Prime Minister of Ukraine Denys Shmyhal states that the government will launch domestic flights from June 5, and foreign flights from June 15.

“From June 5, we will launch domestic flights, and foreign flights – from June 15. And we want cafes and restaurants to start hosting visitors inside from June 5,” he said at a government meeting on Wednesday.

Busin Insurance Company (Kyiv) collected UAH 919,000 of gross premiums in January-March 2020, which is 97.4% lower than the volume of premiums collected for the same period in 2019, the Standard-Rating Agency has said.

The agency updated the insurer’s credit and financial stability rating at uaAA+ on the national scale based on an analysis of its financial statements for the first quarter of 2020.

Receipts from individuals in the company increased almost eight times, to UAH 213,000, and from reinsurers, on the contrary, decreased by 98.87%, to UAH 289,000.

The agency said that the sharp decline in gross business volumes is due to the specific types of insurance that the company provides.

Insurance payments allocated to reinsurers in the first quarter of 2020 compared to the same period in 2019 decreased by 26.62%, from UAH 11.2 million to UAH 8.2 million. As a result of the outpacing rates of gross premium reduction compared with the volume of premiums sent to reinsurers, the coefficient of dependence on reinsurance grew to 892.79%.

The company paid customers UAH 2.117 million of insurance payments and indemnities for the relevant period of 2020, which is 50.90% less than the volume of payments for the first quarter of 2019. However, a larger reduction in gross premiums caused an increase in the level of payments to 230.53%.

The financial result from the operating activities of Busin insurer amounted to UAH 8.863 million, and net profit reached UAH 27.031 million.

The company’s assets grew 8.65 times, to UAH 2.694 billion, cash and cash equivalents by 22.88%, to UAH 115.980 million by March 31, 2020. The company’s net worth had a rise of 14.85%, to UAH 130.770 million, liabilities increased from UAH 197.379 million to UAH 2.563 billion.

Thus, at the end of the first quarter of 2020, the obligations of the insurer were covered by net worth by 5.10%, and cash covered 4.53% of the company’s liabilities.

Busin insurance company was registered in February 1993. It specializes in risk insurance.

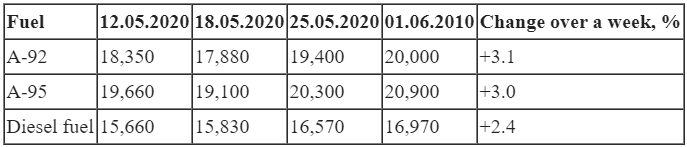

The average large-scale wholesale price of A-92 petrol in Ukraine increased by 3.1%, to UAH 20,000 per tonne over the past week from May 25 to June 1.

The average large-scale wholesale price of A-95 petrol grew by 3%, to UAH 20,900 per tonne, according to data from the A-95 Consulting Group (Kyiv).

The average large-scale wholesale price of diesel fuel was 2.4% up to UAH 16,970 per tonne.

Changes in large-scale wholesale prices of fuel in UAH per tonne (VAT included, 100% prepayment):

©Source: A-95 Consulting Company

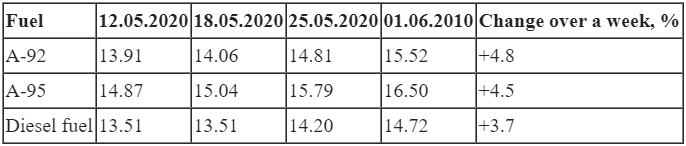

Meanwhile, the average small-scale wholesale price of A-92 increased by 4.4%, to UAH 15.52 per liter; that of A-95 by 4.5%, to UAH 16.50 per liter. The price of diesel fuel increased by 3.7%, to UAH 14.72 per liter.

Changes in small-scale wholesale prices of fuel in UAH per liter (VAT included, 100% prepayment):

©Source: A-95 Consulting Company

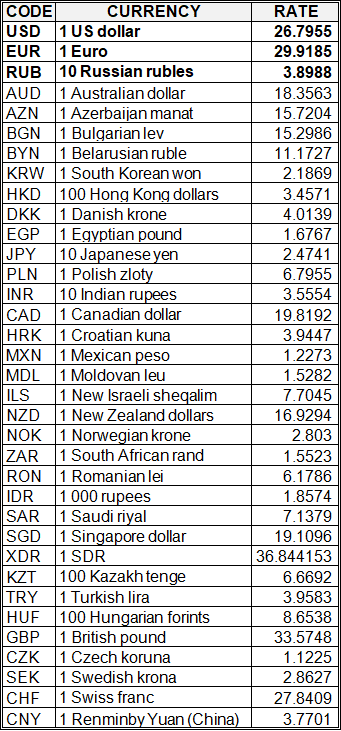

National bank of Ukraine’s official rates as of 03/06/20

Source: National Bank of Ukraine

A new success story has begun due to great patience of Ukrainians, well-coordinated work of state authorities and heroism of doctors, Director General of ANEX Tour Ukraine Ilker Adiguzel said.

According to reports from various countries and statements by public officials in Ukraine, borders will open for air traffic from June 15. ANEX Tour is already checking out the flight schedule based on bilateral agreements. Certainly, first flights will be launched to the countries which have prepared their infrastructure for receiving guests, he noted.

“Turkey, which is our main destination, will start receiving guests from July 1 this year. It has become an exemplary country of the world by taking all necessary safety measures for tourists and the tourism sector as a whole. Also, the UAE and Asian countries most likely will be among the first countries to open for flights. Serious work is being carried out there at the top level with the aim of reviving tourism and making the infrastructure safe. The time of a coronavirus outbreak was the most difficult for European countries. However, we hope that flights to Europe will be allowed at the next stage. We will start from Spain. With its destinations network covering all countries, ANEX Tour is the world’s second largest tour operator. Taking this fact into account, according to the calendar (including the schedule of flights and opening of borders), in line with official decisions and strategic forecasts, which will be approved, we continue offering the best services to our tourists. We are preparing to win hearts of millions of Ukrainian travelers by transporting them safely to vacations of their dream,” Adiguzel said.

He also noted that it is planned to launch new direct flights from Ukraine to popular destinations.

Myronivsky Hliboproduct (MHP) in the first quarter of 2020 received $174 million in net loss compared to $33 million in net profit for the same period in 2019.

According to the holding’s report on the London Stock Exchange’s website, its revenue increased by 2%, to $443 million, export revenue decreased by 11.6%, to $237 million (54% of total revenue compared to 61% in January-March 2019).

MHP’s operating profit decreased by 6%, to $47 million, gross profit grew by 14%, to $92 million. The company’s EBITDA in the reporting period grew by 16%, to $96 million, EBITDA margin to 22% from 19% in the first quarter of 2019.

“The net loss of $174 million compared with a profit of $33 million for the first quarter of 2019 is associated with $182 million of losses from foreign currency cashless transfers (foreign exchange differences) in the first quarter of 2020,” MHP explained.

Net profit before exchange rate differences in January-March 2020 amounted to $8 million, which is 33% lower than in the same period a year earlier.

MHP’s net debt as of March 31, 2020 amounted to $1.22 million compared to $1.14 million as of December 31, 2019.

In the first quarter of 2020, total capital investment amounted to $21 million and were mainly related to the maintenance and production of Perutnina Ptuj.