Slobozhanshchyna Agro, a subsidiary of IMC, has raised UAH 100 million under the government’s soft loan program Affordable Loans 5-7-9% from PrivatBank (Kyiv).

“Since the beginning of the war, financing agricultural production has become a priority for us. The bank systematically supports and will continue to support Ukrainian agribusinesses operating in the frontline and de-occupied regions,” Yevhen Zaigraev, Board Member for Corporate Business and SMEs, said in a press release.

It is noted that the financing will allow Slobozhanshchyna Agro to maintain its business activities in the frontline region of the country for a year.

Zaigraiev added that the company continues to operate in the Sumy region, where there are still high military risks.

“Thanks to this, the company received a more favorable interest rate under the guarantees of the CMU (Cabinet of Ministers of Ukraine – IF-U),” the release said.

“MK is an integrated group of companies operating in Sumy, Poltava and Chernihiv regions (north and center of Ukraine) in the crop production, elevators and warehouses segments. The company’s land bank is about 120 thousand hectares in Poltava, Chernihiv and Sumy regions, with storage capacity of 554 thousand tons for the 2023 harvest of 1.002 million tons.

This year, the company purchased 140 Ukrainian-made railcars, and in early August, for the first time, it shipped its products to ports in its own grain cars. According to Privat, the company ships 60-70 thousand tons of grain to ports by rail every month.

In the first half of 2024, IMC Agro Holding increased its net profit by 2.4 times year-on-year to $21.52 million, while its revenue increased by 51% to $108.32 million, while the share of exports decreased slightly to 81.3% from 81.9% a year earlier.

According to the National Bank of Ukraine, as of August 1 this year, PrivatBank ranked first in terms of total assets (UAH 895.26 billion) among 62 banks operating in the country. The financial institution’s net profit last year amounted to UAH 37.76 billion.

In August, registrations of electric vehicles (new and used) in Ukraine amounted to 6,445 thousand, which is 68% more than in August last year and 36.6% more than in July this year, Ukravtoprom reported on its telegram channel.

As reported, in July 2024, the demand for electric vehicles increased by 38% compared to July 2023 and by 14% compared to June 2024.

As reported, market experts attribute this jump in demand for electric vehicles over the past 1.5 months to the government’s initiative to introduce a 15 percent military tax on car buyers during the first registration, including electric vehicles, which are currently not taxed in Ukraine (except for a small excise tax).

In late August, it was reported that the government had abandoned this initiative.

According to Ukravtoprom, the share of new cars in electric car registrations in August was 18%, the same as a year earlier (21% in July).

The bulk of electric vehicles registered during the month were passenger cars – 6,302 thousand units (new – 1,159 thousand, used – 5,143 thousand), and only five of 143 commercial vehicles were new.

The top five new electric cars in July were BYD Song Plus – 174 units; Honda M-NV – 169 units; Volkswagen ID.4 – 147 units; ZEEKR 001 – 107 units; Nissan Ariya – 83 units.

The top five used cars were Nissan Leaf – 658 units; Tesla Model Y – 588 units; Tesla Model 3 – 561 units; Hyundai Kona – 308 units; Volkswagen e-Golf – 289 units.

In total, in January-August, more than 35.6 thousand battery-powered vehicles were registered for the first time in Ukraine (79% more than in the same period in 2023), with new vehicles accounting for 20%.

For its part, the AUTO-Consulting information and analytical group also notes a jump in demand for electric cars based on information about military training – according to its data, 1.3 thousand new electric vehicles were sold in August, which was a monthly sales record for the entire period of observation.

“Although the market share of electric cars slightly decreased compared to previous months and amounted to 16%, the absolute number of sales was a record, despite the massive power outages,” the group’s website states.

According to experts, 8.2 thousand new electric vehicles (16.9% of the total car market) were sold in Ukraine in 8 months of 2024, which is 30% more than in the same period in 2023.

As reported, in 2023, according to Ukravtoprom, registrations of new and used electric cars in Ukraine increased 2.8 times to 37.6 thousand, with new cars accounting for 20% compared to 17% a year earlier.

