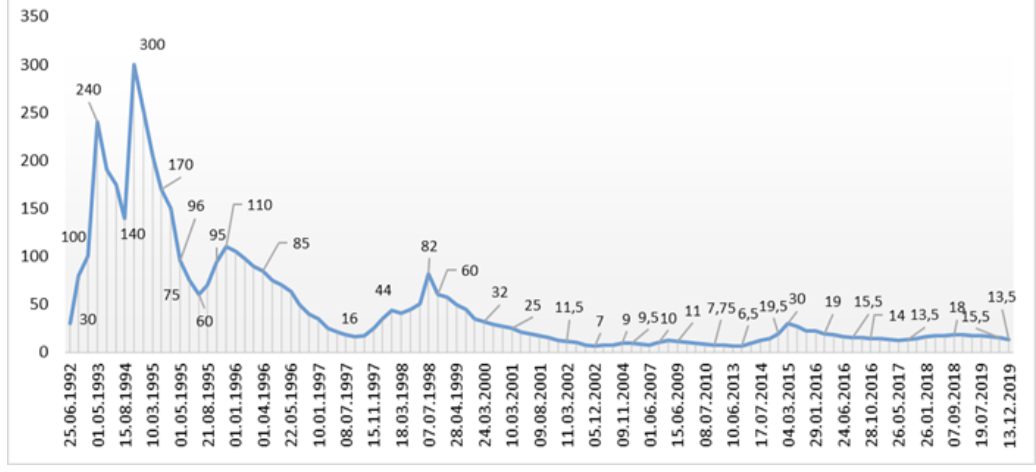

Dynamics of changes in discount rate of National bank of Ukraine

The National Bank of Ukraine (NBU) on December 20 introduced into circulation the upgraded 50-hryvnia bills, as well as 5-hryvnia coins that will gradually replace the respective banknotes, the NBU has reported on its website.

According to the report, first of all, the NBU intends to introduce 5 million of 50–hryvnia banknotes and 5-hryvnia coins. The first batch of means of payment had already been distributed to NBU regional offices.

The NBU has catered to the needs of the public, since customers will not be required to exchange the current 5- and 50-hryvnia bills for new coins and banknotes. No time limits will be imposed on the simultaneous use of new and previous banknotes in payments.

The 5- and 50-hryvnia banknotes of the previous design will be gradually replaced with coins and new banknotes as they wear out. The number of upgraded bills and coins will gradually increase in circulation, depending on the economy’s needs, the bank said.

The NBU said that the introduction of into circulation the upgraded 50-hryvnia bills and 5-hryvnia coins is a part of optimizing and upgrading the banknote and coin series of hryvnia.

Since 2014, the NBU has been upgrading the hryvnia and streamlining cash settlements. Optimization of the banknote and coin series of hryvnia is expected to be completed in 2020 after 200-hryvnia banknotes are introduced into circulation alongside 10-hryvnia coins. Due to comprehensive changes, eventually, the hryvnia series will be optimized to 12 denominations. The new denomination series will have six coins (10 and 50 kopiikas, and 1, 2, 5, and 10 hryvnias) and six banknote denominations (20, 50, 100, 200, 500, and 1,000 hryvnias).

The National Bank of Ukraine (NBU) on October 25, 2019 put into circulation the 1,000-hryvnia banknote, the NBU has reported on its website.

“From today, banks will be able to get it at the National Bank and give it out to their customers. This banknote is now a valid means of payment in Ukraine. It can be freely used to pay in a retail network or make a deposit with a bank,” the press service of the governor of the central bank said, citing Yakiv Smolii.

According to him, the key advantages of putting into circulation the new banknote with a face value of UAH 1,000 are an increase in the convenience of payments and a reduction in the cost of producing and processing banknotes. The 1,000-hryvnia banknote replaces in circulation some of the banknotes with a face value of UAH 100, 200 and 500. In addition, the appearance of the new banknote will simplify payments and savings.

