Ukraine’s economy in 2025 will grow by 4.9% with a slight decrease in inflation rate compared to this year to 8%, such macro forecast of Raiffeisen Bank (Kiev) was shared by the head of its board of directors Alexander Pisaruk.

“As for the dollar exchange rate, we expect devaluation of about 8% in 2025, and the exchange rate itself will be 45.5 UAH/$1 at the end of 2025. The baseline scenario is based on the hypothesis that security risks will improve from the second half of 2025,” he said in an interview with Interfax-Ukraine.

Pisaruk noted that the bank always does stress tests taking into account not only the baseline scenario, but also the best and worst case scenarios.

“But we do not have two fundamentally different development scenarios. All preliminary forecasts on the end of the war did not come true. The head of the NBU said this at the meeting of the European Business Association, and I am ready to sign these words that let’s stop predicting and making mistakes, and let’s just work,” – said at the same time the head of Raiffeisen.

According to him, even if the ceasefire is at the end of the first quarter, it will not dramatically affect performance in 2025.

“It could have an impact on 2026. So even such important things affect with a certain lag. 2025 will be influenced by the current dynamics of inflation growth and the need to curb it,” Pisaruk said.

He added that he would not be surprised if the National Bank has to raise the discount rate as a result of faster-than-expected acceleration of inflation.

“Regarding deposit and lending rates in hryvnia, we do not expect them to deviate significantly from current levels,” the banker pointed out.

He reminded that this process began back in July, and the main factor is the dynamics of the NBU discount rate, which is very likely to be stable until mid-summer 2025.

“But the rates on deposits in US dollars and euros may slightly decrease in response to the relevant decisions of the Fed and the ECB, although they remain quite low in Ukraine now,” – suggested the head of Raiffeisen Bank.

Commenting on the impact of the situation on the front on the mood of the population and business, he stated that this is reflected in the foreign exchange market.

“We observe a significant increase in demand for cash currency, although the supply also remains high. This leads to an increase in interventions by the National Bank, which, fortunately, has reserves for this purpose, formed at the expense of international currency aid,” Pisaruk said.

According to him, the situation now seems quite manageable, as the external aid next year looks sufficient to finance the budget deficit and replenish the NBU’s foreign exchange reserves. The CEO also said that Raiffeisen Bank remains the main supplier of cash currency to Ukraine.

“And who is number two, I don’t even know, because the gap is huge. This is a complicated business – you need to know the counterparties, provide logistics. We know how to do it and have been doing it for decades”, – he noted.

As reported, the GDP of Ukraine, according to the State Statistics Committee, in 2023 grew by 5.3% after a decline of 28.8% in 2022. The National Bank of Ukraine in late October raised the forecast of economic growth for 2024 from 3.7% to 4%, and for 2025 – from 4.1% to 4.3%. At the same time, the NBU in late October worsened the inflation forecast for 2024 from 8.5% to 9.7% and worsened it for 2025 from 6.6% to 6.9% after it fell to 5.1% in 2023 after jumping to 26.6% in 2022. The National Bank of Ukraine (NBU) on November 27 lowered the official hryvnia exchange rate to 41.6010 UAH/$1, the lowest value in its history. In general, since the beginning of 2024, the dollar at the official rate has appreciated by 9.5%, or by UAH 3.59, and since the transition of the National Bank on October 3, 2023 to the regime of managed flexibility – by 13.8%, or by UAH 5.03.

