Metinvest Group’s Kametstal plant, which was set up at the facilities of Dnipro Metallurgical Plant (DMK, Kamianske, Dnipro Oblast), continues to expand its product range.

According to the company, new products are being manufactured on an individual order basis.

In November, the company rolled and shipped rebar with a nominal cross section of 9.5 and 11.5 mm on the 400/200 mill for the first time. Along with 10 and 12 mm rebar profiles, it is used in the construction industry, in particular in the construction of housing and infrastructure facilities. Non-standard parameters of the profile sizes allow customers to optimize metal consumption for the construction of concrete structures of buildings and structures, while ensuring the required strength.

The developers of this solution made changes to the production technology, calibration table, rolling scheme, and calibrated the rolls, etc.

In November, 1,000 tons of 9.5 rebar and 1,500 tons of 11.5 rebar were produced and shipped to Ukrainian customers.

Oleksandr Oliynyk, Chief Rolling Officer of Kametstal, noted that the expansion of the steel product range, including customized products, allows the company to maintain its status as a customer-oriented producer in the Ukrainian and European steel markets.

“If there is a need in the market for such non-standard rebar, we promptly respond to customer requests. Our specialists have enough experience, knowledge and skills to master a new type of rolled steel in demand in a short time,” explained the manager.

“KAMETSTAL was established on the basis of PJSC Dneprovsky Coke and Chemical Plant (DKKhZ) and the Centralized Rolling Mill of PJSC Dneprovsky Metallurgical Plant (DMK).

According to the 2020 report of Metinvest Group’s parent company, Metinvest B.V. (Netherlands) owned 100% of the shares in DCCP.

By the decision of the extraordinary general meeting of participants of ALC “Insurance Company ‘Guardian’ (Kiev) on December 5, 2024, Tatyana Shchuchieva was appointed CEO of the company, according to the information of the company. It is specified that Shchuchieva will assume her duties from December 11, 2024.

As reported, Tatiana Shchuchieva from May 2008 to October 2024 headed IC “Express Insurance”.

IC “Guardian” has been working in the insurance market since 2007. According to NBU data it is among the top 15 risky insurance companies of Ukraine by collected premiums following the results of nine months of 2024.

It is a member of the Presidium of the League of Insurance Organizations of Ukraine. Since January 2020 it has received the status of a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTSBU), has the right to sell “Green Card” policies.

MHP Food and Agricultural Holding, Ukraine’s largest chicken producer, has submitted a binding offer to acquire UVESA Group (UVESA), the market leader in the Spanish food industry in the production of poultry and pork, the company’s press service reports.

“The transaction is an open tender offer addressed to all current shareholders of UVESA, which is subject to certain conditions, including, but not limited to, reaching the minimum acceptance threshold of 50.01%. If regulatory approvals are required to close the deal, MHP will ensure that all requirements are met,” the statement said.

The agroholding emphasized that this acquisition is another step in MHP’s development in international markets and strengthening the company’s position as an important player in the global food market and the European market in particular. Expanding its international presence is in line with MHP’s strategy of transforming itself into an international culinary company with operations in key regional markets.

MHP is one of the largest investors in Ukraine. Since the full-scale invasion, MHP has invested UAH 14.8 billion in business development in Ukraine.

“MHP’s main priority remains the further development of its business in Ukraine. We are working to ensure food safety, stable operation of enterprises, strengthening the country’s economy, supporting the military, our teams and communities, investing in Ukrainian businesses that expand the MHP culinary ecosystem,” the agroholding said, adding that despite the war, MHP demonstrates resilience and growth, scaling up its practices at foreign assets.

The company already has successful experience in acquiring and developing companies in the European Union – in 2019, Perutnina Ptuj (Slovenia, Serbia, Croatia, Bosnia and Herzegovina) became part of MHP Group.

MHP has considerable expertise in poultry production – for the second year in a row, the company has retained the status of the largest poultry producer in Europe according to the WATT Poultry International rating.

In addition, thanks to MHP’s business approaches, solutions and expertise, the European company has significantly increased its efficiency – Perutnina Ptuj’s EBIDTA grew from $34 million in 2018 to $91 million in 2023.

“This experience of MHP will make it possible to make a significant contribution to the agricultural and food sectors in Spain. The deal will help meet the growing demand for high quality and affordable food in the world. This step is of great importance for strengthening the food security of the European Union and is fully in line with Ukraine’s European integration aspirations to become part of the single European market,” MHP summarized.

UVESA Group was founded in 1964 by a group of veterinarians who acquired the Piensos Uve feed mill (Tudela, Navarra province). Between 1972 and 1984, the group expanded its assets to three feed mills, and in 1985 acquired its own slaughterhouse. In 2001, it opened a poultry factory with slaughter and processing facilities in Málaga, in 2008 a new poultry processing plant and in 2016 a poultry hatchery in Navarre. In 2017, Prado Vega and Saconda merged to become Uvesa Cuellar Uvesa Catarroja. By 2020, the company owned 600 integrated farms and launched the production and export of raw sausage under the Alpico brand, as well as a line of halal meat products under the Basmahal brand.

“MHP is the largest chicken producer in Ukraine. The company produces cereals, sunflower oil, and processed meat products.

As reported, the company received $142 million in net profit in 2023 compared to $231 million in net loss a year earlier. The group’s revenue last year increased by 14% to $3.021 billion.

In the third quarter of this year, MHP earned $96 million in net profit, which is 75% higher than in the third quarter of 2023, while revenue increased by 5% to $773 million, gross profit grew by 47% to $249 million, operating profit by 62% to $154 million, and adjusted EBITDA by 56% to $173 million.

The Ukrainian real estate marketplace DIM.RIA and the Association of Realtors of Ukraine have released a joint study of the real estate market in the fall. It analyzed how the price of housing for sale and rent changed, as well as the amounts at which buyers and tenants ultimately concluded agreements with owners.

Primary market

Supply.

As of the end of November 2024, sales departments in 77% of new buildings were active. In the autumn period, 40 new buildings in 72 sections were commissioned in Ukraine: most of them in Kyiv region (excluding Kyiv) – 12 new buildings, 8 new buildings in Lviv region, and 5 in the capital.

Prices.

