In 2023, KSG Agro agricultural holding reduced its net loss by 30.9% to $1.16 million, while revenue increased by 13.8% to $18.79 million.

This data is presented in the company’s annual report on the Warsaw Stock Exchange.

“The increase in revenues in 2023 is largely due to the resumption of grain exports, which were limited in 2022 due to the beginning of Russia’s invasion of Ukraine. In addition, in 2022, the Group used more of its own grain for feed production rather than purchasing it, seeking to reduce dependence on external suppliers of feed ingredients due to wartime logistical reasons,” the document says.

It is specified that the total revenue from crop production last year amounted to $12.6 million compared to $4.5 million in 2022, but the net change in the fair value of crops was less than a year earlier – $1.6 million versus $4.6 million.

It is noted that as an alternative source of income to hedge against unpredictable weather conditions, KSG Agro used its agricultural equipment and expertise to provide tillage and similar land preparation services to other crop producers for a total of $2.5 million compared to $1.3 million in 2022.

Due to lower prices for agricultural products and higher sales costs, the gross profit of the agricultural holding fell 6.6 times last year to $0.48 million, and also recorded an operating loss of $1.62 million and negative EBITDA of $0.40 million, while a year earlier these indicators were positive – $0.44 million and $1.79 million, respectively.

It is also indicated that due to lower exchange rate losses, the total loss in 2023 decreased even more significantly – to $1.21 million from $4.31 million a year earlier.

According to the report, KSG Agro managed to almost halve its net debt last year to $15.63 million from $27.46 million due to a reduction in bank loans to $15.84 million from $27.74 million. The agricultural holding’s free cash flow at the end of 2023 was $0.21 million compared to $0.27 million a year earlier.

During the first quarter of 2024, the group repaid a total of $4.28 million of its existing loans from TAScombank and received new tranches totaling $2.30 million, as well as issued series C and D bonds of its key operating subsidiary KSG Dnipro for approximately $5 million, of which it placed series C bonds for $1.4 million.

The number of permanent employees of the agricultural holding decreased in 2023 to 234 from 274 a year earlier.

It is noted that the group expects the winter crop harvest in 2024 to be at least average.

As for pig farming, it is indicated that during 2023 KSG Agro gradually reduced the massive number of pigs at the farm in Niva Trudova. The main reasons were concerns about the general safety and biosecurity of the herd, as well as changes in the group’s strategy and general market conditions: less herd, more farms – to reduce the risk of losing the entire pig population in the event of a missile or drone strike, the agricultural holding began to distribute the herd to several locations.

The group’s management is currently negotiating ways to expand the number of farms under its management, either through a partnership program with other pig farmers or by leasing or buying additional farms, the report says.

It also indicates that, based on the results of the trials, most of the low-productivity sows were gradually removed from the main herd and sold during the year, and to replace them, KSG Agro is purchasing new sows of Canadian genetics, in particular, it plans to purchase another batch later in 2024. The fresh Canadian genetics are expected to enable the group to produce high-quality piglets that will be sold as piglets rather than being raised further on the group’s farms. It should also shorten the group’s production cycle, further reducing overall safety and biosecurity risks.

KSG Agro, a vertically integrated holding company, is, according to him, one of the top 5 pork producers in Ukraine. It is also engaged in the production, storage, processing and sale of grains and oilseeds. Its land bank is about 21 thousand hectares in Dnipropetrovska and Kherson regions.

KSG Agro earned $1.34 million in net profit in January-September 2023, up almost 14 times compared to the same period in 2022. Its EBITDA for the three quarters of 2023 increased by 67% to $4.54 million, and revenue increased by 16% to $11.9 million.

