Quotes of futures for US stock indices do not show a single dynamics at the auction on Tuesday.

The US stock market has declined in the previous four sessions, and risk appetite remains low due to investors’ fears that the Federal Reserve’s (Fed’s) rapid tightening of monetary policy will dampen economic activity and corporate profits, Market Watch notes.

CEO of JPMorgan Chase & Co. Jamie Dimon said the day before that the S&P 500 index could fall by another 20% amid the ongoing tightening of monetary policy by the Fed. This year, the stock indicator has already lost 24%.

Dimon warned that the US economy could fall into recession in the next six to nine months.

Yields on two-year US Treasuries, which are sensitive to a hike in the base rate, rose above 4.3% on Tuesday, close to the maximum since 2007. The interest rate on ten-year US Treasury bonds rose during trading above the 4% mark.

“The 10-year US Treasuries are back above 4% and we expect the pressure on the US stock market to continue,” said Peter Garnry, head of equity strategy at Saxo Bank A/S. profits and cause disappointment in the prospects of the companies.”

S&P 500 companies’ third-quarter combined earnings are up 4.5% year-over-year, according to Refinitiv’s forecast. Profits of energy companies are expected to have grown by 6.3%, banks – have decreased by 1.6%.

Citigroup Inc., JPMorgan, Morgan Stanley and Wells Fargo & Co. will release quarterly results this week. Bank shares lost 0.2%, 0.4%, 0.3% and 0.5% respectively in early trading on Tuesday.

American Airlines Group Inc. rose by 4.3%. The airline improved its forecasts for revenue and revenue per marginal passenger turnover in the third quarter.

Shares of Delta Air Lines Inc. add 2.8% to the price. The airline said Tuesday it is investing $60 million in flying taxi developer Joby Aviation Inc. and intends to use air taxis to deliver passengers to airports in the future, bypassing traffic jams in New York and Los Angeles.

Joby shares rose 18%.

The value of the December E-mini futures for the S&P 500 fell by 0.1% to 3621.75 points by 15:50 Moscow time on Tuesday. Quotation of the December E-mini futures on the Dow Jones index increased by this time by 0.02%, to 29266 points. Futures on the Nasdaq 100 for December fell 0.14% to 10969.5 points.

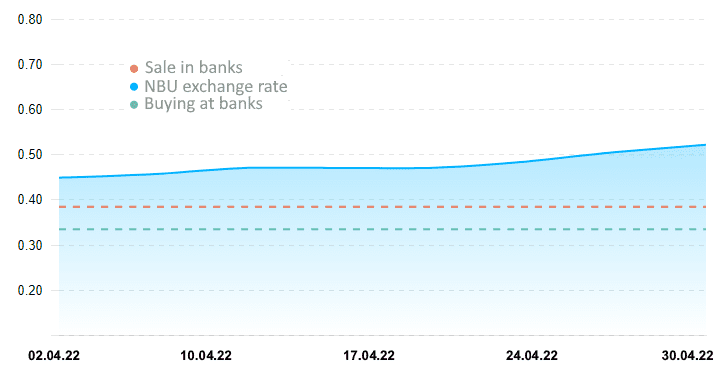

Quotes of interbank currency market of Ukraine (UAH for 1 RUB, IN 01.04.2022-30.04.2022)

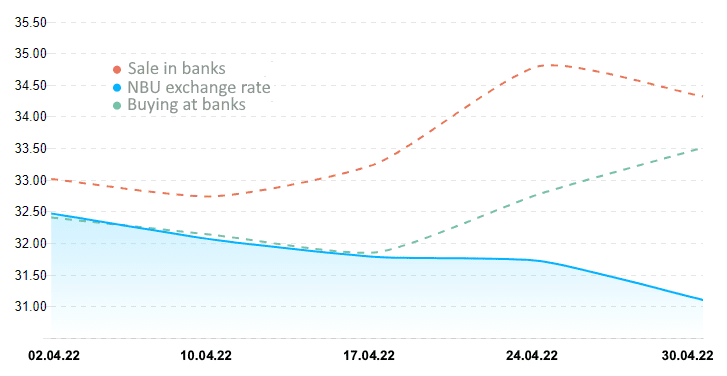

Quotes of interbank currency market of Ukraine (UAH for €1, IN 01.04.2022-30.04.2022)

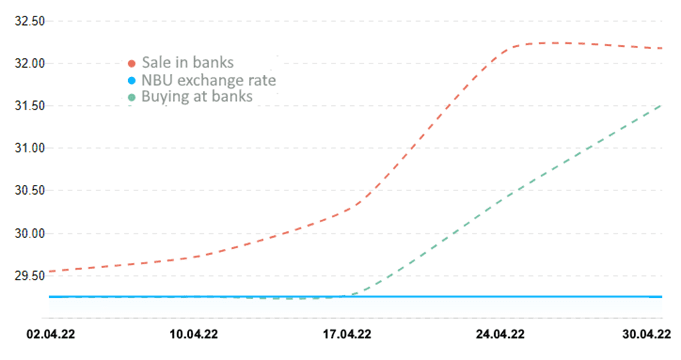

Quotes of interbank currency market of ukraine (uah for $1, in 01.04.2022-30.04.2022)

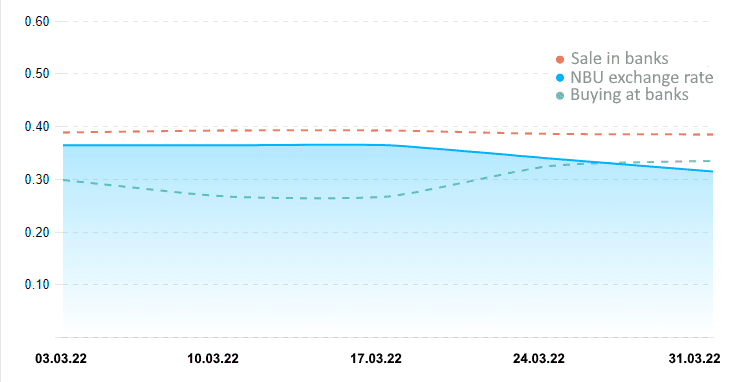

Quotes of interbank currency market of Ukraine (UAH for 1 RUB, in 01.03.2022-31.02.2022)