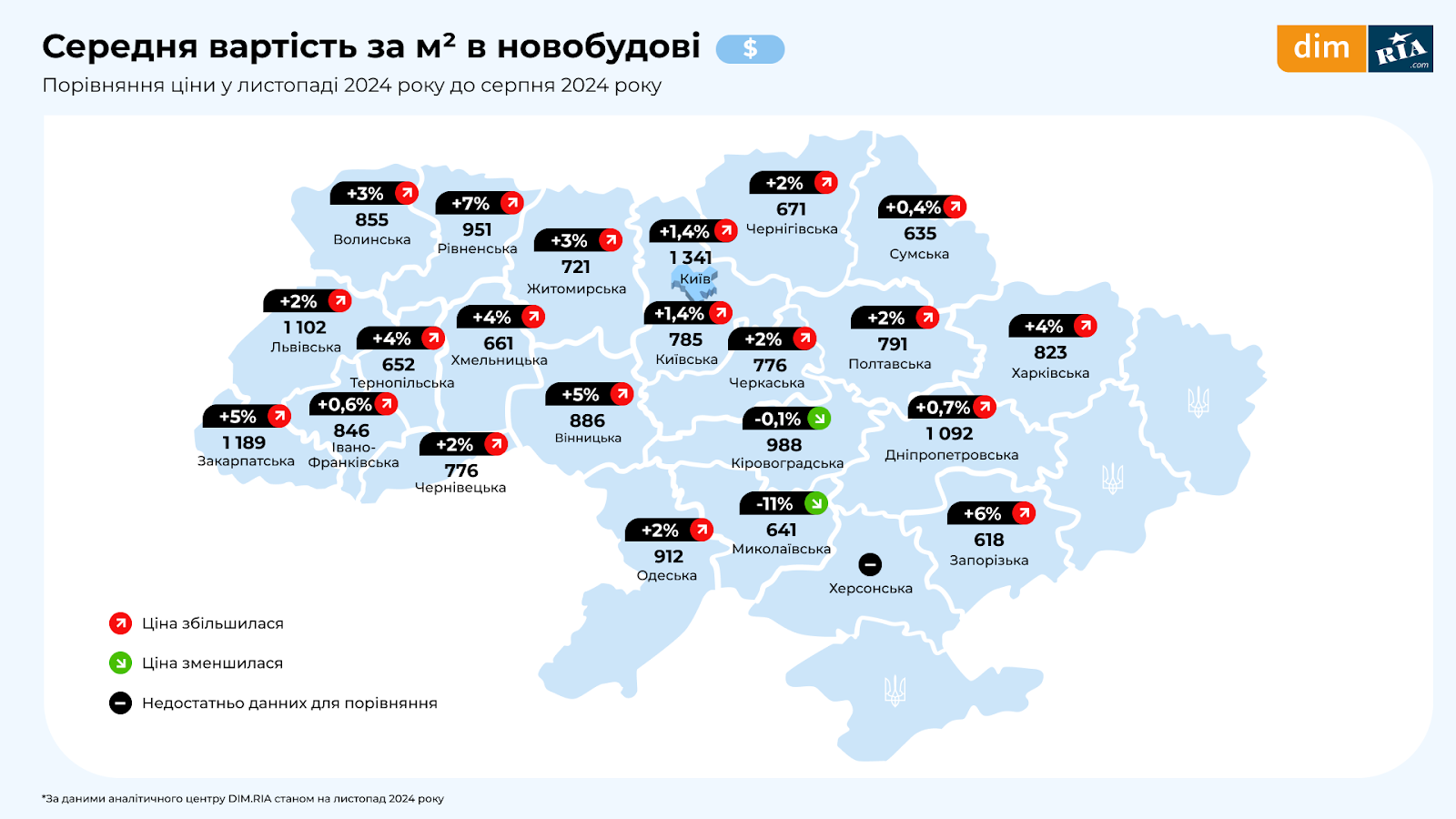

The average price per square meter in dollar terms increased in almost every region of Ukraine during the fall. Analysts noted the most rapid price growth in Rivne, Mykolaiv, Zakarpattia and Vinnytsia regions: +5-7% in dollar terms over three months. Kyiv remains the most expensive city on the primary market with an average price of $1,341 per m².

Demand

During the fall, DIM.RIA analysts noted a significant revival of interest in primary housing among users in the central and some western regions. The number of search queries related to new buildings increased the most in Cherkasy region (+15%) compared to the summer.

Secondary market

Price

In the fall of 2024, the price indicated by owners of one-room apartments in their sales offers increased in most regions. The most significant price increase occurred in Zakarpattia and Rivne regions (+19% each). Chernivtsi, Kyiv, Khmelnytsky, and Poltava regions maintained their prices for secondary housing at the level of the end of summer. The decline in prices occurred mainly in those regions close to the border with the aggressor country.

