TAS Insurance Group (Kyiv) in 2021 concluded 2.518 million insurance contracts, of which 1.223 million were for compulsory types of insurance (up 8%), 1.295 million were voluntary (up 13%).

According to the website of the insurer, TAS signed 2.357 million contracts with insured individuals, which is 10% more than the corresponding figure for 2020. Some 12% more contracts were concluded with clients – legal entities – than a year before last, in total, 160,000 of them were issued.

According to the results of the reporting period, the first place in the company’s portfolio was traditionally occupied by OSAGO, under which 1.050 million policies were issued (up 6%), KASKO – 56,896 (up 17%).

The company reports that in 2021, comprehensive insurance contracts were in consistently high demand among consumers, so 346,496 Povny Avtozakhyst (Full Car Protection) contracts and 15,794 Povny Zhytlozakhyst (Full Housing Protection) contracts were concluded. In turn, 127,356 travel insurance policies were issued during the year.

In total, more than 1.217 million customers entrusted their insurance coverage to TAS Insurance Group last year.

As reported, in 2021, the volume of revenues of TAS reached UAH 2.45 billion. In particular, under OSAGO policies, the insurer collected UAH 857.49 million, while UAH 568.36 million under KASKO agreements, UAH 322.81 million of insurance premiums under Green Card policies.

TAS Insurance Group (Kyiv) in December 2021 paid UAH 102.86 million under insurance contracts, which is 8% more than the amount of compensation paid by the insurer in December of the year before last, according to the company’s website.

Thus, according to the policies of compulsory insurance of car owners’ civil liability, TAS reimbursed the victims UAH 39.13 million, which is 38.04% of the company’s total payments for the month.

The second place in the December portfolio of payments of the insurer with a share of 25.54% is occupied by KASKO with UAH 26.27 million.

Under Green Card policies, the company paid UAH 16.34 million, which is 15.89% of the company’s total payments for the month and is 25.9% higher than the corresponding figure for the reporting period of 2020.

The share of voluntary medical insurance in the insurer’s payout portfolio in December amounted to 15.5%, or UAH 15.94 million.

At the same time, under property insurance contracts, the company reimbursed UAH 2.42 million, which is 4.4 times more than the corresponding figure for December of the year before last.

Under other insurance contracts, TAS paid compensation in the amount of UAH 2.76 million for the 12th month of last year.

Turkey is continuing negotiations with Gazprom on the bulk of contracts for gas supply to the country through the Turk Stream pipeline, Turkish Deputy Energy and Natural Resources Minister Alparslan Bayraktar told reporters.

“We are in talks with Gazprom to increase gas supplies to Turkey because there is a free, uncontracted capacity of 9.75 billion cubic meters of gas in Turk Stream. The contracts expire this year, so there will be such spare capacity in Turk Stream in 2022. We’re talking about new contracts, renewal of some contracts, we are negotiating, I cannot say anything more at this stage,” he said.

He admitted that the situation with Russian gas supplies was complicated by the problem of private importer companies: “The real problem with private importers is arbitration – they offered a discount, then won the arbitration, so private importers suffered.”

“‘Gazprom needs to understand the needs of the domestic market, because today the price of gas is quite important, and it is not easy to increase the price of gas for the population, no one wants to pay more,” the Turkish official added.

“I think Gazprom wants to sell more gas to Turkey, Turkey needs gas, so it’s a ‘perfect alliance.’ Turkey is a growing market, gas consumption is growing, I think Gazprom has the capacity to supply gas to both Turkey and Europe, we have the infrastructure, enough gas pipelines, so I don’t see any problem,” Bayraktar said.

Gas consumption in Turkey is expected to rise to a record 60 billion cubic meters in 2021.

In 2015, Gazprom granted a discount of 10.25% to private Turkish importers, but a year later demanded its cancellation. Claims against Akfel Gaz, Bat Hatt, Kibar Enerji, Avrasya Gaz, and Enerco Enerji were filed with the Arbitration Institute of the Stockholm Chamber of Commerce and arbitration in accordance with UNCITRAL regulations. The arbitration bodies cancelled the discounts for private companies as of January 1, 2017. Failure or difficulty in enforcing the arbitration court ruling in Gazprom’s dispute with Turkish private importers is holding back Russian gas supplies to the country. As a result, some of the former private buyers may not participate in negotiations on new contracts and may be replaced by other importers.

