In Cyprus from January 1, 2026, changes affecting the processing of real estate transactions and taxation on the sale of assets came into force, according to the explanations to the reform.

The key simplification for new transactions is the complete abolition of stamp duty (Stamp Duty) for sale and purchase agreements signed from January 1, 2026. Previously the levy was calculated on the value of the transaction and required separate procedures, it is now zero-rated for new contracts.

Lifetime capital gains tax deductions (CGT) have also been revised, which may reduce the taxable base for real estate sales by individuals. In particular, the limits of the personal deduction, the exemption for agricultural land and the deduction for a principal residence (subject to fulfillment of conditions and proof of documentation) have been increased. These parameters apply to contracts entered into starting in 2026.

A separate block of the reform relates to transactions involving shares in real estate companies. The threshold at which the sale of shares/shares qualifies as a real estate transaction for CGT purposes has been lowered – this increases the tax due diligence requirements for purchases of corporate shells with properties on the balance sheet.

In addition, exemptions for real estate exchange and barter schemes in development (e.g., when land is transferred to a developer in exchange for finished objects) have been extended, and control over compliance with tax procedures has been strengthened: if the parties are in arrears, transfer of ownership rights may be blocked, and Tax Clearance checks have become tougher.

According to the Department of Land and Cadastre of Cyprus (DLS), in 2025, foreign buyers (excluding Cypriot citizens) registered 7,255 sale contracts (sale contracts), of which 4,809 – buyers from outside the EU; the number of transferred objects (transfers/sales) amounted to 4,195 (2,234 – buyers outside the EU).

The top nationalities that most often appear in the “top ten” are: Russians, British, Israelis, Greeks, Romanians, Chinese, Ukrainians, Germans, Americans and Lebanese (Australians and Bulgarians are also found in Nicosia).

Non-resident investments in Bulgarian real estate in January-November 2025 resulted in a net outflow of €18.6 million, while Russia recorded a net outflow of €19.9 million, according to data from the Bulgarian National Bank (BNB).

According to BNB data, a year earlier (January-November 2024), the net outflow of non-resident investments in real estate was estimated at €11.6 million.

The net outflow indicator means that non-residents’ payments under real estate agreements in the country during the period under review were lower than receipts, i.e., sales exceeded purchases in value terms. At the same time, the fact that the total indicator for all non-residents (-€18.6 million) was less than the outflow for the Russian Federation (-€19.9 million) formally indicates a small aggregate net inflow of investment in real estate from other countries (about €1.3 million).

The BNB report, which is referenced by the media, does not provide a separate breakdown by other countries (including Ukraine) in terms of non-resident investment in real estate—only Russia is highlighted separately.

According to Serbian Economist, real estate prices in Serbia are market-driven and not “inflated,” said Ervin Pashanovich, a member of the board of the Association of Real Estate Agents of the Serbian Chamber of Commerce and Industry (Privredna komora Srbije).

According to him, the real estate market in the country remains “free” and without interference, and price levels are confirmed by demand. He noted that the average price per square meter of housing in Belgrade is about €2,400, with attention often focused on the most expensive projects, although there are different price levels on the market.

Pasanovic also pointed out that the majority of purchases are made by citizens seeking to resolve their housing issues, rather than investors, since, in his estimation, rental yields imply a long payback period: an apartment costing €100-150,000 can be rented for around €600 per month, which corresponds to a 24-30 year return on investment.

He added that the share of buyers purchasing housing with loans has reached a record 36%, and the share of foreigners among real estate buyers in Serbia is about 2%.

Pasanovic also commented on the application of the law on simplified accounting and registration of property rights, noting that the possible entry into the market of some previously unaccounted properties, in his opinion, will not lead to a noticeable decrease in prices, since a significant part of them are not located in central areas.

According to data from the Republic Geodetic Authority of Serbia (RGZ), in the third quarter of 2025, the average price of apartments on the secondary market in Belgrade was €2,691 per square meter, and in new buildings, €2,598 per square meter.