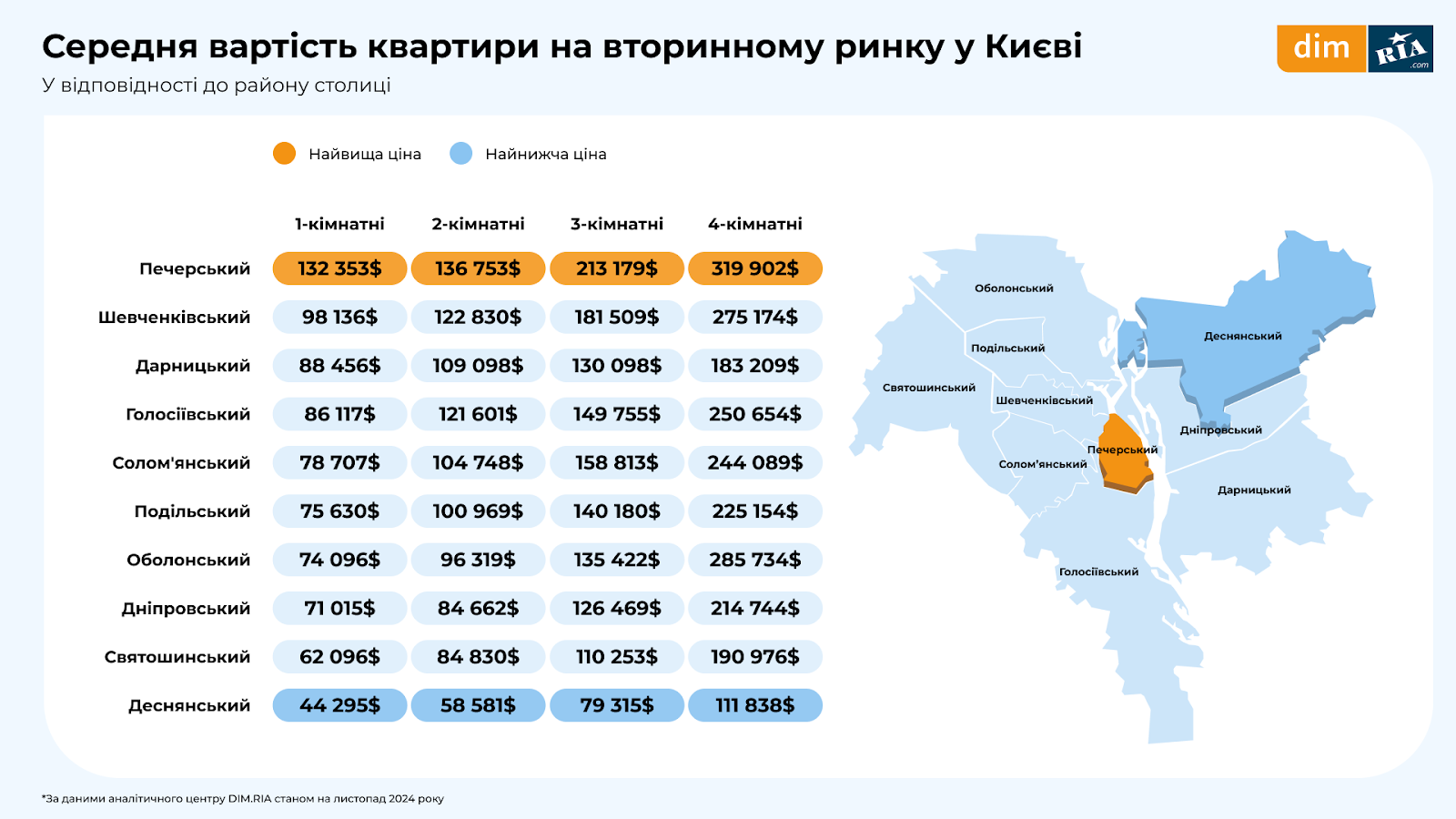

If we look at the capital in more detail, the most expensive in terms of prices in the offers on DIM.RIA are Pecherskyi ($132 thousand) and Shevchenkivskyi ($98 thousand) districts.

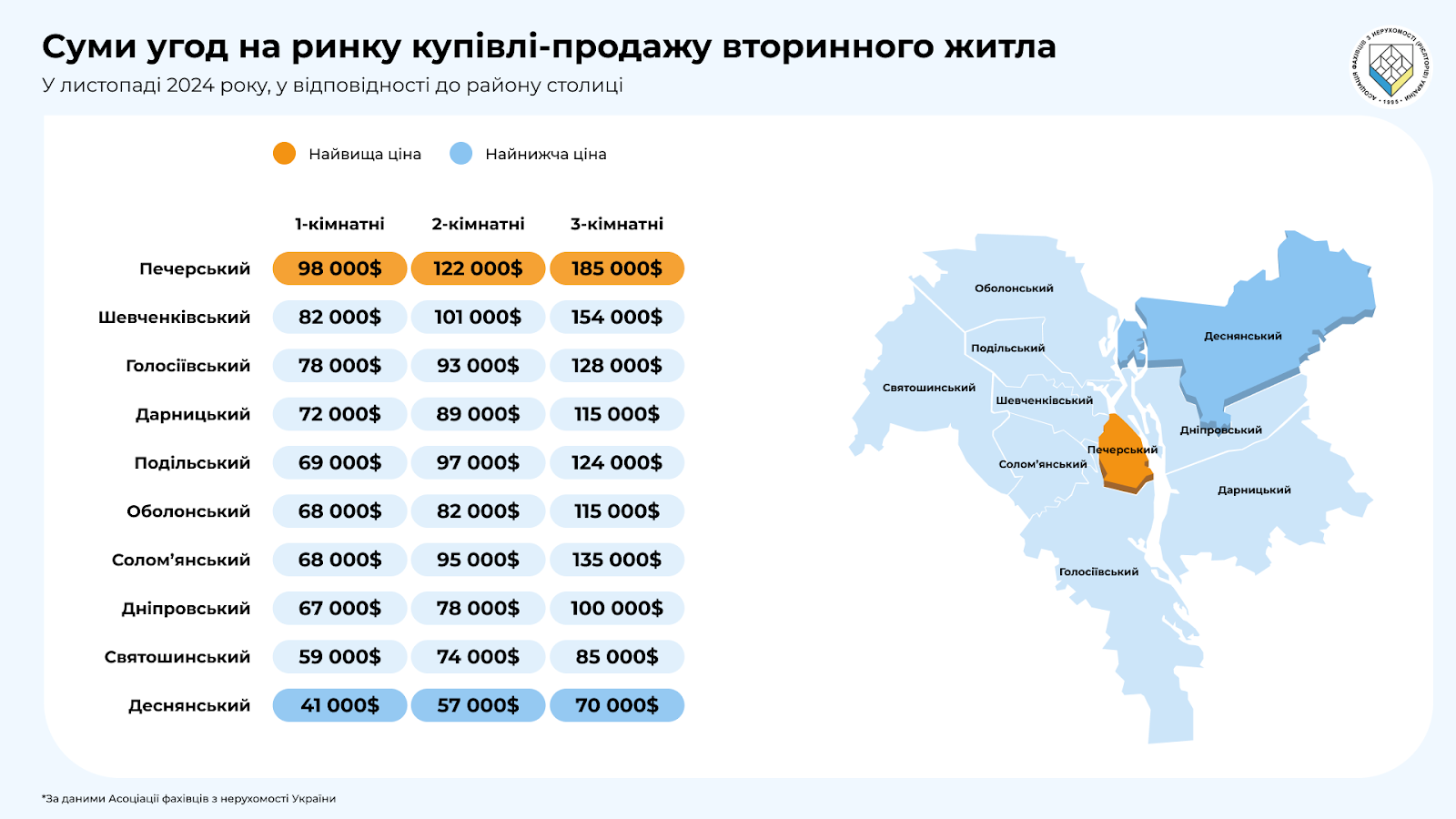

Among the average amounts of transactions concluded on the real estate market in November, Pecherskyi and Shevchenkivskyi districts will also be the most expensive. However, according to the Association of Real Estate Professionals of Ukraine, people buy there at lower prices: on average, one-bedroom apartments in Pechersk are sold for $98 thousand and $82 thousand in Shevchenkivskyi.

