The Cabinet of Ministers intends to limit payments to members of supervisory councils and management of state-owned companies and state-owned banks to 15 minimum wages (MW) for the period of martial law, based on the size of the minimum wage set as of January 1, 2022 (15 MMW is equivalent to UAH 97.5 thousand), said the deputy head of the parliamentary committee on finance, tax and customs policy, Yaroslav Zheleznyak.

“The Cabinet of Ministers wants to limit payments to members of supervisory boards during the war. The corresponding draft decision was sent yesterday from the Ministry of Economy to the Cabinet of Ministers. It also concerns the management of state-owned companies,” Zheleznyak wrote on his Telegram channel on Tuesday.

Insurance companies of Ukraine in 2021 collected net premiums in the amount of UAH 45.987 billion, which is 14% more than in 2020 (UAH 40.350 billion), the National Bank of Ukraine reported on its website.

According to the regulator, the volume of gross insurance premiums collected by insurers last year amounted to UAH 49.708 billion, which is 10% more than a year earlier (UAH 45.185 billion). Of these, receipts from individuals amounted to UAH 27.912 billion, from reinsurers – UAH 1.890 billion (in 2020 – UAH 4.201 billion).

In addition, according to the regulator, in 2021, Ukrainian insurers paid UAH 17.671 billion of net insurance payments (+22.3% by 2020). The level of net payments increased to 38.4% from 35.8%.

According to the NBU, gross insurance payments increased by 20.9% to UAH 17.958 billion. The level of gross payments increased to 36.1% from 31.9%

According to the regulator, the volume of insurance payments owned by reinsurers in 2021 amounted to UAH 8.623 billion (+1.6%), of which non-resident reinsurers – UAH 4.9023.652 billion (+34.3%).

The regulator also reports that last year the volume of formed insurance reserves increased by 7.2% – up to UAH 36.566 billion. At the same time, with a decrease in the total assets of insurers by 1.1%, to UAH 64.209 billion, the volume of assets determined by law to represent insurance reserves increased by 2.3% compared to 2020, to UAH 47.159 billion. The volume of paid authorized capital decreased by 18.7% – to UAH 7.924 billion.

The regulator also reports that in 2021, 131.562 million contracts were concluded, while a year earlier, 120.586 million insurance contracts were concluded.

According to the NBU, the total number of insurance companies in Ukraine as of December 31, 2021 was 155, while on the same date a year earlier it was 208.

PZU Ukraine Insurance Company (Kyiv) collected UAH 300.729 million in gross premiums in January-March 2022, which is 12.71% less than in the same period of 2021, Standard-Rating RA reports. , updating the company’s credit/financial stability (reliability) rating on the national scale at the level of “uaААА” based on the results of the specified period.

According to him, income from individuals of the insurer remained almost at the same level (increased by only UAH 12 thousand to UAH 208.440 million), and from reinsurers decreased by 26.55%, to UAH 6.405 million. Thus, the share of individuals in the gross premiums of the insurer increased by 8.81 percentage points to 69.31%, while the share of reinsurers decreased to 2.13%.

Insurance payments sent to reinsurers for the first quarter of 2022 compared to the same period in 2021 decreased by 50.26%, to UAH 71.651 million. Thus, the coefficient of participation of reinsurance companies in insurance premiums decreased by 17.98 percentage points, to 23.83%.

The insurer’s net premiums increased by 14.28% to UAH 229.078 million, while earned insurance premiums increased by 34.89% to UAH 272.931 million.

During the reporting period, the company paid out UAH 183.737 million to its customers, which is 32.95% higher than the volume of insurance payments and indemnities made in the same period a year earlier. Thus, the level of payments increased from 40.12% to 61.1%, or by 20.98 percentage points.

According to the results of January-March of this year, IC “PZU Ukraine” received a net profit of UAH 25.352 million, which is 3.42 times higher than in the first quarter of last year.

As of March 31, 2022, the company’s assets decreased by 6.32%, to UAH 2.670 billion, equity increased by 0.49%, to UAH 829.536 million, liabilities decreased by 9.10%, to UAH 1.841 billion, cash and their equivalents increased by 154.96% to UAH 278.220 million.

Thus, as of the beginning of the second quarter of 2022, the company had a sufficient level of capitalization (45.06%), and 15.11% of its liabilities were covered by cash. At the same time, as of the reporting date, the company made financial investments in the amount of UAH 383.148 million, consisting of government bonds (73.01% of the investment portfolio) and deposits in banks with an investment grade credit rating (26.99% of the portfolio), which had a positive effect on its provision with liquid assets, the agency notes.

According to the report, IC PZU Ukraine has the support of one of the largest insurance groups in Central and Eastern Europe – PZU Group (which includes the parent company PZU PZU Ukraine – PZU S.A.).

