The portfolio of agricultural equipment provided by lessors to Ukrainian farmers increased by 22.2% in 2021, to 5,870 units, in particular, 2,050 tractors (35% of the total number of equipment), 645 combines (11%), 587 tillage machines (10%) and 530 seeders and harvesters (10%) were leased, according to the website of the Ukrainian Union of Lessors (UUL).

“The total number of agricultural machinery financed by organized market leasing companies amounted to 5,870 units as of the end of 2021. With this result, the lessors’ portfolio of agricultural machinery increased by 22.2% over the year, which indicates the industry’s ability to meet the growing demand of a domestic agricultural producer for the renewal and modernization of agricultural machinery,” the union said in a statement.

At the same time, UUL member companies in 2021 accounted for 2,410 units of agricultural machinery leased (41% of the total portfolio), which is 10.5% more than in 2020.

Among the union’s members, OTP Leasing concluded the most transactions for leasing agricultural machinery last year – 1,250 units (52% of the total), Kredobank – 360 units (15%), Alfa-Leasing – 260 units (11%), and ULF Finance – 168 units (7%).

The most intensive deals on leasing agricultural machinery were carried out in the second and third quarters of 2021 – 684 units and 679 units, respectively, due to the seasonality of the agricultural business.

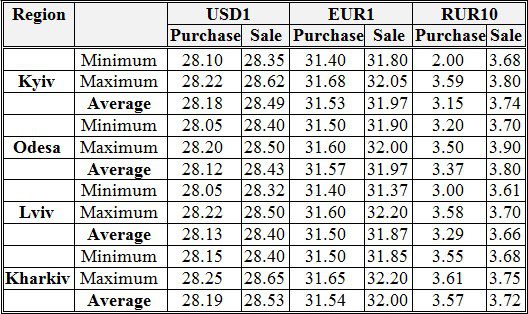

Ukrainian banks’ cash exchange rates on 01/02/22

Source: Interfax-Ukraine

Velta US Inc (the United States), the parent company of Production and Commercial Company Velta LLC with assets for the extraction of titanium containing ores in Novomyrhorod, Kirovohrad region, from January 31 this year began a series of multi-round negotiations with American partners to develop a roadmap for interaction between the Ukrainian supplier of titanium raw materials and U.S. companies and institutions that are consumers of titanium.

In 2022, supplies to the North American market will account for 65% of Velta’s total production, according to a company press release. Such growth is dictated by the shortage of high-quality titanium raw materials in the United States, as well as the high level of American interest in Ukrainian titanium, which is fixed in the law on the budget for national defense.

It is especially important for Velta to start negotiations with American partners right now, Matthew Murray, a member of the advisory board of Velta US inc. and moderator of the talks, believes.

National Defense Authorization Act No. 6505 for Fiscal Year 2022 requires the U.S. Department of State within 180 days to draw up a report on reducing America’s dependence on titanium supplies from China and Russia, including by increasing supplies from Ukraine, the press release says.

“We are firmly convinced that the new stage of negotiations will help find new points of intersection between Velta and our American partners in the titanium industry,” Andriy Brodsky, the CEO of Velta, stated.

As reported, Velta US Inc intends to increase supplies of ilmenite concentrate to the U.S. by 15-23% in 2022. At the same time, in January, Velta held a meeting of the advisory board, formed in October 2021, to discuss further expanding the company’s presence in the U.S. market, taking into account the analysis of signed contracts for 2022.

Ukraine and Turkey will reach an agreement on signing an agreement on a free trade area (FTA) in the next two days, President Volodymyr Zelensky has said.

“We are getting ready to give a powerful economic signal, to sign an FTA agreement with Turkey already within these two days. Our groups are working. I am sure that we will agree,” he said, speaking at the Verkhovna Rada on Tuesday.

JSC Ukrzaliznytsia transported 26.118 million tonnes of cargo in January 2022, which is 18% more than in January 2021 (22.093 million tonnes).

Oleksandr Kamyshin, the head of the company board, said on Telegram this indicator of cargo transportation is also higher than in January 2020 (23.915 million tonnes) and January 2019 (24.553 million tonnes).

According to him, the average daily cargo load in January 2022 increased by 15% compared to January 2021 (604,000 tonnes) – up to 694,000 tonnes, which is also higher than the figures for the same period in 2020 (662,000 tonnes), 2019 (656,000 tonnes) and 2018 (691,000 tonnes).

Cargo turnover in January of this year increased by 32% compared to January 2021 (11.994 billion tonne-kilometers) – up to 15.813 billion tonne-kilometers, which is also higher than in January 2020 (12.997 billion tonne-kilometers) and January 2019 (14.906 billion tonne-kilometers).