ALC Insurance Company ARX Life (ARX Life, Kyiv) has collected UAH 266.3 mln of insurance premiums in 2022, which is 17.02% less than a year earlier, according to Standard-Rating RA website updated credit rating/rating of financial stability (reliability) of the insurer at the level uaAAA on the national scale. Credit-Rating notes that decrease of gross business of the company has been caused by Russian aggression, introduction of martial law, fall of business activity level in the country and is the general tendency in the insurance market of Ukraine.

The volume of payouts and indemnities, performed by the insurer in 2022, has grown by 2,57% in comparison with 2021 – up to UAH 50,294 mln. Therefore, the level of payments of the insurer has grown by 3,61 p.p. – up to 18,89%.

Acquisition expenses of the insurer have decreased by 19,42% down to UAH 151,264 mln in 2022.

According to the results of work for the year “IC “ARKS Life” has received a net profit of UAH 21,594 mln that is by 2,24% more than in the same period of 2021.

As of January 1, 2023 assets of the company have increased by 17.61% up to UAH 232,882 mln, shareholders’ equity – by 22.01% up to UAH 119,692 mln, liabilities – by 13.30% up to UAH 113,19 mln, cash and cash equivalents – in 2.58 times, up to UAH 66,205 mln.

Thus, as of the beginning of 2023, the company had a high level of capitalization (105,74%) and high level of liabilities coverage by monetary assets and their equivalents (58,49%).

At the same time, RA notes that as of January 1, 2023, the insurer carried out financial investments in the amount of UAH 144,893 mln consisting of government bonds (96,55%) and deposits in banks (3,45%).

ARX Life, like ARX, is a part of the international insurance holding Fairfax Financial Holdings Ltd. ARX Life is among the top 10 companies in the life insurance market in Ukraine.

IC “Brokbusiness” (Kyiv) collected UAH 258.9 mln of gross premiums in 2022, which is 1.76% less than during the same period a year earlier, Expert-Rating said in its information about confirmation of insurer financial strength rating at the level uaAA+ on national scale.

According to the agency, the part of insurance premiums, which belongs to reinsurers, for the mentioned mentioned period decreased by 37,47%, and their share in the structure of gross premiums of the company decreased by 1,98 p.p. and made 3,46%.

The company carried out 63,967 mln UAH of insurance payments and indemnities in 2022, which is 29,42% less than in 2021, while the level of payments has reduced by 9,69 p.p. and has amounted to 24,71% following the results of 2022.

In 2022 the shareholders’ equity of the company has grown by 74.32% up to UAH 164,53 million, and its gross liabilities have reduced by 1,69% down to UAH 155,54 million. The Agency notes that an essential growth of the insurer’s shareholders’ equity in the analyzed period has occurred due to the increase in retained profit (by UAH 64,1 mln) in its structure, which has become possible due to the profitable activity of the company in 2022. In this regard, there was an increase in the level of shareholders’ equity coverage of the insurer’s liabilities on 46,12 p.p. – to 105,78 %. Consequently, at the beginning of 2023 shareholders’ equity exceeded the volume of the company’s liabilities by 5,78%.

The volume of cash and cash equivalents as of December, 31st, 2022 has grown in 1,55 times and has amounted to UAH 167,73 mln that has resulted in the increase of the level of liabilities coverage by cash means: by 39,33 p.p. up to – up to 107,84 %.

In the analyzed period the activity of PrJSC IC “Brokbusiness” has been characterized by a high efficiency. In particular, according to the results of 2022 the operating profit of the insurer has grown up to UAH 70,37 mln, and its net profit has increased up to UAH 66,98 mln, while following the results of 2021 the company has received net and operating losses.

IC Brokbusiness works in the Ukrainian insurance market for more than 25 years and is presented in all regions of Ukraine. The insurer has 39 licenses for voluntary and obligatory types of insurance.

