In January-April 2024, TAS Insurance Group (Kyiv) paid UAH 628.6 million in insurance claims under the concluded insurance contracts, which is 57.2% more than the total amount of the company’s payments for the corresponding period last year, according to the insurer’s website.

In addition, it is noted that 27.58% or UAH 173.34 million of payments were made on hull insurance, which is 40.4% more than in the same period last year, for MTPL – by 35.07%, or UAH 220.46 million (+44.4%), Green Card – by 19.34%, or UAH 121.56 million (+75.7%).

VHI payments increased even more – in fact, by 2.3 times – to UAH 93.42 million, which is 14.86% of the total amount of payments made by the insurer in the reporting period.

TAS IG paid UAH 3.43 million under property insurance contracts and UAH 16.39 million under other insurance contracts.

TAS IG was registered in 1998. It is a universal company offering more than 80 types of insurance products in various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

Insurance group “TAS” (Kiev) for January-March 2024 paid out under the concluded insurance contracts indemnities in the amount of UAH 465,89 mln, which is 50,8% more than in the same period of the previous year.

According to the insurer’s website, more than a quarter of its payments (27,54% or UAH 128,31 mln) following the results of the first quarter fell on CASCO, which is 33% higher than the corresponding indicator for the same period of the last year, 35,46% or UAH 165,21 mln – on MTPL insurance (+ 40,1%), 18,91% or UAH 88,12 mln – on voluntary medical insurance (+62,6%)

At the same time, the company has paid UAH 2,8 mln of indemnities under property insurance contracts during the reporting period – by 38,3% more than in the first three months of the last year.

The volume of payments under other insurance contracts amounted to UAH 10.92 mln, which is 30.9% higher than in the same period of 2023.

SG “TAS” was registered in 1998. It is a universal company offering its clients more than 80 types of insurance products on various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

The number of “cash registers in a smartphone” is twice as high as traditional ones