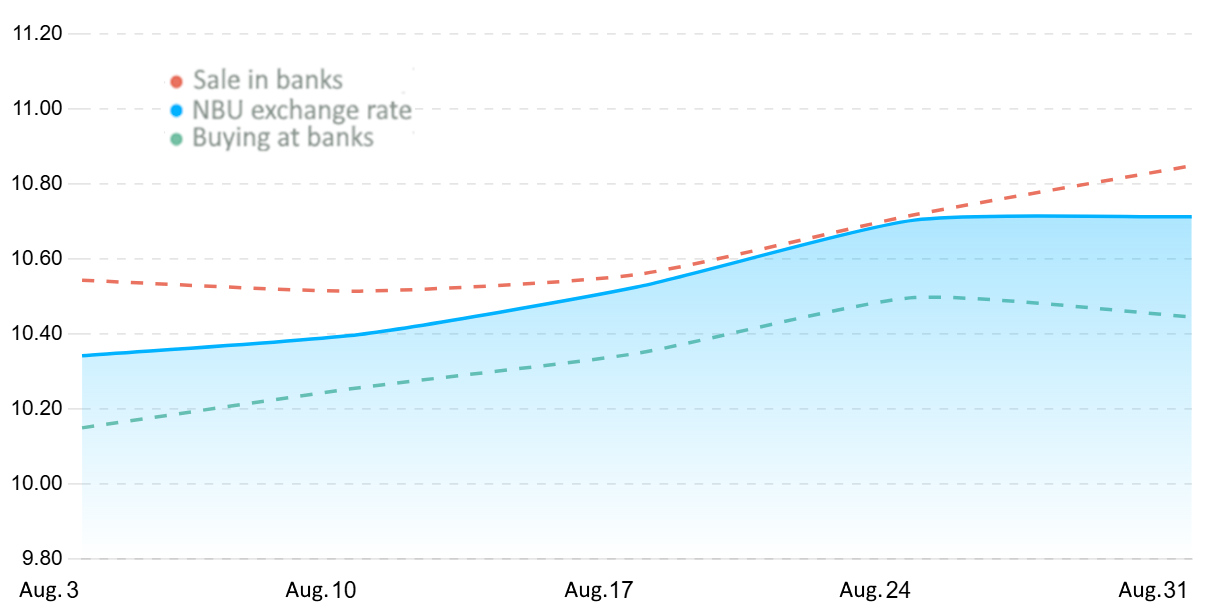

Quotes of interbank currency market of Ukraine (UAH for 1 PLN, in 01.07.2024-30.07.2024)

Open4Business.com.ua

Ukraine’s state budget has received $235 million in concessional financing from the Government of Japan under the World Bank’s new systemic projects, the Resilient, Inclusive and Environmentally Balanced Enterprise (RISE) and the Increasing Access to and Resilience of Education in Crisis-affected Ukraine (LEARN).

As the Ministry of Finance reported in a press release on Wednesday, the RISE program received a $130 million loan that will be used to address critical issues that hinder the growth and sustainable development of the private sector.

The Ministry clarified that the $105 million in Japanese funds received under the LEARN project is the result of the Ukrainian government’s implementation of measures to ensure safe face-to-face learning in schools by providing subventions for shelters and school buses in 2024.

The projects are implemented using the Program-for-results (PforR) financial instrument, when funds are allocated after Ukraine has achieved some of the results.

The Ministry of Finance noted that by the end of 2024, Ukraine expects to raise another $120 million and $95 million under RISE and LEARN, respectively.

The development company Alterra Group, which is currently implementing the Formatsiya.Lviv industrial park project, intends to build a network of seven such parks, said Olena Podolska, head of the company’s international business unit.

“Lviv will be our first park, then we will go to Rivne, two will be in Kyiv, and then we will return to the western region – Ivano-Frankivsk, Vinnytsia, and Khmelnytsky,” she said during the Ukrainian Automotive and Mobility Forum 2024 in Lviv, organized by the Ukrainian Automotive and Mobility Cluster with the support of the USAID Competitive Economy of Ukraine Program.

Podolska noted that there are already several local manufacturers who plan to open 10,000 square meters of production facilities in the Formation.Lviv IP, including the USP sandwich panel manufacturer.

In addition, during the forum, the CEO and owner of Lois Motors LLC, which is implementing a project to create a light electric vehicle LUAZ and plans to scale it up, announced his interest in locating his production in the park.

“I plan to scale up the project and cooperate with the Formatsiya.Lviv industrial park to open either a car production facility for people with disabilities or the next stage of our production,” he said during the forum.

Alterra Group is building 150 square meters of production, warehouse and office space on 30 hectares of land in Formatsiya.Lviv (formerly Formatsiya.Syhnivka). It will include a prototyping laboratory, R&D center, business incubator, event space, offices, and showrooms.

