In April 2025, Ukraine doubled its electricity exports compared to March, reaching 151.6 thousand MWh, while imports fell by almost a third to 187 thousand MWh, according to the Ukrainian energy and climate think tank DiXi Group, citing Energy Map.

As explained by DiXi Group experts on the center’s Facebook page, at the beginning of the month, electricity consumption increased due to lower air temperatures, in particular due to additional heating needs. However, in the second half of April, stable weather conditions – warmer and sunny weather – reduced the load on the power grid and contributed to an increase in exports.

Of the 151.6 thousand MWh, 38% (57.1 thousand MWh) went to Hungary, 35% (52.8 thousand MWh) to Moldova, 15% (23.3 thousand MWh) to Romania, 12% (18.4 thousand MWh) to Slovakia. Supplies to Poland have been suspended since mid-March.

Compared to April 2024, exports increased 12.6 times: at that time, they amounted to only 12 thousand MWh.

The distribution of 187,000 MWh of electricity imports by country is as follows: 45% (83,100 MWh) came from Hungary, 18% (34,200 MWh) from Slovakia, 18% (34.2 thousand MWh) from Poland, 13% (24.5 thousand MWh) from Romania, and 6% (11 thousand MWh) from Moldova.

Compared to April 2024 (223.8 thousand MWh), imports decreased by 16%.

“Despite the growth in exports, the total volume of imports in April still exceeds exports by 19%,” DiXi Group experts note.

As reported, Ukraine increased electricity exports by 131% in March to 76.3 thousand MWh, while imports increased by 11% to 272.3 thousand MWh.

In January-March 2025, the nitrogen holding Ostchem produced 529.3 thousand tons of mineral fertilizers, which is 26.5 thousand tons, or 5.3% more than in the same period of 2023.

“The production structure changed in line with demand and imports: the share of ammonium nitrate and urea decreased, while the share of the most popular type of fertilizer, UAN (urea ammonium nitrate), increased,” the holding said in a statement on Thursday.

Ammonia nitrate production in the first quarter of 2025 decreased to 226,500 tons from 246,000 tons last year, urea to 116,700 tons from 123,500 tons, while UAN production increased from 123,800 to 162.2 thousand tons, and VAS (lime-ammonium nitrate, which is produced only at Rivneazot) – to 15.8 thousand tons from 10.8 thousand tons.

In total, Cherkasy Azot produced 394.8 thousand tons of products, and Rivneazot produced 134.4 thousand tons.

“Ostchem enterprises faced forced production stoppages due to drones entering the territory of our plants and the destruction of external gas and energy infrastructure in the Cherkasy and Rivne regions. Force majeure led to forced disruptions in fertilizer supplies, so we apologize to our customers,” the release said, citing Group DF’s head of corporate communications, Oleg Arestarkhov.

According to him, this was the most difficult season because the holding suffered huge losses due to emergency shutdowns and restarts of production facilities, but he confirmed that fertilizer orders would be fulfilled.

He also thanked the staff of the State Emergency Service of Ukraine for their help in extinguishing the fires, as well as others involved in restoring the destroyed energy and gas infrastructure.

The release also notes that the Ostchem nitrogen holding company revised its strategy in 2025: the new priority is to reduce production risks through investments in the energy independence of enterprises.

“With rising electricity prices and continuing risks, the nitrogen business is forced to take steps to ensure the stability of production chains and reduce external energy consumption,” the holding company explains.

Ostchem is Dmitry Firtash’s Group DF nitrogen holding company, which brings together the largest mineral fertilizer producers in Ukraine. Since 2011, it has included Rivneazot and Cherkasy Azot, as well as Severodonetsk Azot and Stirol, which are not operating and are located in the occupied territories.

Cherkasy Azot (Cherkasy, Ukraine) is one of Ukraine’s largest chemical companies. Its designed production capacity is 962,700 tons of ammonia per year, 970,000 tons of ammonium nitrate per year, 891,600 tons of urea per year, and 1 million tons of UAN per year.

PJSC Rivneazot is one of the largest chemical companies in Western Ukraine. On April 12, 2024, Group DF and South Korea’s Hyundai Engineering signed an agreement to build a chemical hub in Rivne. The project involves the construction of plants for the production of green ammonia and hydrogen based on renewable energy sources, as well as new enterprises and production sites for the production of nitrogen fertilizers and chemical derivatives.

