Who are the top 10 Ukrainian banks by profit?

Ukrainian banks earned almost UAH 160 billion in pre-tax profit in 2023. This is almost twice as much as before the full-scale invasion. However, banks will have to pay tax, which is almost half of their total profit – over UAH 73 billion.

UAH 159.99 billion of pre-tax profit was earned by 63 Ukrainian banks in 2023. This is 1.9 times more than in 2021.

However, last year’s net profit was much lower – only UAH 86.54 billion. At the same time, this is still 12% more than before the full-scale invasion. Back then, 71 banks made a profit of UAH 77.53 billion.

Almost half of the banks’ profits must be paid as income tax under the new law – 46% or UAH 73.45 billion. For comparison, in 2021, the tax was almost 12 times less: UAH 6.37 billion or 7.6% of profit.

Overall, only 7 banks out of 63 ended 2023 with losses of UAH 245 million.

Currently, the top 10 banks have undergone little change: the ranking includes 5 banks with foreign capital, 4 state-owned banks, and 1 bank with private capital. Together, these 10 banks earned 88% of the total profit – UAH 75.94 billion. And their income tax amounted to UAH 63.18 billion.

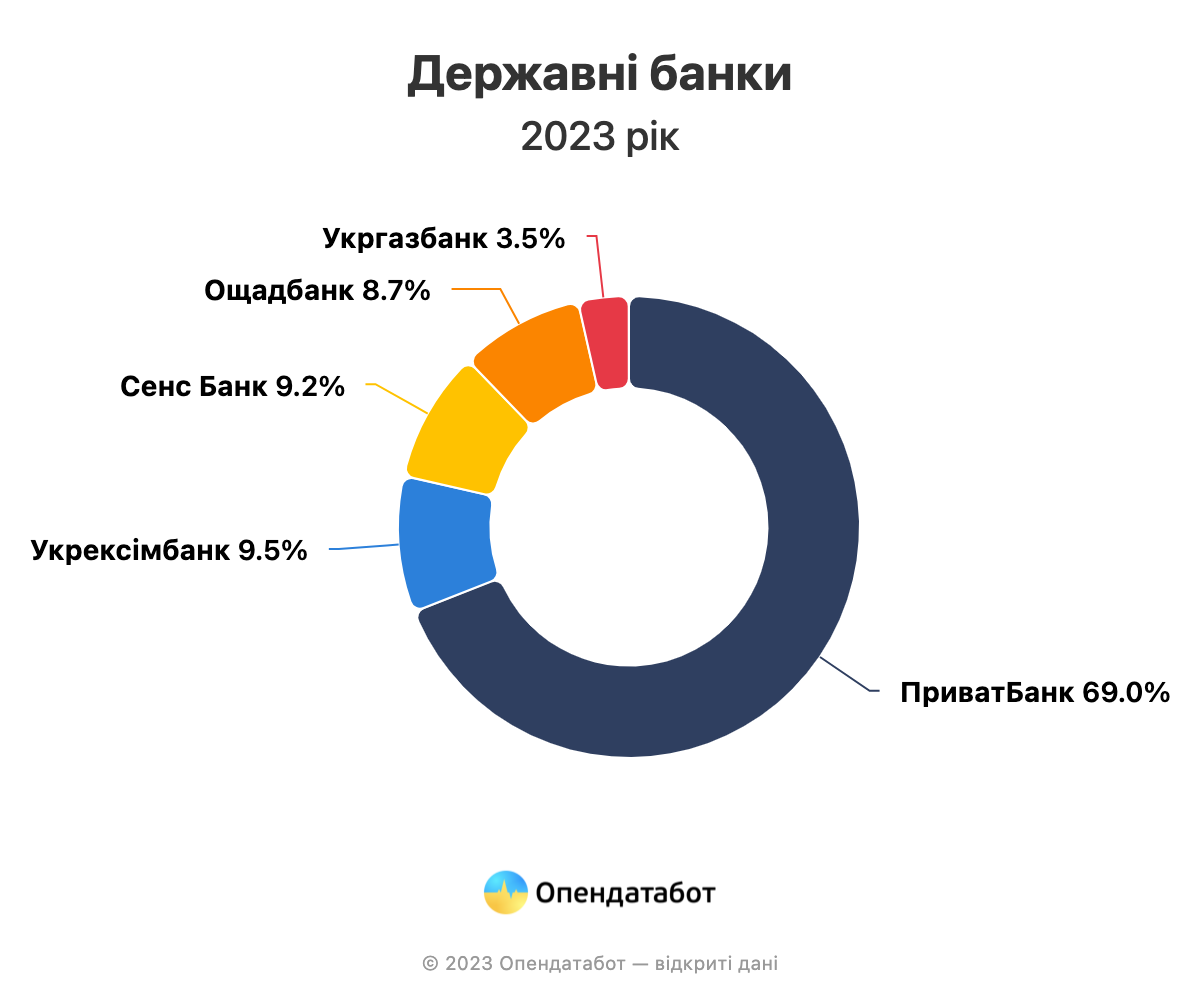

State-owned banks

5 state-owned banks accounted for 63% of the total profit of all banks – UAH 54.71 billion. State-owned Privat is a consistent leader in terms of profit among all Ukrainian banks: UAH 37.76 billion in 2023. This is 8% more than in 2021.

Meanwhile, Oschadbank managed to increase its profit by 4 times last year and received UAH 4.75 billion in net profit. Sens Bank, nationalized in 2023, was also added to the list of state-owned banks.

