The UK economy grew by 0.3% in the second quarter of 2025 compared to the previous three months, according to the latest data from the Office for National Statistics (ONS). The result coincided with both the preliminary estimate and the consensus forecast of analysts polled by Trading Economics.

Thus, the pace of GDP growth slowed from 0.7% in the first quarter.

In April-June, the services sector grew by 0.4%, the construction sector by 1%, while the manufacturing sector contracted by 0.8%.

Consumer spending increased by 0.1%, and government spending by 1.3%. Business capital investment increased by 0.5% (previously reported as a 1.1% decline).

Exports decreased by 0.2% (the decline was recorded for the third quarter in a row), while imports remained unchanged.

British GDP growth in the second quarter was 1.4% compared to the same period last year. Previously, it was reported an increase of 1.2%.

Earlier, the Experts Club analytical center released a video on the economic performance of Ukraine and major countries of the world – https://youtu.be/kQsH3lUvMKo?si=dhZl9SIChwDiTinw

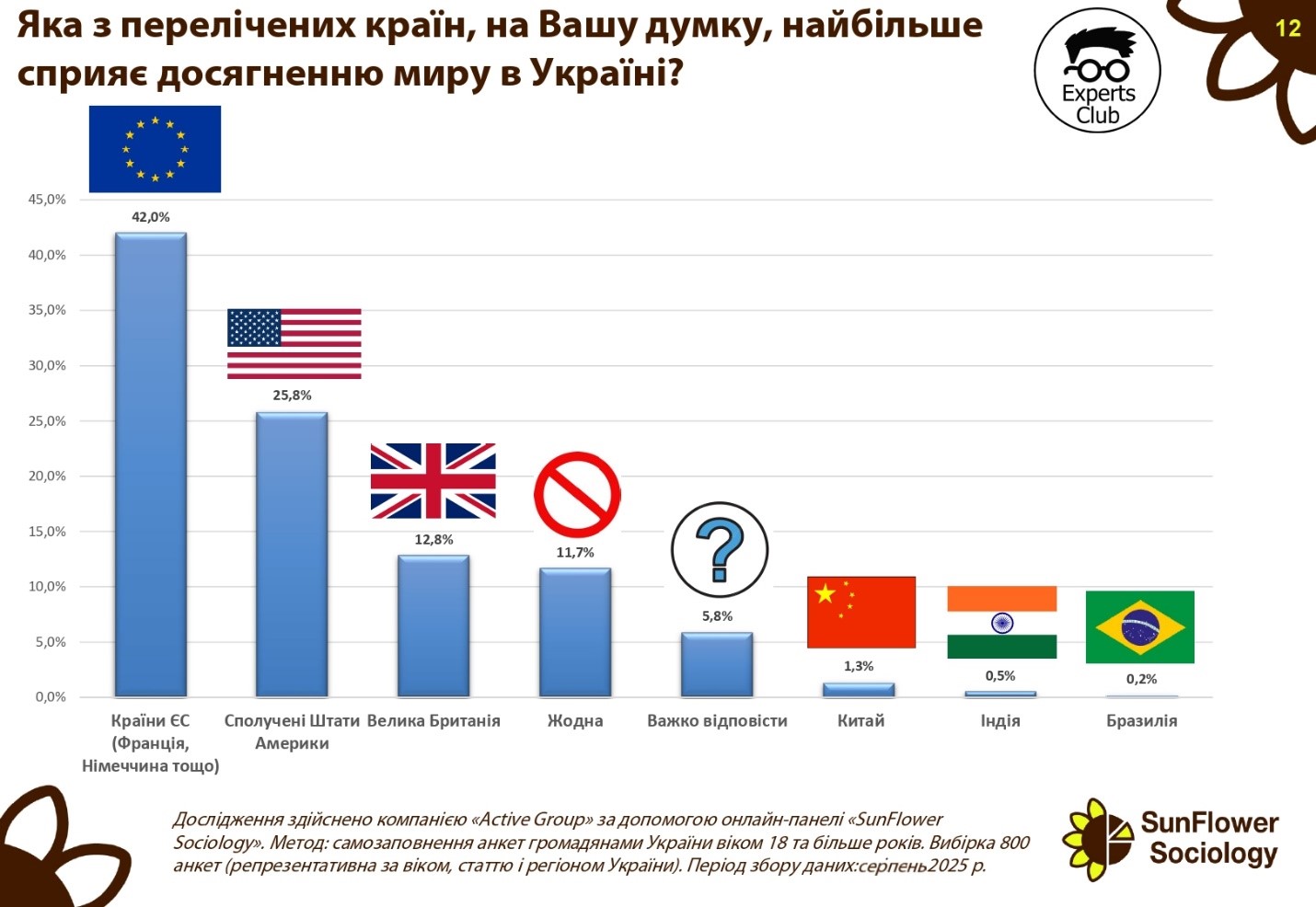

According to the results of a study conducted by Active Group and Experts Club in August 2025, Ukrainians rated the role of European Union countries in promoting peace in Ukraine the highest.

According to the survey, 42.0% of respondents believe that the EU (primarily France and Germany) is making the greatest contribution to the peace process. 25.8% of respondents noted the key role of the United States, and 12.8% noted the key role of the United Kingdom. At the same time, 11.7% of Ukrainians believe that no country is contributing to the establishment of peace, while 5.8% were unable to decide on an answer. Significantly fewer respondents noted other countries: China — 1.3%, India — 0.5%, Brazil — 0.2%.

“The results show that Ukrainians rate the diplomatic and political efforts of the EU and the US highest. Together with the UK, these countries form the main international triangle of trust for Ukrainian society,” said Active Group Director Oleksandr Pozniy.

Maksim Urakin, co-founder of Experts Club, emphasized the economic dimension of the partnership.

