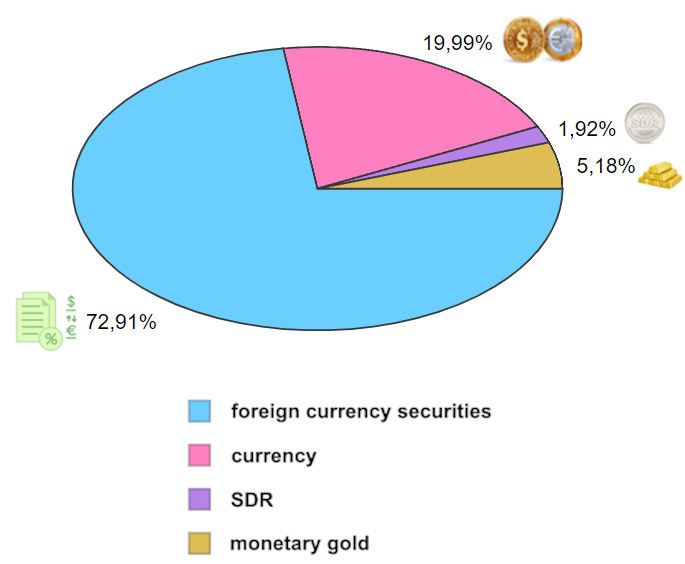

Structure of foreign exchange reserves as of 31.05.2024

Source: Open4Business.com.ua

The number of crossings of the Ukrainian border in the 11th week of summer, from August 10 to 16, stabilized at 737 thousand, with a net weekly inflow to Ukraine recorded for the fourth consecutive week, down to 15 thousand from 24 thousand a week earlier.

According to the State Border Guard Service’s Facebook page, the number of entry crossings decreased to 376 thousand from 380 thousand, while the number of exit crossings increased to 361 thousand from 356 thousand.

The number of vehicles crossing the checkpoints decreased to 131 thousand over the week from 137 thousand a week earlier, while the flow of vehicles with humanitarian cargo increased to 617 from 589.

As for the distribution of traffic by day of the week, according to the border guards, traditionally, the outbound traffic is higher on Friday-Sunday, while the inbound traffic is higher from Saturday to Monday.

The State Border Guard Service points out that there is a periodic accumulation of vehicles leaving Ukraine at the Krakovets and Shehyni checkpoints. According to the State Border Guard Service, there are currently 60 and 50 cars in the queue to leave at these checkpoints, while there are 75 cars at Ustyluh, 50 cars at Kosyno on the border with Hungary, and 35 or less at the rest.

The number of people crossing the border in the 11th week of summer this year is only slightly lower than last year: 384 thousand people entered Ukraine during the same seven days, and 372 thousand left. However, the flow of cars last year was much higher – 144 thousand compared to 131 thousand this year.

As reported, from May 10, 2022, the outflow of refugees from Ukraine, which began with the outbreak of war, was replaced by an influx that lasted until September 23, 2022 and amounted to 409 thousand people.

However, since the end of September, possibly under the influence of news about mobilization in Russia and “pseudo-referendums” in the occupied territories, and then massive shelling of energy infrastructure, the number of people leaving has been exceeding the number of people entering. It temporarily stopped in the second half of December and early January during the holidays, but then resumed again and reached a total of 223 thousand people from the end of September 2022 to the first anniversary of the full-scale war.

During the second year of the full-scale war, the number of border crossings to leave Ukraine, according to the State Border Guard Service, exceeded the number of crossings to enter by 25 thousand, while since the beginning of the third year, the number of crossings has increased by another 101 thousand.

As Deputy Economy Minister Serhiy Sobolev noted in early March last year, the return of every 100,000 Ukrainians home results in a 0.5% increase in GDP. The Ministry of Economy has included in its macroeconomic forecast for this year 1.5 million people returning to Ukraine, while the National Bank, on the contrary, expects an outflow of 0.4 million, which is twice the figure for 2023.

According to updated UNHCR data, the number of Ukrainian refugees in Europe as of July 15 this year was estimated at 6.021 million, and 6.580 million in the world as a whole, which is 24 thousand and 25 thousand more than a month earlier.

In Ukraine itself, according to the latest UN data as of April this year, there were 3.548 million internally displaced persons (IDPs), which is 141 thousand less than at the beginning of the year.

On August 14, 2024, the Embassy of Pakistan in Ukraine hosted a solemn event to celebrate the 77th anniversary of the Independence Day of the Islamic Republic of Pakistan, which was attended by representatives of the Pakistani community from different regions of Ukraine, Islamic religious leaders and friends of Pakistan from among the citizens of Ukraine.

After the reading of the Holy Quran, Ambassador Extraordinary and Plenipotentiary of the Islamic Republic of Pakistan H.E. Major General (retired) Nadir Khan raised the national flag during the performance of the national anthem of Pakistan.

The Ambassador of Pakistan congratulated the guests on a special day in the history of the country, when the unprecedented struggle of the Pakistani people for freedom under the leadership of the Father of the Nation Muhammad Ali Jinnah took place, culminating in the establishment of the state of Pakistan on August 14, 1947.

The diplomat noted that the 77-year history of the country’s independence is full of challenges and trials:

– Incomplete territorial division and unresolved Kashmir issue

– Migration and refugee crisis

– Crisis of governance (death of Muhammad Ali Jinnah and assassination of Liaquat Ali Khan)

– Wars with India (1948, 1965 and 1971)

– Consequences of the Soviet invasion of Afghanistan, which led to the war on terrorism

– Natural disasters, sanctions, etc.

