This is 1.7 times more than in the same period in 2023

Ukrainian banks paid UAH 44.52 billion in income tax for 11 months of 2024, according to the National Bank of Ukraine. This is already 1.7 times more than in the same period in 2023. Of this amount, a record UAH 7.05 billion was paid in November 2024, after the tax rate was increased from 25% to 50%.

More than UAH 44.5 billion in income tax is due from 62 Ukrainian banks for the first half of 2024. This is already 1.7 times more than in the same period of 2023. Last year, the tax for banks was also increased in the last quarter.

Banks paid the largest amount of taxes for the year so far in November: UAH 7.05 billion. More than half of this amount – UAH 4.47 billion, or 63% – was paid by banks with foreign capital.

Overall, banks’ profit before taxes amounted to UAH 175.6 billion. This is a 12% increase compared to the same period in 2023.

11 banks suffered losses of UAH 388 million. Currently, 18% of Ukrainian banks are unprofitable.

https://opendatabot.ua/analytics/banks-2024-11

At the same time, banks’ profits increased by 22% Almost UAH 120 billion was earned by Ukrainian banks in 7 months of 2024, according to the NBU. Net profit after tax amounted to UAH 93 billion. Income tax is also growing along with earnings. Thus, this year, financial institutions have already paid 1.8 times more income tax than last year. Privat accounts for 40% of the profit of all banks, and the MTB has grown the most – by as much as 13 times.

Banks in Ukraine made a total of UAH 119.44 billion in profit. This is 22% more than in the same period last year: UAH 97.53 billion.

This year, the amount of income tax increased by 1.8 times to UAH 25.83 billion. Despite the tax increase, net profit is still 13% higher than last year: UAH 93.61 billion compared to UAH 83.18 billion last year.

Alpari Bank withdrew its license of its own free will in June, so there are now 62 banks operating in Ukraine. 8 of them suffered losses.

The top 10 banks in Ukraine currently account for 86% of the total profit: UAH 80.13 billion.

State-owned banks

State-owned banks account for 63% of the total profit of all banks. Privat is a stable leader: UAH 37.16 billion of profit after tax. This is 8% more than last year.

Privat accounts for 40% of the total profit of all banks in the country. The bank’s tax expenses increased 1.5 times and amounted to UAH 12.13 billion.

In total, 5 out of 6 state-owned banks earned a total profit of UAH 58.84 billion during this period, and tax expenses amounted to UAH 14.6 billion.

