Ukrainian Serhii Yemelianov has won gold medal in a single kayak rowing of class KL3 at 200 meters at the Paralympics in Tokyo.

“He wins by centimetres! Serhii Yemelianov from Ukraine takes ‘gold’ in the men’s KL3 final canoe, silver won by Leonid Krylov (Russia’s representative), bronze is awarded to Robert Oliver from the UK,” the message reads.

Emelianov covered the distance of 200 meters in 40.355 seconds. He was ahead of the Russian by 0.109 seconds.

The average prices for new business-class residential buildings in Kyiv amounted to UAH 48,800 or $1,820 per square meter in early September, which is 30% higher than in the same period last year, Ramil Mehdiyev, CEO of ENSO, has told Interfax-Ukraine.

“The prices for business-class buildings are more intensified than the average prices for new buildings in Kyiv, which have risen over the year from UAH 26,600 to UAH 32,000 per square meter, that is, by 20%,” he said.

The expert explained the difference in the dynamics by a higher share of imported components in construction of business-class real estate. “Imported components are becoming more expensive than local production. The situation with imported materials is aggravated by quarantine restrictions and lockdowns, which have significantly complicated logistics,” Mehdiyev said.

In addition, in business class, the architecture and design solutions are usually much more complex, which bring additional costs both for materials and for work performance by qualified specialists. “You should also not forget about the global trend of housing prices rise and the fact that real estate in Ukraine has become almost the main investment tool for citizens. This increases demand, which in turn affects the price,” Mehdiyev said.

The expert predicts that the upward trend in the cost of housing will continue next year. “According to our estimates, the trend will not change until at least mid-2022. Much depends on the macroeconomic situation and the recovery of the world’s leading economies. First of all, we are talking about China, which is rapidly increasing consumption of raw materials, thereby heating up demand for the same metal,” Mehdiyev said.

According to him, we should also not exclude the emergence of new strains and, as a result, the possible introduction of quarantine restrictions. “This will most likely lead to a repetition of the situation in the spring of 2020, when there were almost no sales in the real estate market. Actually, this led to deferred demand, which was tapped in August 2020. At the same time, a rapid rise in prices began,” the expert said.

The development company ENSO, established in 2017, is implementing three projects in Kyiv.

Farmak pharmaceutical company (Kyiv) in the first half of the year ranked fifth in the pharmaceutical market of Uzbekistan, the company’s share was 2.3%.

Anton Zubov, the director of marketing and sales to the CIS countries of Farmak, told Interfax-Ukraine that in January-June 2021 the company increased sales in the Uzbek market by 61% in monetary terms compared to the same period in 2020.

“Our growth would have been even higher, however, during the pandemic, we were forced to limit the export of enoxaparin sodium (included in the COVID-19 treatment protocols) in favor of meeting the needs of the Ukrainian patient as a matter of priority,” he said.

According to Zubov, Uzbekistan is a key country in the company’s export sales. In the structure of shipments of Farmak products to the CIS countries, it occupies 50%.

Speaking about the main drivers of market development, Zubov noted the focus on the purchase of vaccines and the rapid growth of COVID-associated drugs, mainly antibiotics and anticoagulants.

“It was the increase in the consumption of these drugs that led to such a significant increase in the market this year,” he said.

Zubov stressed that export is a strategic direction for Farmak, and Uzbekistan ranks first in its overall structure.

“According to the export assessment data for the first half of 2021, Farmak is the undisputed leader among Ukrainian pharmaceutical companies supplying their products to the CIS countries. Our share is 32%, which is more than twice the share of our closest competitor. The growth for the same period in relation to the previous year amounted to 23%, this year – 9%. The market share increased by 1.4 percentage points,” he said.

Zubov said that during the COVID-19 pandemic, the first place was taken by the Flenox drug, which is used to treat and prevent blood clots.

In addition, the endocrinological portfolio of the company, with the key drug Dialipon, is also in demand.

The company also notes a consistently high demand for the antiviral group, in particular, for the Amizon drug and the Picolax laxative drug.

At the same time, Zubov noted that, like many countries of the CIS region, Uzbekistan is trying to protect the interests of domestic producers.

“We see that Belarus is moving this way, introducing strict quotas on imported goods and restricting imports on pharmacy shelves. In Kazakhstan, for example, there is a “third is a crowd” rule, when, if there are two offers from local producers, the third offer from the importer is automatically withdrawn. Uzbekistan also actively defends the interests of its manufacturers. Assessing the obvious trends, our company plans to localize production of solid dosage forms in the territory of this country,” he said.

According to Zubov, at present, Farmak is actively developing a project to localize production in Uzbekistan on the basis of a pharmaceutical cluster, which is being built near Tashkent.

“Farmak has already declared its intentions to be localized in Uzbekistan. At the moment, we are actively negotiating with the directorate of the pharmaceutical cluster and are now at the stage of negotiating an investment agreement, “he said.

Zubov recalled that the declared volume of investments is $ 10 million, but “already now we see that, in fact, the amount of investment is likely to exceed the originally planned one.”

“Good equipment and specialists are expensive,” he explained.

Zubov said that traditionally the pharmaceutical market of Uzbekistan is the fourth largest in the CIS. According to IQVIA, its volume in 2020 amounted to $ 1.3 billion against $ 1.6 billion in Kazakhstan, but Uzbekistan is developing more dynamically and may take third place in 2022.

In January-June 2021, the pharmaceutical market of Uzbekistan grew by 75% in monetary terms (in U.S. dollars) and by 45% in natural terms (in the number of packages).