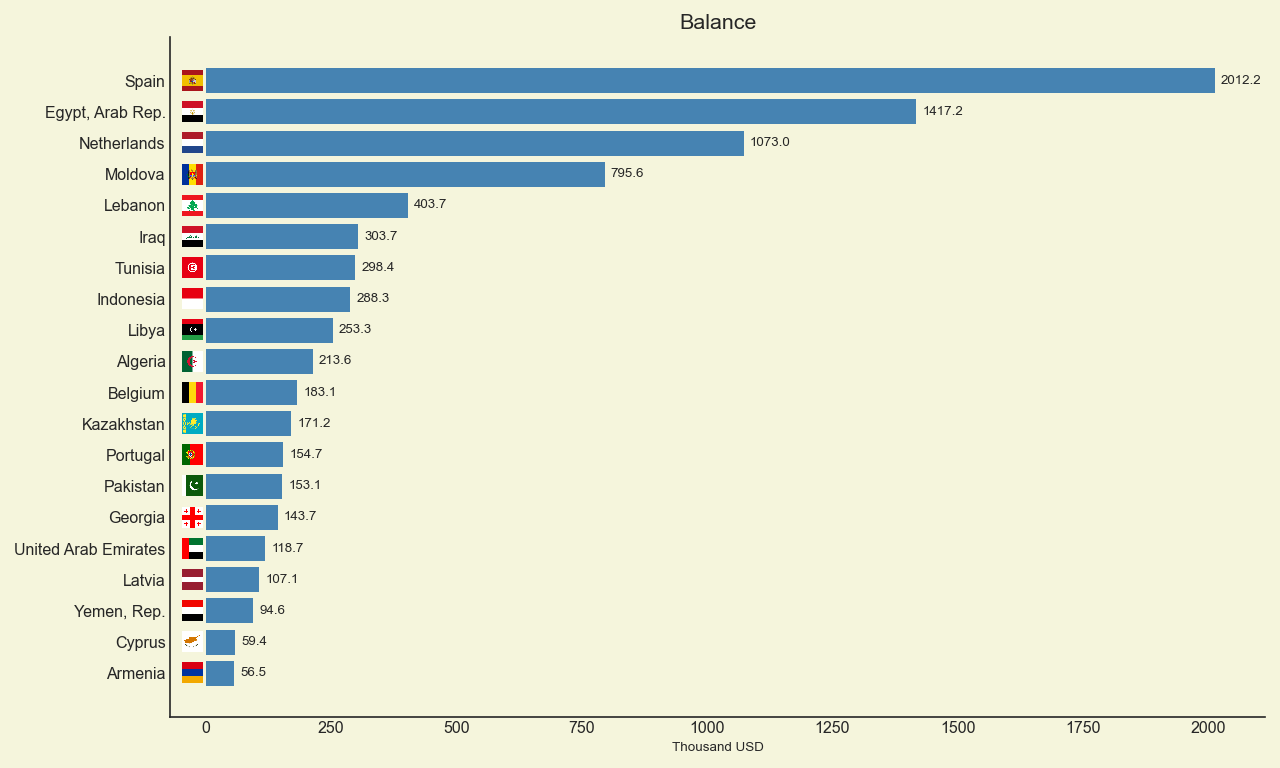

Geographical structure of Ukraine’s foreign trade (surplus) in January-December 2024, million USD

Zavale Graphite Plant (ZGP, Zavalle, Kirovohrad region) increased its net loss by 11.7% in 2024 compared to 2023, from UAH 2.039 million to UAH 2.278 million.

According to the company’s disclosure in the National Securities and Stock Market Commission’s information disclosure system, a shareholders’ meeting will be convened on June 16 this year. There are nine items on the agenda, including the supervisory board’s report for 2024, approval of measures based on its review, as well as approval of annual reports and balance sheets for the past year, hearing of the conclusions of the audit report and approval of measures based on its review; approval of the results of financial and economic activities and the procedure for covering losses.

It is also planned to terminate the powers of the members of the supervisory board and elect new ones, as well as to adopt a decision on granting consent to significant transactions.

According to draft decisions, copies of which are available at Interfax-Ukraine, it is planned not to accrue or pay dividends.

The main product of ZGK is crystalline graphite, which is used in the production of foundry additives, coatings, foundry paints, sealing compounds, etc.

According to the NDU for the fourth quarter of 2024, Grafinvest LLC owns 78.9472% of the shares of ZGK.

PJSC ZGK includes a subsidiary, Zavalivsky Graphite LLC.

The authorized capital of PJSC is UAH 286,000, and the par value of a share is UAH 0.25.

