Ukraine in May exported about 41,000 MWh, while importing half as much – about 20,000 MWh, according to published data on the website of the continental European network of system operators ENTSO-E.

Electric power was exported to Moldova, amounting to 23.3 thousand MWh and to Poland – 17.6 thousand MWh.

In the last week of May, after the announced shutdown of some units, there were no exports except for a few hours during certain days, and the transmission system operator, NEC Ukrenergo, did not auction any capacity for exports at the end of May, except for a few hours on certain days.

Imports came from Slovakia – about 18,000 MWh and from Moldova – about 2,000 MWh (the last few days of May data for Moldova are not displayed on the ENTSO-E website – ER). At the same time, it has increased considerably since May 20, almost six times compared to the first half of the month.

At the same time, exports decreased three times compared with the first two weeks of May.

At the same time in May, due to the growing demand for exports and restrictions on their implementation, traders for the first time began to pay for exports to Moldova and Poland (along the line KAES-Zheshuv) – UAH 1.8 million and UAH 0.5 million respectively. Also 1.3 million UAH were paid for the section for imports from Slovakia on certain days.

As reported, exports of electricity, which was resumed in April after it was stopped in October, amounted to 89.7 thousand MWh for the month. Most of the electricity was exported to Moldova – over 40 thou MWh, another 30.4 thou MWh went to Poland and 19.2 thou MWh to Slovakia.

However, exports to Slovakia lasted only four days, having been suspended since April 21 at the initiative of the Slovak transmission system operator.

The section to Slovakia for 4 days brought to Ukrenergo about 17 mln hryvnia. The NERC, Ukrenergo and the Ministry of Energy are resolving the issue of resuming exports to Slovakia.

Electricity imports in April amounted to about 4 thou MWh – 3.8 thou MWh from Slovakia (a third less than in March) and 0.1 MWh from Moldova (in March there were 1,541 MWh).

Ukrainian President Volodymyr Zelenskyy believes that there is “politics” in the decisions of a number of countries that have banned imports of Ukrainian grain.

“I am grateful to my neighbors who support us, but to be honest, there is politics there. We have the Black Sea blocked and we need help with weapons. We can’t risk relations with some countries,” he said Saturday in an interview with Italian media.

“And I understand that some political currents are taking advantage of this situation and instigating farmers to block grain shipments. But they have no right to block transit,” he said.

“We will solve these issues,” Zelensky stressed.

Ukraine in January-April this year reduced imports of aluminum ores and concentrate (bauxite) in physical terms by 99.98% compared to the same period last year – to 210 tons.

According to statistics released by the State Customs Service (SCS), during this period, imports of bauxite in monetary terms decreased by 99.64% – to $170 thousand.

Imports were mainly from China (100% of supplies in monetary terms).

During this period of this year, as well as in January-April 2022, Ukraine did not re-export bauxite.

As reported, Ukraine in 2022 decreased the import of aluminum ore and concentrate (bauxite) in volume terms by 81.5% compared to the previous year – up to 945.396 tons. Bauxite imports in monetary terms decreased by 79.6% to $48.166 million. Imports were mainly from Guinea (58.90% of supplies in monetary terms), Brazil (27.19%) and Ghana (7.48%).

Bauxite is an aluminum ore used as a raw material for the production of alumina, and from it, aluminum. They are also used as fluxes in steel industry.

Bauxite is imported into Ukraine by the Nikolaev Alumina Refinery (NGR), which before the war was affiliated with the United Company (UC) Russian Aluminum (RusAl, RF). Bauxite is used to produce alumina.

“RusAl in Ukraine also previously owned a stake in the Zaporozhye Aluminum Plant (ZALK), which stopped producing primary aluminum and alumina.

Ukraine in January-April this year decreased the export of coke and semi-coke in physical terms by 73.6% compared to the same period last year to 668 tons.

According to statistics released by the State Customs Service (SCS), Ukraine did not export coke in January-March this year, as it did in December last year. All exports for the four months of 2023 came in April. In monetary terms, it fell by 77.6%, to $170 thousand.

Ukraine imported 32,168 thousand tons of coke and semi-coke in January-April 2023, down 86.2% from the same period in 2022. In monetary terms, imports fell by 86.2% to $16.095 million.