The RGZ reported that the total volume of the Serbian real estate market in the third quarter of 2025 was estimated at €1.8 billion with 30,511 sales contracts, and apartment transactions accounted for about 60% of the total market value (€1.1 billion).

https://t.me/relocationrs/2087

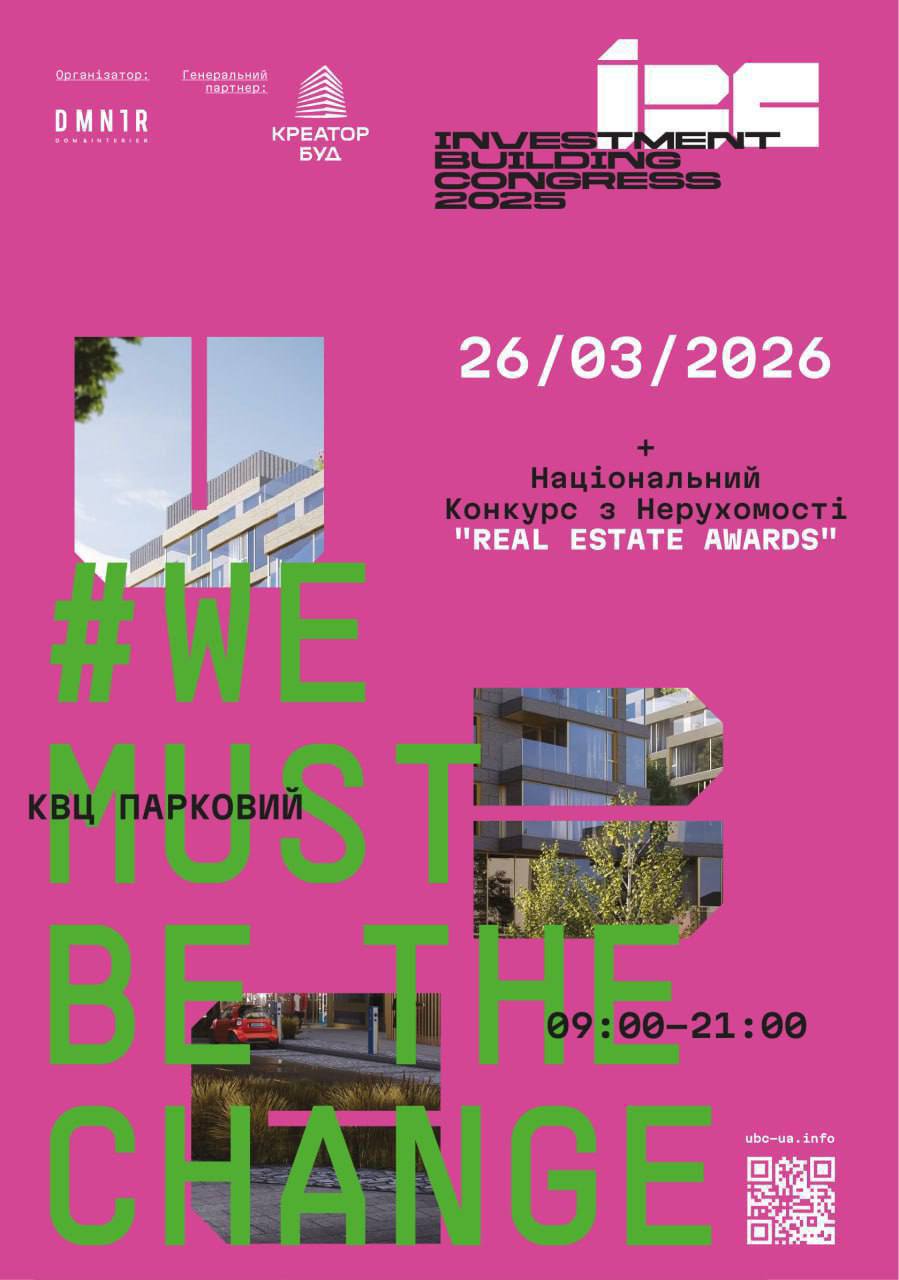

On March 26, 2026, the INVESTMENT AND CONSTRUCTION CONGRESS (IBC) and the Real Estate Market Awards (REM AWARDS) ceremony, the main award of the Ukrainian real estate market, will take place at the Parkovy Exhibition Center in Kyiv.

The INVESTMENT AND CONSTRUCTION CONGRESS and Real Estate Market Awards are positioned as a key meeting point for capital, developers, investors, and leaders of Ukraine’s real estate market in 2026. The event will be held offline and online.

