In 2022, Ukrainian agricultural producers attracted 26,620 loans totaling UAH 47.74 million under the Affordable Loans 5–7–9 program, the website of the Ministry of Agrarian Policy and Food reported on Thursday.

The report clarifies that from mid-March to May 31, 2022, a special program was in place for preferential lending for sowing crops, under which farmers could raise up to UAH 60 million at 0% per annum, and 80% was guaranteed by the state. In total, during the period of its work, agricultural entrepreneurs received UAH 38.51 billion in loans. Since June 1, applications for lending to the agricultural sector have been accepted within the framework of the usual 5-7-9 program.

With its help, small and medium-sized agricultural entrepreneurs receive loans for the purchase of fixed assets and reimbursement of any expenses associated with the implementation of agricultural activities. The program is also aimed at creating jobs in enterprises.

In total, for the period June 1-July 21, Ukrainian banks allocated UAH 9.19 billion to 8.53 thousand agrarians and farmers, including UAH 443.8 thousand under the portfolio guarantee program.

The leaders in terms of lending for this period were Kyiv – UAH 1.540 billion, Khmelnytsky – UAH 1 billion, Kirovohrad – UAH 0.66 billion, Vinnitsa and Poltava – UAH 0.61 billion each.

The largest lending volumes for the specified period came from: Raiffeisen Bank – UAH 3.29 billion, Oschadbank – UAH 1.71 billion, PrivatBank – UAH 1.18 billion, Ukrgasbank – UAH 0.91 billion, Ukreximbank – UAH 0.61 billion.

“The government and the Ministry of Agrarian Policy are well aware of how important it is for farmers to receive preferential loans during the war. Therefore, we are working on launching new credit lines for farmers, and we also expect that in the near future the conditions for paying the body of the loan on preferential lending will be extended from 6 to 12 months,” the ministry quotes its first deputy minister, Taras Vysotsky.

On Tuesday, the government of Ukraine allocated an additional UAH 2.3 billion to the Affordable Loans 5-7-9 program, under which the Cabinet of Ministers compensates the interest rate, Prime Minister Denys Shmyhal said.

“We have also reformatted this program. Now every entrepreneur can get a loan at 0% in the amount of up to UAH 60 million. The state will pay the interest to the bank,” he said in his address on Tuesday evening.

Shmygal stressed that the restart and resumption of business is a necessary condition for the sustainability of the economy.

The prime minister also noted that the government is providing assistance to farmers, and the sowing campaign has already begun in all regions, except for Luhansk.

“We have provided them (agrarians) with concessional financing for UAH 3.5 billion. At today’s meeting of the government, they decided to simplify the registration of agricultural machinery as much as possible. We are doing this so that sowing work in the field does not stop anywhere,” Shmyhal said.

Earlier on Tuesday, the Ministry of Finance announced that within the framework of the program “Affordable loans 5-7-9” from February 21 to April 11, 1,391 loans were issued for a total of UAH 3.95 billion.

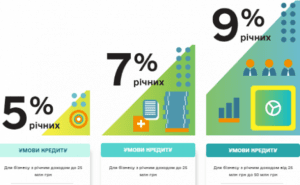

The Ministry of Finance of Ukraine pledges funds for the Affordable loans 5-7-9% program in the draft state budget for 2022, but sees the need to reformat it so that most of the loans are issued for investments in fixed assets, Minister of Finance Serhiy Marchenko said.

“It is important for us to reformat this program so that most of the loans go to investments in fixed assets,” he said in an exclusive interview with Interfax-Ukraine.

Marchenko said that the Ministry of Finance held a meeting with commercial foreign-invested banks with, where they talked about proposals to modernize the Affordable Loans program. “We asked to send proposals in writing. But in writing, this does not mean the need to disturb the market, like, everything is gone and the program is not working. This is one of the most effective programs,” the Minister of Finance said.

“But in the future, it is important to focus on investment goals,” Marchenko said.

Earlier, in June, the Forum for Leading International Financial Institutions (FLIFI), headed by the Board Chairman of Raiffeisen Bank, Oleksandr Pysaruk, sent a letter to the National Bank of Ukraine (NBU) and the Ministry of Finance with a request to limit the implementation of the Affordable loans 5-7-9% program.

The authorized banks issued 512 loans under the Affordable Loans 5-7-9% program for UAH 1.6 billion over the past week, and in general, from the start of the program, the number of loans exceeded 18,100 for a total of UAH 47.5 billion.

As reported on the website of the Ministry of Finance, out of 31 banks participating in the program, the leaders in issuing loans are PrivatBank (agreements for UAH 4.4 billion), Oschadbank (for UAH 4.9 billion) and Raiffeisen Bank Aval (UAH 8.95 billion).

Authorized banks over the past week issued 592 loans under the Affordable Loans 5-7-9% program for UAH 1.9 billion, and in general, from the start of the program, the number of loans exceeded 17,600 for a total of UAH 45.9 billion.

The Ministry of Economy reported on the website that UAH 1.3 billion of the total amount of contracts concluded last week are loans to replenish working capital at 0%, UAH 480 million are loans to refinance the previously issued loans, and the amount of investment loans totaled UAH 194 million.

The Ministry of Finance, in turn, noted that out of 31 banks participating in the program, the leaders in issuing loans are PrivatBank (5,800 agreements for UAH 4.2 billion), Oschadbank (almost 2,400 agreements for UAH 4.5 billion), and Raiffeisen Bank Aval (1,900 loans for UAH 8.7 billion).

More than 7,500 entrepreneurs throughout Ukraine have already used the Affordable Loans 5-7-9% program, and in 2021 it will continue and expand, Prime Minister Denys Shmyhal has said.

“As of now, more than 7,500 different businesses across the country have received more than UAH 17 billion. A mechanism of government portfolio guarantees for small and medium-sized entrepreneurs has been introduced, when the government provides up to 80% of the loan. Tax holidays for private entrepreneurs of the first group also continue. Until June, they are exempt from paying a unified social contribution,” the prime minister said on Thursday.