As the central bank said, the last time the highest face value banknote – UAH 500 UAH was put into circulation 13 years ago. At the same time, Ukrainians’ incomes are rising, prices are changing, therefore, according to theoretical studies used to determine the optimal banknote number by the central banks of the world, to ensure normal money circulation in Ukraine, banknotes of a higher face value than UAH 500 are needed.

According to the press service, the new banknote combines advanced design and money security technologies.

“The 1,000-hryvnia banknote is the highest face value our national currency has today. It is therefore well protected. This banknote contains more than 20 modern security elements, including two modern optically variable elements. Everyone can independently verify its authenticity,” Smolii said.

So, turning the banknote in your hands, you can easily check its modern security element – the SPARK OVI element in the form of a crystal flower, which should gradually change color – from golden to jade green. Another innovative security feature is the “window” thread. This partially embedded in the paper purple polymer thread contains the digits representing the banknote’s face value and the trident – the small coat of arms of Ukraine. Tilting of the banknote brings out the kinematic effect, the background image moves in the opposite direction.

The front of the banknote features a portrait of Volodymyr Vernadskyi, an outstanding scientist, one of the founders and the first president of the Ukrainian Academy of Sciences, created in 1918. The building of the Presidium of the National Academy of Sciences of Ukraine is at the back of the banknote.

The 1,000-hryvnia banknote inherits the new modernized design of the upgraded 20, 100 and 500 hryvnia banknotes.

Electricity production by Ukraine’s power grids decreases by 1.4%

Electricity production by Ukraine’s integrated power grids in January-September 2019 decreased by 1.4%, or 1.631 billion kWh, compared to the same period in 2018, to 114.298 billion kWh, Ukraine’s Ministry of Energy and Environmental Protection told Interfax-Ukraine.

Nuclear power plants (NPPs) during this period reduced their electricity production by 0.5% year-over–year (y-o-y), to 60.562 billion kWh. In particular, electricity output by Zaporizhia NPP was 27.858 billion kWh (+0.8% versus January-September-2018), Yuzhnoukrainsk NPP generated 12.898 billion kWh (+9.2%), Rivne NPP 13.428 billion kWh (+18.9%), and Khmelnytsky NPP 6.38 billion kWh (-37.2%).

Thermal power plants (TPPs), as well as combined heat and power plants (CHPPs) and cogeneration plants increased production by 0.5%, to 42.172 billion kWh. TPPs alone increased output by 0.2%, to 34.651 billion kWh, CHPPs and cogeneration plants saw a 1.7% increase, to 7.52 billion kWh.

In January-September 2019, hydro and pump storage power plants reduced production by 38.3%, to 6.161 billion kWh, while isolated generating plants increased output by 17%, to 1.294 billion kWh.

Electricity production by wind farms, solar power plants, biomass plants more than doubled, to 4.109 billion kWh.

The NPPs accounted for 53% of total electricity output January through September 2019 (52.5% y-o-y), while the share of TPPs, CHPPs and cogeneration plants was 36.9% (36.2%) and that of the hydro and pump storage power plants was 5.4% (8.6%). The isolated generating plants accounted for 1.1% (1%), and the share of renewable energy was 3.6% (1.7%).

The National Bank of Ukraine (NBU) in the period from September 30 through October 4, 2019 first since the start of August entered the market to support the hryvnia, selling $200 million – almost the same amount as for the entire period since the beginning of 2019.

According to a posting on the website of the central bank, all these interventions were made at the single exchange rate (using the matching tool).

At the same time, the National Bank last week managed to acquire $42.5 million, as a result of which the net sale of foreign currency amounted to $157.5 million.

In general, since the beginning of 2019, the NBU has bought $4.199 billion at the interbank currency market, sold $448.2 million, in particular, it bought $930 million in September, $316 million in August, $1.271 billion in July, and $322 million in June, and sold only $ 17 million early August.

The National Bank of Ukraine (NBU) has agreed the rules and registered the domestic payment system Lime Money, the NBU said in a statement on its website.

According to the report, Lime Money’s payment company is Smart Finexpert LLC (Mykolaiv).

Lime Money payment system became the twelfth national payment system in the Ukrainian market, which is created by non-banking institutions.