The business program of the Congress is scheduled from 9:00 a.m. to 6:00 p.m. in the main hall “Chasha” (3rd floor). The program includes panel discussions and professional battles, speeches by market leaders, investment analytics and case studies, partner presentations, as well as an exhibition area.

According to the organizers, the audience of the INVESTMENT AND CONSTRUCTION CONGRESS will consist of more than 6,000 participants, including developers, investors, architects, business owners, and top management.

The evening program will run from 6:00 p.m. to 9:00 p.m. and will include the Real Estate Market Awards 2026 ceremony, a performance by the Rizni Theater, a concert by Dmytro Prokopov, and a concert by the band Druga Rika. The hosts of the evening will be Anton Polishchuk and Nikita Dobrynin.

For more information and registration, visit the Congress website at www.ubc-ua.info

The Interfax-Ukraine news agency is the official information partner of the event.

The Cyprus Parliament is considering initiatives that could significantly tighten the rules on property purchases by third-country nationals and foreign-controlled companies, amid discussions about housing affordability and the risks of uncontrolled land sales.

In particular, the AKEL party has submitted two bills to the House of Representatives that would introduce measurable restrictions for buyers from countries outside the EU. It is proposed to allow third-country nationals to purchase only one residential property with a size restriction (up to 200 square meters), as well as one office (up to 300 square meters) and one store (up to 200 square meters). At the same time, companies with foreign interests, according to the initiative, should be completely deprived of the right to purchase housing.

Another set of proposals concerns strengthening control over ownership structures: it is envisaged that the ultimate beneficial owner of a transaction will be required to disclose their identity in order to prevent purchases through Cypriot or European companies that are effectively controlled by non-residents from third countries.

AKEL also proposes to ban real estate purchases in areas near critical infrastructure, including ports and airports, as well as in coastal and buffer zones, and to completely ban the sale of forest and agricultural land to foreign buyers from countries outside the EU.

The party says the initiatives aim to protect the right to housing for local households, reduce pressure on prices, and take security factors into account. Discussion of the bills is expected to begin in the relevant committee after the Epiphany holidays.

Who mainly buys real estate in Cyprus

According to the audit service, in 2024, 4,321 transactions out of 15,797 (27.4%) were made by buyers from countries outside the EU, with the report noting that the actual share may be higher due to purchases through companies registered in the EU or Cyprus.

Statistics presented in parliament by Interior Minister Constantinos Ioannou for the period from September 2024 to September 2025 show that the most active foreign buyers are British, Israeli, and Russian, with notable transactions by citizens of Greece, Lebanon, and Romania. In terms of regions, for example, the British led in Paphos (890 purchases), followed by Israelis (683) and Russians (327), while in Limassol, Russians (846) and Israelis (571) were the largest buyers.

Ukrainian citizens have also appeared in the rankings of the top 10 most active real estate buyers in Cyprus in different years.

According to Serbian Economist, Serbia’s commercial real estate market will develop around Belgrade and expressway and railway corridors over the next decade, with the most dynamic growth expected in the office and industrial-logistics segments, according to the analytical report “Serbia real estate & construction outlook 2025–2035.”

According to the document, by 2035, Belgrade’s high-quality office stock could increase to 1–1.2 million square meters. The main demand will be provided by IT companies, engineering centers, the financial sector, and international service centers, while in Novi Sad and Niš, more compact clusters of office space focused on technology and research are forming.

The report identifies industrial and logistics real estate as the fastest-growing segment. Experts predict that by 2035, the total volume of modern warehouse space in Serbia could double or triple, with key logistics hubs forming in the Belgrade–Pancevo–Simanovci, Novi Sad–Ruma–Inđija, Kragujevac–Kraljevo, and Niš–Leskovac, as well as along international corridors X and XI.

Individual industry reviews confirm the stability of the industrial segment: according to consulting company iO Partners, in the first quarter of 2025, there were more than 1.2 million square meters of Class A warehouse space on the Serbian market, with vacancy rates remaining at around 6.5% and base rental rates at €5 per sq m per month, indicating a balanced supply and demand structure.

The report identifies potential delays in infrastructure projects, high financing costs, and political cycles that could affect the timing of major development programs as risks for commercial real estate. As strategic recommendations, investors are advised to focus on energy-efficient offices and industrial parks linked to international transport corridors, while the authorities are advised to accelerate the harmonisation of building standards with EU requirements and the digitisation of procedures for commercial projects.