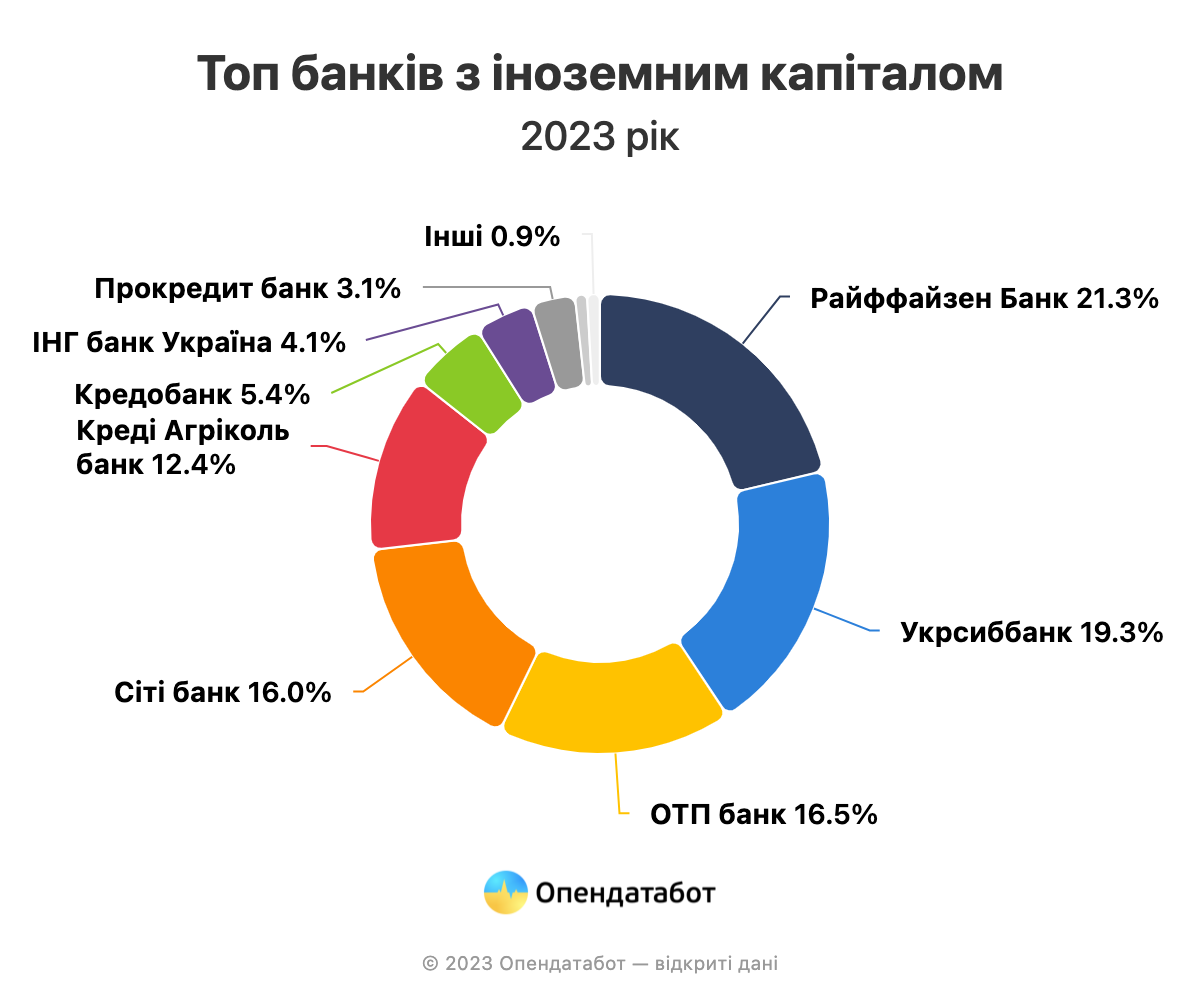

Foreign banks

14 banks with foreign capital earned UAH 22.43 billion. For comparison, 20 banks in this group earned almost the same amount on the eve of the full-scale invasion.

Raiffeisen was the leader in terms of profit last year: UAH 4.78 billion. Together with Ukrsibbank, which almost tripled its earnings compared to 2021, they accounted for 40% of the group’s profit.

Most foreign banks managed to increase their profits last year compared to 2021. Deutsche Bank showed the largest increase: by 18 times.

Private capital

According to the results of the year, private banks are doing the worst. Last year, 44 banks with private capital earned UAH 9.4 billion in profit. This is 25% less than before the start of the full-scale war.

Almost 2/3 of the total profit of this group is accounted for by 2 banks: FUIB, which is the leader of the group – UAH 3.95 billion, which is 5% less than in 2021, and Universal Bank (Monobank), whose profit decreased by 1.6 times in 2021.

https://opendatabot.ua/analytics/banks-2023

foreign banks, private capital, state-owned banks, top 10 Ukrainian banks, UKRAINIAN BANKS

Based on the results of the competition, the Cabinet of Ministers selected Ward Howel Ukraine, Executive Search Ukraine and Pedersen & Partners to select applicants for the positions of members of the supervisory boards of the state-owned Oschadbank, PrivatBank and Ukreximbank (all from Kyiv), respectively.

According to a posting on the Cabinet’s website, the government also determined the terms of payment for the services of companies and the contract for the provision of these services.

It is indicated that the competitive selection was carried out by a commission created by the Ministry of Finance from among its employees, as well as representatives of international organizations involved with an advisory vote.

According to the law “on banks”, the Supervisory Board of the State Bank should consist of nine members, six of whom should be independent, and three – one representative of the president, the Cabinet of Ministers and the Verkhovna Rada.