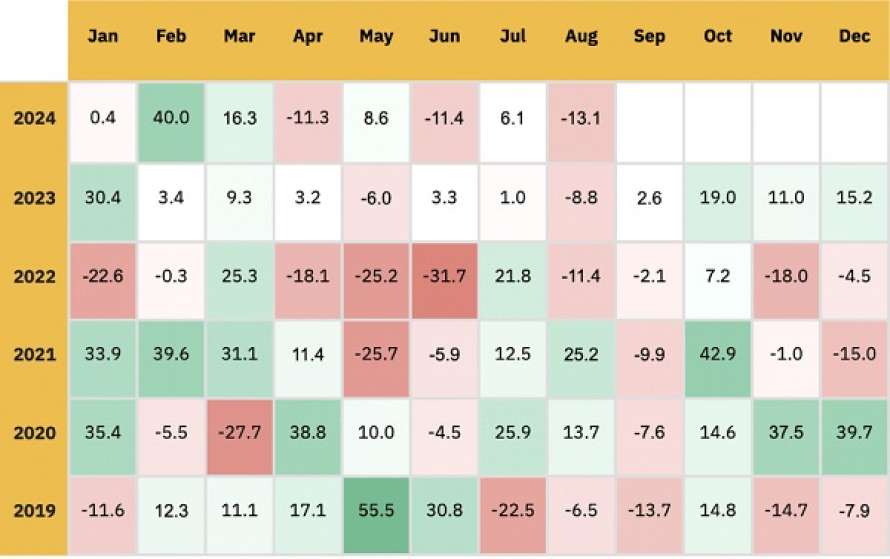

Binance Research, the analytical division of the world’s leading blockchain ecosystem Binance, has published a report for August 2024 that highlights the main trends shaping the cryptocurrency market.

Cryptocurrency market dynamics in August 2024

In August 2024, the cryptocurrency market experienced a significant drop of 13.1% of the total market capitalization. It was triggered by global macroeconomic problems and weak unemployment in the United States, which increased fears of a recession. The Bank of Japan’s decision to raise interest rates on August 5 caused significant disruptions in global stock markets. Asian indices, such as the MSCI Asia Pacific and Japan’s Nikkei 225, were particularly affected, suffering sharp losses throughout the day. This volatility also spread to the cryptocurrency market, leading to liquidations of more than $819 million in one day.

Source: CoinMarketCapAs (as of August 31, 2024)

Despite this “quick crash,” the market began to stabilize after US Federal Reserve Chairman Jerome Powell hinted at a possible interest rate cut in September. In addition, the U.S. Bureau of Economic Analysis revised its second-quarter GDP growth rate to 3%, which exceeded expectations.

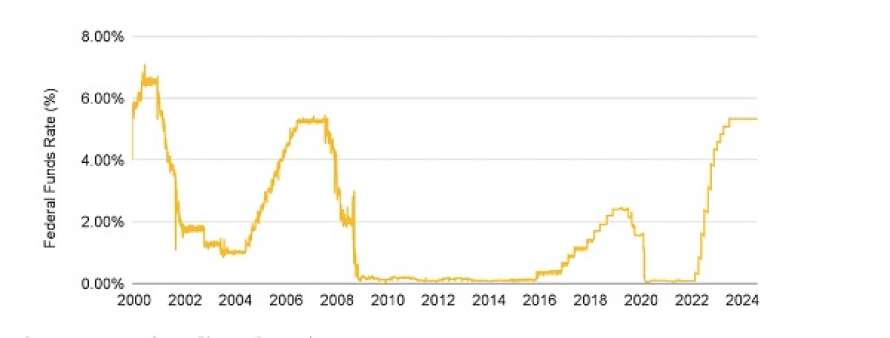

Expected rate cut: a signal for economic growth and lower unemployment

The US federal funds rate was at its highest level since 2001 after a significant rate hike cycle between March 2022 and July 2023. After holding rates steady for 8 consecutive meetings, all eyes are on a rate cut at the next meeting on September 17. -18. For context, the Fed adjusts the target federal funds rate in line with economic conditions. This is done to fulfill their dual mandate of maintaining stable prices (i.e., keeping inflation under control) and supporting maximum employment. Now that inflation in the US has come down significantly from its highs and is rapidly approaching its 2% target, the Fed has turned its attention to unemployment. The hope is that lowering the target rate (i.e., the price of credit) should lead to a new influx of money into the economy, which could lead to more hiring and improved employment figures.

