As of September 27, Ukrainian agricultural producers sowed the main winter crops on an area of 709 thousand hectares (15% of the forecast of 4.56 million hectares), 298 thousand hectares were sown over the past week on September 20-27, according to the website of the Ministry of Agrarian politics and food on Tuesday.

According to the agency, 16% of the planned area, or 622 thousand hectares (+258 thousand hectares for the week of September 20-27), barley – 65 thousand hectares (+33 thousand hectares, 10% of the area), rye – 27 thousand hectares (+11.7 thousand hectares, 31% of the area).

At the same time, it is specified that the most intensive sowing of winter grains is carried out in the Chernihiv region, where 33.1 thousand hectares, or 37% of the forecast, are sown.

In addition, the sowing of winter rapeseed has been fully completed in Ukraine, the final area under this crop amounted to 961 thousand hectares.

Thus, by September 27 in Ukraine, a total of 1.67 million hectares were sown with winter crops, or 18.8% of the last year’s figure. In 2021, Ukraine allocated 8.87 million hectares for winter crops, including 6.66 million hectares for wheat, 1.02 million hectares for barley, 160.6 thousand hectares for rye, and 1.03 million hectares for rapeseed.

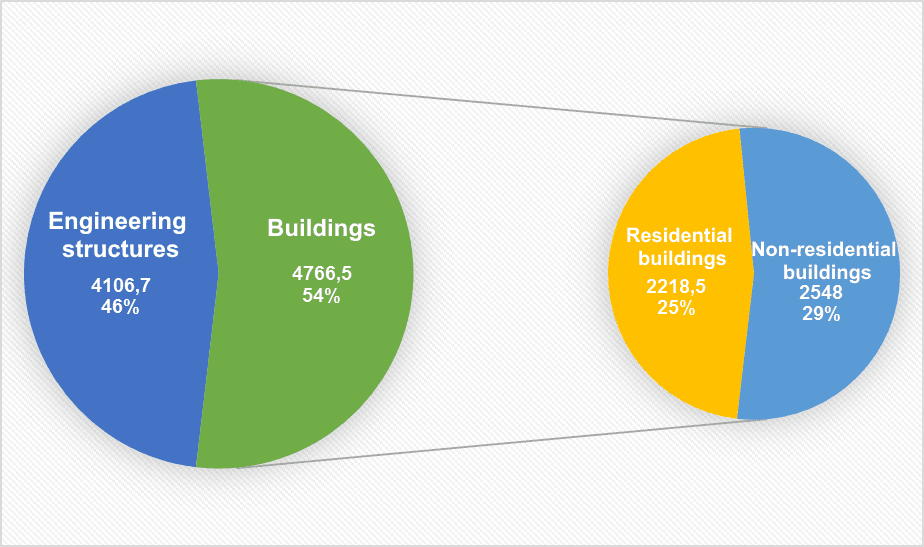

Volume of construction products produced by type in of Jan 2022 (mln UAH)

SSC of Ukraine

Stock indices of Western European countries are growing steadily during trading on Tuesday, recovering from last week’s falls.

The composite index of the largest companies in the Stoxx Europe 600 region rose by 1.16% by 11:00 Moscow time and amounted to 393.25 points.

The British stock index FTSE 100 grows by 0.61%, the German DAX – by 1.29%, the French CAC 40 – by 1.32%. The Italian FTSE MIB rose 1.06%, while the Spanish IBEX 35 rose 0.79%.

Investors are still worried about forecasts of a global economic recession amid persistently high inflation and aggressive measures by the largest central banks to contain it. Nevertheless, the market appeared to buy the shares that fell in price after the sale at the beginning of this week and during the previous week, writes Bloomberg.

Meanwhile, reports of problems with the operation of Nord Stream put pressure on traders. The prospects for a reduction in energy supplies to Europe are one of the main reasons for the growing economic crisis in the region.

Investors are also watching the dynamics of the British pound and government bonds. On Monday, the British currency paired with the US dollar updated a historical low on expectations of tax breaks in the country. Last week, Britain’s new Chancellor of the Exchequer, Quasi Kwarteng, announced a sweeping tax cut that would affect individuals and businesses and increase the budget deficit for the current fiscal year by more than £70bn.

The pound on Tuesday is growing by 1% to $ 1.0802 compared to $ 1.0688 a day earlier.

Among the growth leaders in the Stoxx 600 index, shares of the Italian Nexi S.p.A. are traded. (+6.8%). The company, which specializes in payments, expects to generate free cash flow of 2.8 billion euros between 2023 and 2025, which can be used for M&A deals and share buybacks.

The shares of the German energy company Uniper SE (+10.6%) and the Swiss network of online pharmacies Zur Rose Group AG (+6.7%) are also actively rising in price.

Meanwhile, shares of the British Admiral Group PLC (-6%), which specializes in auto insurance, are traded among the drop leaders.

Bank of Cyprus Holdings, the largest bank in Cyprus, fell 10% on the news that the private equity fund LSF XI Investments LLC (Lone Star) does not intend to improve the offer to buy the bank.

The Bloomberg Commodity Spot commodity price index fell to an eight-month low amid fears of a recession in the global economy.

The index, calculated on the basis of prices for a wide range of commodities – from oil and copper to wheat, on Monday fell by 1.6%, to a minimum since January 24. Its value has fallen by 22% from the peak level recorded in July. The rise associated with a jump in commodity prices immediately after the start of the Russian war in Ukraine has completely disappeared.

The continued strength of the dollar is making dollar-denominated commodities more expensive for overseas buyers, worsening demand prospects, Bloomberg said.

Experts see an opportunity for further decline in commodity prices, despite the fact that the supply of many commodities is limited. The unprecedented pace of raising key interest rates by world central banks, trying to contain the highest inflation in decades, raises fears of a recession in the global economy. The downturn, in turn, will worsen the outlook for energy demand and investor appetite for risk, economists warn.

The simultaneous destruction of three gas pipelines in the Baltic Sea is unprecedented, Nord Stream AG, the operator of the first Nord Stream, said.

“The destruction that occurred on the same day simultaneously on three strings of the offshore gas pipelines of the Nord Stream system is unprecedented. It is not yet possible to estimate the timing of the restoration of the gas transport infrastructure,” the project company said.

On the night from Sunday to Monday, a leak occurred on one of the threads of the Nord Stream 2 pipeline. This happened in the Danish EEZ southeast of Bornholm.

In addition, gas leaks were recorded from both threads of the first Nord Stream – in the exclusive economic zone of Denmark northeast of about. Bornholm.

There are 5-mile no-go zones for shipping around the leak areas.

The first Nord Stream with a capacity of 55 billion cubic meters. m of gas per year has been stopped today due to the running time between repairs by the engines of gas pumping stations, as well as breakdowns of compressor equipment that cannot be eliminated due to sanctions.

Nord Stream 2, of a similar capacity, was built and ready for operation, but did not work due to sanctions restrictions.

The Shegini checkpoint on the Ukrainian-Polish border has resumed the clearance and passage of vehicles, the Western Regional Directorate of the State Border Guard Service of Ukraine reports.

“The passage of persons and vehicles at the Shehyni checkpoint has been resumed. Currently, the queue to leave Ukraine is 120 cars and 4 buses,” the Facebook post says.

As reported, on Tuesday morning, the passage of vehicles was suspended in both directions due to a malfunction in the database of the Customs Service of Ukraine.