By October 18, Ukrainian agricultural producers sowed the main winter crops on an area of 2.8 million hectares (58% of the forecast of 4.5 million hectares), including 954 thousand hectares were sown over the past week on October 11-18 , according to the website of the Ministry of Agricultural Policy and Food on Tuesday.

According to the agency, 61% of the planned area, or 2.5 million hectares, was sown with wheat, 265 thousand hectares (39% of the area) with barley, and 69 thousand hectares (81% of the area) with rye.

At the same time, it is specified that the most intensive sowing of winter crops is carried out in the Dnepropetrovsk and Odessa regions, in each of which over 100 thousand hectares of winter crops were sown per week.

In addition, 999 thousand hectares were sown with winter rapeseed in Ukraine, which is 104% of the previously planned figures.

Thus, by October 18, a total of 3.8 million hectares, or 42.8% of the last year’s figure, were sown with winter grains and oilseeds in Ukraine.

In 2021, Ukraine allocated 8.87 million hectares for winter crops, including 6.66 million hectares for wheat, 1.02 million hectares for barley, 160.6 thousand hectares for rye, and 1.03 million hectares for rapeseed.

Oil prices are slightly reduced during trading on Tuesday, investors assess the risks of a global recession and monitor the dollar.

December futures for Brent on London’s ICE Futures exchange fell by $0.02 (0.02%) to $91.6 per barrel by 14:06 CST.

Quotes of WTI futures for November in electronic trading on the New York Mercantile Exchange (NYMEX) by the specified time decreased by $0.09 (0.11%) to $85.37 per barrel.

Bidding on the eve of both brands completed without significant changes.

Strong growth in US stocks and a weakened dollar on Monday failed to provoke an increase in oil prices, said Warren Patterson, head of commodity strategy at ING.

“Instead, the market appears to be wary of a decline in demand. Chinese President Xi Jinping has made it clear that China will continue to pursue a ‘zero tolerance’ policy for the coronavirus, which increases uncertainty about China’s oil demand until the end of 2023,” he wrote. Patterson.

During the morning session on Tuesday, oil rose in price moderately, but then turned to decline due to the renewed strengthening of the dollar – an index that tracks the dynamics of the US dollar against six major world currencies, by 14:06 CSK rises by about 0.3%.

Also, downward pressure on oil prices is exerted by concerns about the tightening of the monetary policy of many major central banks of the world, aimed at curbing inflation, writes Trading Economics.

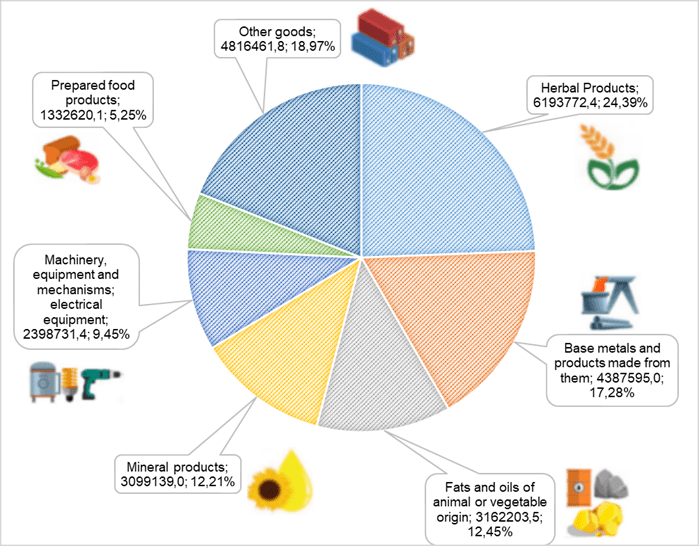

Foreign trade turnover by most important positions in Jan-Aug 2022 (export)

SSC of Ukraine , graphics of the Club of Experts

European stock indices are rising on Tuesday due to investors’ optimism about corporate profits, as well as the continued positive market sentiment after the UK’s fiscal policy reversal announced the day before.

The composite index of the largest enterprises in Europe Stoxx Europe 600 as of 12:50 CST rose by 0.23% to 399.4 points. Growth marks the fourth session in a row.

