In January 2025, Ukraine reduced imports of nickel and nickel products by 66% compared to the same period in 2024, to $1.216 million. In December 2024, this figure was $3.058 million. Nickel exports in January 2025 amounted to $33 thousand, while in December it was $17 thousand. In 2024, Ukraine exported nickel worth $532 thousand.

Nickel is used to produce stainless steel and for nickel plating. Nickel is also used in the production of batteries, powder metallurgy, and chemicals.

In 2024, communities’ budgets received almost UAH 273 million in tourist tax, which is almost 23% more than in 2023 (UAH 222 million 618 thousand) and 53% more than in 2022 (UAH 178 million 949 thousand), the press service of the State Agency for Tourism Development (DART) reports.

Kyiv and five regions are among the leaders in paying the tourist tax.

The capital’s budget received the largest amount of tourist tax – UAH 49 million 182 thousand. In 2023, this amount amounted to UAH 30 million 378 thousand, and in 2022 – UAH 31 million 474 thousand.

The budget of Lviv region was replenished by UAH 47 million 108 thousand. This is almost as much as the amount of revenues received by the regional budget in 2023 – UAH 46 million 85 thousand. This amount is 14% higher than in 2022, when the budget of Lviv region received UAH 41 million 430 thousand of tourist tax.

In Ivano-Frankivsk region, the amount of tourist tax increased by 84% compared to 2023 – up to UAH 33 million 99 thousand, when the regional budget received UAH 17 million 956 thousand. In 2023, the region’s tourist tax amounted to UAH 20 million 408 thousand.

Cherkasy region received UAH 23 million 532 thousand in tourist tax. In 2023, the amount was slightly less – UAH 21 million 574 thousand, in 2022 it was 87% less – UAH 12 million 555 thousand.

The amount of tourist tax in Zakarpattia region last year amounted to UAH 23 million 93 thousand. It is almost the same as in 2023 – UAH 22 million 161 thousand, and 19% more than in 2022 – UAH 19 million 471 thousand.

Dnipropetrovska oblast closes the list of leaders with UAH 15 million 960 thousand. Compared to 2023, the amount of tourist tax in the region increased by 21% to UAH 13 million 219 thousand. In 2022, the region’s tourist tax amounted to UAH 9 million 210 thousand.

For more information, please follow the link: https://surl.li/ioulky

In January 2025, Ukrainian companies reduced imports of copper and copper products by 17.93% compared to the same period in 2024, to $13.815 million. At the same time, copper exports increased by 31.7% to $6.951 million during this period. In December 2024, copper imports amounted to $13.487 million, and exports amounted to $7.128 million.

Copper is widely used in electrical engineering, pipe manufacturing, alloys, medicine and other industries.

Elax PrJSC (Kharkiv), one of the leading suppliers of products and integrated solutions in the field of automation and power supply for industrial enterprises, will pay UAH 50 million in dividends to shareholders based on the results of its operations in 2024 at the rate of UAH 62.5 thousand per share (par value UAH 1).

According to the company’s announcement in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), the decision was made by the general meeting of shareholders on February 17.

The dividend payment period is set from March 4 to July 27, 2025, and will be paid in installments of UAH 10 million.

The company does not disclose the amount of net profit in 2024 (in January-September 2024, according to Clarity Project, it amounted to UAH 39.34 million, retained earnings – UAH 103 million).

According to the NSSMC, as of the third quarter of 2024, the company’s shareholders were Iryna and Dmytro Kolchyk (69.625% and 30.375% of the authorized capital, respectively).

According to the company’s annual report, based on the results of its operations in 2023, dividends were paid in the amount of UAH 50 thousand per share for a total amount of UAH 40 million. In 2023, the company earned UAH 41.8 million in net profit (3.3 times more than a year earlier), with net income increasing 2.5 times to UAH 338.6 million.

Elax provides comprehensive services for the creation of automated process control systems (APCS) based on equipment from leading global manufacturers, develops power supply systems and performs electrical installation and commissioning.

In 2022, it partially relocated production to Rivne.

Customers of the company’s products and services include Metinvest, MHP, Kernel, Lactalis, Nestle, Dyckerhoff, and Zdorovye pharmaceutical company.

According to Clarity Project, in January-September 2024, the company increased its net income by 8% compared to the same period in 2023, to UAH 201.2 million, with net profit growing 2.5 times to UAH 39.3 million.

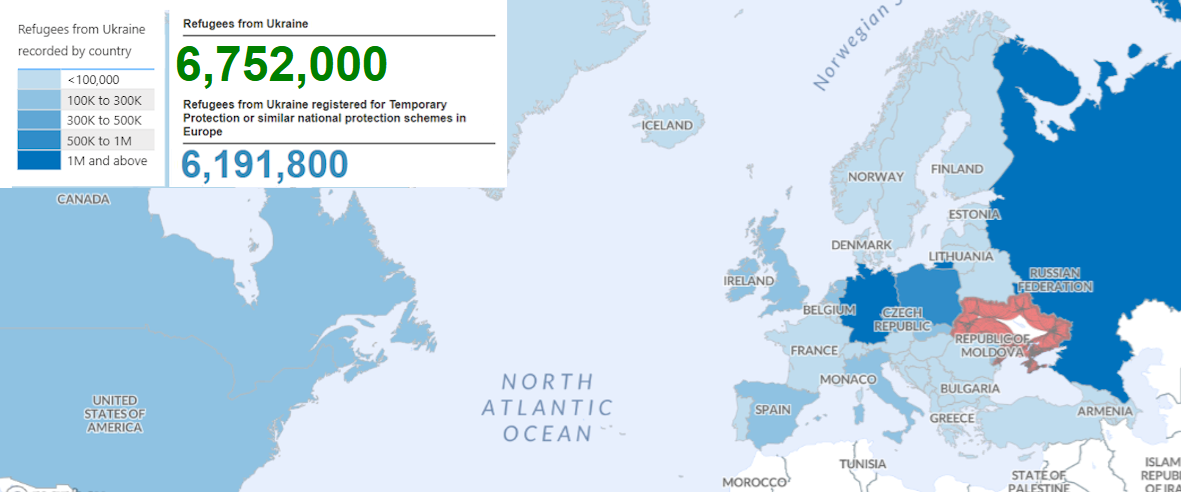

Number of refugees from Ukraine in selected countries as of 31.10.2024

Source: Open4Business.com.ua

Imports of tractors to Ukraine in January this year amounted to $43.87 million, which is 34% less than in the same month in 2023, according to statistics from the State Customs Service.

According to the statistics released by the agency, tractors were mainly imported from China (21.2% of total imports of this equipment, or $9.3 million), Germany (5.5%, or $12.4 million), and the United States (10.7%, or $4.7 million), while a year earlier it was Poland (19.5%), Germany (19.3%), and the Netherlands (11%).

According to the statistics, in January, tractors were exported for $0.56 million against $0.3 million a year earlier, mainly to Zambia (41.4%), Romania (36.2%), and the Czech Republic (14%).

Imports of tractors to Ukraine in 2024 amounted to almost $784 million, down 5.6% from a year earlier, while exports amounted to $5.44 million against $5.74 million.