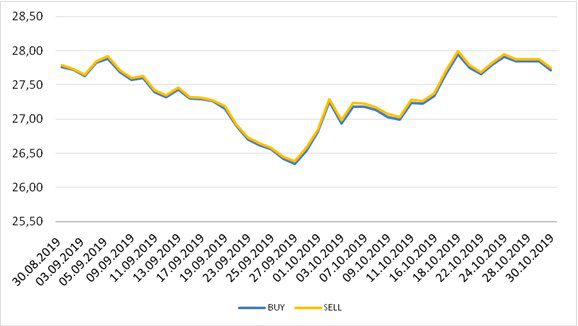

Changes in currency exchange, UAH/EUR, 30.08.19.-30.10.19.

Ukraine since the beginning of the 2019/2020 marketing year (MY, July-June) and as of November 4, 2019 had exported 19.64 million tonnes of grain and leguminous crops, which is 42.9% more than on the same date last MY.

According to the information and analytical portal of the agro-industrial complex of Ukraine, to date, the country has exported 11.67 million tonnes of wheat, 4.39 million tonnes of corn, and 3.34 million tonnes of barley.

As of November 4 of this year, 118,600 tonnes of flour had been also exported.

As reported, Ukraine in the 2018/2019 MY exported a record 50.4 million tonnes of grain, legumes and flour, which is 23% more than in the previous MY.

The U.S. Department of Agriculture (USDA) in September raised its forecast for grain exports for the 2019/2020 MY by 400,000 tonnes compared with the August forecast, to 54.44 million tonnes.

National bank of Ukraine’s official rates as of 04/11/19

Source: National Bank of Ukraine

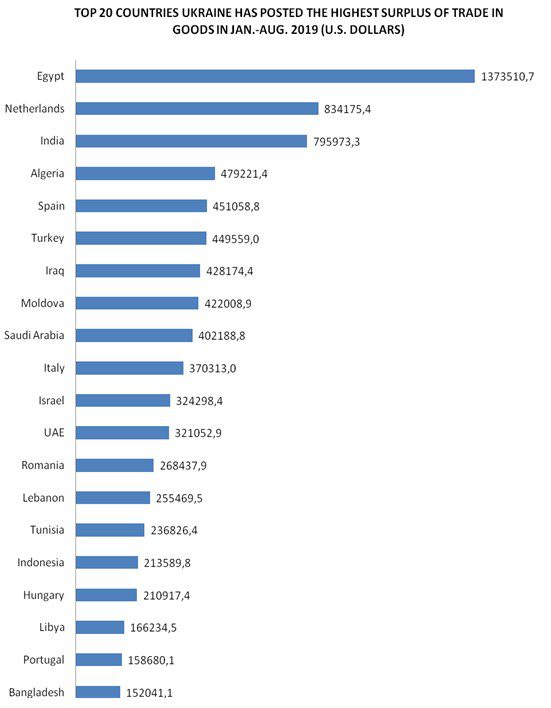

Top 20 countries Ukraine has posted the highest surplus of trade in goods in Jan.-Aug. 2019 (U.S. Dollars)

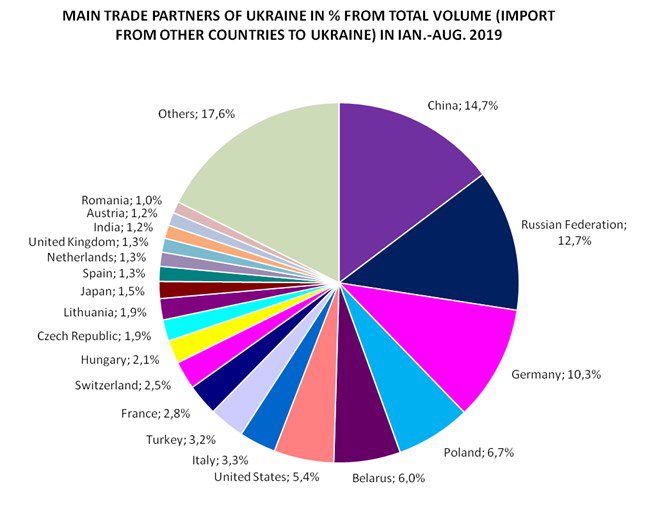

Main trade partners of Ukraine in % from total volume (import from other countries to Ukraine) in Jan.-Aug. 2019