In the European Union, 3.67 million children were born in 2023, according to the EU Statistical Office (Eurostat). This is 5.4% lower than in 2022, when the number of newborns was 3.88 million.

The figure is the lowest since data collection began in 1961, and the year-on-year drop was also a record for this period. The highest number of children was born in 1964 – 6.8 million.

In 2023, the total fertility rate (the average number of children born per woman in her lifetime) fell to a record low of 1.38, compared to 1.46 the previous year.

Source: https://t.me/relocationrs/593

The Czech Republic will take part in six public investment projects to modernize Ukrainian medical institutions.

According to the Ministry of Health, the European Commission has now agreed on projects to modernize the Lviv Regional Hospital for War Veterans and the Repressed, Rivne Regional Hospital for War Veterans, Volyn Regional Clinical Hospital, Kryvyi Rih City Hospital #5, Dnipro City Clinical Hospital #16, and Kyiv Regional Children’s Hospital.

The Ministry of Health notes that the Czech Republic is a member of the Ukraine Facility program and is potentially ready to finance the reconstruction and modernization of 13 hospitals in seven regions of Ukraine.

So far, Russians have damaged 1984 medical facilities and destroyed another 301. According to the World Bank, the reconstruction needs in Ukraine’s healthcare sector over the next 10 years amount to $19.4 billion.

Since the start of the full-scale war, the Czech Foreign Ministry has allocated EUR 4.3 million for medical equipment and machinery for Ukrainian hospitals, ambulances, buses, and communications equipment for medical units.

Ukraine has supplied an additional 3,850 tons of wheat flour to Syria as part of President Volodymyr Zelenskyy’s humanitarian program Grain From Ukraine, Foreign Minister Andriy Sybiga said.

“Together with 500 tons in December, this will provide 60 thousand Syrians for six months,” he wrote on social networking site X.

Sybiga assured that Ukraine continues to support the Syrian people and food security in the Middle East.

PJSC “Meridian” named after Korolyov” (Kyiv), a part of the state concern ‘Ukroboronprom’, plans to allocate 30% or 70% of its net profit of UAH 11 million for dividends in 2024.

These two draft resolutions on dividend payments are on the agenda of the general meeting of shareholders scheduled for April 17.

If 30% of the net profit is allocated to dividends, they will be accrued in the amount of UAH 3.27 per share of UAH 0.5 par value, and 70% – UAH 7.65 per share.

The dividends are to be paid by July 1 this year.

As reported, in 2023, Meridian paid dividends to shareholders of UAH 11 million (90% of net profit of UAH 12.205 million) at the rate of UAH 10.90 per share.

According to the National Securities and Stock Market Commission (NSSMC), as of the third quarter of 2024, the state, represented by Ukroboronprom, owns 50%+1 share of PJSC Meridian named after Korolyov, and another 40.0753% is owned by Meridian Soyuz LLC, one of the beneficiaries of which, according to Clarity Project, is Vadym Hryb, co-owner of the Tekt investment company.

At the meeting, the shareholders also plan to change the type of company from a public joint-stock company (PJSC) to a joint-stock company (JSC) and re-elect the supervisory board, terminating the powers of the previous six-member board.

“Founded in 1953, Meridian is a diversified enterprise specializing in the development and serial production of electronic devices for various purposes, including radio measuring instruments: frequency meters, spectrum analyzers, and generators.

The company also performs galvanizing, laser cutting of metals, and plastic molding.

According to Clarity Project, the company increased its net revenue by 24% in 2023 to UAH 177.43 million, while net profit decreased by 27% to UAH 12.2 million.

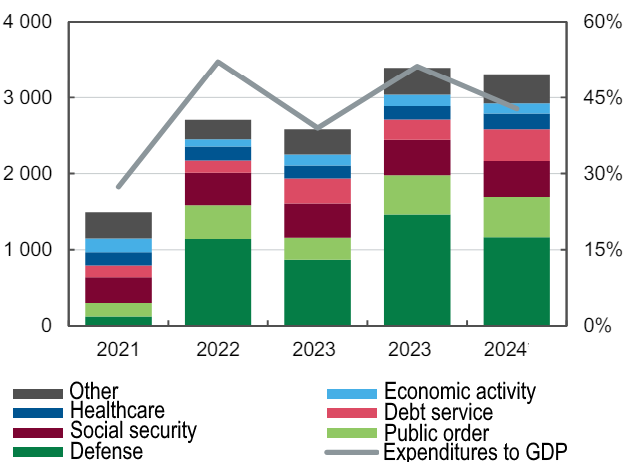

Components of state budget expenditures in 2021-2024, UAH billion

Source: Open4Business.com.ua

Swedish and Ukrainian defense companies Saab and Radionix have signed a memorandum of understanding to form a strategic cooperation in the field of sensors and defense electronics to strengthen Ukraine’s defense capabilities.

According to Saab’s website, the cooperation will involve the development and maintenance of sensors and defense electronics, utilizing the strengths of both companies.

Radionix will provide valuable know-how in the field of radar and optical sighting equipment, while Saab will contribute its experience in the defense industry and knowledge in these technological areas.