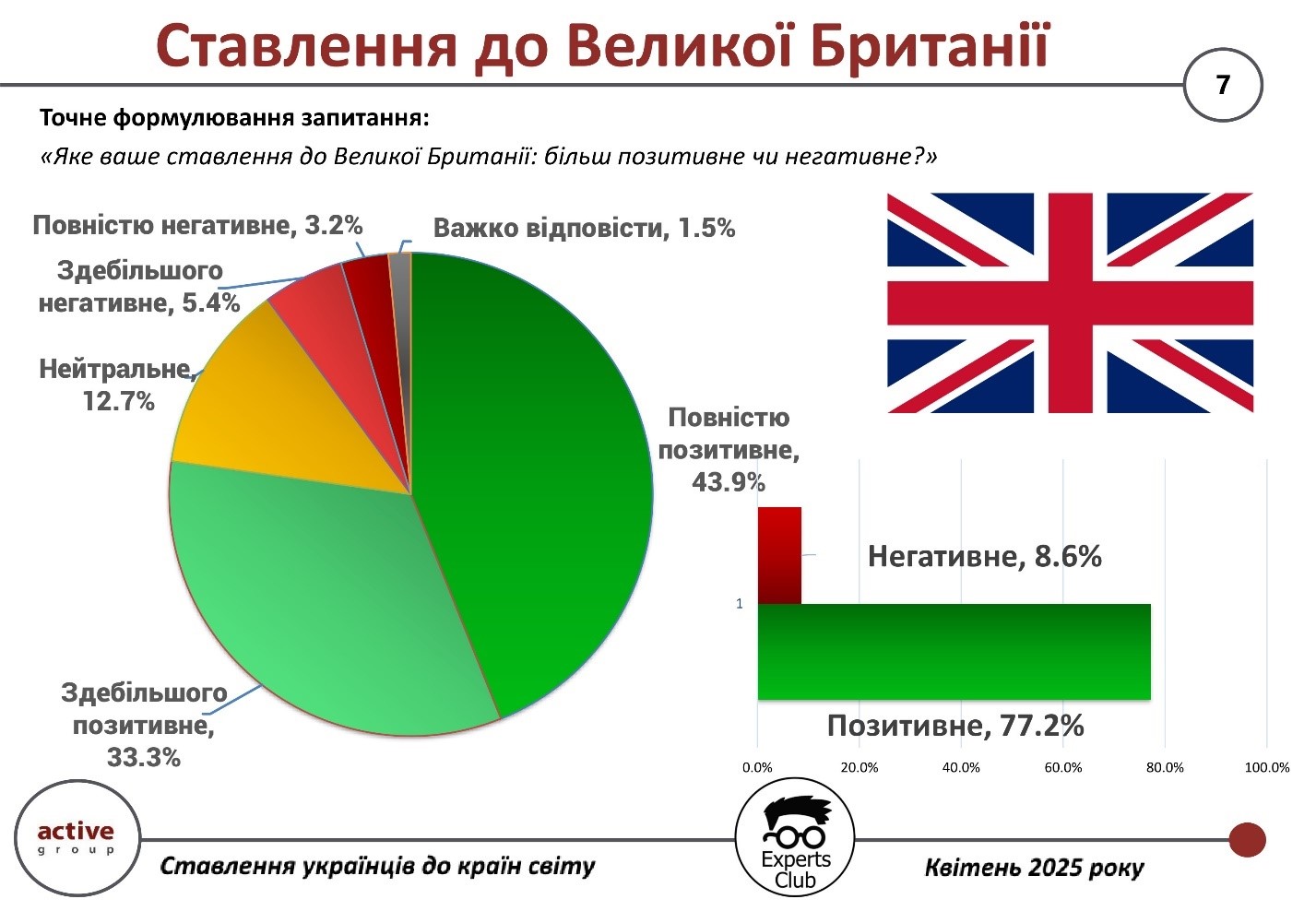

Great Britain is confidently included in the list of countries that Ukrainians view most favorably. This is evidenced by the results of a public opinion poll conducted by Active Group in collaboration with the Experts Club information and analytical center in April 2025.

According to the poll, 77.2% of Ukrainians have a positive perception of Great Britain (43.9% — completely positive, 33.3% — mostly positive). Only 8.6% of respondents expressed a negative attitude (5.4% mostly negative, 3.2% completely negative), while 12.7% chose a neutral position and 1.5% were undecided.

“London’s support during the war, both political and military, was not only noticed but also highly appreciated by Ukrainian society. The UK is perceived as a reliable ally,” commented Alexander Pozniy, co-founder of Active Group.

These results confirm not only the positive image of the UK in Ukraine, but also the strengthening of the strategic partnership at the level of public trust.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

American Cardinal Robert Prevo has been elected the new Pope, taking the name Leo XIV.

The election was announced on Thursday by French Cardinal Dominique Mamberti, who spoke from the balcony of St. Peter’s Basilica to the crowd gathered in St. Peter’s Square.

According to Vatican News, the Conclave elected the 267th Pope of Rome, announcing Cardinal Robert Prevo from the United States as the new pontiff.

It is noted that Prevo is the first Pope from North America and the first Augustinian Pope. The 69-year-old Prevo spent most of his career as a missionary in Peru.

Robert Francis Prevost was born in 1955 in Chicago (USA) and also has Peruvian citizenship.

He received his secondary education at the minor seminary of the Order of St. Augustine in 1973 and received a bachelor’s degree in mathematics in 1977. He was ordained a priest of the Order of Saint Augustine in Rome in 1982, after which he obtained a licentiate and a doctorate in canon law at the Pontifical

University of Saint Thomas Aquinas in Rome.

In 1985, he joined the Augustinian mission in Peru, where he headed the seminary and taught canon law. From 2001 to 2014, he was Prior General of the Augustinians in Chicago (elected twice). In 2015, he was appointed bishop of the Diocese of Chiclayo (Peru).

In 2023, Pope Francis appointed Prevo as Prefect of the Dicastery for Bishops, a key position in the Roman Curia, and on February 6, 2025, elevated him to the rank of cardinal bishop.

The Pope speaks English, Spanish, Italian, French, and Portuguese, and also reads German and Latin.

“It is a great honor for me to realize that he is the first American to become Pope. What excitement and what an honor for our country. I look forward to meeting Leo XIV. It will be a very important moment,” President Donald Trump wrote on the Truth Social platform.