Representatives of the US Embassy in Ukraine are preparing to return and resume work in Kyiv.

“It’s great to be back! Today, members of the Embassy team traveled to Lviv to meet with key partners, including the Ukrainian Foreign Ministry. This visit was the first step towards more regular travel in the near future. Preparations are underway to resume work in Kyiv as soon as possible,” it said. in a tweet from the US Embassy on Wednesday night.

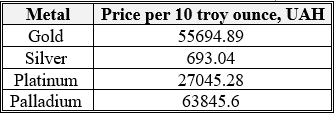

Official rates of banking metals from national bank as of April 27

One troy ounce=31.10 grams

National bank of Ukraine’s official rates as of 27/04/22

Source: National Bank of Ukraine

The total amount of direct documented damage to Ukraine’s infrastructure as a result of the Russian military invasion has reached almost $88 billion, Head of the President’s Office Andriy Yermak said in a telegram.

“Over the past week, direct losses to the Ukrainian economy due to destruction and damage to civilian and military infrastructure have increased by $3.1 billion,” he wrote, referring to the “Russia will pay” project implemented by the KSE Institute with the support of the Office of the President of Ukraine, the Ministry of Economy, the Ministry of Reintegration and the Ministry of Infrastructure.

Yermak noted that the total losses of the Ukrainian economy – direct and indirect – due to the war range from $564 billion to $600 billion.

“Russia must be responsible for all crimes and destruction in our state, and it is at the expense of the aggressor, in addition to international assistance and money from our budget, that Ukraine must be restored,” the head of the Office of the President of Ukraine stressed.

He clarified that this estimate of the cost of losses from the ongoing war has so far been made only on the basis of public sources.

According to the data he cited, as of today, at least 23 thousand km of roads, 277 bridges and bridge crossings, 11 military airfields, 1 airport have been destroyed or seized.

In addition, 535 kindergartens, 866 institutions of secondary, higher and higher education, 231 medical institutions, 173 factories and enterprises, at least 75 administrative buildings were damaged or destroyed.

The American company Mondelēz International, one of the world’s largest producers of snacks and confectionery, has estimated its losses and additional expenses in the first quarter of 2022 due to the war unleashed by Russia against Ukraine at $143 million (after taxes – $145 million).

“In February 2022, Russia launched a military invasion of Ukraine, and the company closed its operations and facilities in Ukraine. In March 2022, the company’s two Ukrainian production facilities in Trostianets and Vyshgorod were seriously affected,” the company said in a quarterly report on Tuesday evening.

According to him, this amount included $75 million reflected in the impairment of these and other assets and exit costs, $44 million in cost of sales and $24 million in marketing, general and administrative expenses.

As reported, PrJSC Mondelis Ukraine (formerly Kraft Foods Ukraine) is part of the Mondelēz International (USA) group of companies, the holding company of which is Mondelēz Nederland Services B.V (Netherlands).

The company in Ukraine includes the Trostyanets confectionery factory (Sumy region) and a subsidiary company “Chipsy Lux” LLC (Kyiv region).

Since 2003, Mondelis Ukraine has been managing business development in the Moldovan market, since 2005 – in the markets of Belarus, Georgia, Armenia and Azerbaijan, and since 2008 – also in the markets of Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkmenistan and Mongolia.

The company’s business in Ukraine as of autumn last year amounted to more than $400 million. Mondelis Ukraine invested more than $200 million in business development in Ukraine.

“Mondelis Ukraine” sells products under the trademarks “Korona”, Milka, “Vedmedic “Barni”, Tuc, “Belvita! Good Morning!”, “Lux”, Halls, Dirol, Picnic and others.

Violation of the territorial integrity of Ukraine is inconsistent with the UN Charter, said UN Secretary General Antonic Guterres.

“We firmly believe that the violation of the territorial integrity of any country is completely inconsistent with the UN Charter. We are deeply concerned about what is happening now. We believe that there has been an invasion of the territory of Ukraine,” Guterres said during negotiations with Russian President Vladimir Putin on Tuesday in Moscow.

The claims that Russia has regarding Ukrainian issues and European global security must be resolved, guided by the UN Charter, Guterres said.