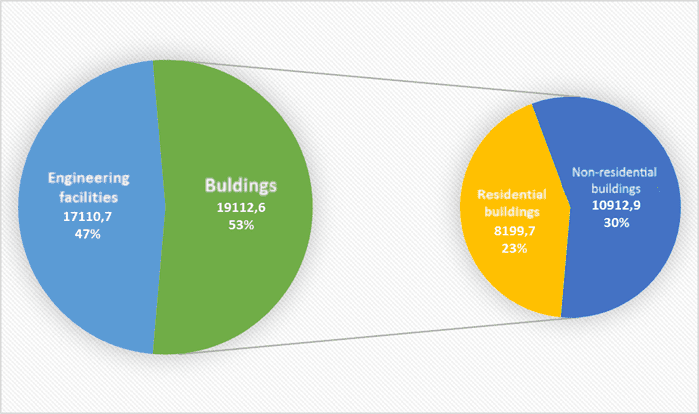

Volume of construction products produced by type in Jan-Apr of 2020 (Mln Uah)

The first after the coronavirus lockdown charter flight, carried out by JONIKA Airlines, has departed from the Kyiv International Airport to Tirana, Albania, with Ukrainian tourists on board.

“Albania is the first country to receive tourists from Ukraine. Today, on June 26, the first charter flight has departed from Ukraine’s Kyiv Airport following the resumption of air traffic with other countries of the world,” the airport said on its Facebook page.

According to the message, the plane took off from Kyiv at 10:00.

Representatives of the tourism industry have appealed to President of Ukraine Volodymyr Zelensky, the government and the profile committees of the Verkhovna Rada with the request to create an anti-crisis committee with the participation of tour operators and to facilitate the mirror opening of borders with other countries, the press service of the Ukrainian League of Industrialists and Entrepreneurs (ULIE) has said.

According to the appeal, the tour operators demand negotiations between the Foreign Ministry and the countries that have opened borders for other countries, excluding Ukraine, as well as the introduction of mirror and simultaneous opening of borders with them.

The representatives of the industry insist that inbound and outbound tourism should receive equal support from the state.

“Designate professionals who will understand the difference between inbound, outbound and domestic tourism. These are concepts that cannot be interchangeable. Why are anti-crisis steps today are taken in the format of replacing outbound tourism with inbound tourism? This is not a way out of the crisis for the industry, but only a substitution of concepts, which will lead to even greater decline,” the appeal states.

According to the tour operators, more than 250,000 people work in the industry, and during quarantine thousands lost their jobs. In addition, travel companies incur losses due to penalties for the return of paid and unused tours. At the same time, the industry representatives emphasized that they do not require financial subsidies or provision of jobs.

The appeal was prepared by representatives of the tourism industry together with the anti-crisis council of public organizations and the ULIE.

Kyivstar mobile operator has extended 4G network coverage in 20 regions of Ukraine, connecting 344 more settlements, the company’s press service has said.

The operator, in particular, connected the towns of Tokmak (Zaporizhia region), Soledar (Donetsk region), Svaliava (Zakarpattia region), Pogrebysche (Vinnitsa region), Belz (Lviv region), as well as hundreds of small villages.

Currently, according to the company, due to the increase in 4G communications territory, more than 80% of Ukrainian residents can take advantage of high-speed mobile Internet access in the Kyivstar network.

Since the launch of the 4G communications by the operator in April 2018, more than 10 million subscribers have already taken advantage of the new technology services. During this period, the consumption of mobile Internet in the Kyivstar network increased from 325 to 649 PB.

In the 4G communications network, each subscriber on average uses 10 GB of traffic per month, which is almost twice as much as on a 3G network.

Kyivstar is the largest Ukrainian telecommunications operator. It provides communications and data services based on a wide range of mobile and fixed technologies, including 3G. By the end of 2018, its services were used by about 26.4 million mobile subscribers and about 900,000 fixed Internet customers.

The shareholder of Kyivstar is the international group VEON (formerly VimpelCom Ltd.). The shares of the group are listed on the NASDAQ Stock Exchange (New York).

Ukraine exported more than 20.5 million tonnes of wheat and 30.3 million tonnes of corn in the 2019/2020 agricultural year (July-June), President of the Ukrainian Grain Association (UGA) Mykola Horbachev has said. “The 2019-2020 grain season was successful. We produced a record number of grains and oilseeds. The grain and oilseeds harvest was a little over 98 million tonnes, which is an absolute record for Ukraine. A record amount of wheat was grown – more than 28 million tonnes. Wheat exports amounted to more than 20 million tonnes. Corn export exceeded all expectations. We exported more than 30 million tonnes. This year was successful,” he said at a press conference in Kyiv on Thursday.

The head of the UGA predicted that by 2026 Ukraine will produce 113 million tonnes of grain and oilseeds a year and export 70 million tonnes.

According to the UGA, export of grain and oilseeds in the 2020/21 season will be some 58.8 million tonnes.

The largest Polish air carrier LOT resumes international flights from July 1, including flights to Kyiv.

According to the company’s website, in particular, flights will be operated to Boryspil International Airport.

In addition, from July 1 LOT will resume flights to Prague (the Czech Republic), Dusseldorf, Berlin (both Germany), Vilnius (Lithuania), Budapest (Hungary), Vienna (Austria), Brussels (Belgium), Bucharest (Romania), Amsterdam (the Netherlands), Tbilisi (Georgia), Oslo (Norway), Barcelona (Spain), Split, Dubrovnik, Zadar (all Croatia), Podgorica (Montenegro), Corfu, Chania (both Greece), and Varna (Bulgaria).