“For our country, it is important not only to have a political partnership with the EU, the US, and the UK, but also an economic one. China, on the other hand, despite its leadership in trade with Ukraine, remains on the periphery of the peace process,” he said.

The survey was part of a large-scale project by Active Group and Experts Club to study Ukraine’s international image and foreign policy orientations.

ACTIVE GROUP, CHINA, EU, EXPERTS CLUB, peace in Ukraine, Pozniy, SOCIOLOGY, UK, URAKIN, US

Official figures indicate net migration is falling, yet concern among Britons is close to the highest it has been since polling began in 1974

Rolling news coverage of protests outside asylum hotels, a series of government announcements on asylum seekers, and Reform’s party conference meant that immigration was once again the political topic of the summer.

In August almost half of Britons (48%) listed immigration as one of the top issues facing the UK. This year has recorded the highest concerns over immigration – outside of one other period during the 2015 Europe migrant crisis – since polling company Ipsos started asking the question in 1974.

But what do the figures really show – and do all of the claims made about immigrants add up?

Despite public concern about immigration rising in recent months, official figures show that the number of people coming into the country is falling – albeit from a record high peak.

Figures from the Office for National Statistics (ONS) show that net migration has mainly hovered between 200,000 and 300,000 people a year since 2011. However, since Brexit came into effect on New Year’s Eve 2020, there has been a large increase in the number of immigrants. Commentators and critics have called this the “Boriswave”, as it occurred following the new post-Brexit immigration system introduced by Boris Johnson.

Recent figures show that the wave is subsiding. Net migration fell by half in 2024, and recent rule changes mean it is expected to fall further. This is largely because of a decrease in health and care visas. Fewer people are now escaping the Ukraine war or fleeing the Taliban through the now closed Afghan humanitarian scheme.

Student visas have also declined. Applications were down 1.5% in August (when student visa applications spiked ahead of the academic year) compared with 2024, and down 18% on the same month in 2023.