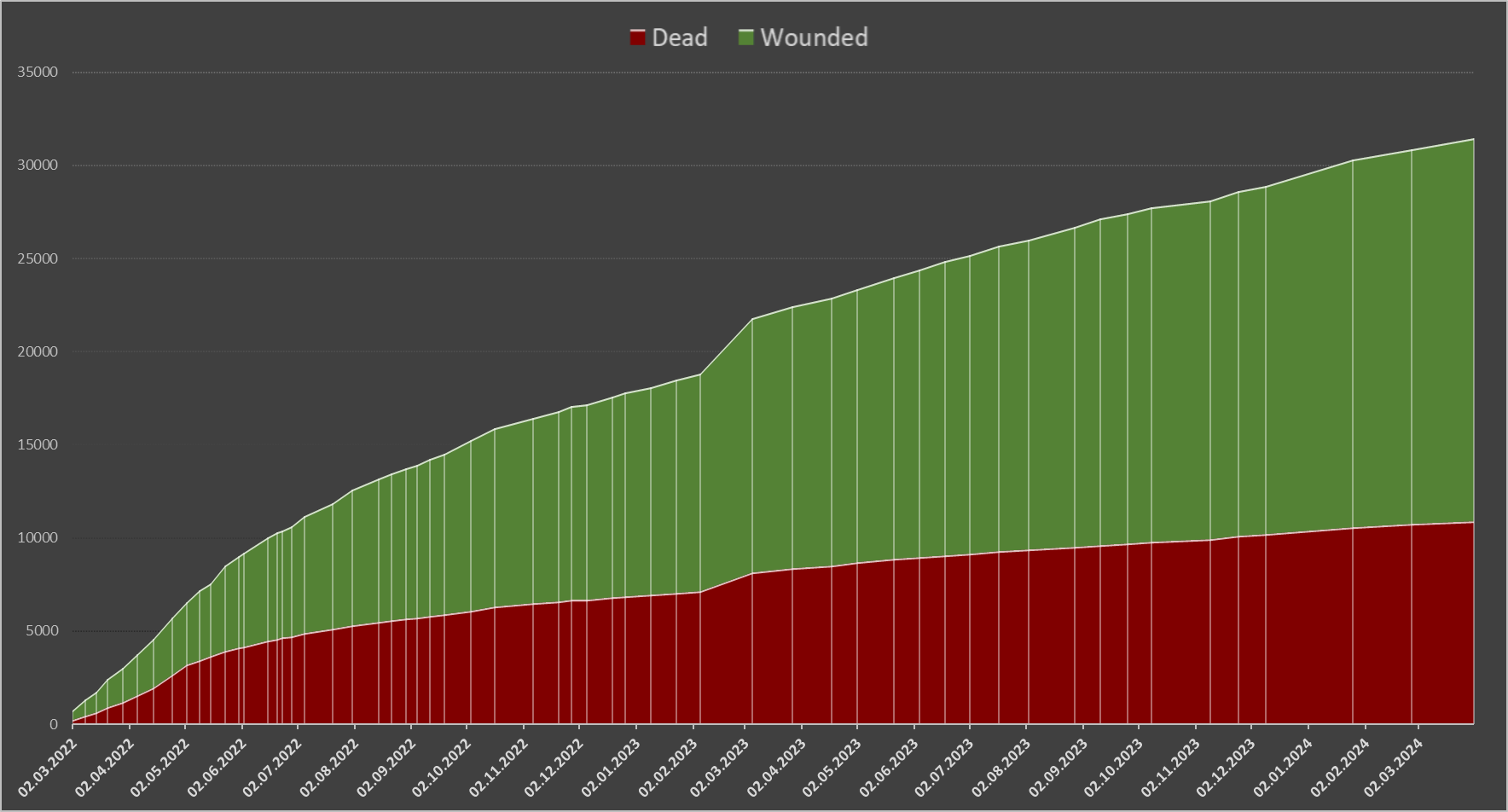

Number of dead and wounded civilians in Ukraine from 24.02.2022 till 31.03.2024 un data

Source: Open4Business.com.ua and experts.news

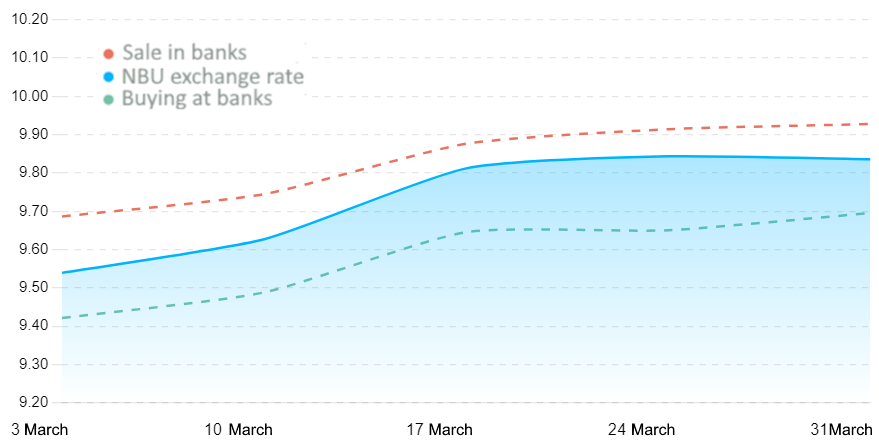

Quotes of interbank currency market of Ukraine (UAH for 1 PLN, in 01.03.2024-31.03.2024)

Source: Open4Business.com.ua and experts.news

Housing commissioning in Ukraine in January-March 2024 increased by 12.2% compared to the same period in 2023 – up to 2 million 178.6 thousand square meters, the State Statistics Service reported.

According to the report, 1 million 166.2 thousand square meters of housing were commissioned in urban areas in the first quarter, which is 20.5% higher than in the first quarter of last year. In rural areas, housing was commissioned by 8.9% more than in January-March 2023 – 1 million 12.3 thousand square meters.

In total, 25.4 thousand apartments were commissioned in the first quarter, which is 2.3% more than in the first quarter of 2023. At the same time, 17.3 thousand apartments were commissioned in apartment buildings. 16.1 thousand apartments were commissioned in cities and 9.2 thousand in villages.

