In January-June this year, FUIB (Kyiv) received UAH 3.82 billion in net profit, which is 4% higher than in the same period of 2023 (UAH 3.68 billion), according to the bank’s quarterly report.

According to the report, the financial institution’s net profit for the second quarter of 2024 decreased by 20.8% compared to the comparable period of 2023 (UAH 2.13 billion) to UAH 1.69 billion.

According to the document, the bank’s net interest income for the first half of the year increased by 31.7% to UAH 7.12 billion, while net commission income increased by 15.1% to UAH 1.23 billion. In particular, these figures improved by 23.6% to UAH 3.56 billion and 43.2% to UAH 0.71 billion in April-June, respectively.

Since the beginning of 2024, the bank’s assets have increased by 6.3%, or by UAH 9.67 billion, and reached UAH 163 billion as of June 30, compared to UAH 125.7 billion at the end of the first half of 2023. This increase was primarily due to the growth of loans and advances to customers from UAH 52.06 billion to UAH 57 billion, in particular, by UAH 3.19 billion in the second quarter of 2024.

Since the beginning of the year, FUIB has increased cash on hand and in transit, as well as funds on the current account with the National Bank of Ukraine (NBU) by 29.6% and 41.2%, respectively, to UAH 3.74 billion and UAH 14.11 billion.

Funds under the item “other financial assets” increased 1.6 times to UAH 4.19 billion in the structure of total assets, which, in turn, was facilitated by more active purchases of foreign currency and an increase in bank card payments.

The volume of loans and advances to banks increased by 15.5% to UAH 4.87 billion, while investments in securities increased by 1.7% to UAH 59.16 billion.

Between January and June, the financial institution managed to increase its customer accounts from UAH 126.54 billion to UAH 132.93 billion, while the funds of banks increased from UAH 2.72 billion to UAH 3.33 billion.

In general, FUIB’s liabilities for this period increased from UAH 135.94 billion to UAH 141.22 billion.

It is noted that the bank’s capital increased by 25.3% over the six months of this year and reached UAH 21.78 billion, in particular, in the second quarter – by 11.3%, or UAH 2.22 billion. It is noted that retained earnings increased by 46.5% to UAH 11.41 billion during this time.

The remuneration of 10 members of the bank’s management board in terms of salary for the first half of 2024 increased by 12.1% compared to the same period of the previous year and amounted to UAH 75.6 million, while the remuneration of eight members of the supervisory board increased by 46.7% to UAH 16.6 million.

JSC First Ukrainian International Bank was founded on November 20, 1991 and started its operations in April 1992. As of March 31, 2024, the bank’s shareholders were SCM Finance (92.3%) and SCM Holdings Limited (7.7%, Cyprus) of Rinat Akhmetov.

According to the National Bank of Ukraine, as of June 1, 2024, FUIB ranked 6th (UAH 169.9 billion) among 63 banks in the country in terms of assets. The financial institution’s net profit for 2023 amounted to UAH 3.96 billion.

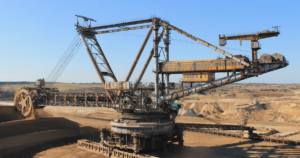

PrJSC United Mining and Chemical Company (UMCC), which manages Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), posted a net profit of UAH 61.6 million in January-June 2024.

According to Yegor Perelygin, interim chairman of the board of UMCC, on Facebook, EBITDA in this period amounted to UAH 139.8 million.

At the same time, sales of finished products in monetary terms increased by 39.1%. The Group sold nearly 70 thousand tons of main concentrates, which is 20 thousand tons more than in the same period last year. The Group paid UAH 211 million in taxes.

“We started the second half of the year very actively and energetically. I can say that, despite all the problems, Vilnohirsk Mining has a normal operating perspective until 2030. We have enough reserves for the economically viable operation of the plant,” said the CEO.

There are several options and scenarios for further developments after 2030, and UMCC is working on them, he added. He clarified that mining operations at Irshansky GOK were fully resumed in the second half of 2024, and two open pits are operating steadily. SOE also said that the nameplate capacity of Irshansk GOK is 2.5 million cubic meters of production.

“Having an understanding of our balance sheet reserves, we see at least 15 years of prospects at a capacity of 180-200 thousand tons per year (after all the reconstructions, this is the real passport capacity of ‘finishing’, i.e., final products). Also, don’t forget that we still have the Selyshchanska area and off-balance sheet resources,” explained the acting Chairman of the Board.

“I’ll be blunt: we have a good understanding of the future development of the entire Irshansk resource base within a time horizon of 27 years at Irshansk GOK (and even more!!!). We are calmly moving forward,” the CEO summarized.

As reported, in the first quarter of 2024, UMCC received UAH 30 million of net profit, while in the same period last year there was a loss.

