Hong Kong’s Hang Seng index fell 0.6% by 8:10 qoq, while China’s Shanghai Composite rose 0.3%.

Among the leaders in the fall of quotations on the Hong Kong Stock Exchange are shares of real estate developers Country Garden Holdings Co. Ltd. (-4%) and China Resources Land Ltd. (-3.7%), manufacturer of sports goods Anta Sports Products Ltd. (-2.3%) and PC maker Lenovo Group Ltd. (-2.2%).

Shares of Chinese electric vehicle manufacturers are also actively declining, including NIO Inc. become cheaper by 2% and XPeng Inc. – by 4.1%. Companies reported an increase in deliveries of electric cars in August, but the pace of increase fell short of investors’ expectations, analysts at Citi said.

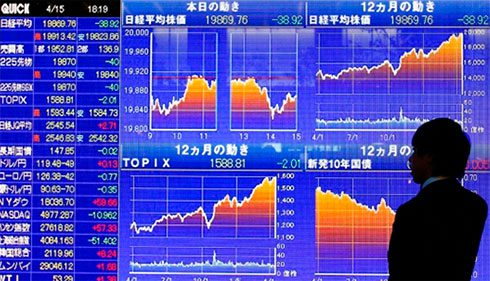

The value of the Japanese index Nikkei 225 to 8:20 q decreased by 0.02%.

Among the components of the indicator, shares of NEXON Co., a mobile game developer, are depreciating most actively. Ltd. (-3.6%), machine-building Mitsubishi Heavy Industries Ltd. (-2.4%) and oil Idemitsu Kosan Co. Ltd. (-2%).

Meanwhile, Japanese retailers Isetan Mitsukoshi Holdings Ltd. are the leaders of growth. (+2.7%), Seven & I Holdings Co. Ltd. (+2.5%) and J. Front Retailing Co. Ltd. (+2.4%).

The South Korean index Kospi rose by 0.3% by 8:25 a.m.

Shares of automaker Kia Corp. rise in price by 1.2%, one of the world’s largest manufacturers of chips and consumer electronics Samsung Electronics Co. cheaper by 0.9%.

Consumer prices in South Korea in August rose by 5.7% in annual terms, showed data from the statistical office of the country. Inflation slowed down from a 24-year high of 6.3% in July and came in below analysts’ forecast of 6.1%, according to Trading Economics.

The slowdown in the growth of consumer prices in the country was ensured by a slowdown in the rise in prices for food and energy resources, according to the report of the statistical office.

On a monthly basis, consumer prices fell 0.1% last month after rising 0.5% in July.

The Australian S&P/ASX 200 fell 0.1%.

The market value of the world’s largest mining companies BHP and Rio Tinto falls by 2% and 2.6% respectively.