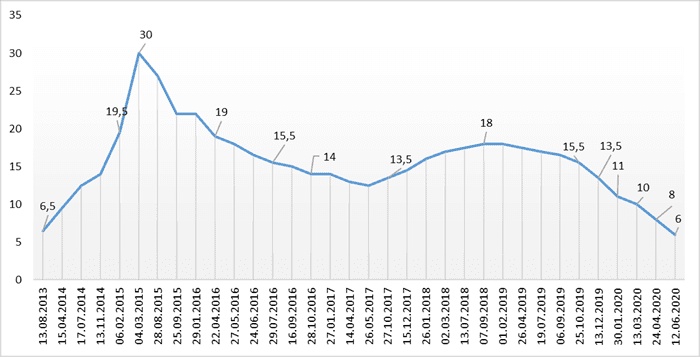

Dynamics of changes in discount rate of NBU.

NBU

The National Bank of Ukraine (NBU) has excluded from the State Register of Financial Institutions such companies as׃ Credit Institution Credit Commerce LLC, Financial Company Monopolium Finance LLC, Finance and Credit Group Chaika LLC on the basis of their applications.

As reported on the regulator’s website, the relevant decisions were made by the NBU Committee on Supervision and Regulation of Non-Bank Financial Services Markets at a meeting on December 11, 2020.

According to the NBU, Credit Commerce had one license to issue loans, financial loans as well. As of September 30, 2020, the volume of assets of this institution was UAH 10.7 million, or 0.006% of the total assets of financial companies.

Monopolium Finance had three licenses: for the provision of guarantees and sureties, loans, financial loans, as well as factoring services. The licenses were revoked at a committee meeting on November 20. The company’s assets amounted to UAH 403.9 million, or 0.2% of the total assets of financial companies.

Finance and Credit Group Chaika had one license for issuing loans, including financial ones. The license was revoked on July 30, the volume of assets is UAH 5.9 million, or 0.003% of the total assets of financial companies.

The National Bank of Ukraine (NBU) is oriented on the growth of the country’s international reserves in 2020 from $25.3 billion at the beginning of the year to more than $27 billion at the end of the year, Deputy Governor of the National Bank Yurii Heletii has said.

“The indicator of international reserves will be higher than at the beginning of the year. Let me remind you that at the beginning of the year it was $25.3 billion. Our target is more than $27 billion,” he said.

According to the banker, the final volume of international reserves will depend on placements by the Ministry of Finance.

He explained that in the October forecast of the NBU, which assumed that international reserves at the end of this year will amount to $29 billion, it was planned to receive financing from the IMF, the World Bank and the EU.

According to the official, the state of international reserves is satisfactory and, according to the composite criterion, which is calculated according to the EU methodology, exceeds 90%.

As reported, the European Commission, on behalf of the European Union, issued EUR 600 million to Ukraine as part of the macro-financial assistance program related to COVID-19.

The National Bank of Ukraine (NBU) sold $8.7 million in the interbank foreign exchange market from October 5 to October 9, which is 83.1% less than a week earlier ($51.1).

According to the data on the website of the central bank posted on Friday, October 9, during the specified period, the NBU only sold currency and conducted all interventions at a single rate.

According to the central bank, $500,000 was purchased at the best purchase and sale price, and $8.2 million at a single rate.

In general, since the beginning of the year, the regulator bought $4.509 billion into the reserves, sold $3.363 billion, including in March it spent $2.2 billion on supporting the hryvnia, $368.7 million in July, while the central bank’s net purchase in April was $678.80 million, in May it was $660.6 million, in June – $1.155 billion and in August – $460.5 million and in September – $34 million.

The independent and professionally governed National Bank of Ukraine (NBU) is critical for macro-financial support from the European Union and other international partners, Head of the EU Delegation to Ukraine Matti Maasikas has said.

“A strong, independent and professionally run NBU is critical to Ukraine’s financial stability, banking sector reform, investment, economic development to benefit Ukraine’s citizens, and macro-financial support from the EU and other international partners,” he wrote on Twitter on Thursday.

The National Bank of Ukraine (NBU) expects a grain harvest in 2020 at the level of 70 million tonnes instead of the projected 70-72 million tonnes, Deputy Governor of the NBU Dmytro Sologub has said.

“We predicted that Ukraine will harvest 70-72 million tonnes of grain. Given the rather significant revision of data on the harvest of early grains (wheat and barley) downward compared to the recent statistics, at the moment we expect about 70 million tonnes,” he said in an exclusive interview with the Interfax-Ukraine agency.