Source: macrotrends.net, Binance Research (as of August 31, 2024)

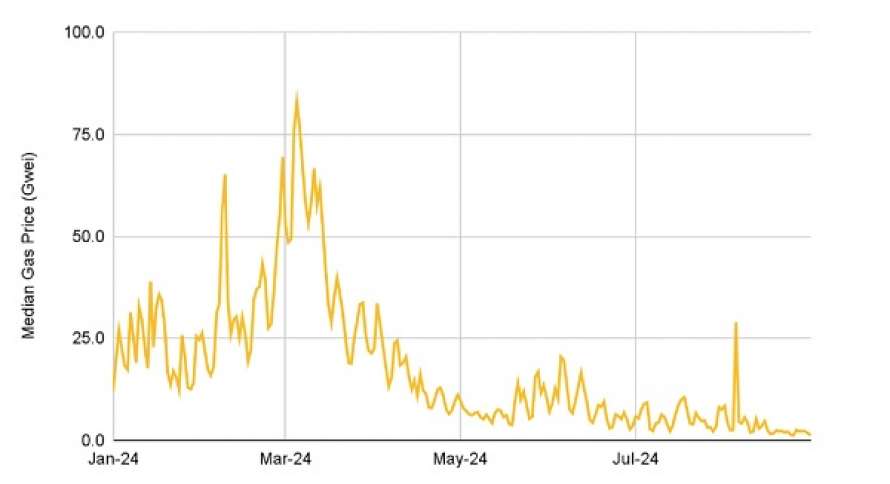

Historic decline in Ethereum fees: impact of the Dencun update and reduced network activity

Transaction and smart contract fees on the Ethereum network at the Layer-1 level have reached their lowest levels in more than five years, with several low-priority transactions costing one gwey or less in recent weeks. The decline in fees can be attributed to reduced network activity and the introduction of blobs during the Dencun update in March, which not only reduced fees at the Layer-2 level but also reduced congestion at the Ethereum Layer-1 level, thereby contributing to the overall decline in fees.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

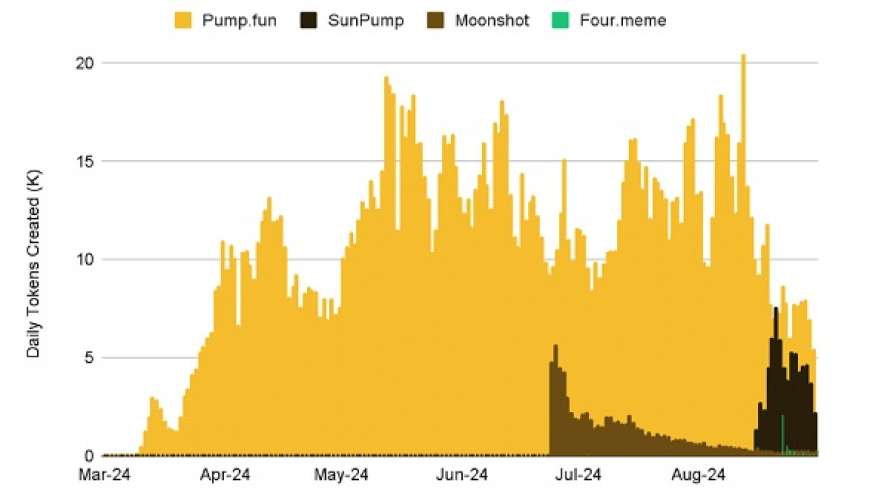

Pump.fun maintains leadership among meme coin launch platforms despite growing competition

Despite the emergence of competitive meme token platforms, Pump.fun remains the leader, setting a new record this month with more than 20 thousand tokens created in a single day. The platform has already launched nearly 2 million tokens and has been powering more than 60% of daily transactions on Solana-based decentralized exchanges since mid-August. As competition intensifies, it will be interesting to see if Pump.fun can maintain its dominant position as the leading meme token launch platform.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

