Employment of people with disabilities in Ukraine can be based on two models, advisor and presidential envoy on disability issues Tetiana Lomakina said in an exclusive interview with Interfax-Ukraine.

According to her, currently 2 million 2,700 people with disabilities live in Ukraine, of which only 26% are employed.

She also noted that if all employers actually fulfill the 4% quota for hiring people with disabilities provided by law, they will all be employed, but theory and practice are different.

“We talked with companies, with entrepreneurs and found two models. The first is social entrepreneurs – those who, when creating a business, put and continue putting the ideals of society higher than earnings at its foundation. You probably know such examples. For example, Kyiv’s bakery Good Bread from Good People or restaurant in Kharkiv Snow on the Head, where people with mental disabilities work. That is, people initially wanted to do good and after that they formalized it into social entrepreneurship,” Lomakina said.

The second model, as the adviser- presidential envoy on issues of disability said, is the use of international business practices by Ukrainian campaigns.

“The most important thing in such campaigns: the principles of policy, corporate standards, daily routine, the rules are the same for all employees, regardless of whether they have physical or mental disabilities. And if these rules are not respected, the same approaches are applied to all … Such a policy of equality stipulates that a person with a disability may have more needs and the company is ready to meet them, but there are rules, indicators are indicators, the result is a result. And it is in such a situation that all these fears that Ukrainian entrepreneurs talk about (about the difficulties of changing the approach to a worker with a disability, if he does something wrong or he has insufficient qualifications), are simply leveled out by the correct setting of the process of organizing work,” she said.

In addition, according to Lomakina, international campaigns pay great attention to staff training and exploring the capabilities of their employees.

“Their corporate training programs are aimed at closing weaknesses and developing strengths. I am sure that all this is possible in Ukrainian conditions, if we put a person and his qualifications in the center of attention,” she added.

According to her, practice shows that it is this approach that makes it possible to fulfill not even a 4%, but a 6% quota for the employment of people with disabilities.

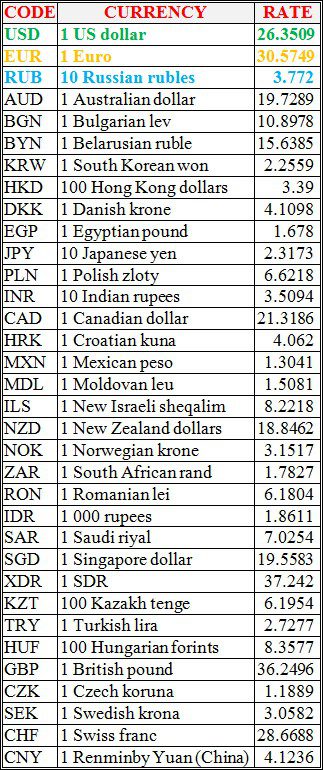

National bank of Ukraine’s official rates as of 26/10/21

Source: National Bank of Ukraine

The Court of Appeal in Amsterdam ruled to return the “Scythian gold” to Ukraine, first we will return the “Scythian gold,” and then the Crimea,” the head of state Volodymyr Zelensky said.

“The long-awaited victory in the Amsterdam Court of Appeal! ‘Scythian gold’ returns to Ukraine. Grateful to the court for a fair decision, and to the Ministry of Justice, the Ministry of Foreign Affairs and the Ministry of Culture and Information Policy of Ukraine for the result. We always regain what is ours. After the ‘Scythian gold,’ we will return Crimea,” Zelensky said on Twitter on Tuesday.

The Amsterdam Court of Appeal ruled on an appeal against a ruling by the Amsterdam District Court in December 2016 that the Allard Pierson Museum was to transfer the Crimean treasures to the Ukrainian state.

This is a collection of artifacts from four Crimean museums.

Escher Group Ltd (Ireland) will supply a new front-office system instead of the old software in stationary offices, as well as fully automate the work of mobile offices and postmen of Ukrposhta.

The signing of the agreement between Ukrposhta and the winner of the tender of the EUR opean Bank for Reconstruction and Development (EBRD), the Irish company Escher Group Ltd, took place in Kyiv on October 26, 2021, Interfax-Ukraine reports.

Director General of Ukrposhta Igor Smelyansky emphasized that the Escher Group software works in more than 30 postal operators around the world.

The contract value is EUR 7.8 million.

In accordance with the terms, it is envisaged to supply 43,000 software licenses, as well as technical support services during four years and software revision if necessary.

As reported, the Verkhovna Rada on October 21 ratified the guarantee agreement for the Ukrposhta Logistics Development project between Ukraine and the EBRD.

Prometey group of companies in 2020 increased its EBITDA by 6.8% compared to 2019 – up to $32.6 million, according to the results of its financial audit conducted by the international company KPMG posted on the grain trader’s website.

At the same time, the company does not provide data on the profit/loss received in the past year.

Prometey in 2020 also increased its revenue by 14.8% compared to 2019 – to $254.2 million. Its assets as of December 31, 2020 amounted to $199.3 million.

“It is noted that Prometey group of companies in 2020 entered the top five (in Ukraine, 1.7 million tonnes of one-time storage) in terms of elevator capacities. In the last marketing year, the group also confirmed its title of one of the leaders in the agricultural sector, selling about 1 million tonnes of grains and oilseeds,” the grain trader said.

Prometey provides services for the storage, processing and logistics of grain and leguminous crops on the basis of 29 elevators in Mykolaiv, Kirovohrad, Kyiv, Khmelnytsky, Zaporizhia, Sumy, Odesa, Kherson and Dnipropetrovsk regions.

In 2021, Prometey Group plans to receive $45 million in EBITDA.