The USAID Business Sustainability Investment Project has awarded a second grant of $2.76 million to OTP Bank (Kyiv) to expand access to finance for micro, small and medium-sized enterprises (MSMEs), the bank’s website reports.

“More than 100 companies have already been financed under the first tranche. The new tranche of $2.76 million will bring the total grant amount to $4 million. The funds will be used to compensate for part of the interest rate for borrowing companies,” the website says.

It is noted that the grant program provides for business lending at an interest rate of 9.9% per annum in the first year of the loan agreement, and the difference with the market rate will be compensated by grant funds.

In the second year and thereafter, clients are obliged to pay interest on the use of credit funds at the rate of UIRD3m+5% per annum.

Under the terms of the program, micro, small and medium-sized enterprises with annual revenues of up to EUR 50 million and up to 250 employees belonging to one of the following target groups: relocated or affected by hostilities, companies in critical industries, and companies with female co-owners can receive financing on such terms.

The maximum loan amount that a company or a united group of companies can apply for is UAH 20 million, and the minimum is UAH 1 million.

“The grant program also applies to factoring agreements, under which the bank’s clients can receive up to 90% of the cost of supplies in the amount of UAH 2 million to UAH 20 million. Special conditions will apply to agricultural producers if they use the funds received under the grant program to purchase products from OTP Agro Factory’s partners,” the press release said.

The press service reminded that during the first stage of the program, which started in 2023, more than 100 Ukrainian enterprises were provided with financing.

According to the National Bank of Ukraine (NBU), as of July 1, 2024, OTP Bank ranked 11th (UAH 114.55 billion) in terms of total assets among 62 banks in the country. The financial institution’s net profit for 2023 amounted to UAH 3.71 billion.

Germany, together with the G7 countries, will provide Ukraine with a 50 billion euro loan, German Chancellor Olaf Scholz said on Monday.

“Germany is and remains the strongest supporter of Ukraine in Europe. And we are continuing our support with a €50 billion loan that we are launching with the G7. This will allow Ukraine to buy weapons on a massive scale. It can build on this,” the Federal Chancellor wrote on the social network X.

As reported earlier, G7 leaders approved an agreement to transfer $50 billion of frozen Russian assets to Ukraine.