In comments to the BBC following his conference speech, Reform leader Nigel Farage blamed Johnson for “millions of people being allowed into Britain, most of whom by the way don’t even work and are costing us a fortune”. However, the available evidence complicates his version of events.

Most people claiming asylum aren’t allowed to work. But despite the large media focus on small boats and asylum seekers, these only make up a tiny proportion of the overall number of people coming to the UK – less than 5% of Home Office visas granted and arrivals detected in 2025.

The largest proportion of people coming into the UK is made up of students (about 47%, including dependents). Students aren’t expected to work, but do contribute by paying fees towards their degrees, and can’t get indefinite leave to remain so either leave the UK or contribute by moving into paid work afterwards.

The second largest group are people on working visas, who make up 20%, with their dependents making up 11%.

Currently, the published data on immigrant earnings is patchy – and isn’t helped by ongoing issues with the ONS labour force survey.

Madeleine Sumption, director of the Migration Observatory at the University of Oxford said that while the data on employment was imperfect and rates “vary widely by immigration category”, the figures suggested employment rates among recent migrants were “not far off existing residents or long-standing migrants”.

A Home Office report managed to link some visa types that were granted between 2019 and 2023, to pay as you earn (PAYE) earnings in the 2023-24 financial year – with most of them recording earnings. As for those without records, it’s probable most will have already left the country.

It’s not just people on working visas who work. The report also found that almost half of people entering on family visas (48%) had some PAYE earnings (and again that’s not including those who are self employed or left the country).

Much of the talk around immigration recently has focused on dependents – family members who are allowed to immigrate alongside the main visa holder. New health and care workers were prevented from bringing their children and other dependents by the Sunak government, as were most students.

The PAYE data suggests many dependents do in fact work – 81% of health and care worker dependents, 45% of skilled worker dependents, and 25% of senior or specialist visa dependents received earnings (once again – these don’t take into account the self-employed, or the fact that many will have left the country. Adjusting the figures to account for the primary visa holders that have left raises the estimates further).

Among all the different types of people coming to the UK, newly arrived refugees (around 28% according to some estimates) and those on humanitarian visas are the least likely to be in work.

In terms of overall earnings, the Migration Observatory found that the immigrant earnings grow quickly – the median non-EU immigrant worker in 2024 earned similar or slightly more than the median UK worker.

So will recent migrants – as Farage stated – cost the UK a fortune in the long run? Based on the available data we still can’t tell – but given the fact that most people moving to the UK won’t be going through the school system, and also have to pay towards their NHS treatment, it’s unlikely they would cost more than others.

In 2024, the Metinvest mining and metallurgical group reduced its rolled steel production in the UK and the EU by 13% to 1.367 million tons, which was caused by unfavorable market conditions in the EU, in particular the availability of cheap Russian slab, according to the group’s annual report.

According to the report, flat steel production at Metinvest Trametal decreased by 3% to 466,000 tons, at Ferreira Valsider by 45% to 190,000 tons, and at Spartan UK by 22% to 153,000 tons.

Overall, Trametal accounted for 34% of total production in the UK and the EU last year (31% in 2023), Ferreira Valsider for 14% (22%), Promet Steel for 41% (35%), and Spartan for 11% (12%).

As reported, in 2024, Metinvest reduced sales of finished metallurgical products by 5% compared to the previous year, semi-finished products by 3%, but increased coke sales by 6%, and sales of other products and services increased by 33%.

Revenue from the metallurgical segment remained virtually unchanged compared to 2023 and amounted to $4.824 billion, while the segment’s share in consolidated revenue decreased by 6 percentage points (pp) to 60%.

At the same time, sales of merchantable pig iron decreased by 15% to $266 million due to a 16% reduction in shipments to 558 thousand tons. In particular, the reduction in resales and production volumes of the group amounted to 12% and 52%, respectively. The share of resales in total sales increased by 4 p.p. to 95%. North America and Europe remained the main markets for this product. They accounted for 71% and 23% of total shipments last year, compared with 70% and 26% in 2023.