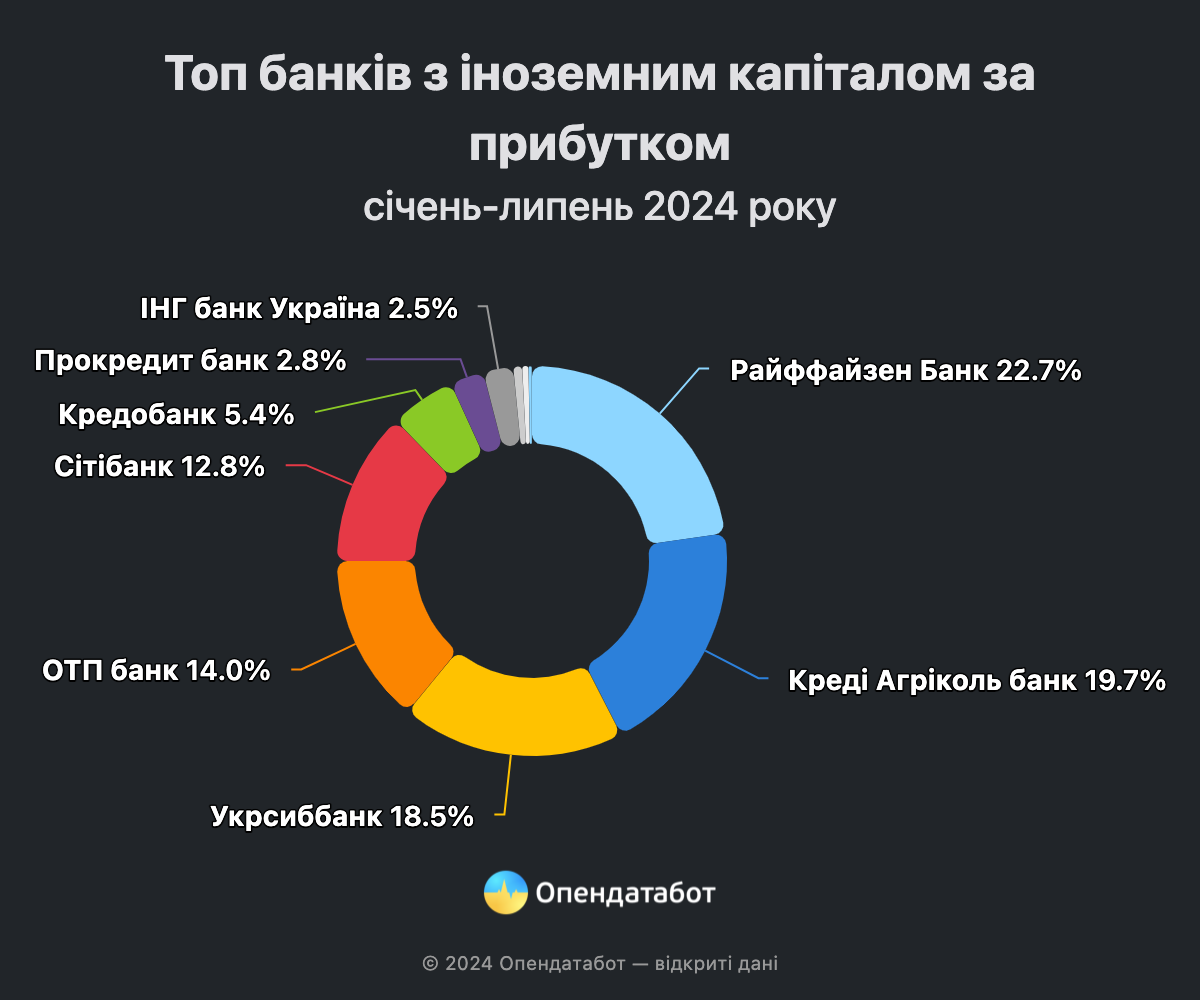

Banks with foreign capital

Banks with foreign capital earned UAH 21.5 billion. This is 9% more than in the same period last year. The profit tax of banks in this group increased 1.7 times this year and reached UAH 7.26 billion. They currently account for 23% of the total profit of all banks.

Raiffeisen Bank remained the leader of this group: UAH 4.87 billion. This is 28% more than in the same period last year. Raiffeisen Bank’s tax expenses doubled to UAH 1.63 billion.

Banks with private capital

The total profit of banks with private capital increased by 29% to UAH 13.39 billion. Accordingly, taxes doubled to UAH 3.95 billion. Currently, this group of banks accounts for 14% of the total profit.

FUIB is the leader of the group with UAH 4.24 billion. At the same time, MTB Bank showed the largest increase among all banks in the country: by 13 times, up to UAH 539.8 million.

As a reminder, the Verkhovna Rada is currently considering draft law No. 11416-d, which proposes to introduce a 50% income tax for banks in 2024.

The Association “Insurance Business” (ASB) opposes the increase of income tax, which is included in the draft law No. 11416 “On Amendments to the Tax Code of Ukraine and other laws of Ukraine on the peculiarities of taxation during martial law”. In the opinion of the ACB, which its representatives made public during the meeting of government and business representatives, the bill creates conditions for disproportionate pressure on bona fide businesses and employees. At the same time, the new type of turnover tax will complicate the already complicated administration of taxes and fees, creating new corruption risks.

In addition, the draft law lacks measures to combat the shadow economy and measures to improve the efficiency of the State Tax Service. Such factors will lead to discrimination of bona fide business and contribute to the growth of the shadow economy, the Association’s website says.

In addition, the developers of the bill do not take into account the negative consequences of its adoption, which will be in the reduction of business activity, which will lead to a decrease in the total taxable base, an increase in the risks of shadow economy and the introduction of various tax optimization schemes, which automatically raise the risks of corruption, according to the ASB.

Vyacheslav Chernyakhovsky, Director General of the Insurance Business Association, speaking at the meeting, noted that the insurance market already bears the burden of double taxation: 3% of gross insurance payments and 18% of income tax on a common basis.

“Our Association has conducted research on the basis of insurers’ reporting data for 2023, made public by the National Bank of Ukraine. We proved on figures that 3% tax on income means more than 35% on profit. This will have a particularly negative impact on those life insurance companies that are engaged in accumulative life insurance”, – warned Chernyakhovskyi.

According to him, if this is extrapolated to the economy as a whole, the introduction of an additional 1% tax on income in the form of a military levy corresponds to an increase of 12 percentage points in corporate income tax on the general taxation system, which would correspond to a general rate of over 30%.

Ukrainian business calls on the government and people’s deputies to take into account the proposals of the business community, to hold a professional discussion of alternatives to fill the budget and possible cuts in expenditures and to jointly work out a decision on the sources of budget revenues, the report says.

Revenues from income tax in August 2021 compared to August 2020 may double, the head of the parliamentary committee on finance, taxation and customs policy, Danylo Hetmantsev, has said.

“Some 214.5% (UAH 37.1 billion) more was charged this month in income tax compared to last year. In addition, according to forecasts, in August taxpayers will pay twice as much year-on-year income tax (UAH 35.3 billion),” he wrote on Telegram.

At the same time, he stressed that the increase in revenues is not associated with the payment of tax in advance.

“No payment of income tax in advance. No calls to taxpayers with requests to transfer money to the budget. Just de-shadowing,” he said.