In January-March, Kyiv region commissioned the most housing – 453.2 thousand square meters or 4.9 thousand apartments (20.8% of the total), exceeding the figure for the same period last year by 28.2%. Next comes Lviv region – 212.1 thousand square meters or 2.2 thousand apartments (9.7%), exceeding the result of the previous year by 19.5%; Ivano-Frankivsk region – 157.9 thousand square meters or 1.8 thousand apartments (7.3%), “plus” 15.5% respectively; Volyn region – 153.2 thousand square meters or 2 thousand apartments (7%), “plus” 75% respectively.

In Kyiv, 236.8 thousand square meters of housing or 3.4 thousand apartments (10.9%) were commissioned in the first quarter, which is 33.8% higher than in the first quarter of 2023.

According to the State Statistics Service, the largest increase in housing commissioning in January-March was recorded in Donetsk region, where the figure increased 5 times compared to the same period in 2023 – up to 4.3 thousand square meters (0.2% of the total), and in Zaporizhzhia region – plus 335%, up to 11.6 thousand square meters (0.5%).

The data are given taking into account the housing commissioned in accordance with the temporary procedure for commissioning houses built without a building permit, as well as excluding the territories temporarily occupied by the Russian Federation and parts of the territory where hostilities are/were conducted, the State Statistics Service reminds.

As reported, by the end of 2023, the commissioning of housing in Ukraine increased by 3.8% compared to 2022 – up to 7 million 380.7 thousand square meters.

PJSC “Ukrnafta” has launched a black high-development well in Ukraine’s West, the company’s press-service announced on Tuesday.

According to its data, the result more than doubled the forecasted one: the well flow rate is 54 tons per day with the expected 22.6 tons.

The object was planned as an exploratory well with the purpose of discovering deposits of stratigraphic deposits at a depth of more than 1.2 km. The drilling works were performed by Navigator-Komplekt LLC selected through a tender on Prozorro. This is the first of three wells to be constructed by this contractor.

“Ukrnafta” received a high-yield well and, more importantly, a technology to increase production at a particular field. Acid fracturing (AHF) is included in the investment projects for the construction of all wells at this field,” said the company’s director Serhiy Koretskyy.

As reported, Ukrnafta in 2023 increased production of oil with condensate by 3% (by 39.9 thousand tons) compared to 2022 – to 1 million 409.9 thousand tons, gas – by 5.8% (by 60.4 million cubic meters), to 1 billion 97.4 million cubic meters.

The company’s strategic goal is to double its oil and natural gas production to 3 million tons and 2 billion cubic meters respectively by 2027.

“Ukrnafta, Ukraine’s largest oil producer, is the operator of a national network of 537 gas stations, of which 456 are operational. The company is implementing a comprehensive program to revitalize its operations and update the format of its network of gas stations. Since February 2023, Ukrnafta has been issuing its own fuel coupons and NAFTACard, sold to legal entities and individuals through Ukrnafta-Postach LLC.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share stake. On November 5, 2022, the Supreme Commander-in-Chief of the Ukrainian Armed Forces decided to transfer to the state the share of corporate rights of the company owned by private owners, which is now managed by the Ministry of Defense.

Representatives of the tourism industry paid UAH 616 million 391 thousand to the budget in the first quarter of 2024, which is 61% more than in the same period of 2023, when the budget received UAH 383 million 221 thousand, the press service of the State Agency for Tourism Development (DART) reports.

At the same time, they clarify that before the full-scale invasion in 2021, the state budget received UAH 629 million 135 thousand.

“The budget revenues for the first quarter of this year clearly demonstrate that tourism has not only adapted to the difficult working conditions during martial law, but is also developing, creating jobs and supporting local communities. Taxes from the tourism industry are an important part of the economy that is now working to support our army,” said DART Head Mariana Oleskiv, quoted in a press release.

The agency noted that in January-March, the total number of taxpayers engaged in tourism activities increased by 19% compared to the first quarter a year earlier. The number of legal entities increased by 6%, and individuals by 24%.

The largest share of state budget revenues (64%) was paid by hotels – UAH 395 million 194 thousand. This is 69% more than in the same period in 2023 (UAH 233 million 693 thousand) and 32% more than in the same period in 2022 (UAH 299 million 782 thousand). In the pre-war year of 2021, in January-March, the treasury received almost the same amount from hotels – UAH 394 million 576 thousand.

Tax revenues from the activities of tour operators have doubled – UAH 88 million 727 thousand compared to UAH 44 million 854 thousand for the same period last year. In 2021, the state treasury received UAH 47 million from tour operators.

In addition, tax revenues from the activities of travel agencies also increased – UAH 50 million 330 thousand compared to UAH 33 million 844 thousand for the same period in 2023 and UAH 46 million 238 thousand in January-March 2021).

In 2024, the share of tax paid by tourist centers and children’s recreation camps increased by 41%. In the first quarter, the budget received UAH 36 million 180 thousand of tax from these accommodation facilities, compared to UAH 25 million 653 thousand in the first three months of last year. However, compared to the same period in 2021, tax revenues fell by 70% from UAH 119 million 183 thousand.

There was an increase in taxes paid from campsites and parking lots for residential caravans – UAH 704 thousand against UAH 499 thousand. Although compared to 2021, taxes from these accommodation facilities are halved, the budget received UAH 1 million 535 thousand.