TAS Insurance Group (Kyiv) paid UAH 73.95 mln in compensation under insurance contracts in November 2022, which is 31.1% less than during the same period a year earlier.

As it is stated on the web-site of the company, payments on CASCO contracts amounted to UAH 21,58 mln, which is 29,18% of total payments of the company per month, on MTPL – UAH 27,82 mln or 37,62% of total payments.

In turn, the share of “Green Card” in the payments portfolio of the company for the month was 16,24% or UAH 12,01 mln.

At the same time the indemnities of “TAS” Insurance Group based on voluntary medical insurance contracts in November amounted to UAH 9,45 mln, which is 12,78% of the total indemnities for the month.

Under other insurance contracts in the last month of autumn 2022 TAS IG has paid UAH 3,09 mln.

TAS IG was registered in 1998. It is a universal company, offering customers more than 80 types of insurance products for various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

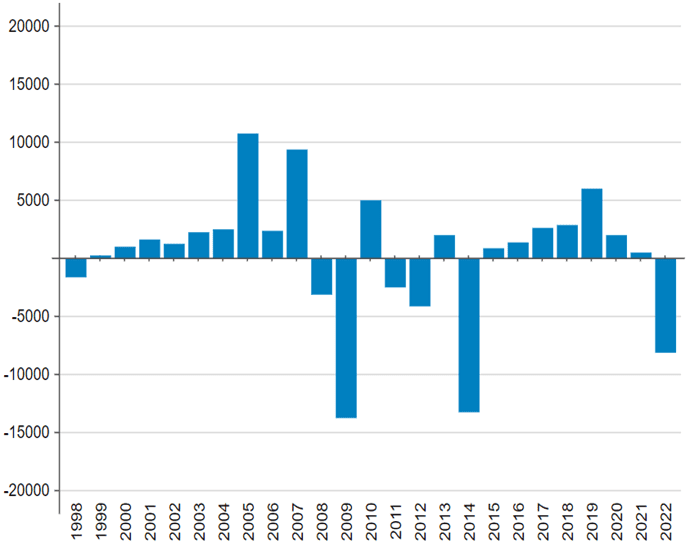

Dynamics of balance of payments of Ukraine in 1998-2022 (USD mln)

http://www.minfin.gov.ua

TAS Insurance Group (Kyiv) in January-October paid 738.9 mln. UAH of indemnities under the concluded insurance contracts, which is 20.8% less than the amount of payments made in 10 months.

Most of the payments with a share of 39.96% took CMTPL – 295.3 million UAH (-15.3%), CASCO with a share of 27.36% (202.17 million UAH, -32.5%), VMI with a share of 13.05% (96.4mln UAH, -30%) compared to January-October of last year.

The company paid out UAH 114,65 mln on policies “Green Card”, which amounts to 15,52% of the total indemnities of the insurer (-1,4%).

In turn, 7,4 mln UAH have been paid out for 10 months on property insurance contracts, and 22,95 mln UAH on other insurance contracts, which is 9,5% more than the corresponding figure for the same period last year.

TAS Insurance Group (Kyiv) in January-August 2022 paid UAH 589.22 million as compensation, which is 19.3% less than in the same period a year earlier (UAH 730.58 million), according to the company’s website.

At the same time, it is noted that 27.1% of the total insurer’s payments fall on KASKO (UAH 159.66 million), 40.19% – on OSAGO (UAH 236.81 million), 14.97% – on Green Card (UAH 88.21 million).

Voluntary medical insurance accounted for 13.34% of all payments, or UAH 8.61 million.

At the same time, under property insurance agreements, TAS paid UAH 5.42 million for the specified period, which is 5.6% more than a year ago.

The volumes of payments under other insurance contracts also increased by 20.9%: in January-August of this year, TAS paid a total of UAH 20.51 million on them.

TAS was registered in 1998. It is a universal company offering customers over 80 types of insurance products for various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.