According to the diplomat, today Pakistan is the only Muslim nuclear power with powerful armed forces.

In his speech, the Head of the Diplomatic Mission also focused on the work of the Embassy over the past year of his stay in Ukraine.

“We work in close cooperation and coordination with our Ukrainian friends. The visit of the Minister for Foreign Affairs of Ukraine to Pakistan, the participation of the First Lady of the Islamic Republic of Pakistan in the Forum of First Ladies and Gentlemen, regular communication and exchange of messages between the leaderships of the two countries are just some of the moments that reflect the positive in our relations with Ukraine,” he said.

The Ambassador emphasized his country’s unwavering position in support of Ukraine’s territorial integrity and sovereignty

“We wish and want to see full peace return to Ukraine as soon as possible. Pakistan has been and will always be happy to play a constructive role in resolving the conflict,” the diplomat emphasized.

A message from the President of Pakistan, Mr. Asif Ali Zardari, was also read out.

The ceremony concluded with a prayer for the well-being and prosperity of the people of Pakistan, the Muslim Ummah and humanity, as well as for the return of peace and prosperity to Ukraine.

The Islamic Republic of Pakistan recognized Ukraine’s independence on December 31, 1991. On March 16, 1992, diplomatic relations between Ukraine and Pakistan were established. The Embassy of Pakistan has been operating in Kyiv since October 1997.

This week, the National Bank of Ukraine (NBU) slightly reduced its net sales of foreign currency on the interbank market to $518.60 million from $540.95 million a week earlier, according to the regulator.

According to the data, the central bank did not purchase foreign currency, while sales decreased from $541.2 million to $518.60 million.

The official hryvnia exchange rate decreased by 0.2%, or 10 kopecks, to 41.2110 UAH/$1 over the week, while the hryvnia weakened by about 2 kopecks on the cash market to 41.35 UAH/$1 and by 3 kopecks on the cash market to 41.46 UAH/$1.

Since the beginning of 2024, the dollar has appreciated by 8.4%, or UAH 3.21, at the official exchange rate, and by 12.7%, or UAH 4.65, since the National Bank switched to managed flexibility on October 3, 2023.

In July, the official hryvnia exchange rate fell by 1.4%, or 55 kopecks, to 41.0063 UAH/$1, while in June its decline slowed to 3 kopecks after weakening by 90 kopecks in May.

According to the data published by the NBU during this period, from Monday to Thursday, the negative balance between the volume of purchases of foreign currency by the population and its sale slightly widened from $22.35 million to $24.93 million.

Ukraine’s international reserves in July, according to preliminary estimates by the National Bank, decreased by 1.8%, or $572.3 million, to $37 billion 231.9 million, while net international reserves (NIR) fell by $3 billion to $23.30 billion. According to the Quantitative Performance Criterion (QPC) in the updated EFF Extended Fund Facility program, Ukraine’s NIMR should be at least $28.8 billion by the end of September this year, and at least $26.3 billion by the end of the year.

At the same time, in August, Ukraine already received a $3.9 billion grant from the United States and EUR4.2 billion from the EU, of which EUR1.5 billion was a grant.

Power outage schedules may return due to the heat wave, Deputy Energy Minister Mykola Kolesnyk said.

“The heat is coming back. We see the temperature rising. Today we did not apply any restriction schedules, and tomorrow we do not plan to. Severe weather can lead to an increase in electricity consumption. Especially when it’s a fairly high, stable temperature,” he said during the telethon.

Kolesnyk clarified that the power system remains damaged after eight massive complex attacks by the Russian occupiers on energy infrastructure facilities, which could lead to a shortage of electricity.

Active work is currently underway to restore energy infrastructure facilities, the Deputy Energy Minister noted.

“One of the largest repair campaigns is underway to ensure that the maximum amount of equipment is prepared for the next heating season,” Kolesnyk said.

The consulting company of the Chairman of the Board of the Amber Business Association of Ukraine won

On Friday, 16.08.2024, an online auction was held for the sale of a special permit for the amber-bearing Polyana field (geological exploration with pilot industrial development and further extraction, for 5 years) with an area of 44.63 hectares in Rivne region.

The bidding started at UAH 4,641,520. Three bidders competed for the lot, with the final bids as follows:

Mykola Kotniuk is the head of the Amber Business Association of Ukraine, which unites 24 participants in the amber industry.

Is the Polyana site worth the UAH 91 million investment in a 5-year special permit? NADRA.INFO asked the winner of the auction.

“Our specialists will conduct a survey of the site, analyze the available geological information, and obtain the conclusions of the legal department on the possibility of obtaining a temporary land plot. After that, the investors will make the final decision on the payment for the lot,” said Mykola Kotnyuk.

If the winner does not buy the special permit, he will lose UAH 2 million of the guarantee fee, and the right to buy it will go to Com Resource LLC.

It should be noted that this was the second attempt by the State Service of Geology and Subsoil of Ukraine to find an investor for the Polyana field. At an auction in July, the lot was valued at UAH 35 million, but the special permit remained unacquired. Then, another company of Mykola Kotnyuk, Ukrainian Amber LLC, offered UAH 22,000,001 for the Polyana plot.

Kom Resurs LLC also participated in the first auction, valuing the lot at UAH 4,710,000. In July, the company was solely controlled by Ivan Debeliy (Antonov, Kryshchenko and Vertyporokh became owners of the company in August.

AMBER, AUCTION, State Service of Geology and Mineral Resources