Qatar seeks a sustainable investment partnership with Ukraine, the Minister of Commerce and Industry, Acting Minister of Finance of Qatar H E Ali bin Ahmed Al Kuwari said during the second meeting of the joint commission on economic, trade and technical cooperation between the two countries.

“In August 2020, the Qatari company QTerminals signed an agreement with the Ukrainian side on the concession for Olvia seaport in Mykolaiv. In the next five years, it is planned to invest in the development of the Ukrainian port and infrastructure. We will continue to expand the investment partnership,” he said.

“Today’s meeting of the commission is a necessary tool to achieve this goal,” he added.

Following the meeting, the co-chairs of the commission namely Minister of Commerce and Industry of Qatar H E Ali bin Ahmed Al Kuwari and Ukrainian Minister of Finance Serhiy Marchenko signed a protocol on amending the agreement between the governments of Ukraine and Qatar on avoidance of double taxation and prevention of tax evasion in relation to income tax.

The parties also discussed further steps in the development of bilateral relations and defined promising areas of cooperation, in particular, attracting investments, developing entrepreneurship and cooperation in tourism, agriculture, infrastructure, energy, health care, and financial sector, the report said.

“The meeting reaffirmed the desire of the two states to intensify economic activity. Despite the COVID-19 pandemic, we are seeing an upward trend in bilateral trade and hope to continue this positive trend. One of our top priorities is to attract investment in the economies of the two countries and strengthen business cooperation,” Marchenko said.

The Ministry of Finance recalled the first meeting of the joint commission on cooperation between Ukraine and Qatar took place in 2018.

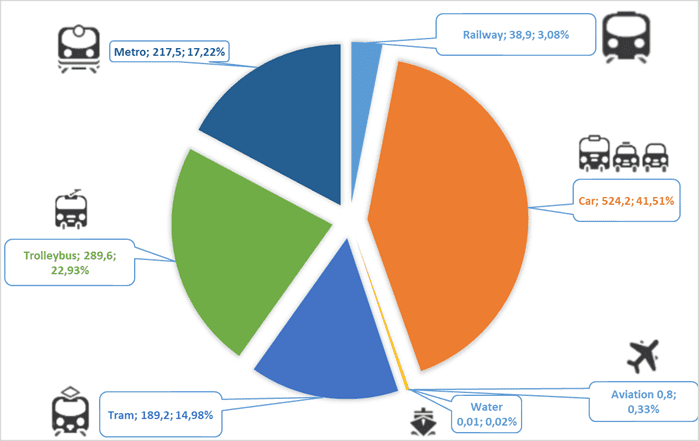

PASSENGERS CARRIED IN JAN-JUNE OF 2021, IN MLN

Fierce competition in all industries and the rampant development of information and communication technologies constantly require businesses to look for new means to expand markets.

In August 2021, the Ukrainian Exporters Club launched a new online “Digital expo – Ukrainian Products and Services” Project. The Scope of the Project is to draw the attention of foreign importers, distributors, representatives of trading networks to Ukrainian products, attract them to cooperation and, thus, increase Ukrainian exports.

Digital expo is a web resource where only Ukrainian companies are represented. Each of them has its own web site with a scope of activities description, photos and presentations of products and services and a feedback form to send requests for cooperation. For ease of search, all companies are grouped by main categories, namely:

PRODUCTS:

Metallurgy and Metalworking Production

Energy and Raw Materials Resources

Agriculture and Animal Husbandry

Food Industry

Mechanical Engineering

Vehicles and equipment

Chemicals and Pharmaceuticals Industry

Agriculture

Wood and Furniture

Construction Industry and Public Works

Glass and building materials

Precision equipment

Electrical and electronic equipment

Textiles and clothing

Luxuries

Products for sports and recreation

SERVICES:

Information Technology

Printing and publishing

Transport and related services

Marketing, Advertising and Mass Media

Banking

Finance and Insurance

Business services

Health Care

TOURISM

Digital expo is three sites, each in its own language: in Ukrainian, English and Chinese. This is done in order to improve market coverage and increase the confidence of foreign companies located in different regions of the world.

In fact, “Digital expo – Ukrainian Products and Services” is not a new project of the Ukrainian Exporters Club. It is a modernized, updated and adapted to modern market needs “Inspired By The Best In Ukraine” Project, which was created in 2015.

The previous project was supported by DHL and the EBRD at various stages of its life. It presented Ukrainian products and services at the international exposition IF CHINA in Beijing in 2016 and CIIE in China in 2019.

In the summer of 2021, the electronic catalogues of the Ukrainian Exporters Club became Digital expo.

In the last 3 months (June to August) of 2021, the exhibitors received more than 10,000 requests for cooperation from Malaysia, Poland, Turkey, China, Korea, Baltic States and other countries.

The modern project has become even better. It participates in international online expositions, including: worldexpo, expotobi, food1.com, echemi.com, infobel.com, foodfocus.co.za and others.

“Digital expo – Ukrainian Products and Services” is supported by world and Ukrainian reputable organizations, including: Ministry of Economy of Ukraine, Kyiv Chamber of Commerce and Industry, Entrepreneurship And Export Promotion Office, Euromonitor International and Others. The general media partner of the exposition is the Interfax-Ukraine News Agency.

You can learn more about the “Digital expo – Ukrainian Products and Services” Project and apply for participation at the link: https://inspiredbythebestofukraine.ticketforevent.com/ru/home/40010/