Since the beginning of the 2000s, Turkey has embarked on a liberalization of the natural gas market, under which most of the contracts of state-owned Botas have been reassigned to private importers. However, after a failed coup attempt in 2016, Law N674, “On Measures Under the State of Emergency Regime,” was passed, and external management was imposed on these companies by the state Savings Deposit Insurance Fund (TMSF), which effectively meant nationalization.

Ukrainian state and private notaries in 2020 certified 217,810 contracts for the sale of land plots, which is 27.8% more than in 2019.

As reported on the website of the Ukrainian Agrarian Association, an increase in the number of contracts provoked the adoption on March 31, 2020 of a law on the conditions for the turnover of agricultural land, although this law will come into force only on July 1, 2021.

According to the association, in the fourth quarter of last year, almost 75,000 sale contracts were certified, while in the third – about 60,000, and in the second – about 45,000.

As the association said, a similar situation is with donation agreements, the total number of which in the past year, according to notaries, increased by 9.6%, to 55,980 and in the fourth quarter the number was close to 20,000.

The association said that in 2019 the number of contracts for the purchase and sale of land plots increased by 12.9%, and in 2018 – by only 1.2%, donation contracts – decreased by 1.1% (in 2018 it increased by 3.1%).

As reported, at the first stage of the law on the turnover of agricultural land – until December 31, 2023 – it will be allowed to sell land plots only to citizens of Ukraine in the amount of no more than 100 hectares per person, as well as exclusion for public needs and exchange of land plots with a difference of the normative monetary evaluation of no more than 10%.

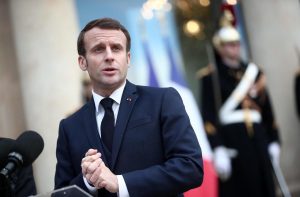

During the visit of French President Emmanuel Macron to Ukraine, several major contracts may be signed, in particular, an important contract with Alstom for the supply of electric locomotives, Ukrainian Ambassador to France Vadym Omelchenko has said.

“President Macron’s visit to Ukraine is, definitely, planned. We are working on this every day, first of all, on the substantial filling of the agenda of this visit,” Omelchenko said at the online conference titled “Seven years after the Maidan” on Monday. The ambassador believes several major contracts will be signed during the visit of the French President to Ukraine.

“This is, first of all, the major contract with Alstom and the Ukrainian government for the supply of electric locomotives, which also provides for local content in Ukraine. We also hope that we will have time to learn the issue of expanding cooperation with Alstom on the construction of high-speed railway tracks between Kyiv and Lviv, Kyiv and Odesa,” Omelchenko said.

It is also planned to sign contracts for the construction of drinking water stations.

“Such a station has already been constructed in Mariupol, it is tens of millions of euros, and we hope that such construction will also start in Kyiv and Luhansk,” the diplomat said.

Earlier, Head of Ukrzaliznytsia Volodymyr Zhmak said Ukrzaliznytsia has very outdated tracks and needs to be updated strategically. At this stage, according to him, Ukrzaliznytsya is interested in 50 two-system electric locomotives capable of transporting from 5,500 to 6,000 tonnes of cargo.

The number of Green Card international insurance contracts signed by the member companies of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU) increased by 21.72% in January-February 2020 compared to the same period in 2019, to more than 59,536.

According to the MTIBU’s website, the amount of accrued insurance premiums for the indicated period decreased by 10.93% compared to the same period last year, to UAH 271 million.

At the same time, the amount of compensation paid on claims increased by 2.1 times, to EUR 2.704 million, while the number of claims paid by 87.7%, to 1,115.

The MTIBU is the only association of insurers that carry out compulsory insurance of vehicle owners’ civil liability for harm caused to third parties.