The Cabinet of Ministers of Ukraine has allocated an additional UAH 400 million for the purchase of housing for veterans in 2024.

“The additional funds enable the Ministry of Veterans to provide financial compensation for the purchase of housing for 186 more people this year. The funds will be transferred to the recipients’ accounts during the current month,” the Ministry of Veterans Affairs said in a statement.

It is noted that thanks to additional funds in 2024, UAH 10.5 billion will be allocated to provide own housing for 4619 veterans and their families.

Ukrainian farmers who bought domestic agricultural machinery in November will receive UAH 231.5 million in partial compensation (25% of the cost) from the state, the Ministry of Economy reports on its website.

“In November, 792 agricultural producers applied for partial compensation, having purchased more than 1.3 thousand units of machinery and equipment made in Ukraine for UAH 1.1 billion. Under the terms of the program, the state will refund UAH 231.5 million to them. Since the start of the program, farmers have purchased machinery and equipment worth over UAH 4.2 billion. The total amount of compensation from the state for this period amounted to over UAH 876.7 million,” said First Vice Prime Minister and Minister of Economy Yulia Svyrydenko.

The agency noted that most of the compensation in November was transferred through Oschadbank (UAH 62.7 million), PrivatBank (UAH 58 million) and Raiffeisen Bank (UAH 25.2 million). In total, funds were transferred through 24 banks out of 33 financial institutions participating in the program.

In terms of the number of machines purchased since the start of the program in April 2024, the leaders are farmers in Poltava (532 units), Cherkasy (458 units) and Kirovohrad (417 units) regions. In terms of the cost of machinery, Ternopil (UAH 388.9 million), Kyiv (UAH 388.6 million) and Sumy (UAH 373.5 million) regions are the leaders. Agrarians in these regions are also leaders in terms of compensation received: Ternopil – UAH 81 million, Kyiv – UAH 80.9 million, Sumy – UAH 77.8 million.

On Wednesday, President of Ukraine Volodymyr Zelenskyy signed a law on taxation of remuneration for gig contracts of Diia.City residents (draft law No. 9319) with an amendment to bring new tax rules (draft law No. 11416d) into force for individual entrepreneurs and legal entities on a single tax from January 1, 2025, said Danylo Hetmantsev, chairman of the parliamentary committee on taxation and customs policy.

“Draft Law 9319 has been signed. The increase for individual entrepreneurs comes into force on January 1. Everything is as promised,” he wrote in his telegram channel.

His deputy Yaroslav Zheleznyak noted that the law had been awaiting the president’s signature for 17 days.

As reported, on November 28, the President of Ukraine signed Law 4015-IX (Bill No. 11416-d) on amendments to the Tax Code regarding the peculiarities of taxation during martial law. The document envisages an increase in the military tax from 1.5% to 5% starting from October 1 this year, a 50% increase in the bank profit tax in 2024, and an increase in a number of other taxes and fees.

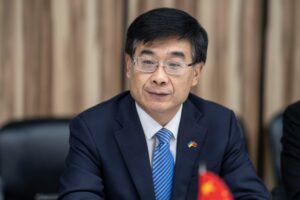

Head of the Office of the President of Ukraine Andriy Yermak met with the newly appointed Chinese Ambassador to Ukraine Ma Shengkun.

“During the meeting, we discussed the prospects for bilateral cooperation between China and Ukraine,” the press service of the Presidential Office reports on its telegram channel.

During the meeting, Yermak noted that China’s role is important in achieving a just and lasting peace for Ukraine.

“In addition, they discussed the possibility of bilateral dialogue at the highest level,” the statement said.

More than 52% of customers became new to the Foxtrot brand during the month of the company’s assortment being presented on the Kasta marketplace, the press service of the omnichannel retailer reported.

The release notes that among several thousand orders, more than 52% of customers were new to Foxtrot.

“The first month’s experience not only proves the correctness of the cooperation strategy between Foxtrot and Kasta, but also confirms the importance of such collaborations for both market development and consumers. In addition, innovative approaches and the exchange of best practices allow us to find new opportunities to improve the service and offers to our customers,” said Kirill Popov-Cherkasov, Foxtrot’s ecommerce director.

The product groups with the largest receipts among the orders for Kasta were charging stations (in particular, powerful models of the BLUETTI line); laptops (ACER Predator, APPLE MacBook Air M3); smartphones (APPLE iPhone 16 Pro, SAMSUNG Galaxy S24) and large household appliances (refrigerators, washing machines). Accessories and small appliances are also very popular among Kasta visitors. In particular, in quantitative terms, the top five includes such product groups as clothes dryers, knife sets, portable vacuum cleaners, and electric kettles.

As reported earlier, Foxtrot omnichannel retailer has been represented on the Kasta marketplace since November 13. The collaboration involves the placement of about 10 thousand products from the retailer’s assortment.

“Foxtrot is one of the largest omnichannel retailers in Ukraine in terms of the number of stores and sales of electronics and household appliances. The company operates 123 stores in 67 cities, including the frontline cities of Kherson, Kramatorsk and Sloviansk, an online platform Foxtrot.ua and a mobile application of the same name. In 9M24, Foxtrot paid UAH 700.5 million in sales.

The Foxtrot brand is developed by Foxtrot Group of Companies. The co-founders are Valery Makovetsky and Gennady Vykhodtsev.

Kasta (Kasta Group LLC, EDRPOU 41021687) is a marketplace of clothing, footwear and accessories in Ukraine, founded in 2010, and a resident of Diia City since January 16, 24. The authorized capital is UAH 58.2 million, according to the results of 2023, the revenue was UAH 64 million 388 thousand, the net loss was UAH 31.1 million.

Oil prices rose in pre-holiday trading on Tuesday, recovering the losses incurred the day before.

The cost of February futures for Brent on the London ICE Futures exchange rose by $0.95 (1.3%) to $73.58 per barrel.

February futures for WTI on the New York Mercantile Exchange (NYMEX) rose by $0.86 (1.2%) to $70.1 per barrel.

Media reports that China may issue special treasury bonds worth a record 3 trillion yuan ($411 billion) in 2025 to raise funds to support the national economy have encouraged oil traders. China is one of the world’s largest oil importers and consumers.

Quotes continue to be supported by concerns about geopolitical tensions in Eastern Europe and the Middle East, as well as the prospect of tighter sanctions against Russia and Iran.

Meanwhile, expectations of an oversupply of crude oil amid unclear demand prospects and a stronger US dollar are having a restraining effect on oil prices, making commodities less attractive.

The market was evaluating the latest statements by US President-elect Donald Trump, who threatened to restore Washington’s control over the Panama Canal if the fee for passage through it is not reduced, and was also waiting for official data on commercial oil reserves in the US, which will be published this week with a delay due to the holidays.

“We can assume that WTI will trade around the $70 mark until Friday, when the late weekly report from the Energy Information Administration is released, which will set additional price targets,” Ritterbusch said in a research note.

On Wednesday, exchanges in the US, UK, Germany, France and other European countries, as well as Hong Kong, South Korea and Australia, are closed for Christmas. Many sites will remain closed on Thursday.