According to the project presentation, the first phase of the park is scheduled to be commissioned in the first quarter of 2025.

Alterra Group LLC is a Ukrainian company specializing in the development and management of turnkey commercial real estate.

The company manages 35 facilities with a total area of 175 thousand square meters. These include warehouse and production complexes, business centers, shopping and entertainment centers.

The company’s completed commercial real estate projects in Ukraine include the PORT logistics center, PROSTIR business hub (both in Lviv), Palo Alto business center (Kyiv), and Joule and JAM warehouse complexes in Kyiv region.

Exports of IT services in 2024 will decline by 4-6% compared to 2023 and may amount to $6.3-6.4 billion, Lviv IT Cluster predicts.

“The decline in IT services exports that began in 2023 continues. Under the optimistic scenario, by the end of 2024, it will decrease by 4% compared to 2023. Under the pessimistic scenario, this figure will reach 6%. We should expect $6.3-6.4 billion. Thus, in 2024, the tech industry will not show growth for the second year in a row compared to last year,” follows a study by IT Research Ukraine conducted by the Lviv IT Cluster.

At the same time, despite the challenges of a full-scale war, the technology industry in Ukraine remains one of the key industries and provides significant foreign exchange earnings. The IT sector is the largest exporter of services in Ukraine, accounting for 38% of total exports of services. In total exports, IT ranks second after food exports, the study says.

According to the data, 2118 IT companies operate in Ukraine. Half of them are service companies, including 47% outsourcing and 3% outstaffing. Another 31% of companies are product companies. The rest have a mixed business model.

45.7% of the IT companies surveyed said they do not plan to open new representative offices in the short term, 17.1% plan to open in Ukraine, and 34.3% abroad. Most want to open a representative office in Poland. In addition, 6% of CEOs plan to close their office in Ukraine.

The number of specialists working in the IT industry in 2024 decreased by 1.6% to 302 thousand. Most of them, 238 thousand people, live and work in Ukraine. The number of Ukrainian specialists abroad also decreased to 62-64 thousand people against 65 thousand in 2023, the study says. The average age of a Ukrainian IT specialist is 31.5 years. The majority of respondents, 68%, do not have children.

The median income of IT professionals in Ukraine, according to IT Research Ukraine 2024, decreased by 1.7% compared to 2023 and amounts to $2590. At the same time, the majority of respondents reported that their expenses for rent, food, and other basic needs have increased.

Most 97% of IT companies donate and implement projects that bring Ukraine closer to victory. 67.6% of surveyed companies have mobilized specialists on their staff. IT companies support their employees serving in the Ukrainian Defense Forces by providing them with job security, fixed salaries, or partial compensation.

The shareholders of Credit Agricole Bank Ukraine decided to keep all profits generated in Ukraine inside the country, thus increasing the Tier 1 capital, said Vitaliy Kucher, Member of the Management Board and CFO of the bank.

“We have made a political decision, and all the income that the bank earns in Ukraine remains in Ukraine. That is, we do not postpone the distribution of dividends, we distribute them, we increase the Tier 1 capital,” he said at the Association of Ukrainian Banks conference ‘Financial Sector of Ukraine 2024: Results, Challenges, Forecasts’ in Kyiv on Wednesday.

“That is, the money stays here forever to support the economy, to build a sufficient buffer for the development of lending,” Kucher added.

According to him, in case of building an acceptable investment climate and predictable environment, conducting the right regulatory and state policy, “money will flow here (to Ukraine – IF-U).”

The CFO also noted that the group’s central management is actively involved in the subsidiary’s operations, in particular, unlike a number of other foreign banks, he personally visits Ukraine during a full-scale war.

Credit Agricole Bank (formerly Index Bank) was founded in 1993. Its sole shareholder is Credit Agricole S.A. (France). According to the National Bank of Ukraine, as of October 1, Credit Agricole Bank ranked 10th in terms of total assets (UAH 121.08 billion) among 62 banks operating in the country. The net profit of the financial institution for the first nine months of 2024 amounted to UAH 5.12 billion, and its equity as of October 1 amounted to UAH 14.15 billion.