finance, tax and customs policy Danylo Hetmantsev said from the rostrum of the parliament.

At the same time, one of the main innovations of the bill is to strengthen the protection of minority shareholders, one of the authors of the bill, MP from the Servant of the People parliamentary faction Roksolana Pidlasa said.

“Today, the majority of the rights of the world’s shareholders appear only if the share of their stockholding reaches 10%,” she said.

According to the explanatory note to the bill, the bill also brings the rules on the representation of shareholders in accordance with EU law, in particular, Directive 2007/36/EC of the European Parliament and of the Council of July 11, 2007 on the exercise of certain rights of shareholders in listed companies, and also harmonizes legislation on mergers, acquisitions and divisions of JSC with Directive 2017/1132/EC.

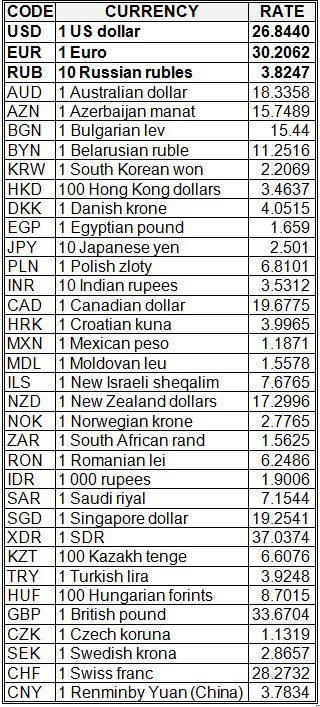

National bank of Ukraine’s official rates as of 16/06/20

Source: National Bank of Ukraine

Milk production in Ukraine in January-May 2020 decreased by 3.6% compared to the same period in 2019, to 3.64 million tonnes.

According to the State Statistics Service, over the five months of this year, 1.41 million tonnes of meat (in live weight) were produced, which is 1% more than in January-May of the previous year.

Egg production over the five months of this year fell by 0.4%, to 6.99 billion eggs.

According to the State Statistics Service, milk production in Ukraine in 2019 decreased by 3.6% compared to 2018, to 9.7 million tonnes. Egg production in 2019 increased by 3.4%, to 16.68 billion eggs, meat (in live weight) by 5.3%, to 3.49 million tonnes.

Kyiv Sikorsky International Airport has canceled all regular international passenger flights until 03:00 on June 17, 2020 due to the extension of the COVID-19 quarantine in the capital, the airport’s website reports.

The reason for the cancellation of flights at the airport is cabinet resolution No. 392 of May 20, 2020.

Passengers are advised to closely monitor the flight schedule and clarify information with the airline representatives.

As reported, on June 12 the Cabinet of Ministers lifted the temporary ban on entry to Ukraine for foreigners and resumed operation of 15 checkpoints for air traffic at international airports.