Metinvest Group, taking into account associated companies and joint ventures, is expected to increase the payment of income tax by more than seven times in January-June 2021, year-over-year, to UAH 10.2 billion, a source in the tax authorities told Interfax-Ukraine.

In turn, Metinvest confirmed to the agency information about a significant increase in income tax payments in the first half of 2021.

“Enterprises of the Metinvest group will pay income tax in the first half of 2021, replenishing the national budget by UAH 10.2 billion (compared to the first half of 2020, the income tax paid was about UAH 1.4 billion). Thus, according to the results of the first half of the year, income tax payments increased by 7.4 times. This unprecedented increase in tax payments during coronavirus pandemic will help support the cities where Metinvest enterprises operate, pay salaries in full and on time communal and medical workers,” the company told the agency.

At the same time, the group said that Metinvest is one of the largest taxpayers in Ukraine. Thus, in 2020, the company increased its tax payments by 5%, to UAH 22.1 billion year-over-year. Earlier, the group said that over 15 years of its work, it transferred UAH 165 billion to the budgets of all levels.

Insurance Company MetLife (Kyiv) in 2020 made insurance payments in the amount of more than UAH 211.9 million, which is 27% more than a year earlier, according to a press release from the insurer.

At the same time, it is noted that the bulk of payments fell on situations related to the insurance protection of health of the company’s clients.

The company reports that in 2020, some 29 large payments were made, including 22 payments each in the amount of more than UAH 500,000, six payments in the amount of more than UAH 1 million and one payment in the amount of more than UAH 2 million. The number of insured events for which payments were made also increased by 14%.

In addition, during 2020, some 21,095 payments were made to the insured under life and health protection programs. Among the main reasons for payments in 2020, there were surgical interventions (6,028) and injuries (5,214) – they account for 53% of all appeals.

The company also reports that since the beginning of MetLife’s operations in Ukraine (2003-2020), the total payments to the company’s clients have exceeded UAH 857.845 million.

According to the industry rating Insurance TOP, during 2019-2020 MetLife is the constant leader in terms of the volume of insurance payments of all life insurance companies in Ukraine.

PrJSC MetLife was registered in 2002, it is a member of the international group of companies MetLife, Inc.

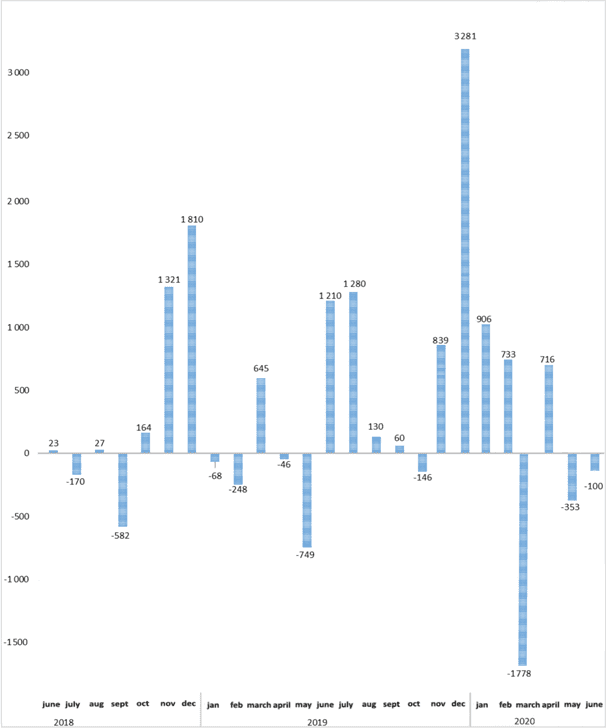

Dynamics of balance of payments of Гkraine (USD MLN).

