A bribe to the top officials of anti-corruption bodies was offered for the closure of a criminal proceeding where former ecology minister Mykola Zlochevsky was suspected of embezzlement, which would have allowed him to return to Ukraine, Director of the National Anti-Corruption Bureau of Ukraine (NABU) Artem Sytnyk has said.

“A bribe of $6 million was intended to close the episode when the ex-minister of ecology assisted in embezzling the stabilization loan from the National Bank issued to Real Bank,” Sytnyk said at a briefing in Kyiv on Saturday morning.

He said that a number of persons were suspected in this episode, including Zlochevsky.

“Why people who offered illegal benefit were in a rush? Because tomorrow Mr. Zlochevsky had a birthday and had a plan to achieve the maximum result, namely to close the criminal proceedings and ensure the return of Mr. Zlochevsky to Ukraine,” the director of NABU said.

Sytnyk also said that three people have been detained to date: the first deputy head of the main department of the State Fiscal Service in Kyiv, the second person is related to Burisma, he is an authorized representative of Zlochevsky and the third person is a former employee of the State Fiscal Service, who is also an authorized representative of Zlochevsky.

“At first, during the conversation, there was a proposal of $1 million for simply transferring the case to other investigating authorities… After refusing to receive these funds and continuing negotiations, they offered $5 million to close the criminal proceeding and it was important to do this before June 14, 2020,” Sytnyk said.

According to him, the funds were seized, and the amount of $1 million, which was in the car of the first deputy chief of the State Fiscal Service of Kyiv, was also seized.

“At present, the first deputy head of the State Fiscal Service’s department has been declared suspected of committing a crime… for offering a bribe. As for the other two detainees, as the director of NABU said, draft notices of suspicion have already been prepared for them.

Head of the Specialized Anti-Corruption Prosecutor’s Office (SAPO) Nazar Kholodnytsky recalled that the criminal proceedings in which Zlochevsky appears were suspended.

“The sum (of the proposed bribe) amounted to $6 million, of which $5 million were intended for a person who should have made the procedural decision to close the case, and $1 million was supposed for consulting services of an intermediary,” the head of the SAPO said.

On June 12, a former official, with the assistance of an official of the State Fiscal Service in Kyiv and others, tried to transfer $6 million of illegal benefit to Kholodnytsky and NABU top officials.

The Institute of Molecular Biology and Genetics (IMBG) is developing multi-test systems for the diagnosis of COVID-19 against seasonal flu-like illnesses, said Viktor Liashko, the Deputy Minister of Health and Chief Sanitary Doctor of Ukraine.

“Influenza-like diseases span about 200 viruses. We actively cooperate with our academic institutes. IMBG has developed test systems [for diagnosing COVID-19 by PCR method]. Today it is developing a multi-test system that will allow us to conduct certain tests and will show percentage content of those viruses that circulate during this period of increased viral diseases,” he said on the NV Radio on Thursday.

Commenting on the likelihood of a second wave of the COVID-19 epidemic, Liashko noted that it will be more likely during the seasonal growth of influenza and flu-like illnesses.

“It is this second wave that we fear. Then there may be serious growth of incidences. In such cases, the combination of infections is possible, and it will be difficult to diagnose which pathogen caused the disease: flu or coronavirus,” he said.

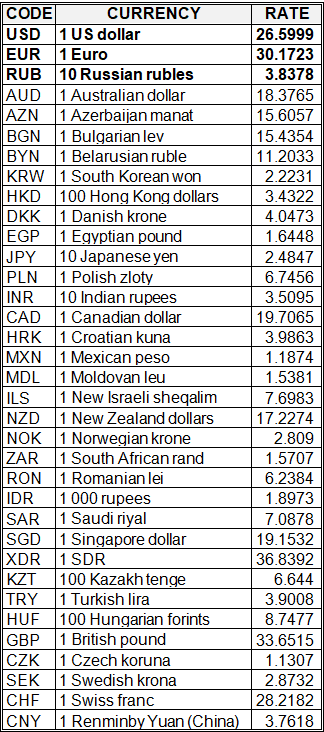

National bank of Ukraine’s official rates as of 12/06/20

Source: National Bank of Ukraine

Foreigners will need to have insurance for entry to Ukraine as soon as international flights are resumed, Health Minister of Ukraine Maksym Stepanov has said during a press briefing in Kyiv.

A possibility of testing the passengers for coronavirus (COVID-19) is also being considered.

“Speaking about border crossing and the resumption of international flights scheduled for June 15, we jointly with the Infrastructure Ministry suggest introducing the ‘red’ and ‘green’ zones. The ‘red’ zone will include the countries where the epidemiological situation is worse than in Ukraine, the ‘green’ one is [the countries] with a better situation. The ‘green’ zone foresees observation and self-isolation. In addition, we are considering a possibility of testing, but only by medical workers. At the same time, those who arrive in Ukraine must be insured. We are working on all of these issues,” Stepanov said.