Sales of semi-finished products increased by 9% last year to $389 million, thanks to a 16% increase in sales volumes to 716,000 tons amid a reduction in inventories. Shipments to the Middle East and North Africa (MENA) increased by 237,000 tons, accounting for 50% of total shipments in 2024 (20% in 2023). In contrast, shipments to Europe decreased by 143,000 tons and accounted for 38% of total sales (68% in 2023). The average selling price declined in line with the dynamics of CFR Turkey square billet prices (down 7% compared to 2023).

In 2024, flat steel sales declined by 6% to $2.244 billion. This was due to lower sales prices following the dynamics of the corresponding benchmark for hot-rolled coils CFR Italy, which fell by 9%. Total shipments increased by 7% to 3.047 million tons, driven by a 26% increase in resales to 2.111 million tons, which increased their share in total shipments to 69% (up 10 percentage points). Deliveries were primarily to Europe, which accounted for 72% of the total (71% in 2023). Sales in the region increased by 193,000 tons thanks to demand from key customers, expansion of the customer base, and stable operations at Black Sea ports. Domestic sales accounted for 23% of sales (25% in 2023).

Sales of long products remained unchanged in 2024 at $948 million. Shipments increased by 5% to 1.372 million tons, primarily due to higher production volumes at Kametstal. Ukraine and Europe remained the main markets for these products. They accounted for 45% and 35% of total sales, respectively, compared with 48% and 39% in 2023. The Group increased its shipments to North America, which accounted for 17% of total sales in 2024, compared with 12% a year ago. Average sales prices declined in line with the benchmark for CFR Turkey square billets.

The report notes that in 2024, Metinvest achieved significant results from operational improvements. In particular, in the metallurgical segment, coke consumption at Kametstal was reduced and blast furnace productivity was improved thanks to the rapid adaptation of pulverized coal injection technology to alternative types of coal under military supply restrictions. In addition, the optimization of raw material procurement contributed to the positive results.

Metinvest is a vertically integrated group of mining and metallurgical companies. Its enterprises are located in Ukraine, in the Donetsk, Luhansk, Zaporizhia, and Dnipropetrovsk regions, as well as in the European Union, the United Kingdom, and the United States. The main shareholders of the holding company are SCM Group (71.24%) and Smart Holding (23.76%). Metinvest Holding LLC is the management company of the Metinvest Group.

EU, METINVEST, PRODUCTION, rolling, UK

The UK government intends to lower the age threshold for participation in elections to 16 years, Reuters reports citing sources in the ruling circles. According to the information, the initiative is part of a large-scale reform aimed at modernizing British democracy and increasing the participation of young people in political life. The legislative changes are due to be introduced in the coming months and will cover both parliamentary and local elections.

“Many young people aged 16-17 are already working, paying taxes, able to join the army and participating in public life. Their voice deserves to be heard at the elections,” said representatives of the initiative group.

Currently in the UK, the right to vote is from the age of 18. However, Scotland and Wales already have provisions allowing people to vote in local government elections from the age of 16.

Experts estimate that the adoption of such changes on a national level could affect hundreds of thousands of young voters. Opponents of the initiative have expressed concern about how mature political decisions can be at such an early age, but recent polls show that more than 60% of respondents aged 16-18 believe it is important to have the right to vote.

Net migration to the United Kingdom (the difference between the number of immigrants and emigrants) in the year to June 2023 amounted to a record high of 906 thousand people, according to revised data from the Office for National Statistics (ONS). Previously, a positive migration balance of 740 thousand people was reported. Among the reasons for the revision, the ONS cites more available data, additional information on visas for Ukrainians, and optimization of the procedure for assessing migration from countries outside the so-called EU+ (EU, Norway, Iceland, Liechtenstein, Switzerland).

In the year to June 2024, net migration fell by 20% compared to the revised level of the previous 12 months – to 728 thousand people. The decline is mainly due to a decrease in the number of dependents arriving on study visas.