UMCC started its actual operations in August 2014 after the property complexes of Vilnohirsk Mining and Metallurgical Plant and Irshansk Mining and Processing Plant were transferred to its management by the Cabinet of Ministers. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

Ukraine has scheduled the auction of a 100% stake in UMCC for October 9, 2024, via Prozorro.Sale. The starting sale price is UAH 3 billion 899.358 million.

TAS-Dniprovagonmash LLC (DVM, Kamianske, Dnipro region), a major Ukrainian railcar manufacturer controlled by businessman Sergiy Tigipko’s TAS Financial and Industrial Group, ended January-June 2024 with a net profit of UAH 18.85 million, three times less than in the same period in 2023.

According to the company’s interim reports, published on Tuesday in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its net income in the first half of the year increased by 37.8% to UAH 796.47 million.

The company reduced its gross profit by 3% to UAH 78.4 million, earning UAH 26.44 million in operating profit (2.2 times less).

As reported, in the first quarter of this year, TAS Dneprovagonmash reduced its net profit by 5.2 times compared to the same period in 2023, to UAH 7.17 million, with a 4.4% decrease in revenue to UAH 379.24 million.

Thus, in the second quarter of 2014, the company reduced its net profit by 44% year-on-year to UAH 11.68 million, while net revenue increased by 30.4% to UAH 417.22 million.

In April-June, the plant’s production capacity was utilized by 22%, and the equipment utilization rate was 26%,

The report notes that in the second quarter of 2024, the plant produced 140 freight cars (177 units in the first quarter), which accounted for 23% of the total Ukrainian production (28% in the first quarter). Its main competitors include Kryukiv Carriage Works, Karpaty Railcar Plant, and Ukrzaliznytsia plants.

The average selling price of a freight car is UAH 2.215 million. Key customers: “TAS Poltavagon, MTB Bank, TAS Logistic, and Tecom Leasing.

According to the company, exports for this period amounted to UAH 3.4 million (0.8% of sales in the second quarter).

As noted in the report, TAS Dneprovagonmash’s annual budget for 2024 provides for the supply of 26 units of products to the European market.

“In the second quarter of 2024, the freight base of railway logistics in Ukraine showed an upward trend – +2%, or +0.9 million tons, compared to the first quarter of 2024 and +27.3%, or +9.8 million tons, compared to the same period in 2023. This, in turn, contributed to an increase in demand for newly built freight cars,” the statement said.

At the same time, the company continues to note the presence of factors restraining the dynamics of car building, in particular massive shelling, the abolition of restrictions on the maximum service life of cars in 2021, and an increase in the rolling stock turnover due to the lack of traction rolling stock at Ukrzaliznytsia.

“However, in general, in the second quarter, the production of freight rolling stock by Ukrainian enterprises tended to grow. The work of the Ukrainian Corridor (transport – IF-U), namely the Black Sea routes, remains a key factor in the growth of cargo turnover and the formation of demand for freight cars,” the document states.

As reported, at the beginning of 2023, TAS Group became a strategic investor in the TransAnt GmbH railcar building joint venture of Austrian Voestalpine and ÖBB Rail Cargo with a 40% stake, and in the spring of 2024 it became the majority owner of TransAnt, increasing its stake to 61%.

According to the company, in the second quarter of 2024, it shipped platform cars as part of the project.

This year, the company intends to invest UAH 100.2 million in the development of the European direction (for the purchase of equipment).

As reported, the company produced 378 freight cars in 2023 (including for the EU market), which is 34.8% less than in 2022, while sales decreased by 40.6% to 370 units. Revenue decreased by 2.8% to UAH 1 billion 77 million, while net profit increased slightly to UAH 49.2 million.

TAS Group was founded in 1998 by businessman Tigipko. Its business interests include the financial sector (banking and insurance) and pharmacy, as well as industry, real estate, and venture capital projects.

Dnipro Metallurgical Plant (DMZ, formerly Evraz-DMZ), a part of DCH Steel of businessman Aleksandr Yaroslavsky’s DCH group, posted a net profit of UAH 504.591 million in 2023, up from UAH 4.225 million in 2022.

According to the announcement of the general meeting of shareholders scheduled for August 29, 2024, in remote mode, it is planned to allocate UAH 454.601 million of the 2023 profit to repay losses of previous years.

The shareholders intend to leave the rest of the net profit undistributed.

The shareholders will consider 13 items on the agenda, including the report of the Supervisory Board, the report of the Executive Body, the report and conclusions of the Audit Committee, the auditors’ report for the year, approval of the results of financial and economic activities for the year and distribution of profits.

In addition, the shareholders will terminate the powers of the members of the Supervisory Board and the Audit Commission, amend the charter and the Regulations on the Supervisory Board, cancel the Regulations on the Audit Commission and other bodies, and elect new members of the SB.

