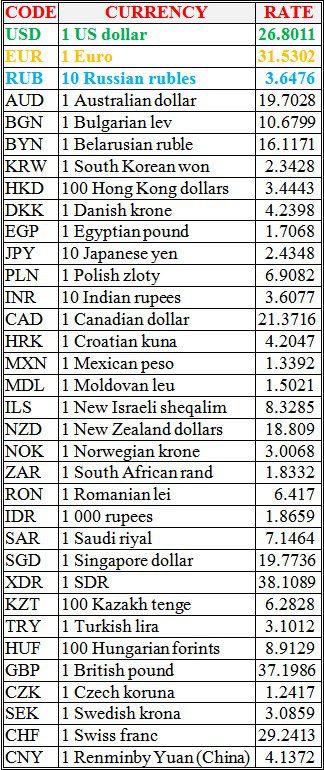

National bank of Ukraine’s official rates as of 10/08/21

Source: National Bank of Ukraine

Ukrainian Foreign Minister Dmytro Kuleba, in a telephone conversation with Saudi Arabian Foreign Minister Prince Faisal bin Farhan Al Saud, invited a delegation of Saudi business representatives to visit Ukraine and assess the country’s investment opportunities.

“Dmytro Kuleba invited a delegation of Saudi investors and company leaders to visit our state to assess investment opportunities for doing business and the possibility of participating in a large privatization program. The Minister expressed hope that trade issues will be successfully considered in October at the next meeting of the Intergovernmental Ukrainian-Saudi Commission on economic and scientific-technical cooperation in Riyadh,” the press service of the Ministry of Foreign Affairs of Ukraine reports.

Kuleba himself said that Saudi investments are already working successfully in Ukraine.

“We will welcome their increase. Ukraine is a country of new economic opportunities, especially in the fields of energy, IT, infrastructure, healthcare, agricultural and industrial sectors,” the minister said.

The parties noted the positive dynamics of bilateral relations since their previous conversation in the past, including the holding of the first in eleven years of political consultations between the foreign ministries, and also agreed to continue to maintain a high rate of development of relations between Ukraine and Saudi Arabia.

Kuleba noted a significant increase in the number of tourists from Saudi Arabia in Ukraine, which became possible due to the abolition of visa requirements by Ukraine and the opening of direct flights. The Minister expressed hope that next year the number of Saudi guests will increase further, which should be facilitated, in particular, by the granting of additional permits to Ukrainian carriers for regular flights to Saudi Arabia.

Prince Faisal bin Farhan Al Saud, in turn, expressed gratitude for the warm welcome of his compatriots, which strengthens friendly ties between the two countries. He also noted strong trade ties and expressed his conviction that the two countries have great potential for the development of trade and investment.

The parties expressed their readiness to work on the preparation of high-level visits. The Saudi Minister accepted the invitation to visit Ukraine and invited his Ukrainian counterpart to pay a visit to Saudi Arabia.

Ukrainian automakers in January-July 2021, according to preliminary data, produced 5,247 vehicles, which is 2.5 times more than in the first half of 2020, according to the Ukrautoprom website.

At the same time, the production of passenger cars increased by 2.7 times, to 4,847 units.

As reported, in this segment of the Ukrainian car industry, statistics for 2020 were formed only by Eurocar plant, while Zaporizhia Automobile Plant (ZAZ) resumed production of passenger cars only in September.

The positive dynamics in January-July this year is maintained by the production of buses, having increased by 23% over the same period last year, to 381 units, while the production of commercial vehicles (excluding KrAZ trucks) decreased by 32%, to 19 units.

Ukrautoprom also informs that in July car plants produced 704 vehicles – almost three times more than in July last year, but 6% less than in June this year.

Some 617 cars were produced, which is 3.6 times more than in July 2020, but 11% less than in June 2021.

Some 85 buses were manufactured last month – 42% more than in July last year and 52% more than in June 2021.

Only two commercial cars were produced (against four a year earlier).

Israeli diplomat Mykhailo Brodsky, who was appointed the new ambassador of Israel to Ukraine, presented copies of his credentials to Deputy Foreign Minister of Ukraine Dmytro Senyk.

“Israeli Ambassador to Ukraine Mykhailo Brodsky presented copies of his credentials to Deputy Minister of Foreign Affairs of Ukraine for Digital Development, Digital Transformation and Digitalization Dmytro Senyk. The sides confirmed their mutual commitment to cooperation and partnership,” the Israeli diplomatic mission said in a statement posted on Twitter.

Earlier, it was reported new Israeli ambassador to Ukraine Mykhailo Brodsky arrived in the country. His appointment as Israel’s ambassador to Ukraine was approved by the Israeli government in July 2021.

Boryspil International Airport (Kyiv) in January-July 2021 served 4.565 million passengers, which is 60% more compared to the same period in 2020 (2.848 million).

At the same time, according to the airport’s data provided to the Interfax-Ukraine agency, in July it served 1.168 million passengers, which is 3.5 times more than in July 2020, of which 735,640 people were on regular flights, 432,354 people – on non-scheduled flights.

In July, the airport accepted and dispatched 8,635 flights, which is 2.5 times more than in July 2020.

In addition, over the seven months of 2021, Boryspil airport served 2.512 million passengers on regular flights (an increase of 22%) and 2.053 million on non-scheduled flights (an increase of 2.6 times).

In total, for this period of 2021, the airport accepted and sent 37,899 flights, which is 49.4% more than in the same period in 2020.

At the same time, the number of transfer passengers for the seven months of this year decreased by 60%, to 156,812 people (for the same period last year, this figure was 392,346 people).

The share of transfers in the total passenger traffic in January-July 2021 decreased from 13.8% to 3.4%.