Now the official website of Ukraine has become available in Chinese, Ukrainian Foreign Minister Dmytro Kuleba said.

“Today we launched the sixth language version of the official website of Ukraine, Chinese: https://ukraine.ua/zh/. More than 1.5 billion people speak Chinese in the world, it is one of the official languages of the UN. Promotion of a positive image of Ukraine in the world is the priority of the Foreign Policy Strategy,” Kuleba said on Twitter.

The official website of Ukraine is already available in English, German, French, Spanish and Arabic.

Ukrainian swimmer Andriy Trusov has won another gold medal at the 2020 Paralympics in Tokyo.

“Andriy Trusov won the S7 men’s 50 meters freestyle,” the Paralympics said on Twitter.

The third place was taken, also by Ukrainian swimmer Yevhen Bohodaiko.

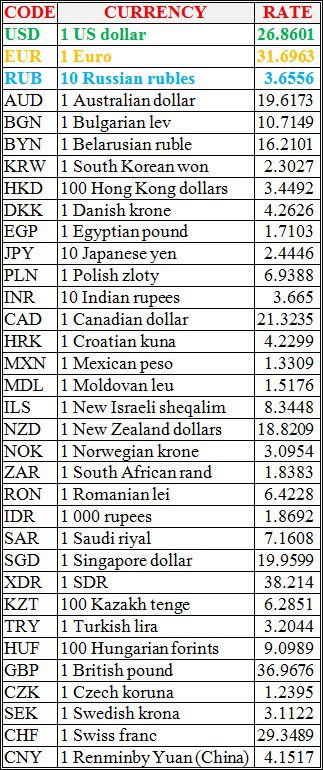

National bank of Ukraine’s official rates as of 31/08/21

Source: National Bank of Ukraine

The mobile operator Kyivstar in the second quarter of 2021 increased its total revenue by 18.1% compared to April-June 2020, to UAH 7.904 billion, the company’s press service said.

According to the published data, in the second quarter Kyivstar increased its EBITDA by 17.4% over the same period last year, to UAH 4.783 billion. At the same time, the EBITDA margin decreased by 0.4 percentage points (p.p.), to 67.4%.

Revenues from mobile services increased by 18%, to UAH 6.597 billion.

In addition, the operator noted that in the second quarter of 2021, the consumption of minutes per user (MoU) decreased by 3.3%, to 620 from 641 in the same period last year. At the same time, the use of mobile Internet in April-June increased by 23.6%, to 6.2 gigabytes per subscriber, while the average revenue per user (ARPU) increased by 16.4% and amounted to UAH 84.

The subscriber base in the second quarter of 2021 grew by 2.1% and amounted to 25.9 million. The subscriber base of the Home Internet service increased by 11.5%, to 1.16 million users.

Capital expenditures of Kyivstar during the reporting period decreased by 6.34% compared to the second quarter of 2020 and amounted to UAH 1.462 billion. According to the company, in total for the six months, Kyivstar’s capital expenditures amounted to UAH 2.539 billion. These funds were mainly used to build 4G networks on roads and in rural areas, as well as to improve the quality of services.

To improve customer service, the telecoms operator in the first half of 2021 modernized its IT systems by introducing a new technological solution from Ericsson.

In January-June 2021, Kyivstar transferred UAH 4.9 billion of taxes and other payments to the state budget and remains the largest taxpayer in the communications industry, the company said.

Kyivstar is the largest Ukrainian telecommunications operator. It provides communications and data services based on a wide range of mobile and fixed technologies, including 3G. By the end of 2020, its services were used by about 25.9 million mobile subscribers and about 1.1 million fixed Internet customers.

The shareholder of Kyivstar is VEON international group (formerly VimpelCom Ltd.). The group’s shares are listed on the NASDAQ (New York) stock exchange.

Dniprospetsstal Electrometallurgical Plant (Zaporizhia) in January-July this year increased the output of finished rolled products by 10% compared to the same period last year, to 95,200 tonnes.

A representative of the enterprise informed Interfax-Ukraine that steel production for this period increased by 7.3%, to 133,040 tonnes.

In July 19,000 tonnes of steel were smelted, 12,000 tonnes of rolled products were produced.

As reported, Dniprospetsstal in 2020 increased the output of finished rolled products by 1.3% compared to 2019, up to 154,000 tonnes, steel by 2.7%, up to 225,000 tonnes.

Dniprospetsstal is the only Ukrainian manufacturer of long products and forgings from special grades of steel: stainless, tool, high-speed, bearing, structural, as well as from heat-resistant nickel-based alloys.