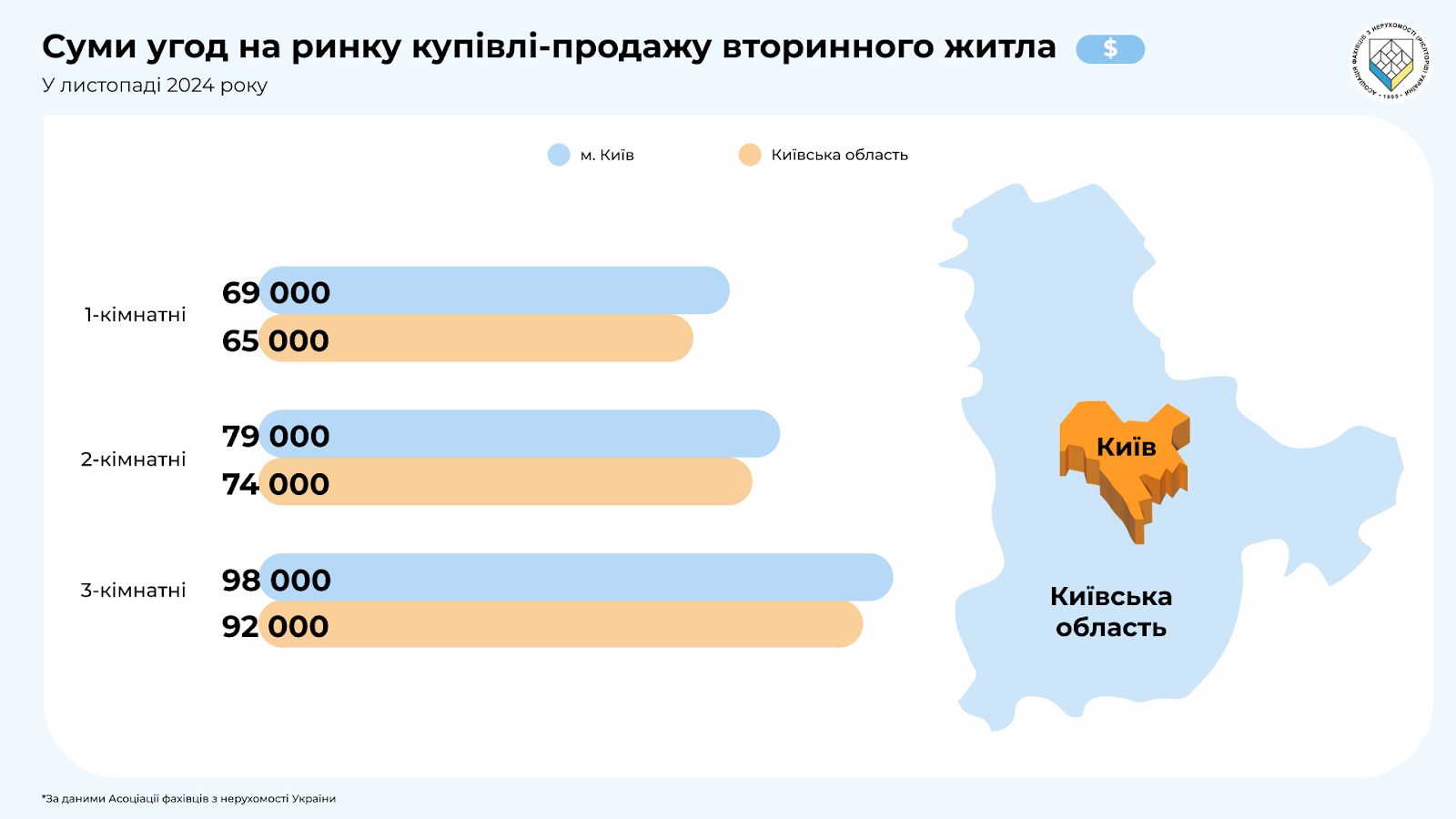

The average amount of a transaction for the sale and purchase of a one-room apartment in all districts of Kyiv is $69 thousand, and in the region – $64 thousand.

