The Financial Stability Board (FSB), which includes, in particular, the leadership of the National Bank and the Ministry of Finance of Ukraine, proposes to abandon the preferential taxation of motor fuel. According to the press service of the NBU on the website on Monday, an increase in taxes on imports, in particular excises on fuel, is proposed as one of the ways to further increase budget revenues.

“According to the results of January-May 2022, the state budget deficit was larger than for the whole year of 2021 and 2020. Budget revenues decreased, including due to preferential taxation of imports, while at the same time, spending increased significantly, primarily for military needs and social programs,” the NBU said in a statement.

As reported, on June 23, the FSB agreed on key areas of action to narrow the state budget deficit and reduce the volume of its monetary financing: optimization of government spending and revenue growth, activation of domestic market borrowing and increasing the predictability of international aid.

At the end of March, the Rada adopted amendments to the Tax Code, according to which it canceled the excise tax on the supply of gasoline and liquefied gas and reduced VAT on the import of motor fuel to 7%.

Subsequently, a draft law was submitted to the Rada that provided for the rejection of these benefits, but these norms were excluded from it even before they were introduced to the hall, as they caused fears of an even greater increase in the price of fuel. As a result, from July 1, import privileges for most goods will be canceled, but they will remain for motor fuel.

The National Bank of Ukraine is also proposing to the government and the Rada to introduce a 10% additional import duty, similar to the one that existed in 2014-2015, to ease pressure on the hryvnia and replenish the state budget. However, the government and the profile committee have so far refused to apply such a measure.

President of Ukraine Volodymyr Zelensky signed the law On Amendments to the Tax Code of Ukraine regarding the abolition of taxation of income received by non-residents in the form of payments for the production and/or distribution of advertising, and improvement of the taxation procedure for value added tax transactions for the supply of electronic services by non-residents to individuals No. 1525-IX, which the Verkhovna Rada adopted on June 3. The website of the head of state reports that the document defines a special taxation procedure for value added tax of non-resident companies that provide electronic services to persons residing in Ukraine.

“This will allow increasing state budget revenues from VAT. Such taxation rules are already becoming a common practice in foreign countries, for example, in the countries of the European Union, Australia, Belarus, Kazakhstan, and the like,” it said.

It is reported that foreign companies that supply electronic services to Ukrainians will be required to register as value-added tax payers using a simplified procedure through a special electronic service if the total amount from the implementation of the relevant transactions exceeds UAH 1 million per year. Non-residents will fill out simplified statements in electronic form in the state or English language.

At the same time, according to the document, transactions for the supply of distance learning services via the Internet are exempted from VAT if this network is used exclusively as a means of communication between a teacher and a student. Also, transactions on the supply of educational services by access to public educational, scientific and information resources on the Internet from the branches of knowledge and specialties in which the training of applicants for higher education is carried out are exempted from value added tax, if their implementation and provision does not require human participation.

From January 1, 2022, Ukrainian companies which pay for services for the production or distribution of advertising abroad, will be exempted from VAT.

The total amount of applications for budgetary value added tax (VAT) refunds in December exceeds UAH 14 billion, and it will be financed on time, said head of the State Tax Service Oleksiy Liubchenko.

“In December, we have full understanding that the application for UAH 14.1 billion will be given to payers, which didn’t happen in December 2019,” Liubchenko said on the air of Savik Shuster’s program Freedom of Speech (Svoboda Slova) on Friday.

He noted that following the results of 11 months of this year, applications for budgetary VAT refunds amounted to UAH 122.7 billion, while UAH 128 billion was reimbursed during this period.

The Verkhovna Rada has ratified the protocol with amendments to the convention with Austria for avoidance of double taxation and prevention of tax evasion with respect to taxes on income and property.

The Ministry of Finance said on its website the protocol provides for an increase in the general tax rate of dividends from 10% to 15% and interest from 2% to 5%.

“Increased were also the rates of royalties paid for the use of any copyright on scientific work, patent, etc. from 0% to 5%, for the use of copyright on literary works or works of art from 5% to 10%,” the Ministry of Finance said.

In addition to the increase in rates, it is envisaged to supplement the convention with new articles on limiting the possibility of applying the preferential provisions of the convention, if the main purpose is to obtain such benefits, and on expanding the ability of the competent authorities of Austria and Ukraine to exchange tax information.

“These changes and rates correspond to the general practice of Ukraine’s conclusion of such agreements and protocols to them with other countries of the world – similar rates are contained in most of the conventions and protocols to them, concluded by our state,” the ministry explained.

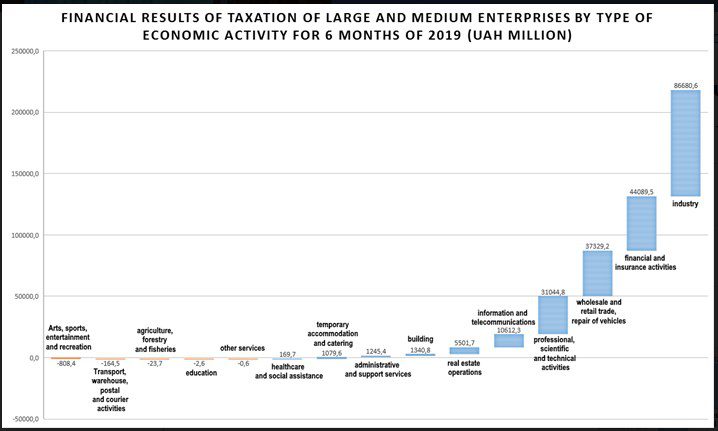

Financial results of taxation of ukrainian enterprises by type of economic activity (UAH million)

enterprises by type of economic activity (UAH million)