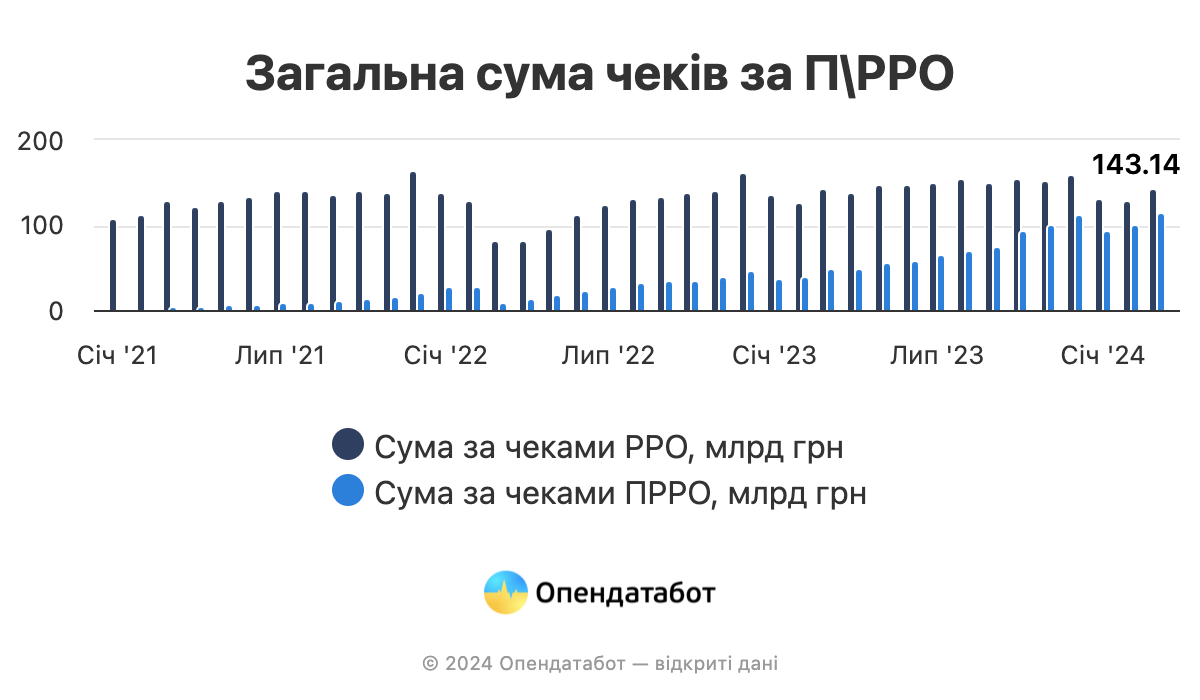

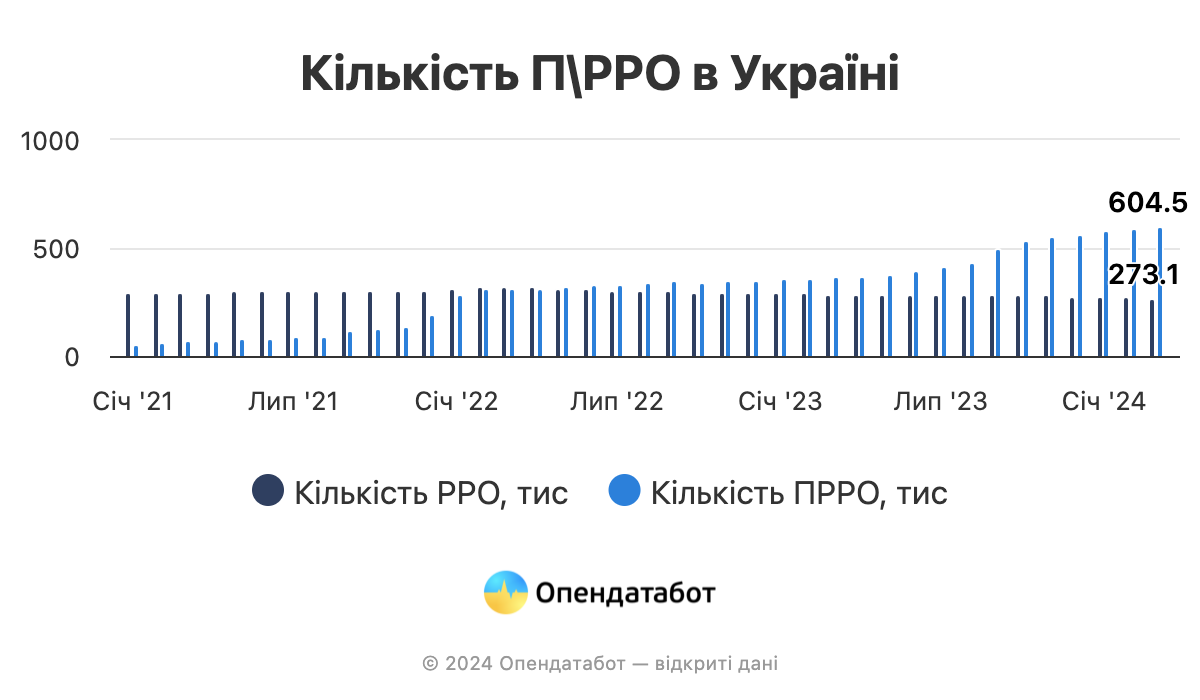

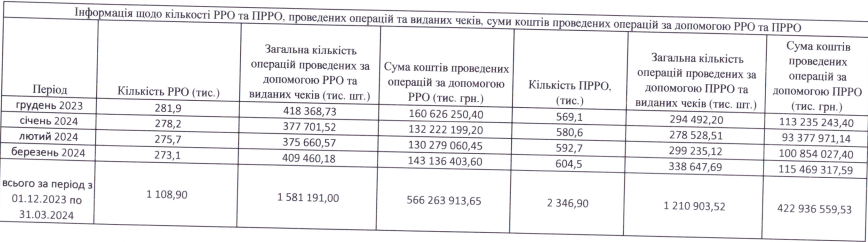

According to the Tax Service, 877.6 thousand cash registers are currently registered in Ukraine. Almost 70% of all registered financial accounting devices are PTRs, while the popularity of “traditional” cash registers is steadily declining. Back in 2021, the number of online cash registers was 8.5 times lower, indicating an increase in their popularity.

69% of the total number of cash registers, i.e. almost 605 thousand, are now PTRs. Their number increased 1.6 times over the year. Compared to the period before the full-scale invasion, in 2021, the number of “cash registers in smartphones” increased 8.5 times. It is worth noting that online cash registers appeared only in 2020.

At the same time, traditional cash registers have been losing popularity since March 2022. Over 2 years, their number has decreased by 15% – from 323.1 thousand to 273.1 thousand.

Accordingly, there are now 2.2 times more cash registers than cash registers. For comparison, at the beginning of April 2021, the situation was radically different – the number of cash registers was 4.2 times higher than online cash registers. So then, every hundredth check was from a cash register, and in 2024 – every second.

The average amount of cash register checks has also increased – 11 times in 3 years. If in 2021 it was UAH 9 billion, now it is UAH 103 billion.

In 2024, the total amount per month for PTRO checks averaged UAH 238.4 billion, almost half of which – 43% – was from online cash registers. For comparison, in 2021, this amount averaged UAH 142.8 billion, and the share of PTRs was only 6%.

“Businesses prefer cash registers for their convenience, easy installation, and lower price compared to fiscal machines. The fact that the Ministry of Finance is planning to limit the operation of cash registers – to ban the offline mode, to return paper accounting books and gluing receipts – in today’s situation looks like a shot in the foot. Instead of leaving Ukraine in the club of highly digitalized countries, they are trying to drag us back to the bureaucratic past, where doing business is expensive and difficult,” comments Rodion Yeroshek, CEO and co-founder of the Ukrainian restaurant automation company Poster.