Interesse

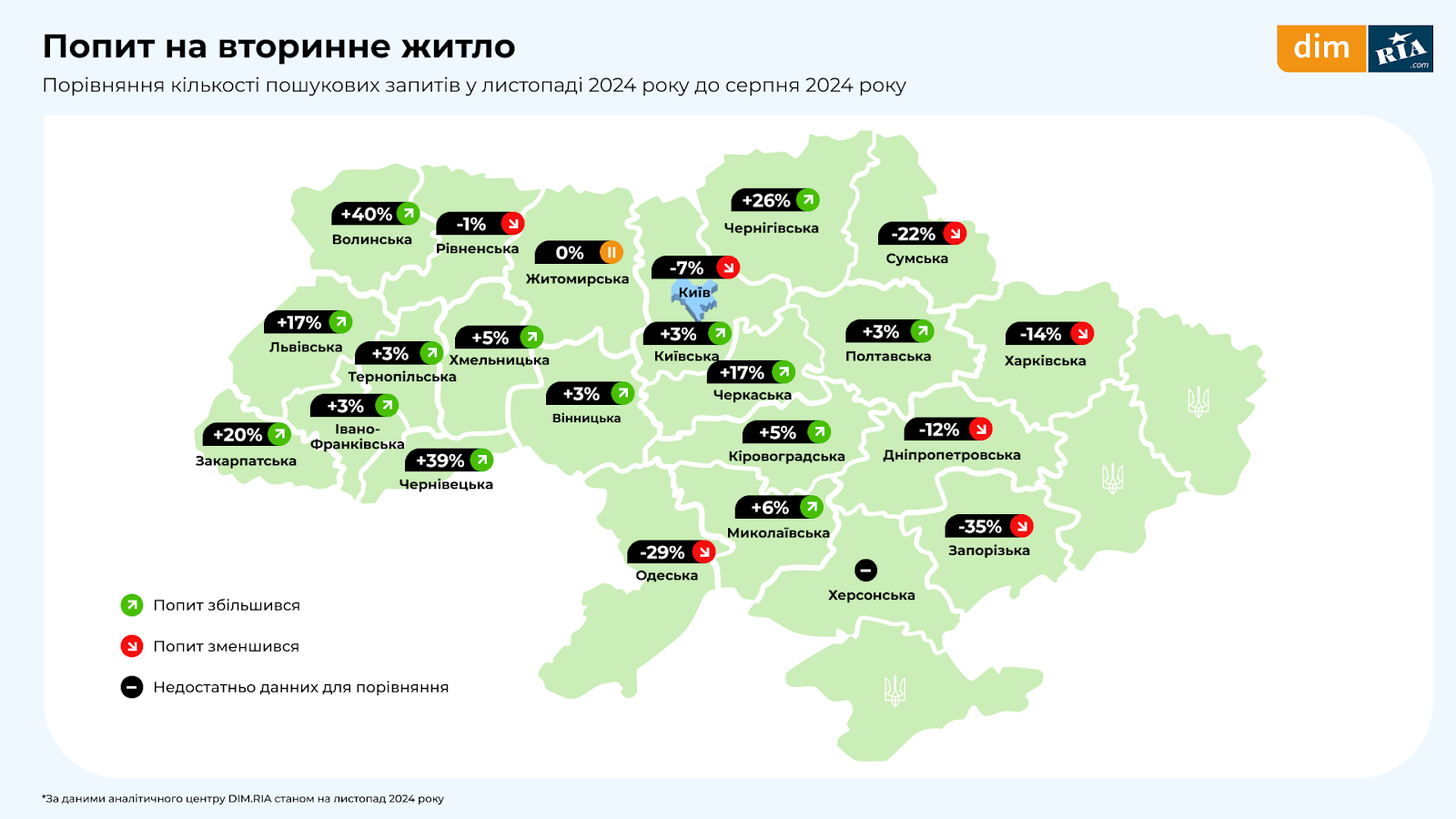

Im September-November belebte sich in den meisten Regionen das Interesse der Nutzer an Zweitwohnungen, wobei der größte Anstieg der Suchanfragen in den Regionen Volyn und Chernivtsi zu verzeichnen war (+40% bzw. +39%). In der Hauptstadt war das Interesse am Kauf von Zweitwohnungen im Vergleich zum Sommer um 7 % geringer, in der Region Kiew um 3 % höher.