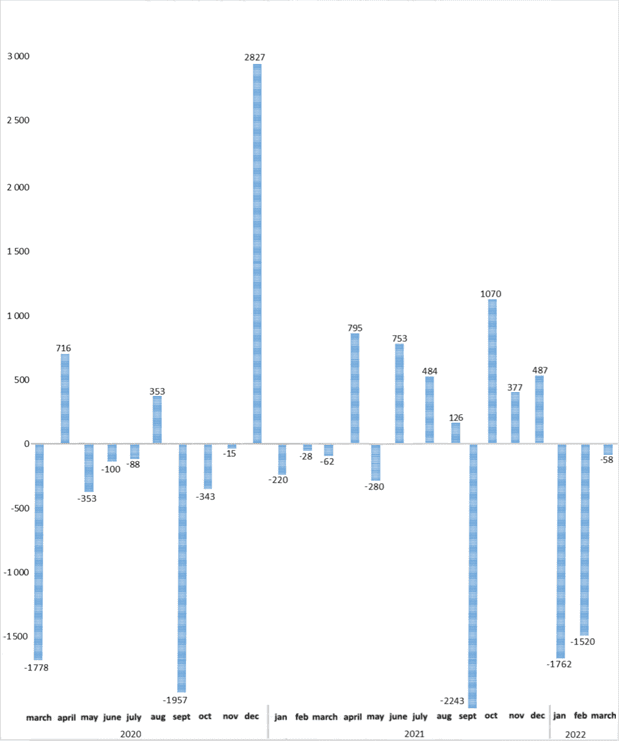

Dynamics of balance of payments of Ukraine (USD mln)

NBU

National Nuclear Generating Company Energoatom paid UAH 11.3 billion to the state budget in January-May 2022, which is twice the figure for the same period last year.

“Thanks to such indicators, Energoatom ranked third among all taxpayers in Ukraine and received special thanks for the financial support of Ukraine from the Central Interregional Department of the State Tax Service for Work with Large Taxpayers,” the company said on its Telegram channel on Monday.

As reported, Energoatom paid more than UAH 4.8 billion to the state budget in the first quarter of this year, which is a third or almost UAH 1.2 billion more than in the same period last year.

The surplus of Ukraine’s consolidated balance amounted to $783 million in April 2022, while in April 2021 the surplus amounted to $795 million, the National Bank of Ukraine (NBU) reported on its website.

According to its data, the current account surplus in April 2022 amounted to $1.1 billion, which is 23.4 times more than the surplus in April 2021 ($47 million).

The NBU also reported that exports and imports of goods for the month decreased by 51% and 45.7%, respectively.

The main factor behind the decline in exports to $2.4 billion was a 52.8% reduction in food exports, due to a decrease in grain exports (by 64.8%). There was also a decrease in exports of ferrous and non-ferrous metals – by 71.3%, chemical industry products – by 45.7%, wood and wood products – by 2.8%, mineral products (including ores) – by 41.9% and engineering products – by 35%.

The volume of imports of goods for the specified period decreased to $2.7 billion, including non-energy imports – by 51.1%. In particular, imports of industrial products fell by 18.2%, engineering products by 68.9%, food products by 41.4%, ferrous and non-ferrous metals by 72.4%, chemical industry products by 61.6%, and wood and wood products by 75.3%.

At the same time, energy imports decreased by 17.2%.

According to the National Bank, in April 2022 there was a $785 million trade in services deficit compared to a $347 million surplus in April 2021. The NBU explained this by the growth of refugees abroad, whose expenses exceeded those of April 2021 by 3.7 times. At the same time, the export of services fell by 41.9%.

The surplus in the balance of primary income in April 2022 amounted to $783 million (in April 2021, the deficit was $491 million). Receipts under remuneration decreased by 6.1%, and payments on income from investments by 81.2%.

Net lending of the outside world (the total balance of the current and capital account) in April this year amounted to $1.1 billion versus $48 million in April of the previous year.

The net outflow from the financial account was $1.9 billion (versus $747 million in April 2021), driven by outflows from private sector operations.

Net inflow from public sector operations amounted to $818 million (in April 2021, an outflow of $1 billion).

The NBU estimated the net inflow of foreign direct investment at $85 million, while in April of the previous year this figure was $626 million.

According to the regulator, the net increase in the external position of the country’s banking system in operations with portfolio and other investments amounted to $454 million. It was due to an increase in the external position in the currency and deposits item by $504 million.

The external position of the real sector (excluding foreign direct investment) in April 2022 increased by $2.5 billion. It was due to an increase in net external debt on trade loans by $1.5 billion, an increase in the volume of cash outside banks by $1 billion (again refugee account).

As of April 1, 2022, the volume of international reserves amounted to $26.9 billion, which provides import financing for 3.9 months.