The agricultural exporter Kernel-Trade and the company specializing in wholesale trade in metals and metal ores Polyus Trading topped the list of the largest recipients of budgetary value added tax (VAT) refunds in August with an indicator of over UAH 1 billion, according to data of the State Treasury Service.

According to them, Kernel-Trade received almost UAH 1.6 billion of VAT refunds last month, Polyus Trading – UAH 1.095 billion, while there is no information on the budgetary refund of this tax to these companies in July.

The top five largest recipients of budgetary VAT refunds in August were also two steel plants – Zaporizhstal – UAH 407 million (in July – UAH 282 million) and ArcelorMittal Kryvyi Rih – UAH 386 million (UAH 315 million), as well as the agricultural exporter ADM Ukraine – UAH 231 million (UAH 159 million), the State Treasury Service said.

The second top five in the list are opened by Poltava Mining and Processing Plant – UAH 182 million (UAH 187.3 million) and Pivdenny Mining and Processing Plant – UAH 170 million (there are no data on reimbursement in July).

The top ten are closed by Viterra Ukraine – UAH 163 million (UAH 194.7 million), Yeristovo Mining and Processing Plant that topped the July list – UAH 157 million (UAH 383 million), as well as AGT – UAH 144 million (UAH 306.2 million), according to the treasury data.

The third five largest recipients in August looked like this: Mykolaiv Alumina Plant – UAH 121 million (UAH 120 million), Nikopol Ferroalloy Plant – UAH 110 million (UAH 190.5 million), Optimusagro Trade – UAH 96 million (UAH 144 million), and Leoni Wiring Systems UA GMBH – UAH 94 million (UAH 200 million).

Two more companies received over UAH 90 million in VAT refunds in August: Nika-Agrotrade – UAH 91 million (UAH 143 million) and Mondelez Ukraine – UAH 90 million (UAH 45 million).

According to the State Treasury Service, in general, in August 2021, budgetary reimbursement decreased to UAH 10.78 billion compared to UAH 11.15 billion in July and UAH 11.99 billion in June.

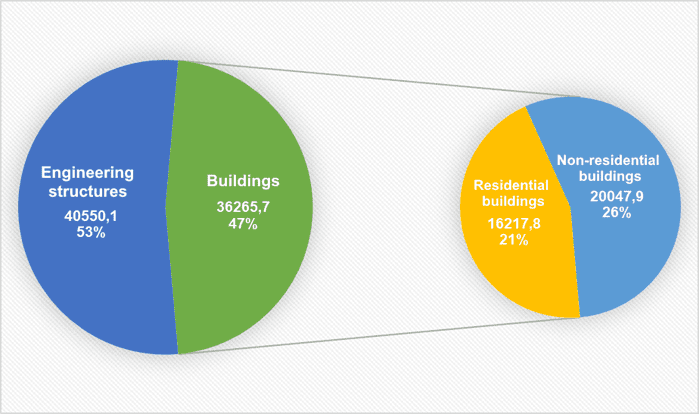

VOLUME OF CONSTRUCTION PRODUCTS PRODUCED BY TYPE IN JAN-JUNE OF 2021 (MLN UAH)

Ukraine exported furniture worth $578.85 million in January-August 2021, which is 62.5% more than the same period last year, head of the cluster platform of the Ukrainian Association of Furniture Manufacturers Oksana Donska told Interfax-Ukraine.

“The large share of Ukrainian furniture exports falls on the EU countries [87.9% of the total], while the CIS countries account for 7.9%, Asia – 2.1%, and America – 1%,” Donska said.

According to the expert, Poland, Germany, Denmark, Austria and Belgium are among the top five exporting countries of Ukrainian furniture and their parts.

“Exports to Romania have grown significantly this year – by 85.8%, from $9.1 million to $16.9 million, to the UK – by 140%, from $4.7 million to $11.4 million, and to France – by 84.9%, from $7.8 million to $14.4 million,” Donska said.

According to the data of the State Customs Service, to which the expert refers, the leaders in the commodity structure of exports are: 23.7% – wooden furniture (9403 60), and 23% – parts of furniture for seating (9401 90). Convertible sofas and armchairs (9401 40) gave 10.4% of exports, furniture parts (9403 90) – 10.2%, wooden bedroom furniture (9403 50) – 7.2%, and upholstered furniture that cannot be converted into beds (9401 61) – 6.9%.

The largest export volumes go through Lviv customs – 45.5%. In second place is Volyn customs (8.3%), followed by Kyiv and Rivne customs (7.9% and 6.8%, respectively).

Currently, most of the export is carried out by land transport (95.6%). At the same time, Donska noted that the development of business relations with the countries of the Middle East and America, which the Furniture of Ukraine Business Expo team is actively working on, will influence an increase in the number of orders for delivery by sea.

The Ukrainian Association of Furniture Manufacturers was established in 2001 and brings together entrepreneurs and enterprises operating in the furniture market.

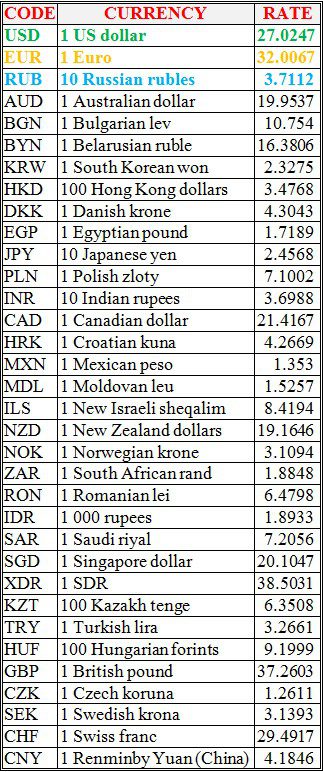

National bank of Ukraine’s official rates as of 03/09/21

Source: National Bank of Ukraine

The United States may provide Ukraine with a credit line totaling $4 billion for the period 2022-2030 to reform the system of public administration in the irrigation industry, as well as to attract investments in the renovation and modernization of irrigation infrastructure facilities.

The relevant information was published by deputy of the Verkhovna Rada from the European Solidarity faction Oleksiy Honcharenko on the Telegram channel, who presented a list of possible Ukrainian-American projects presented by President of Ukraine Volodymyr Zelensky during his working visit to the United States.

According to the deputy, Ukraine applied to the United States for a loan of $4 billion for the period 2022-2030 for the implementation of the project to restore the engineering infrastructure of irrigation systems and the development of irrigated agriculture in Ukraine, since the country’s financial capabilities do not allow it to independently implement this project.

As reported, on Thursday, Minister of Agricultural Policy and Food Roman Leshchenko said that large international agricultural companies Cargill and Lindsay had confirmed their desire to assist in the implementation of irrigation reform in Ukraine, since they see this project as a long-term strategic perspective. According to him, the ministry is negotiating with companies from Israel, the US, France and China regarding public-private cooperation in the reconstruction of irrigation systems in the southern regions of Ukraine.

In April 2021, the Cabinet of Ministers called on the restoration of irrigation systems for agricultural lands in the southern regions of the country by the end of this year.

The restoration of the reclamation industry has become a national project until 2024. In 2021, the Ministry of Agrarian Policy launches a pilot project to restore irrigation systems in Odesa, Kherson, Mykolaiv and Zaporizhia regions.