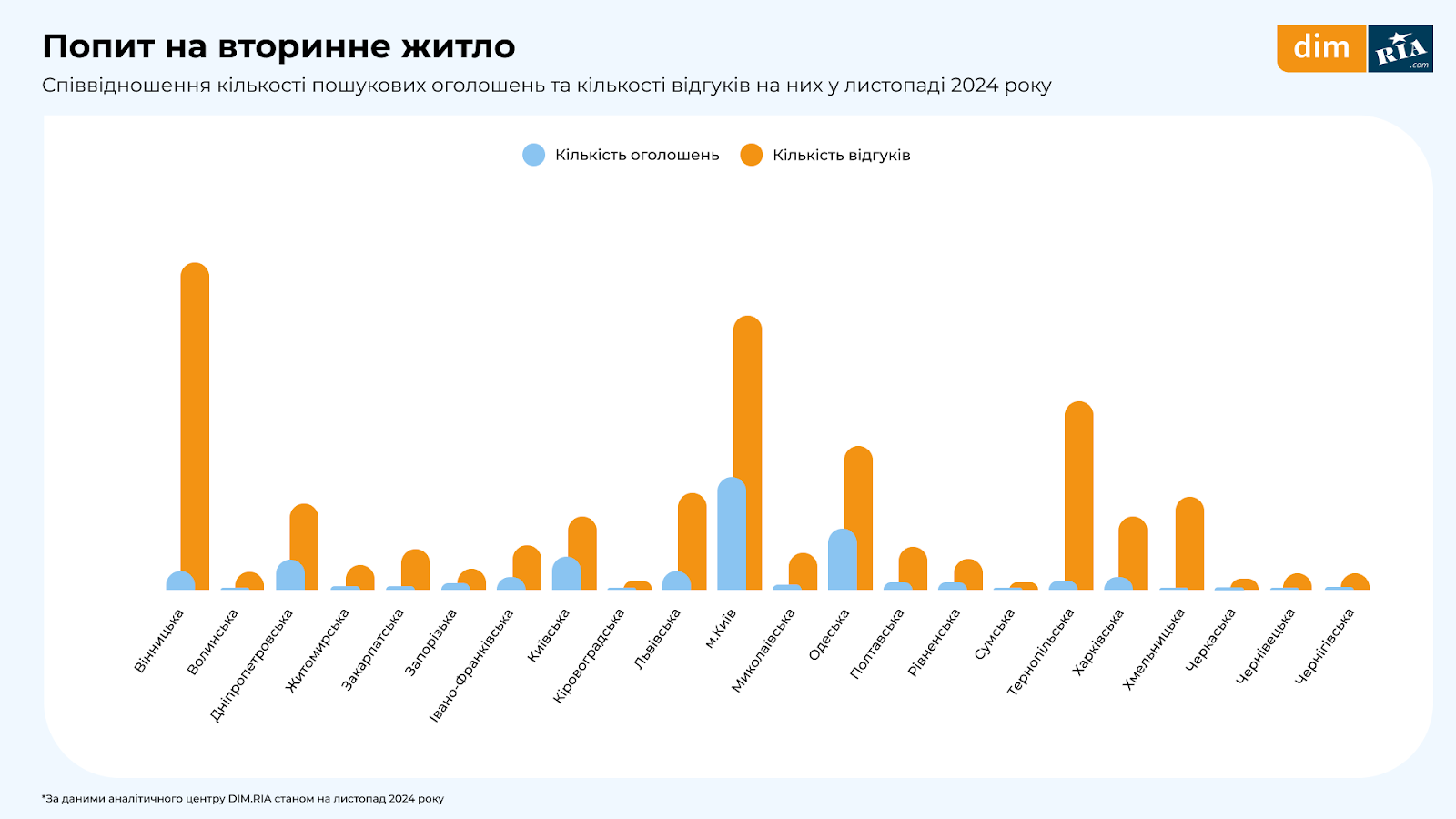

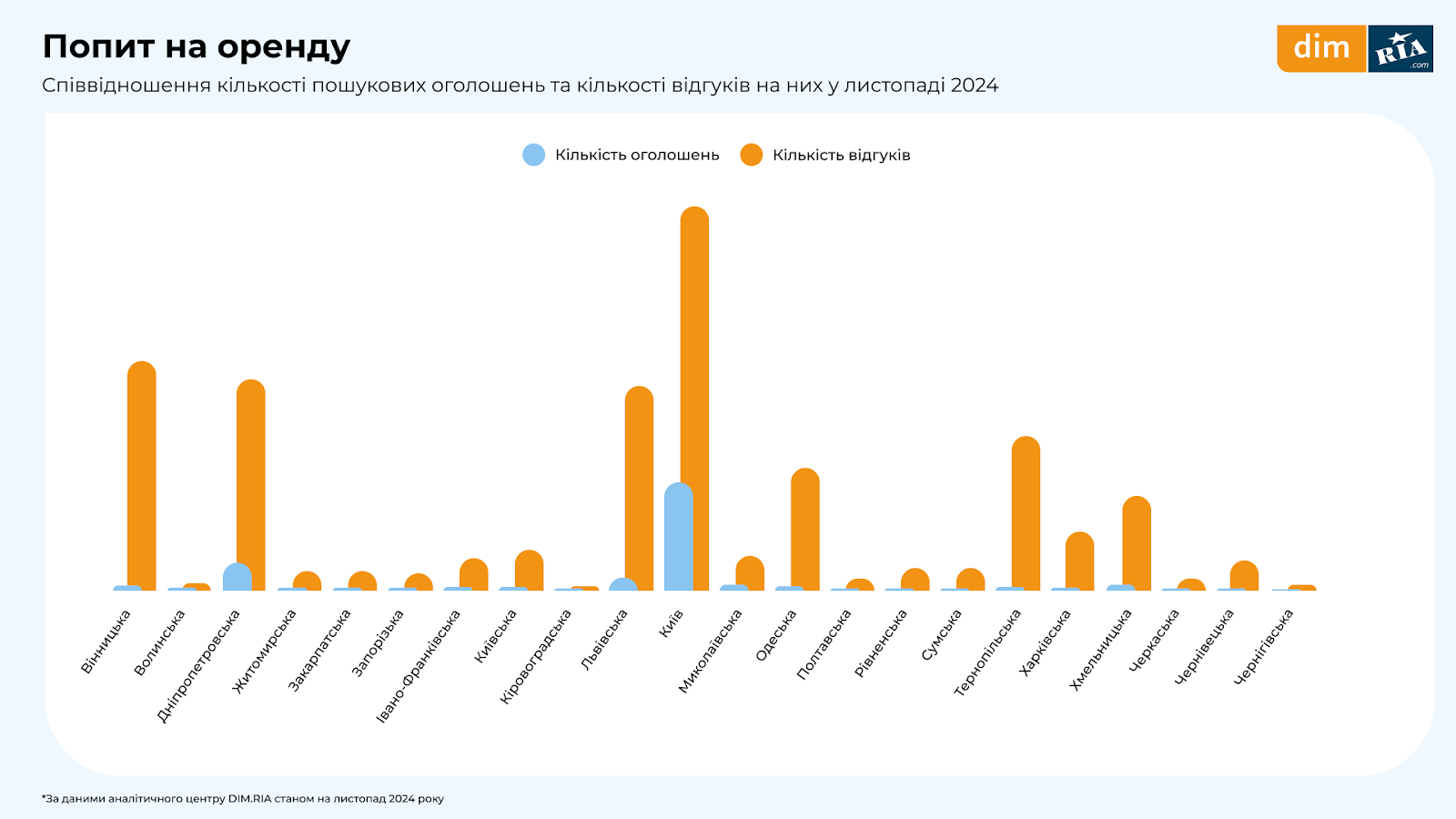

The number of user reviews traditionally exceeds the number of ads posted. In the capital, demand is more than twice as active as supply.

The rental market

Supply.