Context.

As of October 1, 2023, the moratorium on inspections of the use of PTRs by entrepreneurs was lifted, and now it has become mandatory. If a tax audit of the documentation reveals that sole proprietors make a profit from the sale of goods unofficially, they will face a hefty fine. This condition partly explains the rapid growth in the popularity of using PTRs.

Currently, the Ministry of Finance of Ukraine plans to restrict the operation of “cash registers in a smartphone”.

https://opendatabot.ua/analytics/safe-prro

Insurance group “TAS” (Kiev) in March 2024 attracted UAH 291.27 mln of insurance premiums under the concluded insurance contracts, which is 68% higher than the volume of payments collected by the company for the same period last year.

According to the insurer’s website, the volume of CASCO sales increased by 46.1% to UAH 57.39 mln of payments, which is 19.7% of the total amount of March premiums, MTPL – by 42% to UAH 90.54 mln or 31.1% of the total volume, Green Card – by 2.4 times to UAH 112.5 mln or 38.6% of the total volume.

Besides, the volumes of collections under property insurance contracts have grown by 29,3% – the company has attracted UAH 4,94 mln of payments under them in March.

Under contracts of voluntary medical insurance the company for the first month of spring 2024 collected UAH 2.73 million of payments, under other insurance contracts – UAH 23.21 million, which is 48.9% more than in the past.

As reported, in March the company paid out UAH 157.08 million – it is by 38.6% more indemnities of the company compared to March a year earlier. At the same time, a quarter of payments of the insurer for the reporting period (25,39%) came to CASCO – UAH 39,88 mln (+23,1%), MTPL – 34,48% of the volume of payments – UAH 54,16 mln (+14%), “Green Card” – 23,04%, or UAH 36,19 mln (+86,2%).

At the same time, the volume of payments under VHI has grown in 2,47 times, up to UAH 22,83 mln, that is equal to 14,54% of the total amount of payments of the company following the results of the reporting period. Under other insurance contracts the company’s payouts following the results of March totaled UAH 4,02 mln.

IG “TAS” was registered in 1998. It is a universal company offering its clients more than 80 types of insurance products on various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

In January-March 2024, PZU Ukraine Insurance Company (Kyiv) collected UAH 481 million in insurance premiums, which is UAH 170 million or 54.66% more than in the first three months of 2023.

According to the insurer’s information, the largest increase in payments for the reporting period was recorded in the CASCO and Green Card segments – by 30% and 79%, respectively. In total, UAH 98 million of premiums, or 20% of the insurer’s total payments, were attracted under hull insurance contracts in the first quarter.

Under the Green Card and ROM policies, PZU Ukraine attracted UAH 109 million in premiums, which is 23% of the insurer’s total revenues.

The share of compulsory motor third party liability insurance (MTPL) in the company’s portfolio amounted to 28%, or UAH 135 million of premiums, which is 78% more than in the same period last year. The share of voluntary health insurance amounted to 16%, or UAH 79 million (+63%).

The company’s revenues from other insurance contracts in January-March amounted to UAH 60 million.

PZU Ukraine is a part of one of the largest insurance groups in Central and Eastern Europe – PZU Group (which includes the parent company of PZU Ukraine – PZU S.A.).

Metinvest Mining and Metallurgical Group, including its associates and joint ventures, increased its payments of taxes and duties to the budgets of all levels in Ukraine by 1.7 times year-on-year to UAH 4.2 billion in January-March this year.

According to the company’s press release on Monday, the largest deductions include subsoil use fees, which increased 7.5 times year-on-year to UAH 1.3 billion compared to Q1 2023. The Group also increased its personal income tax payments by 22% to UAH 791 million. In addition, Metinvest transferred UAH 870 million of unified social tax to the budget, which is 20% higher than in Q1 2023.

At the same time, Metinvest’s Ukrainian enterprises paid UAH 407 million in income tax in January-March 2024. Land payments increased by 8% year-on-year to UAH 312 million, and environmental tax by 34% to UAH 182 million.

Yuriy Ryzhenkov, CEO of Metinvest, noted that despite the war in Ukraine and many unfavorable business factors, the Group managed to achieve positive dynamics in payments.

“This is the result of our team’s efforts to improve efficiency in all areas and to adjust the company to the new environment. As the largest taxpayer in the industry, we realize that the economy of the frontline regions and the entire country, as well as the ability to support the army and Ukrainians, depend on our stable operation. And we will do everything to continue to overcome all the challenges of wartime on the way to victory,” the top manager emphasized.

As reported, in 2023, Metinvest paid UAH 14.6 billion in taxes to the Ukrainian budget.

“Metinvest is a vertically integrated group of steel and mining companies. The Group’s enterprises are mainly located in Donetsk, Luhansk, Zaporizhzhia and Dnipropetrovs’k regions.

The main shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage it.

Metinvest Holding LLC is the management company of Metinvest Group.