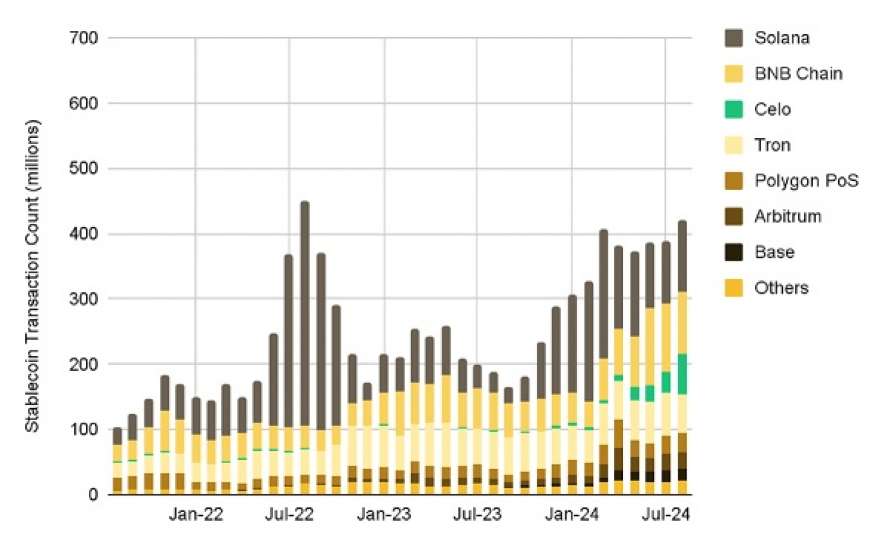

The stablecoin market continues to grow: new transaction records in the CELO and Solana ecosystems

The stablecoin market continues to grow rapidly, with the number of transactions approaching historic highs. Significant growth is observed in the CELO and Solana ecosystems. While the supply on USDT CELO has quickly reached the USD 200 million mark, Solana is leading the way in terms of transaction volume, helping PayPal’s PYUSD reach a market capitalization of USD 1 billion. As stablecoins gain popularity around the world, it is important to keep an eye on how macroeconomic factors and regulatory changes will affect the development of this sector.

Source: Binance Research (as of August 31, 2024)

The full report is available here.

About Binance

Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a suite of financial products that includes the largest digital asset exchange by volume. Trusted by millions of people around the world, Binance’s platform aims to bring the freedom of money to users and has an unrivaled portfolio of crypto products and offerings, including: trading and finance, education, data and research, social good, investment and incubation, decentralization, infrastructure solutions, and more. For more information, please visit: https://www.binance.com.

Source: https://lenta.ua/kriptovalyutniy-rinok-u-serpni-analiz-vid-binance-research-163691/

In August, China increased exports by 8.7% year-on-year to $308.65 billion, according to the report of the General Administration of Customs of the People’s Republic of China.

Thus, the figure reached its highest level in 23 months. At the same time, the increase was the most significant since March 2023.

Imports increased by 0.5% to $217.63 billion.

Analysts on average predicted a 6.5% increase in exports and a 2% increase in imports, according to Trading Economics.

China’s exports to South Korea last month increased by 3.4%, to the European Union by 13.4%, to the United States by 4.9%, and to ASEAN by 8.8%.

Imports from South Korea increased by 13.3%, ASEAN by 3.5%, India by 3.2%, and Russia by 3.2%. Meanwhile, supplies from the European Union decreased by 4%, Japan – by 3.8%, the United Kingdom – by 2.1%, and the United States – remained unchanged.

China’s foreign trade surplus in August increased to $91.02 billion compared to $67.81 billion in the same month of 2023. The surplus in trade with the United States amounted to $33.81 billion.

In January-August, China’s exports rose by 4.6% year-on-year (to $2.31 trillion), while imports increased by 2.5% (to $1.71 trillion). The foreign trade surplus amounted to $608.49 billion, including $224.57 billion in trade with the United States.