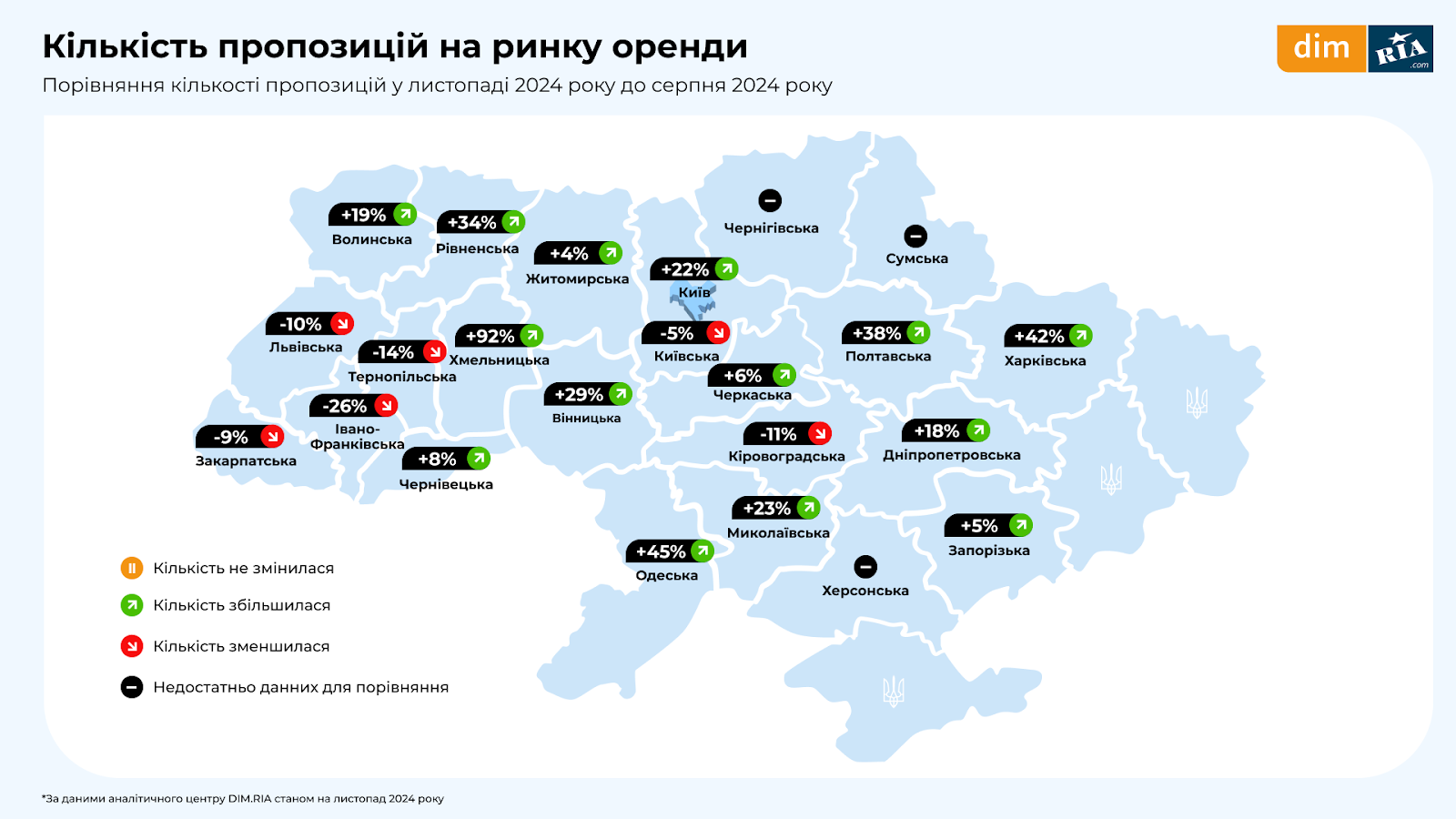

In the rental market, the number of housing offers for rent increased in most regions compared to August this year. The largest increase was recorded in Khmelnytsky, Odesa and Kharkiv regions.