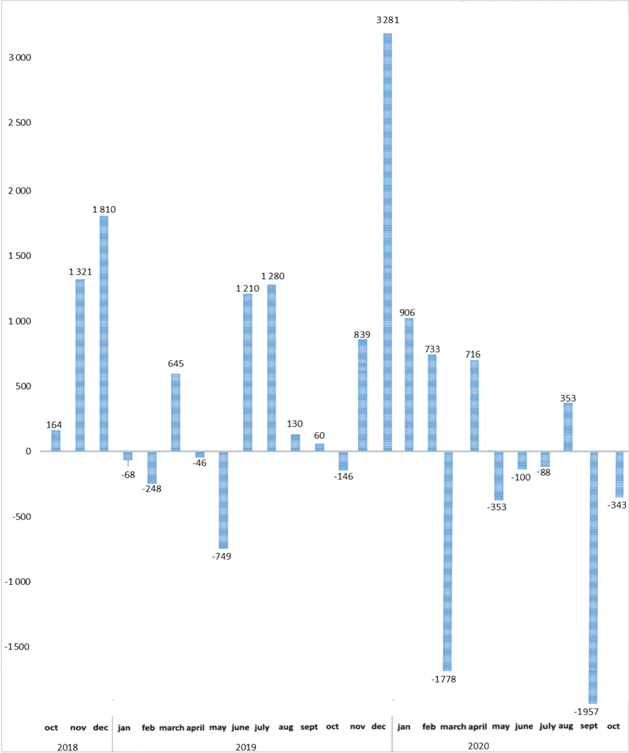

Dynamics of balance of payments of Ukraine (USD mln).

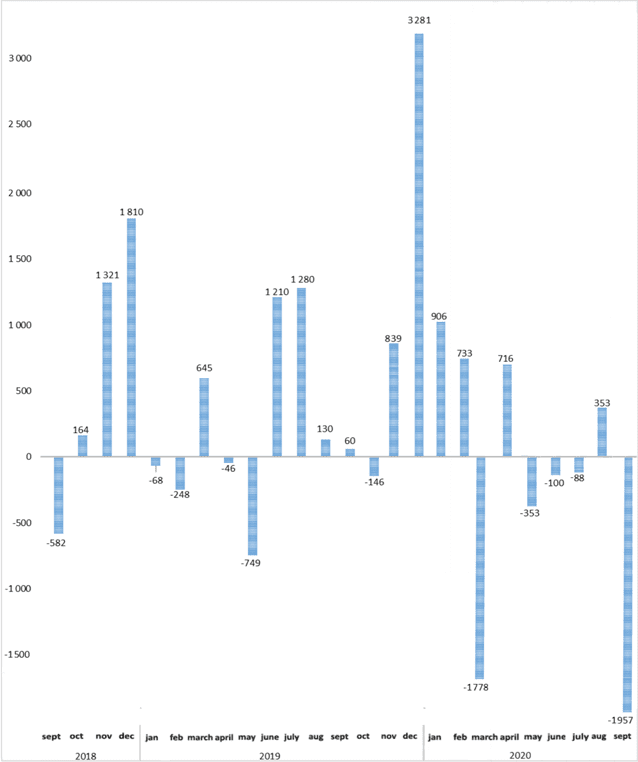

Dynamics of balance of payments of Ukraine (USD mln).

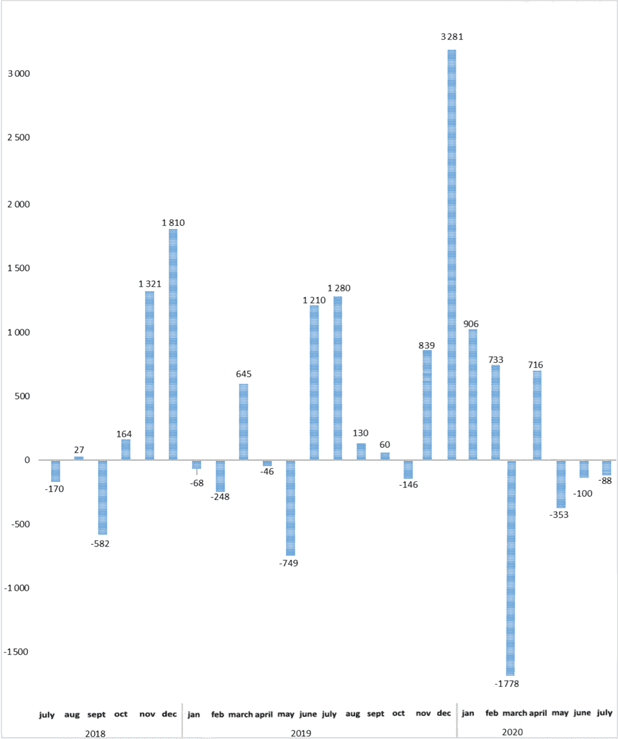

Dynamics of balance of payments of Ukraine (USD Mln)