Ophthalmologists at the Filatov Institute of Eye Diseases and Tissue Therapy of the National Academy of Medical Sciences of Ukraine (Odesa) performed the world’s first surgery to remove an intraocular hemangioma in a child. For the first time in the world, the Filatov National Institute of Robotics and Tissue Therapy of the National Academy of Medical Sciences of Ukraine (Odesa) performed a surgery to remove a large intraocular choroidal hemangioma in a child.

The institute told Interfax-Ukraine that the operation was performed by Mykola Umanets, MD, head of the Department of Retinal and Vitreous Pathology.

“Surgical removal of intraocular hemangiomas is not performed due to the very high risk of bleeding and the lack of effective methods to stop it. All modern methods of treating intraocular hemangiomas are aimed at stopping the growth and destruction of the tumor and are effective in the case of small tumors. In cases of large tumors, the only way to solve the problem is to remove the eye,” the institute emphasized.

The operation was performed on a 13-year-old patient. In August 2023, during an eye examination before school, the patient complained of a partial loss of visual field, but there were no complaints of visual impairment and he did not seek medical attention. During the examination in August 2024, doctors found that the vision in the left eye had significantly decreased. During the examination at the Filatov Institute, an almost complete detachment of the retina and a hemangioma under it were found. The situation was complicated by the patient’s young age (at a young age, tumors grow rapidly and behave much more aggressively), untimely treatment, large size of the tumor and unfortunate location almost close to the optic nerve, development of a large retinal detachment with loss of vision.

In 2020, the Filatov Institute removed a large hemangioma from an adult patient for the first time in the world, and it was also the first in the world.

“Just like in 2020, we relied on a unique method of high-frequency electric welding of biological tissues in ophthalmology, developed by scientists of the Filatov Institute together with specialists of the E.O. Paton Institute of Electric Welding, which allows us to remove a hemangioma in an adult patient at the Filatov Institute. The new method allows to remove a hemangioma in an adult patient at the E.O. Paton Institute and significantly reduces the risk of bleeding with the help of unique tools developed by specialists of the two institutes. During the operation, each dissected vessel was “brewed” to prevent bleeding,” the institute noted.

Hemangiomas are benign tumors in various parts of the body caused by abnormal growth of blood vessels and are practically penetrated by them. Hemangiomas can also form in the internal organs, in particular (very rarely) in the choroid (choroid). They do not threaten the patient’s life, but are accompanied by a significant decrease in vision and can cause the development of serious complications, such as retinal detachment, hemorrhages in the eye cavity, and increased intraocular pressure (glaucoma).

Prior to the successful surgery performed by the ophthalmologists of the Filatov Institute in 2020, the world had recorded the only case of surgical removal of an intraocular hemangioma: In 2019, Italian ophthalmologist Barbara Parolini performed surgery to remove a small tumor in an adult patient.

Source: https://interfax.com.ua/

Ukrainian metallurgical enterprises increased production of total rolled steel in January-August this year by 26.6% year-on-year, up to 4.318 million tons from 3.410 million tons, according to preliminary data.

According to Ukrmetallurgprom on Tuesday, steel production for the period increased by 30.8% to 5.274 million tons, and pig iron by 21.1% to 4.732 million tons.

In August, the company produced 589.3 thousand tons of rolled products, 690.7 thousand tons of steel, and 643.6 thousand tons of pig iron, compared to 588.6 thousand tons of rolled products, 708.9 thousand tons of steel, and 621.4 thousand tons of pig iron in the previous month.

As reported, in 2023, Ukraine increased production of total rolled products by 0.4% compared to 2022 to 5.372 million tons, but reduced steel production by 0.6% to 6.228 million tons, and pig iron by 6.1% to 6.003 million tons.

In 2022, Ukraine reduced production of total rolled products by 72% compared to 2021, to 5.350 million tons, steel by 70.7% to 6.263 million tons, and pig iron by 69.8% to 6.391 million tons.

In 2021, the company produced 21.165 million tons of pig iron (103.6% compared to 2020), 21.366 million tons of steel (103.6%), and 19.079 million tons of rolled products (103.5%).