As reported, in 2022, DMZ earned a net profit of UAH 4.225 million, while in 2021 it amounted to UAH 1 billion 725.157 million. In 2023, DMZ increased its rolled metal output by 86.2% compared to 2022, to 105.6 thousand tons, and coke output by 38.5%, to 292.7 thousand tons.

In 2021, DMZ earned a net profit of UAH 1 billion 725.157 million, while it ended 2020 with a net loss of UAH 394.091 million. In 2022, the plant reduced its rolled steel production by 74.2% compared to 2021, to 58.4 thousand tons, and coke production by 56.3%, to 211.3 thousand tons.

DMZ specializes in the production of steel, pig iron, rolled products and products made from them.

On March 1, 2018, DCH Group signed an agreement to buy Dnipro Metallurgical Plant from Evraz.

As of the first quarter of 2024, Drampisco Limited (Cyprus) owns 97.7346% of DMZ shares.

The authorized capital of the company is UAH 574.994 million, with a share price of UAH 0.25.

In January-June 2024, state-owned PrivatBank (Kyiv) earned UAH 30.6 billion in net profit, up 2.7%, or UAH 0.8 billion, compared to the same period last year, the financial institution said on Wednesday.

“At the same time, the bank’s financial result before tax amounted to UAH 40.7 billion, which is 11% more than in the first half of 2023,” the state bank said.

According to data published on Privat’s website, income tax for the six months amounted to UAH 10.1 billion, compared to UAH 6.9 billion for the same period in 2023, when the rate was 18%, compared to 25% this year.

The bank’s total assets for the first half of the year increased by 1.5% to UAH 692.5 billion.

It is noted that the net loan portfolio of individuals and legal entities of the bank exceeded UAH 102.7 billion, which is 34%, or UAH 26.2 billion, more than last year and 11.6% more than at the beginning of the year.

“Since the beginning of the year, we have been actively lending not only to individuals and micro, small and medium-sized businesses, but also developing loan programs for corporate clients and large businesses in all regions of the country. We pay special attention to enterprises in the frontline regions, as well as to financing households and businesses under alternative energy generation programs,” Gerhard Bösch, Chairman of the Board of PrivatBank, said in a release.

According to the press service, deposits and balances on customer accounts amounted to UAH 681.1 billion, up from UAH 550 billion at the beginning of the year, with growth of UAH 30 billion, or 8%, in hryvnia accounts.

As of the end of the first half of 2024, PrivatBank’s active customer base amounted to 18.3 million individuals and 880 thousand legal entities, which is 50 thousand and 5 thousand less than at the beginning of the year, respectively. The number of Privat24 users reached 13.5 million.

Privat’s network includes 1184 branches (1199 at the beginning of the year), 6854 ATMs (6880), 10,419 thousand terminals (10,473 thousand) and more than 308.6 thousand POS terminals, according to the release.

As reported, at the end of June, it became known that Boesch was dismissed from the post of PrivatBank’s CEO after three years of work. The Supervisory Board of the financial institution has already started the selection process for the vacant position.

State-owned Oschadbank (Kyiv) earned UAH 8.81 billion in net profit in January-June 2024, up 29%, or almost UAH 2 billion, compared to the same period last year, the financial institution said on Tuesday.

“Such dynamics testifies to the effectiveness of the implementation of the military strategy of Oschad,” the state bank commented on the results.

It is specified that in January-June, the bank received UAH 2.7 billion of net profit from the revaluation of financial instruments in the securities portfolio, and in June, the net profit of Oschad amounted to UAH 74 million.

The bank’s net interest income increased by almost 26% to UAH 10.96 billion for the half-year, while net non-interest income increased by about 13% to UAH 4.09 billion.

“This result was achieved, in particular, due to the increase in lending to businesses and households: the respective loan portfolios of large corporations, micro, small and medium-sized businesses and individuals increased during the first six months of the year,” Oschadbank explains.

According to the release, the financial institution’s operating profit for the first half of 2024 exceeded UAH 7 billion, which is a quarter better than the result for the same period last year.

It is noted that Oschad has sufficient liquidity and capital at its disposal. In particular, the bank’s regulatory capital adequacy ratio (RCR) as of July 1, 2024 amounted to 14.35%, while the NBU’s established standard is 10%.

“We are pleased with the results achieved due to the stable operation of Oschadbank and successful adaptation to the wartime conditions. One of our main tasks now is to ensure that these results are even more beneficial to the real sector of the economy to ensure a stable recovery and further development of the country,” said Oschadbank Chairman of the Board Serhiy Naumov.

According to him, the bank is currently paying special attention to providing clients with affordable financial resources to restore energy infrastructure and strengthen energy independence of businesses and citizens.

According to the NBU, the bank’s net profit last year amounted to UAH 6.84 billion. As of June 1, 2024, Oschad ranked second in terms of total assets (UAH 415.82 billion) among 63 operating banks.