German DAX adds 0.84%, French CAC 40 – 0.32%, British FTSE 100 – 0.52%, Italian FTSE MIB – 1.22%, Spanish IBEX 35 – 0.55%.

Britain’s new Chancellor of the Exchequer, Jeremy Hunt, announced on Monday that he was phasing out much of the fiscal stimulus proposed by former British Treasury Secretary Quasi Kwarteng on 23 September.

In particular, the British government will return to plans to increase the corporate tax rate from 19% to 25% from April 2023, and will also refuse to reduce the tax on dividends, carry out wage reform, freeze alcohol duties and introduce a zero VAT rate. for foreign buyers.

In addition, the lowering of the base income tax rate to 19% from 20%, planned for April, will be postponed, and the program to subsidize homeowners’ electricity costs will be reduced.

Hunt’s proposals are expected to save the British authorities £32bn.

The Bank of England called “incorrect” the report of the Financial Times newspaper that the Central Bank will postpone the sale of government bonds from its portfolio until the market stabilizes.

Statistical data from Germany, published on Tuesday, showed some improvement in the mood of investors and analysts. The index of economic expectations for the next six months in October rose to minus 59.2 points from minus 61.9 points a month earlier. Experts polled by Trading Economics, on average, expected it to fall to minus 65.7 points.

Share quotes of European automakers are rising during trading on data from the European Automobile Manufacturers Association (ACEA), which showed an increase in car sales in the European Union in September by 9.6% compared to the same month in 2021. The increase in sales in the EU was noted in the second month, before that the figure had been declining for thirteen months in a row.

Shares of Volkswagen added 2.1%, Mercedes-Benz – 3.2%, Stellantis – 2.3%, BMW – 1.5%, Renault – 2%.

The value of shares of the French Publicis Groupe SA, one of the world’s largest advertising holdings, increased by 2.2%. Publicis has improved its 2022 organic revenue growth forecast to 8.5% from previously expected 6-7%, noting that it is yet to feel the impact of its customers’ spending cuts.

Swiss Re’s share price edged up 0.8% in trading. The Swiss reinsurer has a preliminary estimate of $1.3 billion in claims related to Hurricane Ian, and is therefore likely to post a net loss of $500 million in the third quarter.

Swiss pharmaceutical company Roche Holding AG shed 1.4%. Roche’s third-quarter revenue fell 8%, but the company reiterated its full-year guidance.

Rio Tinto, which lowered its full-year forecast for refined copper production, is down 1.2%. The company also said that iron ore shipments this year will be closer to the lower end of its forecast.

The US dollar is declining against other major currencies during Tuesday’s morning deals as investors’ risk appetite rebounds.

At the same time, the dollar continues to receive some support from expectations of further tightening of the monetary policy of the US Federal Reserve System (FRS) in the face of persistently high inflation, writes Trading Economics.

The ICE-calculated index showing the dynamics of the dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona) is losing 0.13%, the broader WSJ Dollar Index – 0.22%.

The euro/dollar pair is trading at $0.9862 by 8:47 am CST, compared to $0.9844 at the close of the market on Monday. Euro rises in price by 0.18%.

The rate of the American currency against the yen is reduced by 0.13% and amounts to 148.84 yen against 149.04 yen following the results of the previous session.

The pound sterling rose to $1.1384 from $1.1359 in previous trading.

Britain’s new Chancellor of the Exchequer, Jeremy Hunt, has abandoned much of the fiscal stimulus proposed by former British Treasury Secretary Quasi Kwarteng on 23 September.

“The most important goal for our country now is stability,” Hunt said on Monday, speaking before Parliament.

Hunt’s proposals are expected to save the British authorities £32bn.

In particular, the government will return to plans to increase the corporate tax rate from 19% to 25% from April 2023, and also abandon plans to reduce the tax on dividends, carry out wage reform, freeze alcohol duties and introduce a zero VAT rate. for foreign buyers, writes the Financial Times newspaper. In addition, the lowering of the base income tax rate to 19% from 20%, which was planned for April, will be postponed.