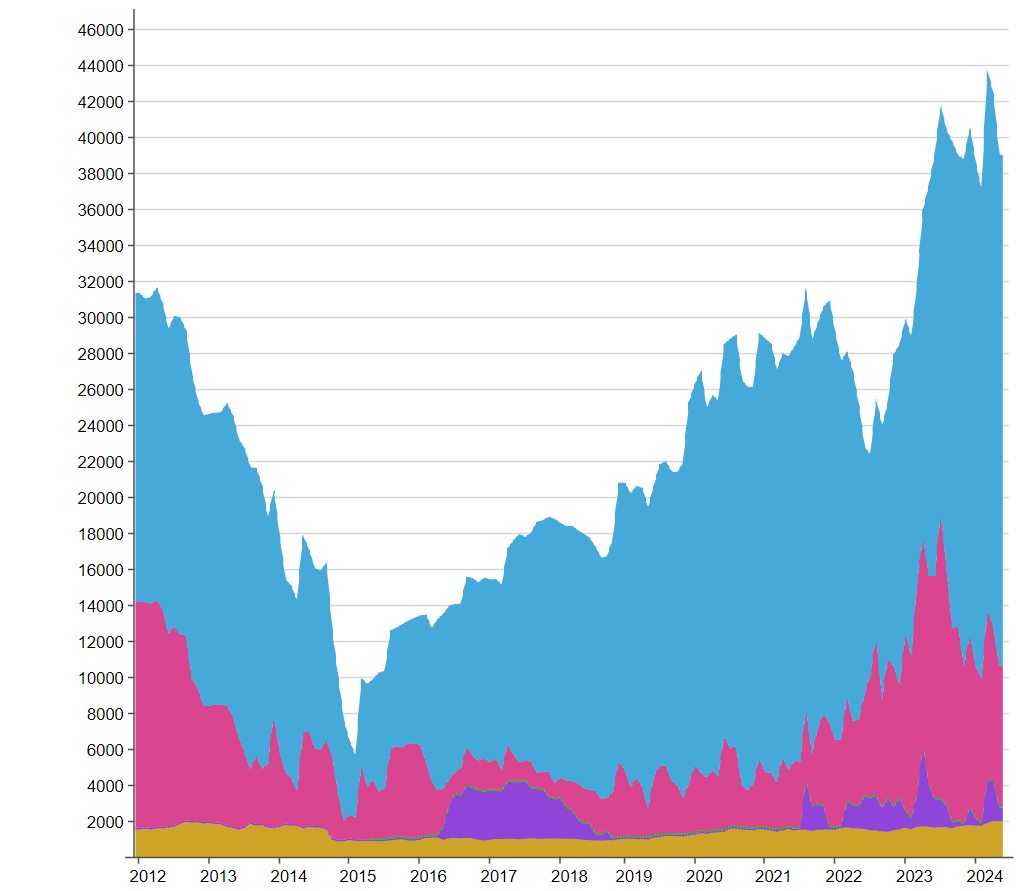

Dynamics of reserves of Ukraine from 2012 to 2024, mln USD

Source: Open4Business.com.ua

Ukraine will strengthen its diplomatic presence in the Asian space, President of Ukraine Volodymyr Zelenskyy has said.

“The entire Asian space and the Pacific Ocean region is now one of the centers of events where it is decided what the next decades will be like. Ukraine has its own view of global development, and it should be exclusively peaceful development within the framework of a rules-based world order,” Zelensky said at a meeting of heads of Ukraine’s foreign diplomatic missions entitled ‘Military Diplomacy: Resilience, Weapons, Victory’ on Monday.

He noted that Ukraine is ready to join the relevant processes as a security donor and defender of the international order. “We will strengthen our diplomatic presence in the Asian space,” the Ukrainian president said.

Zelenskyy also emphasized the importance of strengthening ties with Japan. “Japan. We have achieved a true strategic partnership and we must make this model of relations exemplary,” the president said.

Zelenskyy also outlined other areas of Ukraine’s international diplomatic efforts. “The Euro-Atlantic – every representative of Ukraine must work to strengthen understanding: NATO will be complete only with Ukraine as a member,” he said.

According to Zelenskyy, the negotiation process with the European Union “should be exactly as dynamic as Ukraine needs it to be.”

As for the Black Sea region: “We have to work with all partners so that it is a region free from the Russian military threat. You must strengthen our initiatives such as Grain from Ukraine, the Crimean Platform, and bilateral cooperation in the region.”

The Head of State also emphasized the importance of a strong partnership with African countries, with those who respect international law. “Ukraine needs economic cooperation with Africa, security cooperation, as well as direct diplomatic work, in particular in the format of the Ukraine-Africa forum to be held.”

The President also noted good results in cooperation with such countries as Chile and Argentina, as well as with the Caribbean states. “We have to increase cooperation, and the task of the relevant ambassadors and employees of the Ministry of Foreign Affairs of Ukraine is to implement our initiative to hold the Ukraine-Latin America summit,” the President said.

Naftogaz-Energoservice is holding a tender for the purchase of voluntary medical insurance (VMI) services. According to the announcement in the electronic state procurement system Prozorro, the expected cost of purchasing the services is UAH 593.645 thousand.

Documents are accepted until August 22

The winner of a similar tender a year earlier was IC Salamandra

In January-July 2024, Express Insurance (Kyiv) collected insurance premiums in the amount of UAH 504.7 million, which is 32.2% more than in the same period of 2023.

According to the insurer’s website, the number of contracts concluded during this period was 2.2 times higher.

Premiums for hull insurance amounted to UAH 395 million (+18.4% compared to 7 months of 2013), for MTPL – UAH 94.6 million (2.5 times more), for VHI – UAH 7.1 million (+9.7%), for other types of insurance – UAH 8 million (96.3%).

In July 2024, the company attracted UAH 79.1 million in premiums, which is 28.3% more than in July last year. In particular, motor hull insurance premiums amounted to UAH 59.5 million (+16.4%), and motor TPL premiums – UAH 17.5 million (2.1 times).

As reported, in January-July 2024, Express Insurance paid UAH 287.1 million in claims, which is 60.1% higher than in 2023. In particular, payments under motor hull insurance amounted to UAH 242.2 million, or 53.9%, under MTPL – UAH 37.6 million (+143.1%), under voluntary health insurance – UAH 3.4 million (-9.4%), payments under other insurance contracts – UAH 4 million (+40.7%).

In July 2024, the company paid out UAH 43.8 million to customers, which is 47% more than in July 2023. In particular, UAH 36 million (+35%) was paid out under motor hull insurance contracts, and UAH 6 million (+175.2%) under MTPL insurance contracts.

Express Insurance ALC was founded in 2008. It is part of the UkrAuto group of companies. The company specializes in motor insurance. Since April 2012, it has been an associate member of the Motor Transport Insurance Bureau of Ukraine.