Dragon Capital has downgraded its forecast for Ukrainian economic growth in 2021 from 4.6% to 3.5% due to unexpectedly worse-than-expected preliminary GDP data for the second quarter of this year, the founder of the company Tomas Fiala has said. The growth of the gross domestic product (GDP) of Ukraine in January-July 2021 became stronger, reaching 2.1%, the Ministry of Economy has said. The President’s Office estimates the growth of Ukraine’s GDP in 2021 at 3.8%, Deputy Head of the President’s Office Yulia Svyrydenko has said.

The real gross domestic product (GDP) of Ukraine in the second quarter of 2021 increased by 5.7% compared to the same period in 2020, the State Statistics Service reported.

The deficit of Ukraine’s foreign trade in goods in January-July 2021 decreased by 26.2% compared to January-July 2020, to $1.725 billion from $2.339 billion, the State Statistics Service of Ukraine has reported. The surplus of Ukraine’s balance of foreign trade in the first half of 2021 fell by 46.3% compared to the first half of last year, to $0.41 billion.

The growth of consumer prices in Ukraine in annual terms in August 2021 remained at the level of 10.2%.

Receipts of the state budget of Ukraine in August 2021 amounted to UAH 142 billion, which is 8.7% higher than the target and 41.7% more than August 2020, according to the data of the Treasury Service.

The total public debt of Ukraine in August 2021 in U.S. dollars decreased by 0.5%, or by $440 million, to $92.53 billion, the Ministry of Finance said on its website.

Industrial production in Ukraine in August 2021 increased by 0.6% compared to August 2020, while in July the growth was 0.2%, in June – 1.1%, in March – 5.4%, and in April – 13%.

Real wages in Ukraine in August 2021 compared to August 2020 grew by 10.9%, compared to July of this year it fell by 2.2%, the State Statistics Service has said.

The volume of construction work performed in Ukraine in July 2021 increased 0.5% compared to the same period in 2020.

Publisher of “Open4Business”, PhD in Economics, Maksim Urakin

Transport enterprises of Ukraine (excluding the territory of the Autonomous Republic of Crimea and Sevastopol, as well as part of the JFO zone) in January-August 2021 increased the carriage of goods by 4.3% compared to the same period in 2020, up to 398.5 million tonnes, the State Statistics Service reported.

According to the report, the freight turnover of carriers for the specified period increased by 1.5%, to 188.4 billion tonne-kilometers.

According to statistics, in January-August 2021 some, 201.7 million tonnes of goods were transported by rail in domestic traffic and for export, which is 2.6% more than in January-August 2020. Automobile transport carried 141.7 million tonnes (more by 18.6%), water transport – 3.2 million tonnes (less by 3.1%), pipeline – 51.8 million tonnes (17.4% less), aviation – 100,000 tonnes (more by 1.3%).

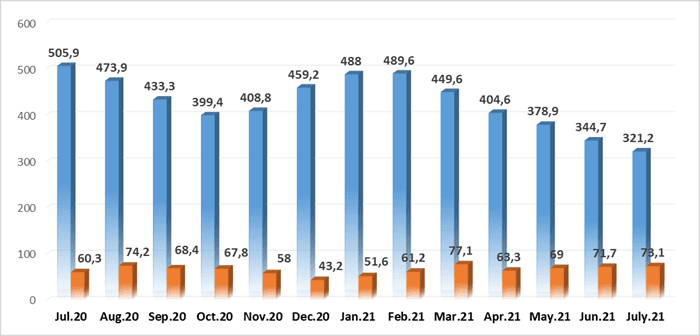

Number of unemployed in Ukraine and job opportunities, July 20 – July 21

Ratio of fertility and mortality by region in Jan-July 2021

SSC of Ukraine

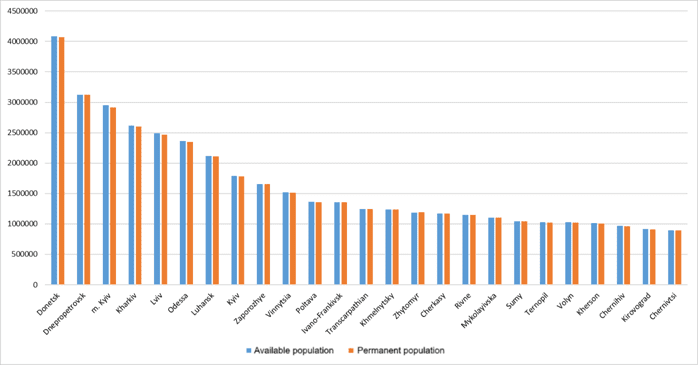

Ukrainian population by regions as of July 1, 2021 (graphically)

SSC of Ukraine

The deficit of Ukraine’s foreign trade in goods over January-August 2021 decreased by 33.9% compared to the same period in 2020, to $1.731 billion from $2.619 billion, the State Statistics Service of Ukraine reported on Wednesday.

According to its data, exports of goods from Ukraine over the specified period increased by 35.6% compared to the same period in 2020, to $41.788 billion, and imports – by 30.1%, to $43.519 billion.

The State Statistics Service clarified that in August, compared with July 2021, the seasonally adjusted volume of exports increased by 1.9%, to $6.008 billion, imports – by 0.6%, to $6.089 billion.

The seasonally adjusted foreign trade balance in August 2021 was negative and amounted to $80 million, which is better than the previous month ($156 million).

The coverage of imports by exports in eight months of this year amounted to 0.96% (over the same period in 2020 – 0.92%).

The State Statistics Service specified that foreign trade operations were carried out with partners from 231 countries of the world.