Price

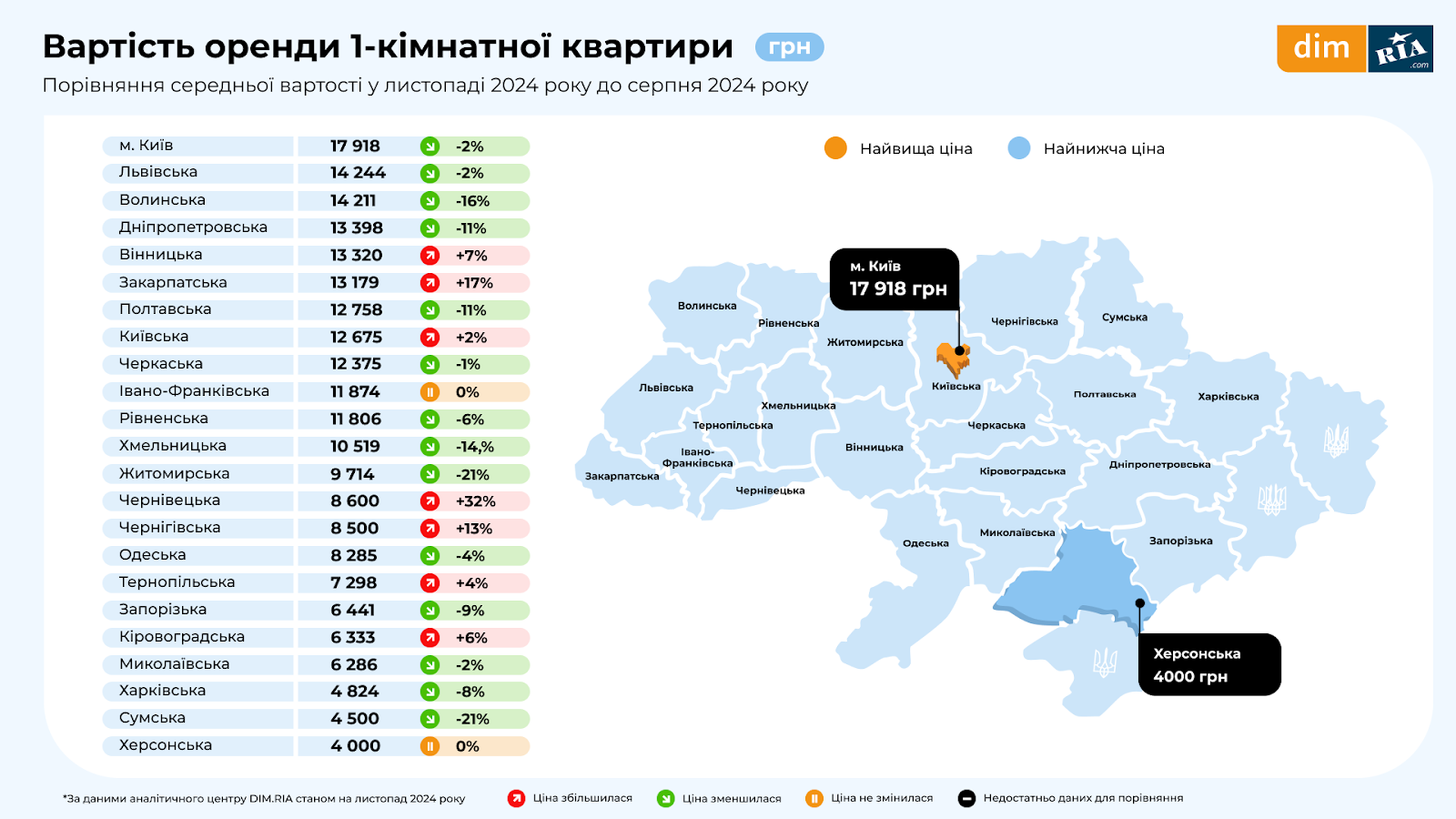

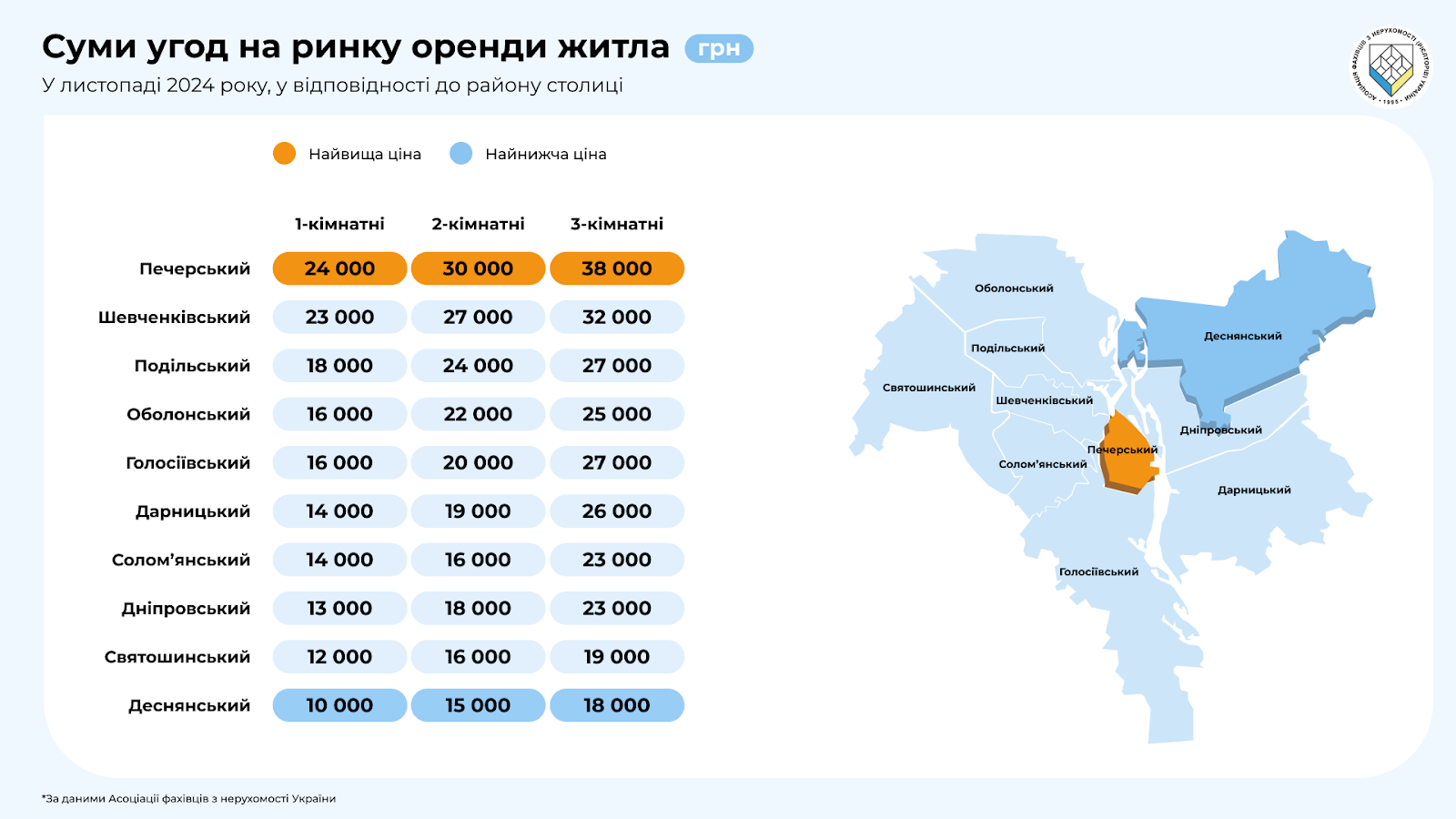

The most expensive location for renting an apartment remains Kyiv with an average price tag of UAH 17,918 for a one-bedroom apartment. During the fall, the average cost of a one-bedroom apartment in the capital decreased by almost UAH 300. The highest price increases were recorded in Chernivtsi (+32%) and Zakarpattia (+17%) regions.

Property owners in the capital can choose an apartment for different budgets depending on the district: from UAH 11.7 thousand in Desnianskyi district to UAH 22.3 thousand in Shevchenkivskyi district.

According to analytical data from the Association of Real Estate Professionals of Ukraine, in some districts, transactions are ultimately concluded for lower amounts. Thus, in November, the average price for a one-bedroom apartment in Desnianskyi district was UAH 10 thousand, in Sviatoshynskyi district – UAH 12 thousand, and in Dniprovskyi district – UAH 13 thousand.

Interest

The number of responses to rental offers in September-November in Kyiv was many times higher than the number of offers posted by owners on the marketplace. A similar situation continued to be observed in other regions of Ukraine.

The Ukrainian company Sich Ukraine, together with the American Compression Works Inc. starts supplying multifunctional abdominal turnstiles under the SICH AAJT trademark.

“I want to announce the news that I have been waiting for for a long time. It took a lot of time and effort, but believe me, it was worth it. I present to you our new product – the SICH AAJT-S abdominal turnstile,” said the company’s founder Alexander Gadomsky at an event on the occasion of the company’s 10th anniversary in Kyiv on Tuesday.

It is noted that this tourniquet can be used in the event of trauma to control nodal bleeding of the upper and lower torso, to stop pelvic bleeding, and to control bleeding of the torso that is not compressed, in particular after fragmentation injuries.

Gadomsky told Interfax-Ukraine that this cooperation with the American manufacturer will involve the supply of the AAJT tourniquet to Ukraine under the SICH trademark.

“Today, there are only two manufacturers in the world that produce node turnstiles: two American manufacturers. Neither of them has been officially represented in Ukraine. And this is a problem because everything was imported “in the gray,” and the Armed Forces or units could not buy it officially,” he said.

Gadomsky added that the company has passed all the certifications and registered the product in Ukraine, which will make the turnstile more affordable.

As reported, Sich Ukraine is a manufacturer of SICH-Tourniquet tourniquets founded in 2014. Today, the company is an official supplier of the Ministry of Defense of Ukraine, the National Guard and the National Police. In 2023, SICH-Ukraine produced and delivered more than 500,000 tourniquets to military units as part of the official IFAK kits of the Ministry of Defense and in separate batches for the needs of the military. According to the company, over ten years of operation, it has donated more than 100,000 SiCh-Bandage hemostatic bandages and 30,000 SICH-Tourniquets.

Dynamics of export of goods in January-August 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua