Agroholding KSG Agro has begun installing drip irrigation systems for corn crops on an area of more than 300 hectares in the village of Nyva Trudova (Dnipropetrovsk region), which will double the yield of this crop to 6 tonnes per/ ha, the company said in a press release on Wednesday.

“Drip irrigation is an opportunity to practically double the average yield even in difficult weather conditions. This was understood back in Soviet times, when the lands on which the agricultural holding’s farms are now operating were irrigated on an area of 5,000 hectares [the current land bank of the company is 21,000 hectares],” Board Chairman of the agricultural holding Serhiy Kasianov said.

According to KSG Agro, the project for the installation of U.S. irrigation systems and JCB (Turkey) and IVECO (Italy) pumping systems was developed by Technoservice (Mykolaiv). After its completion, the irrigated areas can be expanded for other crops.

The company said that it hopes for state assistance in the implementation of this project, since the draft state budget for 2022 provides for UAH 2.7 billion of financing for reclamation complexes and the maintenance of water systems.

The Ukrainian coworking and flexible office market is returning to pre-quarantine levels, the average occupancy rate of locations is 75%, according to a study by CBRE Ukraine and the Ukrainian Coworking Association.

According to its data, the pre-quarantine occupancy rates were 80-90%, while in May-August 2020 they decreased to 50-60%. With the introduction of adaptive quarantine, many large companies have revised their rental strategy towards coworking, after which the demand for flexible offices has shifted to recovery.

“The share of large companies in the structure of users of coworking spaces and flexible offices is growing. Now it is at the level of 11%, but there is a tendency to growth in demand for services from corporate clients. The main share is medium-sized businesses, namely 35%. Small businesses and start-ups account for about 20%, respectively,” the study says.

It is also noted that over the past year, the trends in planning solutions have changed on the market: the demand for open space offices has decreased by 50% and in the structure of space occupies on average only 10% of the location. At the same time, the profitability of individual offices, which occupy up to 55% of the premises, has significantly increased, the report says.

According to a survey of members of the Coworking Association, the majority of respondents use technological solutions to improve customer experience. Thus, 78% of coworking spaces use their own mobile applications for effective interaction between residents and management, and more than half use software to automate business processes and manage locations.

The coronavirus pandemic as a whole has accelerated the transformation of the office market and increased rental interest. As of August 2021, the total supply of coworking spaces in Kyiv amounted to 96,000 square meters, or 4.9% of the total volume of high-quality office space. At the same time, the new supply is steadily increasing, including due to scaling in the regions.

National bank of Ukraine’s official rates as of 24/09/21

Source: National Bank of Ukraine

The Verkhovna Rada intends to prohibit the use of hydrogenated palm oil in the production of food products, mostly consumed by children, to regulate the use of trans fatty acids in them, as well as to establish labeling requirements for foods containing palm oil and fines for their sale. Corresponding bill No. 5148 on amendments to certain laws of Ukraine concerning improving the quality of food products eaten by children was supported at first reading by 304 MPs with the required 226 votes.

According to an explanatory note to the document, it is proposed to ban the use of palm oil in traditional dairy products, as well as hydrogenated palm oil and other hydrogenated vegetable fats in baby food and confectionery.

In addition, the bill prohibits the production and circulation of food products in which the content of trans fatty acids exceeds 2 grams per 100 grams of the total amount of fat in the food product.

The explanatory note states that the sale of food products containing the above substances and ingredients entails the imposition of a fine on legal entities in the amount of 40 minimum wages (currently the minimum wage is UAH 6,000), on individual entrepreneurs – in the amount of 25 minimum wages.

The document also establishes the labeling of products containing palm oil, which, if the bill enters into force, will have to be marked with the easily visible phrase “Contains palm oil” next to the name of the product.

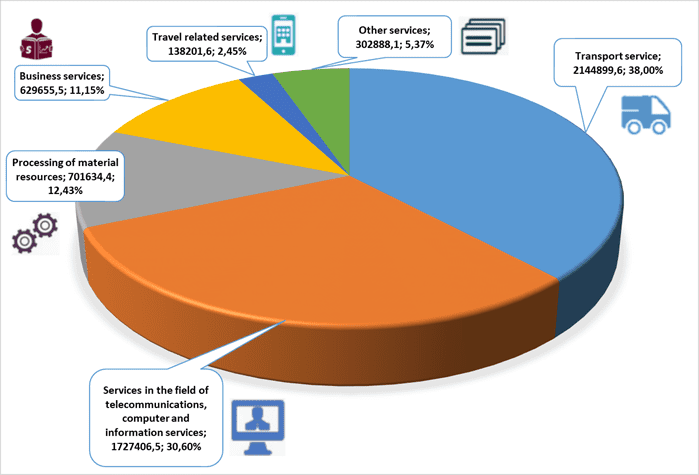

Structure of export of services in Jan-june 2021 (graphically)

SSC of Ukraine