Exports were to Moldova (100% of supplies in monetary terms) and imports were mainly from Poland (91.29%), Hungary (5.14%) and Colombia (3.56%).

As earlier reported, in 2022, Ukraine reduced the export of coke and semi-coke in volume terms by 98% compared with the previous year – up to 3.856 tons, in monetary terms by 97.6% – to $1.011 million. The main export was carried out in Hungary (42.63% of supplies in monetary terms), Georgia (37.69%) and Turkey (17.41%).

Ukraine imported 359.192 thousand tons of coke and semi-coke in 2022, down 54.5% compared to 2021. In monetary terms, imports decreased by 50.3% to $174.499 million. Imports were mainly from Russia (43.43% of supplies in monetary terms, before the war), Poland (30.07%) and the Czech Republic (13.15%).

Due to the war, a number of mines and coke plants are located in territories temporarily outside Ukrainian control.

Ukraine in January-April of this year reduced the import of nickel ores and concentrates in physical terms by 97.5% compared to the same period last year – up to 7.238 thousand tons.

According to statistics released by the State Customs Service (SCS), in monetary terms, imports of nickel ores decreased by 98% to $257,000 during the period.

Imports were from Guatemala (100% of shipments in monetary terms).

Ukraine did not export or re-export this product in January-April, both this year and last year.

As it was reported, in 2022, Ukraine reduced the imports of nickel ores and concentrates by 71.9% in physical terms compared to the previous year – up to 346.719 thousand tons. In monetary terms, imports of nickel ores decreased by 73.8% to $15.428 million. Imports were from Guatemala (100% of deliveries in monetary terms).

For 2022, like in 2021, Ukraine did not export or re-export this product.

Ukraine imports nickel ore from Pobuzhsky Ferronickel Plant (PFK, part of Solway Group).

PFC processes about 1.2 million tons of ore per year.

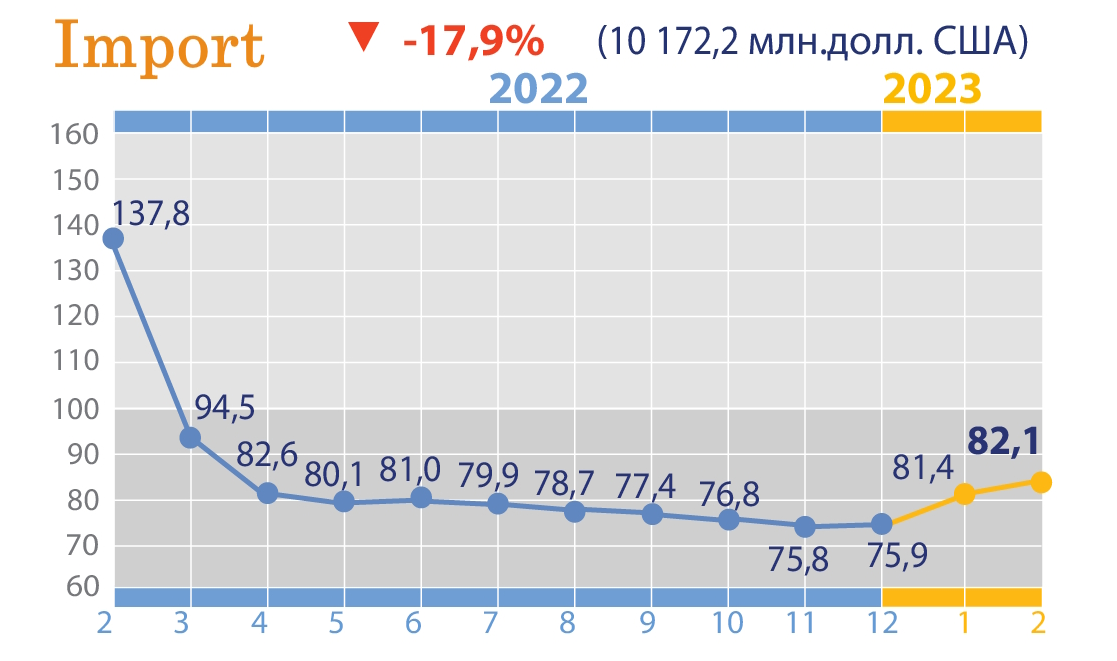

Import changes in % to previous period in 2021-2023

Source: Open4Business.com.ua and experts.news